Frequently asked questions about changes to NOLs over the past few years.

Jump to ↓

| What is an NOL? |

| Why do NOL deductions matter? |

| Can NOLs be carried back? |

| Does the 80%-of-income NOL limitation still apply? |

| Can NOLs still be carried forward indefinitely? |

Net Operating Losses (NOLs) play a crucial role in the financial management and tax planning of businesses. Over the past several years, there have been pandemic-era changes and subsequent returns to previous versions of the NOL rules. Let’s take a look.

In 2017, the Tax Cuts and Jobs Act (TCJA) changed the rules for deducting net operating losses. Before 2017, NOLs were fully deductible and could be carried back two years and carried forward 20 years.

Specifically, TCJA changed the NOL rules by:

- limiting NOL deductions to 80% of taxable income,

- disallowing NOL carrybacks, and

- lifting the 20-year limit on NOL carryovers.

In 2020, the CARES Act temporarily – and retroactively – provided for a special 5-year carryback for taxable years beginning in 2018, 2019 and 2020.

Today, most taxpayers no longer have the option to carryback a NOL. At the federal level, businesses can once again carry forward their NOLs indefinitely, but the deductions are limited to 80% of taxable income.

What is an NOL?

An NOL is the excess of a business’s tax deductions for the tax year over its taxable income for that year.

Example: For tax year 1, Business A has $100,000 of gross income and $125,000 of tax deductions. Business A has an NOL of $25,000 for tax year 1.

Why do NOL deductions matter?

Not all businesses have consistent income. Some businesses experience income volatility from year to year while other businesses have consistent income year over year. NOL deductions allow businesses to smooth out any year-to-year income volatility. Without the NOL deduction businesses with volatile income are taxed more over time on the same income than businesses that have consistent income.

Example: Business A has a $50,000 NOL in year 1 ($0 taxable income) and $100,000 taxable income in year 2. It pays no tax in year 1 and tax of $21,000 in year 2 (assuming a 21% corporate tax rate). So, over two years, A has a $21,000 tax liability on $50,000 of income.

Business B has income of $25,000 in both year 1 and year 2 for a total of $50,000 of income. Business B pays $5,250 in tax each year for a total tax liability of $10,500 on $50,000 of income. In this scenario, A pays twice as much tax as B ($21,000 – $10,500 = $10,500).

However, if A can use the $50,000 year 1 NOL to offset $50,000 of its $100,000 income, then A has a tax liability of $10,500 on $50,000 of income just like B.

Can NOLs be carried back?

No. While the CARES Act temporarily allowed NOL carrybacks, most taxpayers no longer have the option to carryback an NOL.

NOLs arising in tax years ending after 2020 can only be carried forward. The 2-year carryback rule in effect before 2018, generally, does not apply to NOLs arising in tax years ending after December 31, 2017. However, an exception applies to certain farming losses, which may be carried back 2 years. See section 172(b) and Pub. 225, Farmer’s Tax Guide.

Does the 80%-of-income NOL limitation still apply?

Yes. NOLs in 2021 or later may not be carried back, and NOL carryforwards are limited to 80% of the taxable income in any one tax period.

Can NOLs still be carried forward indefinitely?

Yes. NOLs can be carried forward indefinitely, however, they are limited to 80% of taxable income.

About the Author: Deborah Petro is a Senior Editor with Thomson Reuters Checkpoint. Before joining Thomson Reuters in 2019, Deborah practiced tax law in Chicago. Deborah is a graduate of Vanderbilt University and earned her J.D. and LL.M. in Taxation from Chicago Kent College of Law.

|

BlogHow are C corporations taxed? Tips on how to avoid double taxation and reduce taxes. |

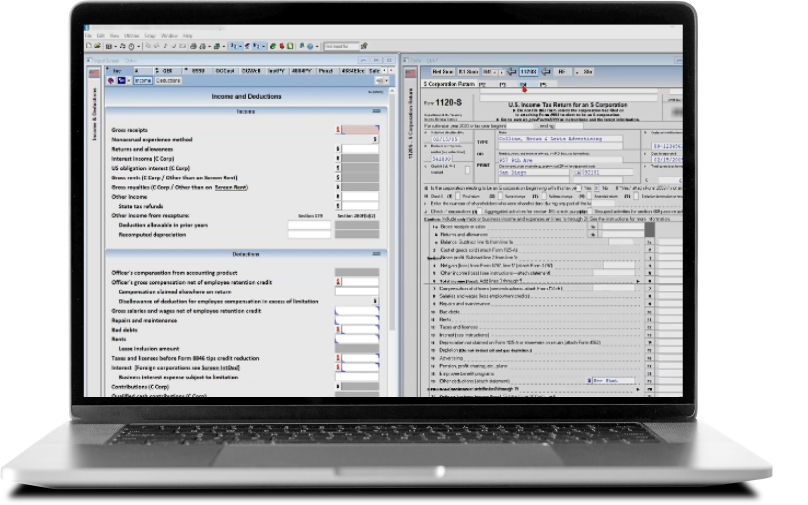

SoftwareUltraTax CS: Professional tax preparation software with a full line of federal, state, and local tax programs that can reduce tax workflow time for calculating carryback net operating losses. |

|