Streamline compliance, mitigate risks, improve productivity, and innovate your tax practice with AI.

Jump to:

| The impact of AI on business protection |

| Navigating the shifted focus on consulting |

| Automating the traditional method |

It is a transformational time for businesses as artificial intelligence (AI) increasingly impacts how companies of all industries operate and serve their customers. The accounting profession is no exception. In fact, a growing number of accounting firms and corporations are taking a closer look at AI and how it can help them keep pace with tax law changes and ensure tax regulatory compliance.

To shed more light on the power of AI, the Thomson Reuters Future of Professionals report explores how innovative technology can help improve operational efficiencies and productivity in an ever-changing regulatory environment.

|

Future of Professionals ReportHow AI is the Catalyst for Transforming Every Aspect of Work

|

The impact of AI on business protection

Mitigating risk and staying on top of the latest tax law changes to protect the welfare of the business has long been critically vital for the profession. Failure to do so can result in hefty fines and penalties, as well as a tarnished reputation and loss of clientele. However, staying abreast of change and ensuring tax regulatory compliance isn’t always easy, especially in a dynamic and global market. Underscoring this point, the Future of Professionals survey of more than 1,200 individuals working in the tax and accounting, legal, global trade, risk, and compliance fields found that 90% of respondents believe that an increasingly regulated world will have either a transformational, high-impact, or moderate impact on their profession over the next five years.

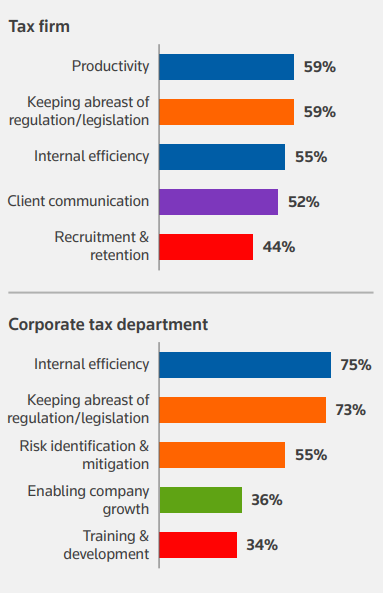

Given these findings, it is no surprise that staying on top of tax regulations and legislation, as well as risk identification and mitigation, ranked as among the top priorities for both tax firms and corporate tax departments.

More specifically, the report revealed that well over half (59%) of tax firms cited keeping abreast of tax regulations and legislation as a top priority. For many corporate tax departments and the state of it, protecting the welfare of the business by keeping abreast of regulations and legislation was the dominant priority (73%). Risk identification and mitigation ranked among the top three priorities for corporate functions (55%).

Enter artificial intelligence (AI). The benefits of AI and the role it can play in staying on top of tax law changes and protecting the business are becoming increasingly evident. Largely, survey respondents across firms, corporations, and governments believe that the capabilities of AI can help them keep pace with tax regulation and legislation and assist in risk-related work. For instance, within tax functions, AI can help reduce tax audits and penalties through improved data quality and the identification of trends in transfer pricing. Likewise, AI can detect patterns that identify potential risks of losses that could occur based on analysis of large amounts of data, including contracts.

Said one survey respondent, “AI can assist with identifying client needs and impacts of changing regulations and legislation much faster than we have been able to identify these needs and impacts through manual practices.”

However, that’s not to say that firms and corporations should not heed caution given the potential risks that can result from the use of AI. Because it’s newer technology, especially generative AI, there are likely some risks that have yet to be discovered. Given the risk factors, it is important to establish proper AI policies and guidelines to address such concerns as transparency, privacy, and data security.

Navigating the shifted focus on consulting

In today’s increasingly complex legislative and regulatory environment, clients are placing a higher premium on better business planning and strategic advice. Therefore, the shift toward providing more higher-value, higher-margin consulting services continues to sweep the profession.

It is important to note that AI can help firms better attract and retain talent. Improving operational efficiencies and eliminating mundane tasks gives staff more time to spend with clients and the ability to focus on more meaningful and satisfying work like strategic consulting. Furthermore, emerging areas of law and regulation, including AI itself, are opening up new career pathways for talent.

“This fact has several potential downstream implications for talent with the most basic one being that clients will need outside advice on these new areas and the laws, and firms will need professionals to have this expertise,” the survey stated.

Underscoring this point, 41% of survey respondents predict that, as AI increasingly becomes a fixture in the workplace, new career paths will become available. For example, as noted in the report, new roles to operate at the multinational or international organizational level could emerge to align the regulatory landscape of AI across jurisdictions.

As more firms focus on driving growth through strategic consulting services and growing talent, the time and labor spent on compliance-based work and tracking tax law changes can be supplanted by AI. This means improved efficiencies and greater productivity.

Automating the traditional method

The power of automation is not to be taken lightly. Staying on top of the latest tax law changes has historically been a time-consuming process that involves searching for relevant, authoritative sources, applying the results of the research to the client’s specific situation, and then formulating the conclusion to present to the client. Leveraging AI with tax compliance and automating traditional research methods can prove game-changing.

With AI-powered tax research software, professionals can get targeted search results in less time. This makes staying on top of tax law changes easier and faster. Firms can then dedicate more resources to higher-margin services and professionals can more confidently examine all angles of an issue with ease.

For instance, the tax provision stage is a key part of managing data related to taxes. It involves carefully figuring out what a company owes in taxes, which can be a complicated task due to frequent changes in tax laws and the company’s own changing makeup. By employing AI, tax provision tools are able to produce precise tax liability estimates and reduce the chances of mistakes. When you make the process of tax provision more efficient, it not only helps a company meet legal requirements but also saves time, increases productivity, and enhances the company’s approach to tax strategy and planning.

AI-powered technology can also extend beyond tax research to help simplify and streamline bookkeeping processes, accounting workflows, legal documents, tax codes, and real-time notifications.

AI has the ability to quickly process vast amounts of data and analytics, which not only helps improve a company’s decision-making capabilities but can also aid in anomaly detection and fraud prevention. Again, this means greater efficiencies, improved productivity, and, ultimately, more profitability.

Double-check results

While the benefits of AI are not overlooked, it remains important that firms and corporations double-check AI results to safeguard the business. This may seem redundant and time-consuming but it is imperative to ensure accuracy and to help improve employee knowledge and skillsets while AI continues to impact the tax and accounting profession.

In fact, as noted in the report, the lack of trust and unease about the accuracy of AI results is one of the main reasons why professionals see the need for the regulation of AI at all levels. Concerns about using the AI output as advice without a human double-checking for accuracy are real and highlight the need for enhanced ethics programs to mitigate risks.

So who should regulate AI? The majority of tax firms and corporations believe that the tax profession should be the one to regulate AI, according to the survey, but some respondents said they are in favor of regulation at multiple levels.

Stated one respondent, “I believe that AI will (and should) be regulated by both the government and by my profession. That said, inevitably it will need self-regulation by its providers and additional regulation by the other professions utilizing it as well.”

In a highly regulated profession like tax and accounting, the power of AI and the role it can play in helping professionals stay on top of tax law changes and help ensure tax regulatory compliance is not to be underestimated. For more information, be sure to explore the Future of Professionals report.

View the interactive infographic |

|

Product PageDiscover how to gain unrivaled expertise with generative AI technology and become a pioneer in the tax an accounting industry. |