Embracing AI with a balanced strategy empowers midsize firms to remain agile and innovative, bridging the gap between the capabilities of larger firms and the resource limitations of smaller firms.

Jump to ↓

| Understanding the AI opportunity for midsize firms |

| Enhancing efficiency with AI |

| Leveraging AI for strategic insights |

| Overcoming midsize firm challenges in AI integration |

| Actionable strategies for successful AI implementation in midsize firms |

| Embrace AI now to secure your firm’s future |

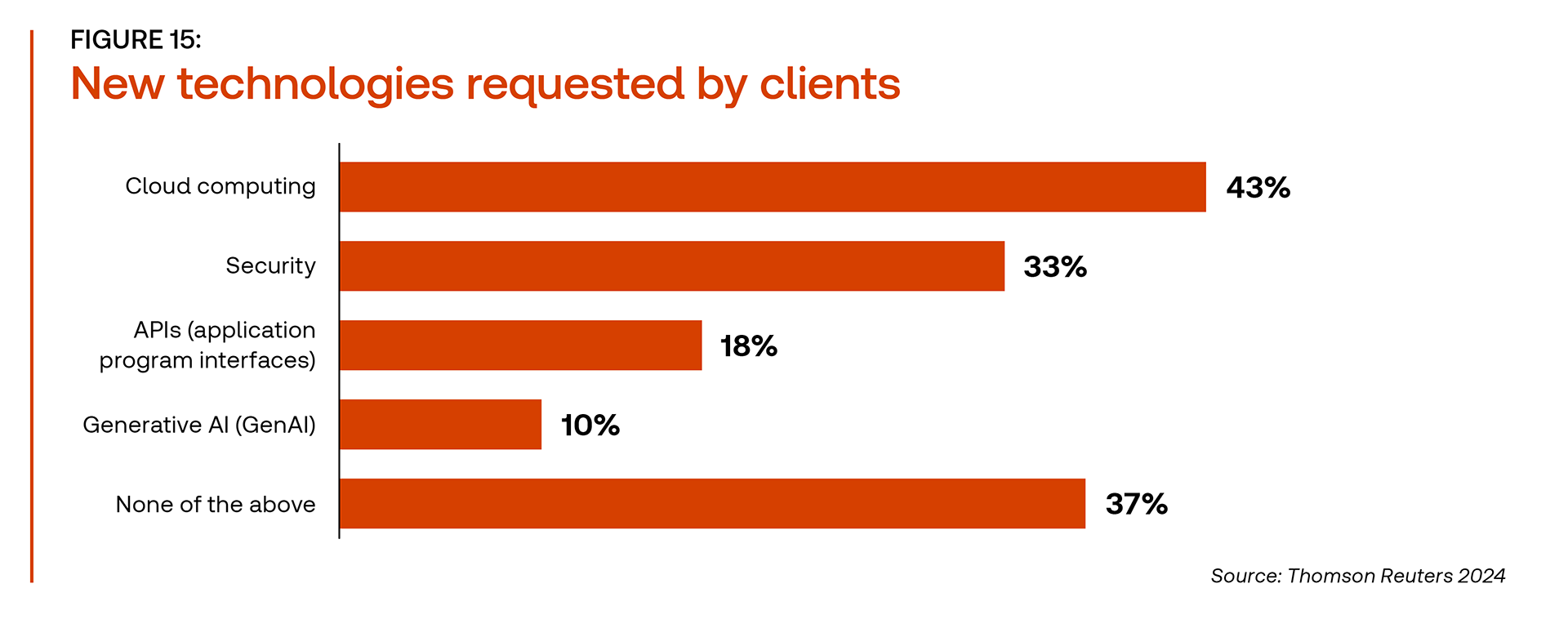

In today’s tax and accounting industry, technology is no longer a luxury but a necessity. The 2024 Tax Firm Technology Report by Thomson Reuters Institute highlights a pivotal moment for midsize tax and accounting firms. While large firms often have the resources to invest heavily in technology, midsize firms can leverage artificial intelligence (AI) to enhance their operations, improve client satisfaction, and stay competitive.

This balanced approach allows firms to be agile and innovative, capitalizing on the AI opportunity to bridge the gap between the capabilities of their larger counterparts and the resource constraints of smaller firms.

Understanding the AI opportunity for midsize firms

AI is transforming industries by automating routine tasks, providing deep insights, and enhancing decision-making processes. For midsize tax and accounting firms, AI offers the potential to streamline operations, reduce costs, and improve service delivery.

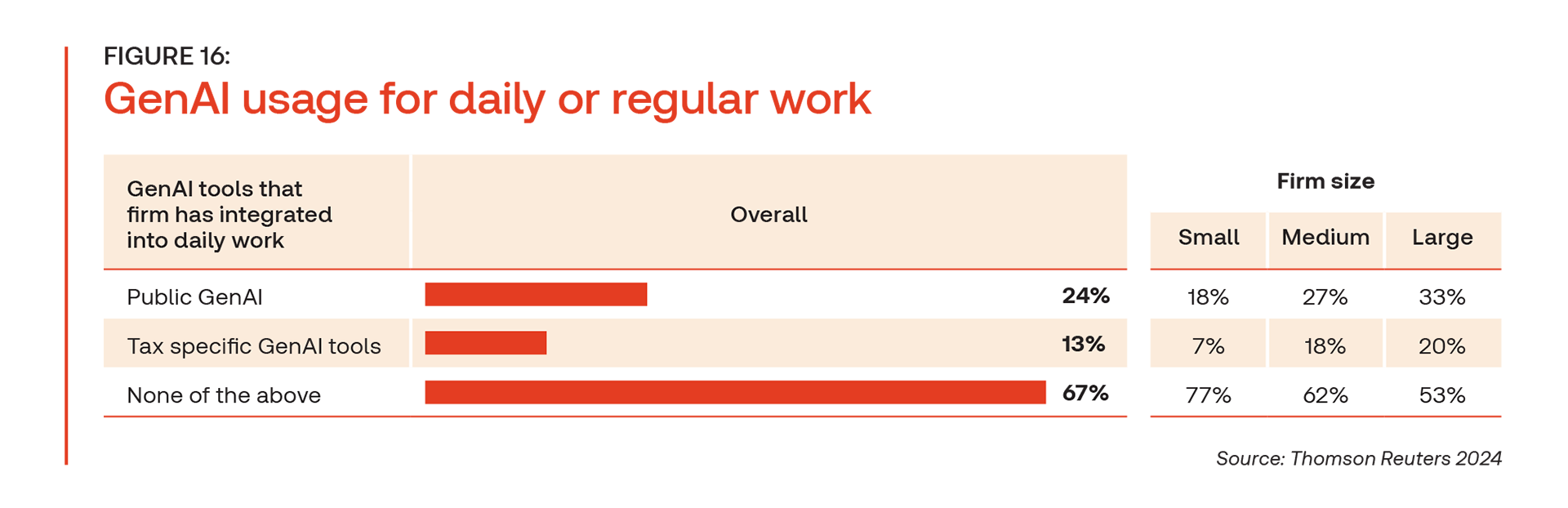

The 2024 Tax Firm Technology Report indicates that while only a small percentage of firms currently use tax and accounting AI tools, the interest and potential for growth in this area are significant. Midsize firms, in particular, can benefit from AI by focusing on specific areas where it can make the most impact.

Enhancing efficiency with AI

One of the primary advantages of AI for midsize firms is the ability to automate routine and repetitive tasks. AI can handle data entry, document management, and compliance checks, freeing up valuable time for professionals to focus on more complex and strategic activities.

According to the report, many firms are already using technology for direct tax compliance and trial balance. By integrating AI into these processes, firms can further enhance efficiency, reduce errors, and improve turnaround times.

Moreover, AI can assist in managing client interactions and communications. AI-powered chatbots and virtual assistants can handle basic client questions, schedule appointments, and provide updates on tax filings, ensuring clients receive timely and accurate information without overburdening staff. This not only improves client satisfaction but also allows firms to allocate resources more effectively.

Leveraging AI for strategic insights

AI’s ability to analyze vast amounts of data quickly and accurately can provide midsize firms with strategic insights that previously demanded significant time and effort. By utilizing AI-driven analytics, firms can identify trends, predict client needs, and offer more personalized services.

For instance, AI can help firms analyze client portfolios to identify tax-saving opportunities, optimize tax planning strategies, and forecast future tax liabilities. This level of insight enables firms to offer more value-added services, positioning themselves as trusted advisors rather than just service providers. By doing so, midsize firms can differentiate themselves in a competitive market and build stronger client relationships.

Overcoming midsize firm challenges in AI integration

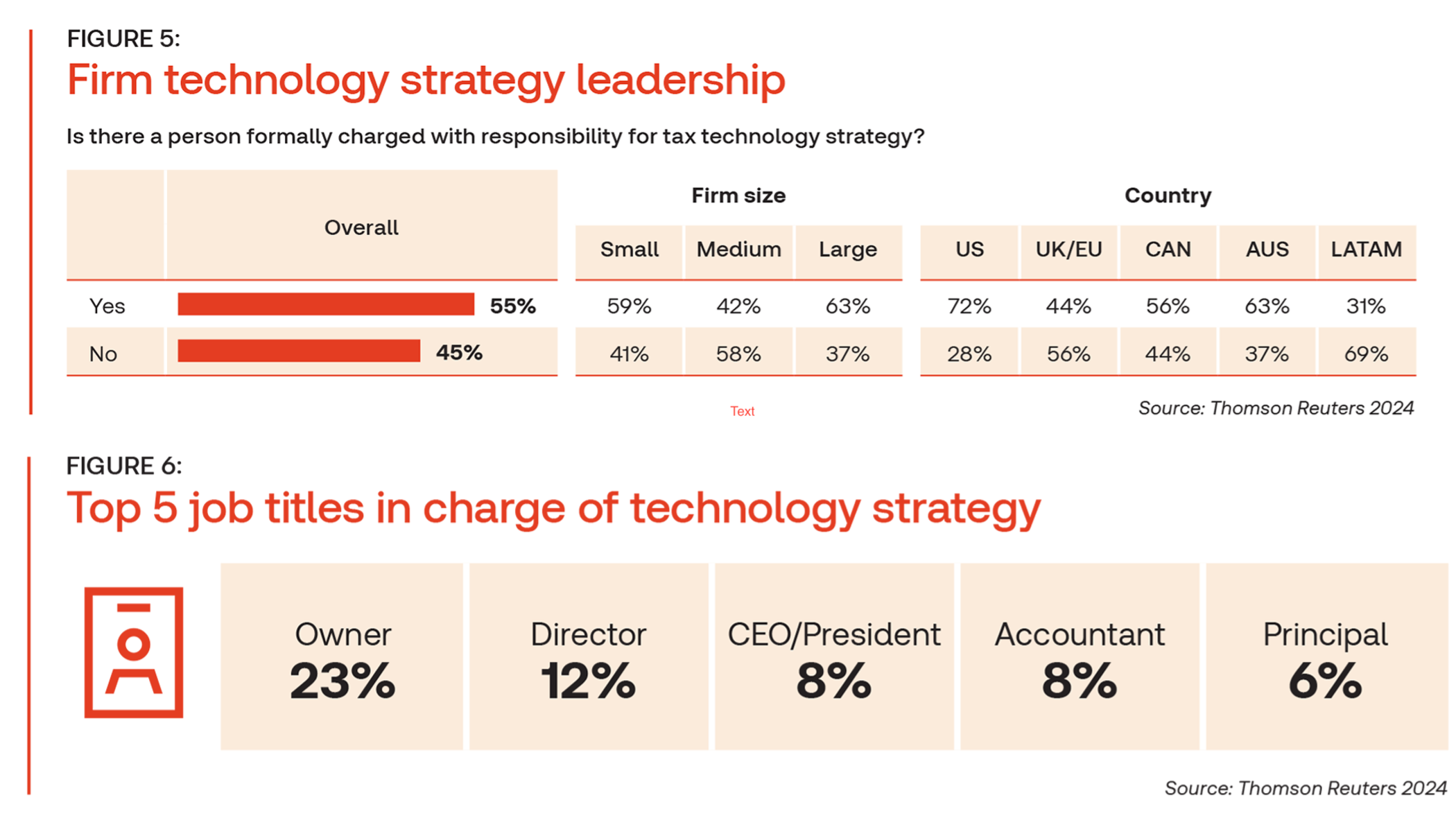

While the benefits of AI are clear, midsize tax and accounting firms face several challenges when integrating these technologies. One key challenge is the lack of dedicated technology leadership.

Dedicated technology leadership

-

- Challenge: Many firms lack dedicated technology leadership. Fewer midsize firms have a person formally in charge of technology strategy, leading to a lack of clear direction and strategic alignment.

- Solution: Appoint a dedicated technology champion or consider creating hybrid roles that combine tax and technology responsibilities. Additionally, utilizing consultants or outsourcing technology services can provide support and expertise.

Training and competency

-

- Challenge: There is a lack of consistent technology training, with less than one-third of survey respondents from midsize firms receiving regular training. This can result in lower tech competency among staff, making it harder to effectively use and integrate new AI tools.

- Solution: Investing in regular and comprehensive technology training can help improve staff competency and ensure that the firm can leverage AI tools effectively. This could include structured learning programs and ongoing support for new technology adoption. Investigate what support is available from professional bodies and other sources of help. Effective change management often combines top-down leadership with ground-up advocacy in the form of team champions who work to make their colleagues more effective with new technologies

Actionable strategies for successful AI implementation in midsize firms

To successfully implement AI, midsize tax and accounting firms can follow these strategies:

-

- Identify key areas for AI integration: Determine which areas of your firm can benefit most from AI, such as tax preparation, client communication, and data analysis.

- Set clear objectives: Define what the firm aims to achieve with AI, whether it’s improving efficiency, enhancing accuracy, or boosting client satisfaction.

- Invest in training and upskilling staff: Ensure that your team is proficient in using AI tools by providing regular and comprehensive training.

- Foster a culture of innovation: Involve leadership in the AI adoption process and encourage a culture of openness to new technologies.

- Balance current systems with new technologies: Gradually integrate AI into existing systems to avoid disrupting current workflows.

- Establish metrics for success: Set up metrics to track the success of AI implementations and make adjustments as needed.

Embrace AI now to secure your firm’s future

AI presents a transformative opportunity for midsize tax and accounting firms. By enhancing efficiency, leveraging strategic insights, and preparing for future advancements, these firms can not only improve their operations but also deliver superior value to their clients.

As the 2024 Tax Firm Technology Report suggests, the time to act is now. Midsize firms that embrace AI and integrate it into their workflows will be better positioned to navigate the challenges of the modern tax landscape and thrive in an increasingly competitive market.

Explore key resources that can help your firm with its AI adoption today ↓

|

|