Survey reveals possible opportunities for tax work, clients, concerns, and future roles

Jump to ↓

| Impact on tax and accounting work |

| Impact on clients |

| Impact on concerns |

| Impact on future roles |

|

|

Statistics from the Future of Professional Report

|

The adoption of digital tools powered by artificial intelligence (AI) is accelerating rapidly in the tax and accounting profession. At the same time, these practitioners are feeling increasingly optimistic about AI’s future impact, according to the professionals surveyed in Thomson Reuters’ 2024 Future of Professionals Report.

As they look ahead to 2025 and beyond, tax and accounting professionals will need to consider how AI-powered tools—specifically, generative AI (GenAI)—will transform their workflows and the services they provide. These professionals are likely to discover that AI will bring many benefits along with the changes—if they’re prepared for its impact.

Impact on tax and accounting work

Why are professionals exploring and making use of AI? Perhaps the biggest driver is efficiency. According to the Future of Professionals Report, the most common current uses of AI-powered automation are drafting emails and correspondence, reviewing documents, summarizing information, and conducting basic research. Looking specifically at tax and accounting practices, report respondents cited drafting documents, managing large data sets, and conducting more technical tax research.

There are several other reasons why tax and accounting professionals should consider incorporating AI into their workflows. These capabilities include:

- Data entry. Generative AI systems can automate data entry tasks by extracting information from various documents, such as invoices and receipts.

- Document generation and summarization. Generative AI models have the potential to automatically generate financial reports, invoices, or other accounting documents. They could also assist in summarizing lengthy financial statements or reports to obtain useful insights quickly.

- Fraud detection. AI can help pinpoint patterns and anomalies in large financial datasets that may indicate fraudulent activity.

- Forecasting. AI’s predictive analysis prowess can help accountants identify future trends and make more informed decisions.

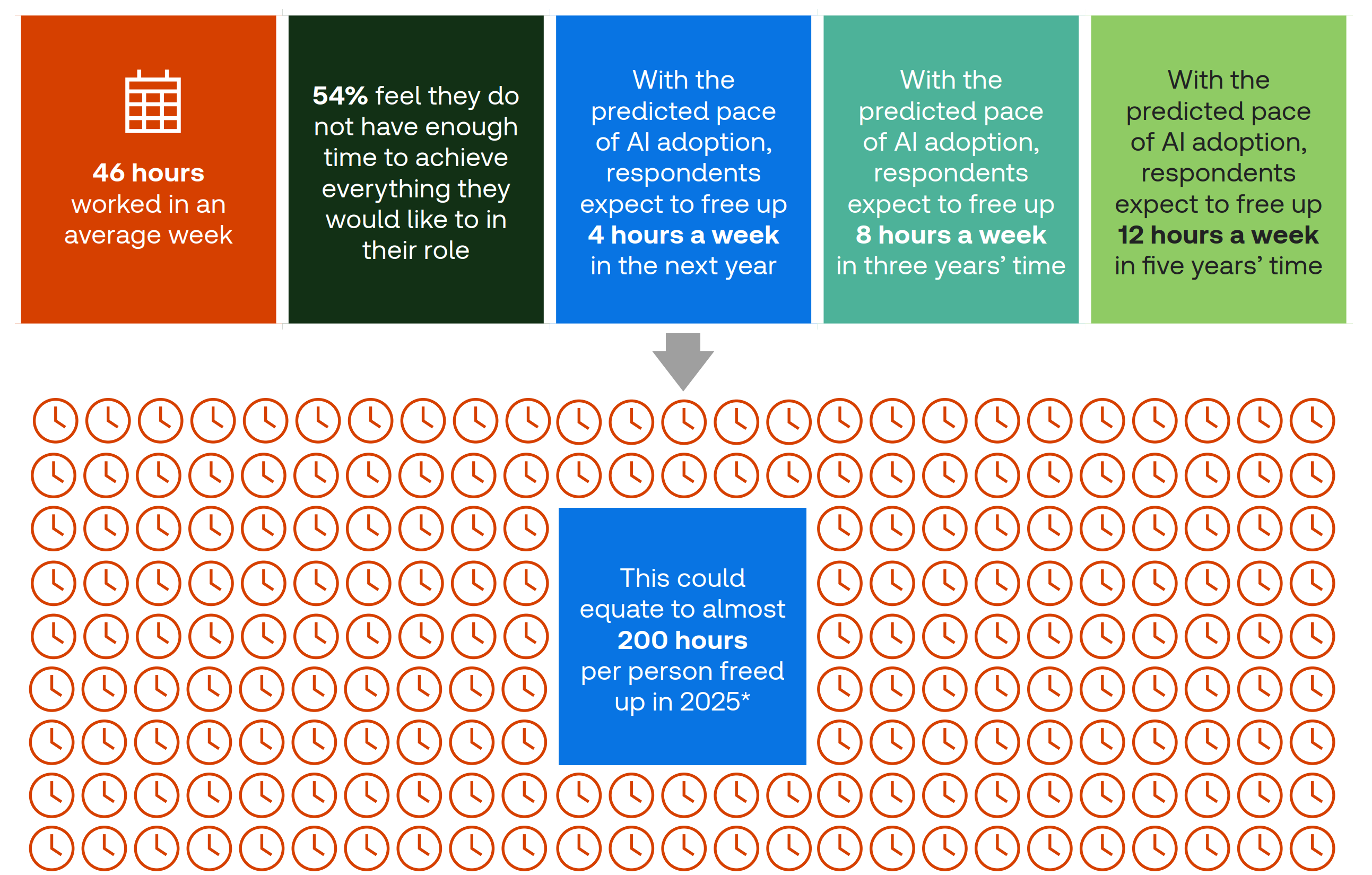

Thanks to capabilities like these, AI is projected to dramatically increase efficiency for tax and accounting professionals. The respondents in the Future of Professionals Report predict that AI could free up four hours per week within one year. Their projections increase to eight hours per week in three years, and 12 hours per week in five years.

How might professionals use those extra hours? In the report, 34% of those at tax and accounting firms mention work-life balance as the main area where they’d devote more of their time. That said, finding and maintaining that work-life balance may become more challenging. 69% of the tax and accounting professionals surveyed in the report believe that the same or higher portion of work matters will be brought in-house from external contractors within the next five years.

With these trends in mind, one type of AI technology professionals should consider is a GenAI assistant. This is a digital tool that uses generative AI to automate essential but time-consuming tasks such as those discussed earlier. This digital tool is designed to allow professionals to focus on more profitable uses of their time.

As tax professionals consider the use of AI tools, they should make preparations to incorporate them successfully into their practices. These are some key best practices that firms should follow as they introduce AI into their operations:

- Invest in training. To integrate AI into their workflows, firms should establish comprehensive training programs that cover the basics of GenAI, its applications in tax work, and the responsible use of this technology.

- Prioritize data security. Clients need to feel confident that their tax and accounting specialists are rigorously protecting their sensitive information from cybercriminals.

- Stay informed on compliance. As AI becomes more prevalent and increasingly impacts the tax and accounting industry, firms will need to keep on top of changing regulations and legislation.

One other thing to note: Small-size firms can benefit from using AI as much as larger ones can. AI tools can help smaller practices accomplish more, even within the limitations of size and resources.

Impact on clients

One of the most powerful arguments for incorporating AI technology into tax and accounting workflows is the benefits it can provide to clients, such as faster response times and more insightful analysis, especially when tax laws can be ever-changing. These are selling points that the tax and accounting professionals surveyed in the Future of Professionals Report are aware of:

- 59% of respondents see opportunities for handling large volumes of data more effectively.

- 47% see immediate opportunities for improving client response times. One respondent noted that AI could be used to “help draft emails in tax technical areas that explain [these matters] in layman’s terms. As a professional, I do spend a lot of time explaining things to my client that can be very technical”.

|

From a tax professional in the Future of Professionals Report

That points to another pathway for tax and accounting practitioners to explore the use of AI. This still-evolving technology could allow firms to move away from basics such as tax filings and spend more of their valuable time on comprehensive advisory services like financial planning. Respondents in the Future of Professionals Report note that they’ll need to articulate the value of AI to their clients beyond efficiency, 54% are confident that they can do so. Citing advisory and other services would provide useful, profitable selling points.

Because of the added value tax professionals can provide, another element of the client relationship that AI is likely to change is tax firm rates. By freeing firms to focus on higher-value services, AI could allow firms to move from traditional hourly billing to more lucrative alternative pricing models such as value-based and fixed-fee systems.

In any case, professionals will need to keep up with the ongoing evolution of AI-powered technology as they seek to provide new services to clients or deliver current services more efficiently. One type of AI that is likely to have an impact on tax and accounting professionals in the near future is agentic AI. This type of AI has the capability to act independently from pre-programmed rules to perform complex tasks and even make decisions.

|

|

Impact on concerns

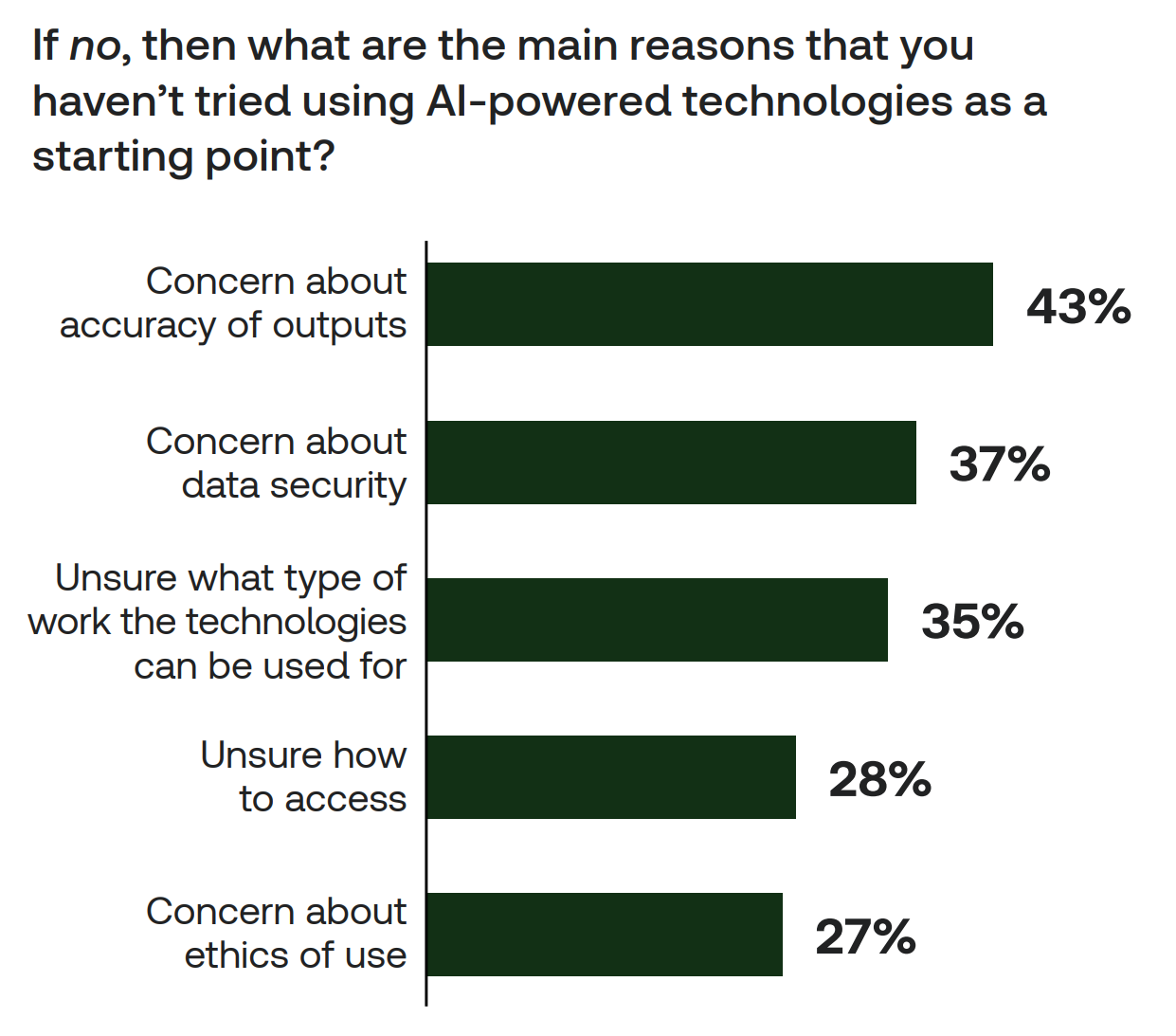

While tax and accounting practitioners are increasingly adopting AI-powered tools, the Future of Professionals Report notes that professionals in all fields are tempering their optimism with some caution. Among their top concerns are the security of proprietary data—an issue that 65% of respondents considered “vital for responsible use”—and the accuracy of the information and analysis that AI tools deliver.

Tax professionals also believe in establishing clear boundaries about AI’s use in their work. Only about 66% of these professionals responding to the Future of Professionals Report survey said that they were comfortable with AI providing advice directly to clients on tax planning or compliance issues. In addition, 56% of practitioners expressed strong support for industry standards regarding its ethical use, including professional certification. In sum: While AI is steadily winning over professionals as a complementary tool, it simply can’t replace human expertise.

The report also revealed another concern. Compared to risk, fraud, and legal professionals, practitioners in the tax industry believe that shortages of skilled employees in their field will have a “high or transformational impact” on the future of their profession. This could help push more rapid adoption of AI tools among tax and accounting practitioners to make up for the scarcity of available talent.

Impact on future roles

As AI-powered tools continue to make inroads into the tax and accounting industry’s practices, professionals in these fields foresee that AI will increase the need for new or expanding types of expertise. It seems clear that AI won’t do away with professional positions. But it is highly likely to transform tax professionals’ practices.

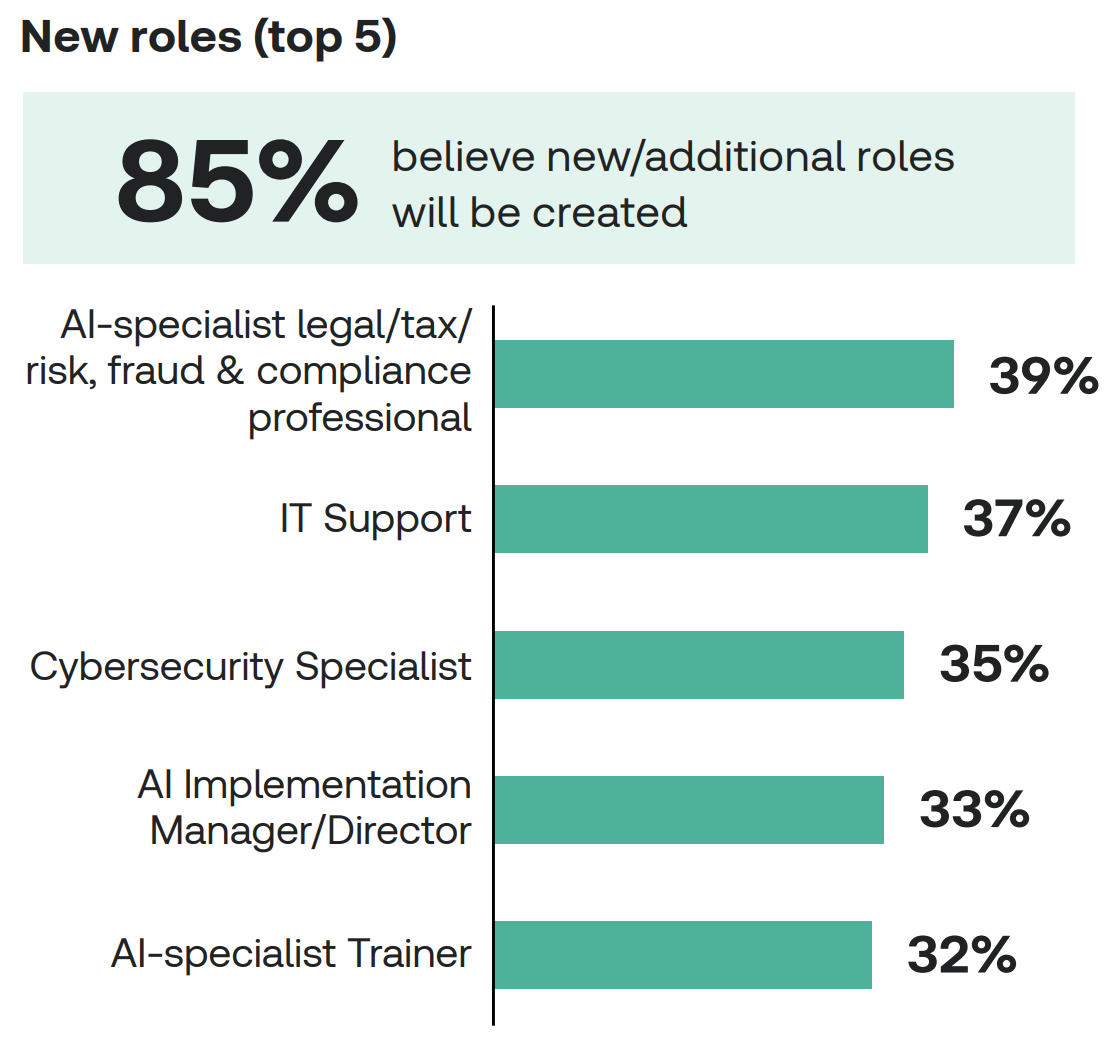

According to the Future of Professionals Report, 85% of respondents believe AI will require the development of new roles and skills. Perhaps not surprisingly, the most likely new role that tax and accounting professionals cite is AI specialists.

As noted, the increased use of AI would free tax professionals from many necessary but routine (and time-consuming) tasks, allowing them to focus on services that provide greater value to clients. Report respondents foresee a rising demand for skills including problem-solving, strategic thinking, client communication, and professional judgment. Among other things, the increasing use of AI will impact how auditors perform their work.

AI will create new challenges for the tax and accounting profession, but also professionally satisfying opportunities. The future of tax practice has never looked brighter.

But the impact of AI is only the beginning. There are different ways in which tax and accounting firms will be using AI in the coming years—and the skills they’ll need to acquire.

Subscribe to monthly newsletter ↗