Drowning in paperwork and seasonal staffing headaches, Scottsdale CPAs found a smarter way to manage tax season. Discover how the shift to integrated digital solutions led to faster workflows, higher client satisfaction, and impressive revenue growth.

Highlights

- Automation helped Scottsdale CPAs reduce turnaround time and operational costs.

- Choosing integrated solutions reduces friction and inefficiency in the tax process.

- Modernization promotes better client and employee satisfaction.

What springs to mind when you think of peak busy season? You’re probably reminded of long workdays, high stress, and mountains of manual work. But modern tax preparation solutions are beginning to change that.

Keestan Willes, Accounting Manager at Scottsdale CPAs, PLLC, faced these exact challenges. Her firm’s manual, paper-based tax preparation process lacked automation and efficiency, making engagements time-consuming, costly, and hard to scale. Today, her story offers a roadmap for practice managers looking to put seasonal burnout in the rearview. Here’s how her firm did it.

Jump to ↓

| Working with a manual tax preparation process |

| Automation: The key to modern tax preparation |

| The impact on their tax preparation process |

| A practice manager’s perspective |

| Finding a path for your tax and accounting firm |

Working with a manual tax preparation process

Before embracing automation, Scottsdale CPAs operated like many traditional firms. Their tax preparation process relied heavily on manual data entry and paper-based workflows that took countess hours away from talented professionals.

Finding and retaining qualified seasonal employees to assist proved difficult as well. Temporary workers would need extensive training during the busiest time of year, only to leave just as they became productive.

As operational costs kept climbing, the firm faced longer turnaround times, increased overhead, and limited capacity for growth. They knew that change was needed. To become a more productive tax practice, they needed a modern tax preparation process.

Automation: The key to modern tax preparation

Scottsdale CPAs chose Thomson Reuters to upgrade their workflow. They combined UltraTax CS, SurePrep, and SafeSend to create an end-to-end modern tax preparation process.

Faster preparation

UltraTax CS became the backbone of their tax preparation capabilities. The platform efficiently handles all of the firm’s tax preparation needs, processing approximately 1,200 returns annually. “We do about 1200 returns a year, and UltraTax CS handles all our tax prep,” says Keestan.

No more paper

SurePrep completed the digital transformation by eliminating paper processes entirely. SPbinder’s digital storage kept workpapers organized, accessible, and easy to document. This proved particularly valuable as remote work became more prevalent. “We wanted everything to be able to be accessed from anywhere,” Keestan noted.

Smoother tax return delivery

SafeSend made client collaboration a breeze. Tax return delivery that once took considerable time and effort now averages under 3 minutes per return. “I can process a return in SafeSend in under 3 minutes,” Keestan explained. The solution streamlined the entire delivery workflow, eliminating bottlenecks that had previously slowed down their operation.

The impact on their tax preparation process

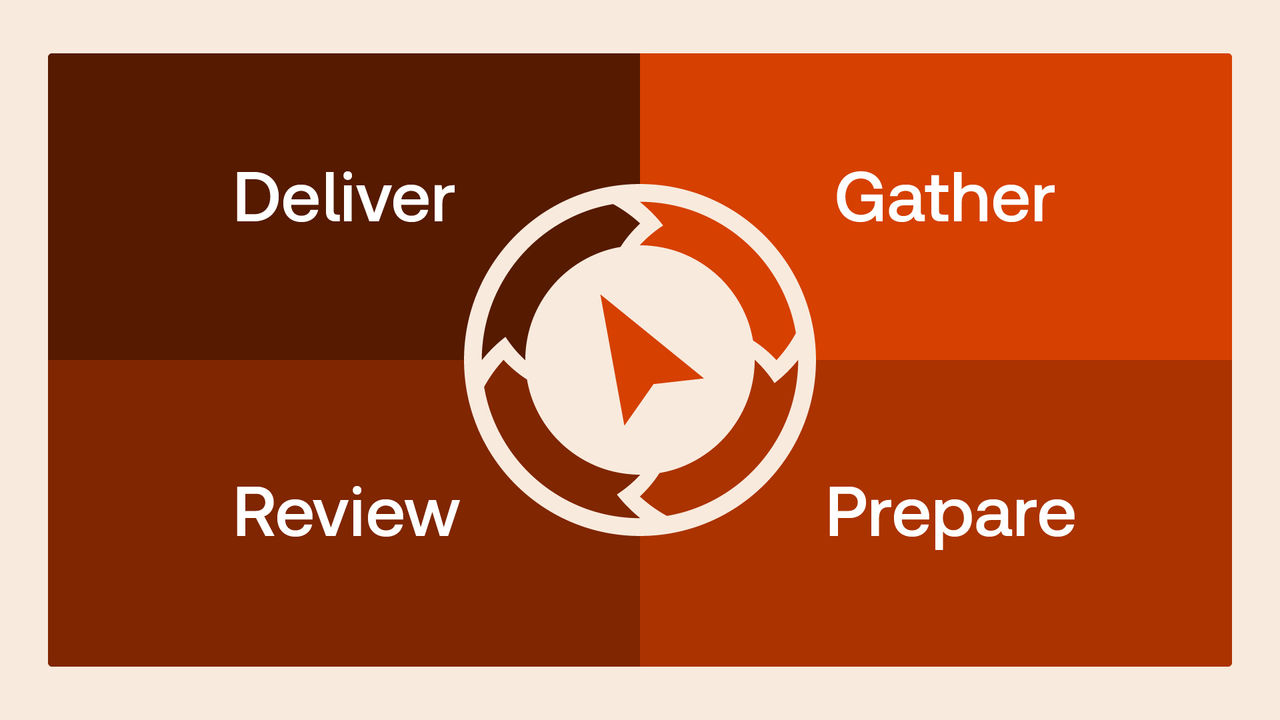

Partnering with Thomson Reuters and introducing automation into their tax preparation process completely revamped Scottsdale CPAs’ busy season roadmap.

Operational efficiency

Scottsdale CPAs now operates more efficiently with fewer staff members while processing the same volume of returns. The firm no longer depends on seasonal interns, saving additional time in searching and onboarding.

Perhaps most impressively, the firm achieved significant revenue growth over the past four years despite reducing headcount. “We’ve decreased our staff and increased our revenue significantly over the past four years,” Willes confirms. This outcome demonstrates the powerful ROI potential of strategic technology investments.

Enhanced client experience

Modernization delivered benefits beyond internal operations. Clients noticed the difference immediately.

The electronic process provides clear instructions and automated reminders that keep clients informed throughout the preparation process. Communication became more consistent and professional, reducing confusion and back-and-forth exchanges.

Clients find the digital experience more engaging and efficient compared to paper-based methods. Document submission is simplified, status updates are automatic, and the overall interaction feels more professional and current.

The result? Measurably higher client satisfaction scores and improved retention rates.

A practice manager’s perspective

In addition to automating more data entry compared to alternative solutions, SurePrep 1040SCAN integrates with SPbinder to automatically sort workpapers into a standardized index so preparers don’t have to. “I really don’t know how I’d prepare a return without it at this point. It definitely keeps us organized,” Keestan said.

The impact of UltraTax CS on daily operations has been equally significant. “UltraTax CS has allowed us to handle all our tax preparation needs efficiently, even with a high volume of returns,” she explained.

Finding a path for your tax and accounting firm

As Scottsdale CPAs discovered, transitioning from manual to modern tax preparation delivers increased efficiency, reduced operational costs, improved client satisfaction, and revenue growth.

For tax and accounting professionals struggling with similar automation and tax preparation process questions, there’s never been an easier or more critical time to give your workflow an upgrade.

Ready to upgrade your automation? Contact Thomson Reuters for a demo of SafeSend, UltraTax CS, and SurePrep to see a smarter, more integrated way to tackle automation for your tax preparation process. Like Scottsdale CPAs, your journey from manual to modern starts when you accept that it’s time for a change.

Automation that works smarter

Get a free, 30-minute demo of SafeSend, SurePrep, and UltraTax CS!

Claim offer ↗