Addressing common concerns about artificial intelligence.

Jump to ↓

| How is AI affecting accounting? |

| Is AI replacing accounting jobs? |

| What is AI automating in accounting? |

| Can AI do accounting? |

| How to use AI to innovate |

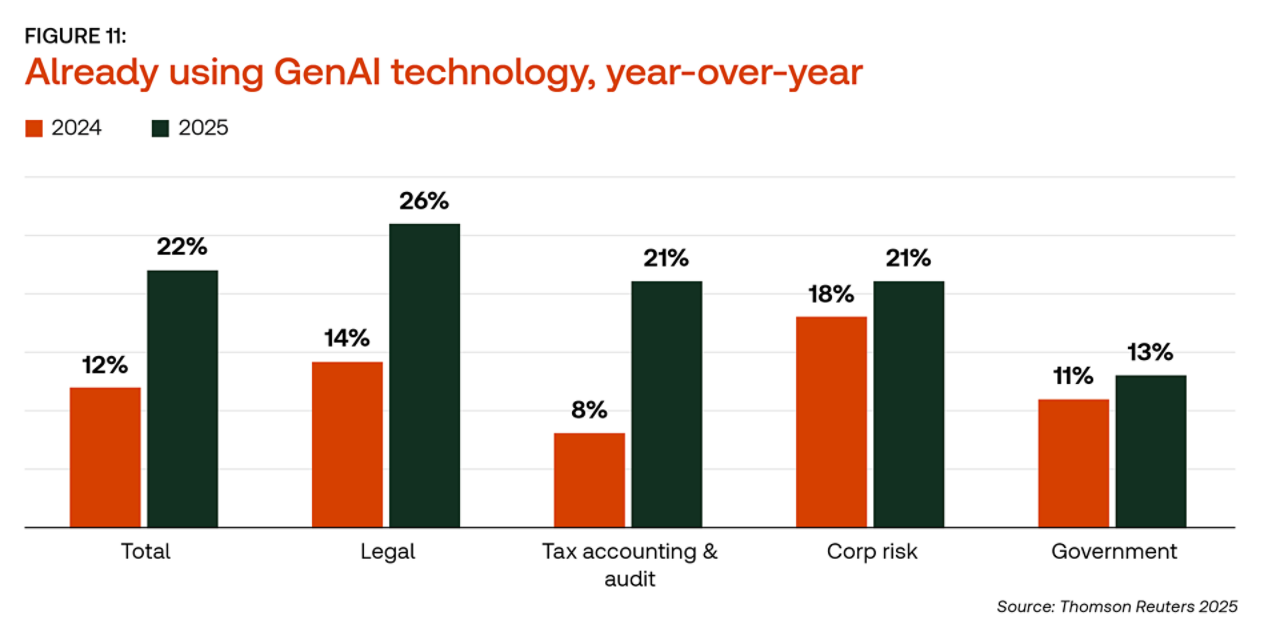

Artificial intelligence (AI) is making its presence felt across many industries — and the accounting profession is no exception. According to the 2025 Generative AI in Professional Services Report, 25% of tax firms are planning to use GenAI technology, with 21% already using some AI tools.

But between the top challenges of attracting talent and integrating AI in an ethical manner, some tax professionals are concerned about how AI will affect accounting jobs. While AI is undeniably changing the face of the industry, it also holds positive implications for the future of accounting.

Explore how GenAI will impact the future of legal; tax, accounting, and audit; risk and fraud; and government professionals’ work

2025 GenAI in Professional Services Report

How is AI affecting accounting?

A growing interest in artificial intelligence is leading more firms to stake an investment in its potential. Tax, accounting, and audit firms using GenAI technology jumped to 21% in 2025 from only 8% in 2024. This was the biggest increase in usage rates across the other surveyed industries of legal, corporate risk, and government.

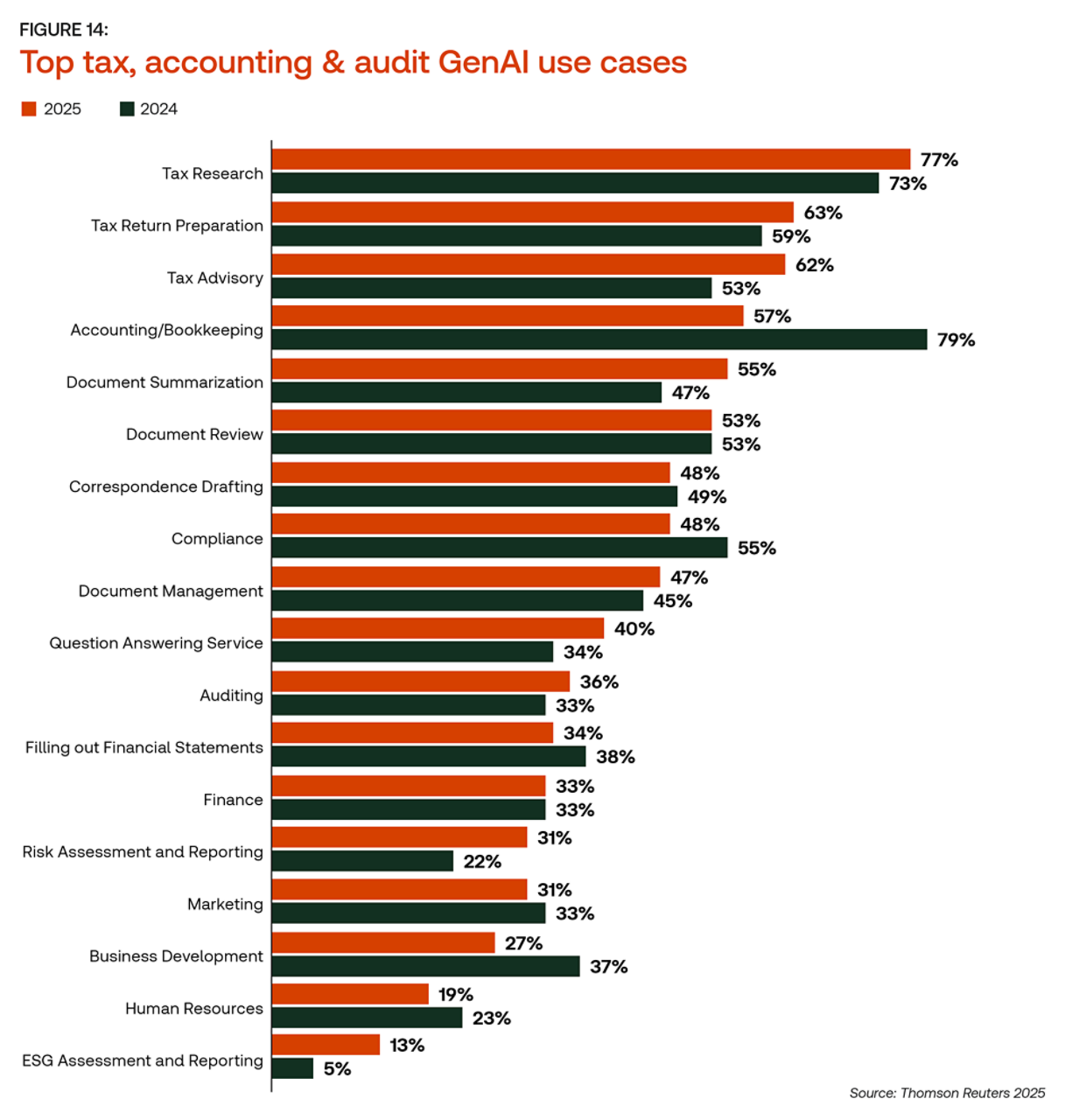

Apart from an official organizational standpoint, 52% of accounting firm staff already use an open-source generative AI tool, such as ChatGPT, for personal work use cases. Survey respondents listed the top five applications of GenAI in tax, accounting, and audit work as:

Apart from an official organizational standpoint, 52% of accounting firm staff already use an open-source generative AI tool, such as ChatGPT, for personal work use cases. Survey respondents listed the top five applications of GenAI in tax, accounting, and audit work as:

- Tax research

- Tax return preparation

- Tax advisory

- Accounting/bookkeeping

- Document summarization

The top use cases illustrate the success of using GenAI technology to automate menial, repeatable tasks frequently found in tax and accounting work. Tax advisory is another growing area where firms are using GenAI with client data to provide better insights at a faster rate.

General sentiment about AI was positive, with 68% of tax firm survey respondents choosing “excited” or “hopeful” when asked about the future of generative AI in their industry. “Current and emerging generations of GenAI tools could be transformative,” said one U.S. director of tax. “For example, deep research capabilities, software application development, and using GenAI to help with business storytelling would have significant impacts on the future of professional work.”

Is AI replacing accounting jobs?

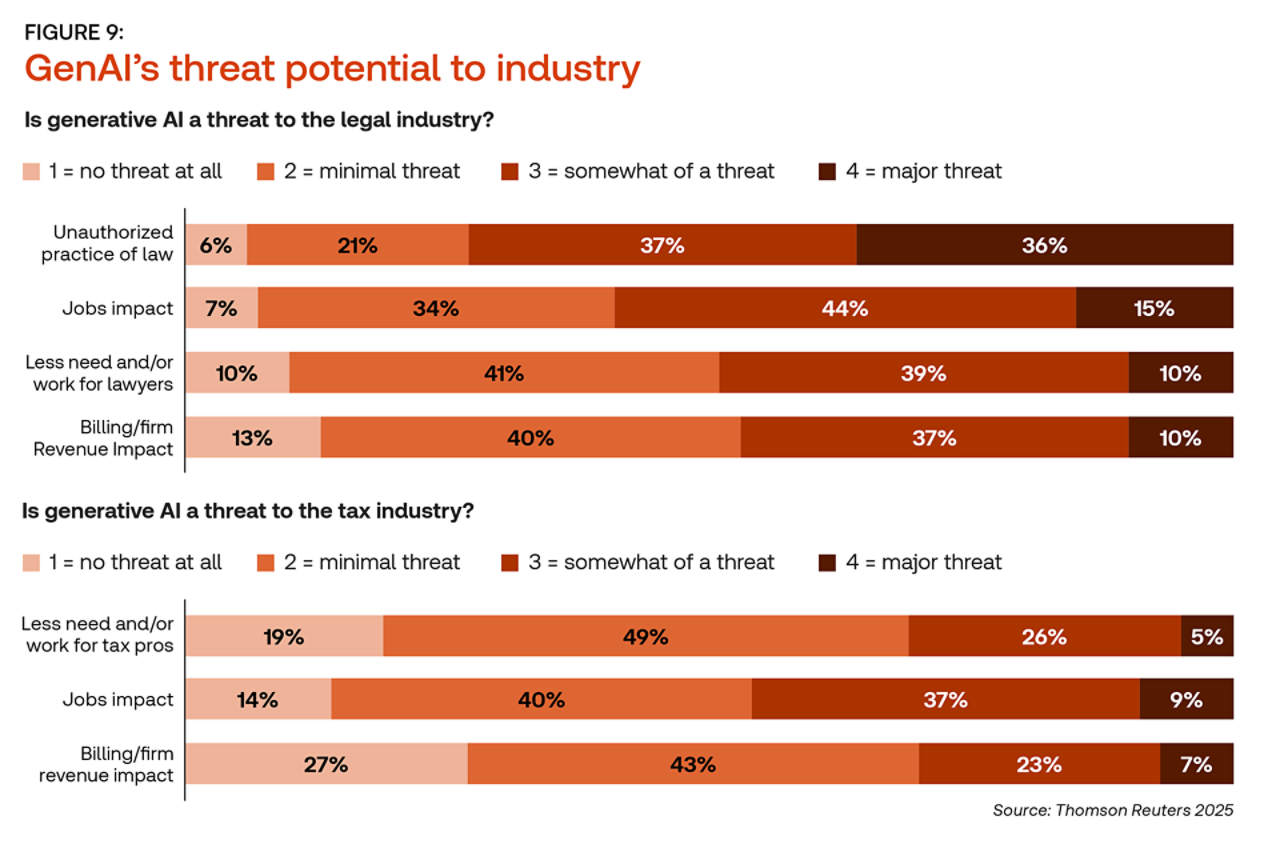

Concerns about AI replacing accounting jobs are certainly valid. The World Economic Forum’s 2025 Future of Jobs Report predicted that accounting, bookkeeping, and payroll clerks would be the seventh fastest declining job in the next five years. They cited AI and autonomous systems as primary drivers for the decline but also acknowledged aging workers and slower economic growth as factors for the decline in clerical roles. Similarly, 46% of respondents in the Thomson Reuters Institute GenAI report said generative AI was a “somewhat” or “major” threat to jobs impact in the tax industry.

However, the Thomson Reuters Institute suggests that the true answer about how GenAI may impact jobs may be years — if not decades — away: “For instance, consternation about whether GenAI will take jobs can be more easily placated when professionals better understand what tasks these tools can and cannot do.”

To keep up with the changing times, accountants should embrace AI tools to up their skillsets. The Future of Jobs report listed “AI and big data” as the fastest growing skill for 2025 to 2030. Over a third of tax firm survey respondents from the Thomson Reuters Institute report said GenAI skills were a factor in their current hiring practices.

By integrating AI into tax, accounting, and audit workflows now, staff can focus on the higher-value work they actually want to do, such as offering advisory services. A soft skill like handling client communication with empathy is an area that can’t be replaced by GenAI tools.

What is AI automating in accounting?

AI is a web of connected technologies that accountants can use to automate mundane tasks that are essential to day-to-day operations.

Robotic process automation (RPA), for example, is software that’s designed to act as a complement to processes performed by a human. Robotic accounting is a form of RPA that relies on software “bots” to perform certain accounting tasks, such as:

- Invoicing and account reconciliation

- Cash flow reporting and forecasting

- Budgeting and bookkeeping

- Document management and audit support

- Tax research and preparation

- Compliance

Agentic AI is a step above RPA. Agentic AI refers to AI systems that have the capability to act independently to accomplish goals and tasks. This means agentic AI can autonomously gather and categorize transaction data, apply accurate tax treatments, and help users throughout the tax filing process — alerting staff when anomalies or strategic decisions require experienced input.

These uses of AI allow tax professionals and accountants to take more of a hands-off approach to their repetitive, manual activities.

Can AI do accounting?

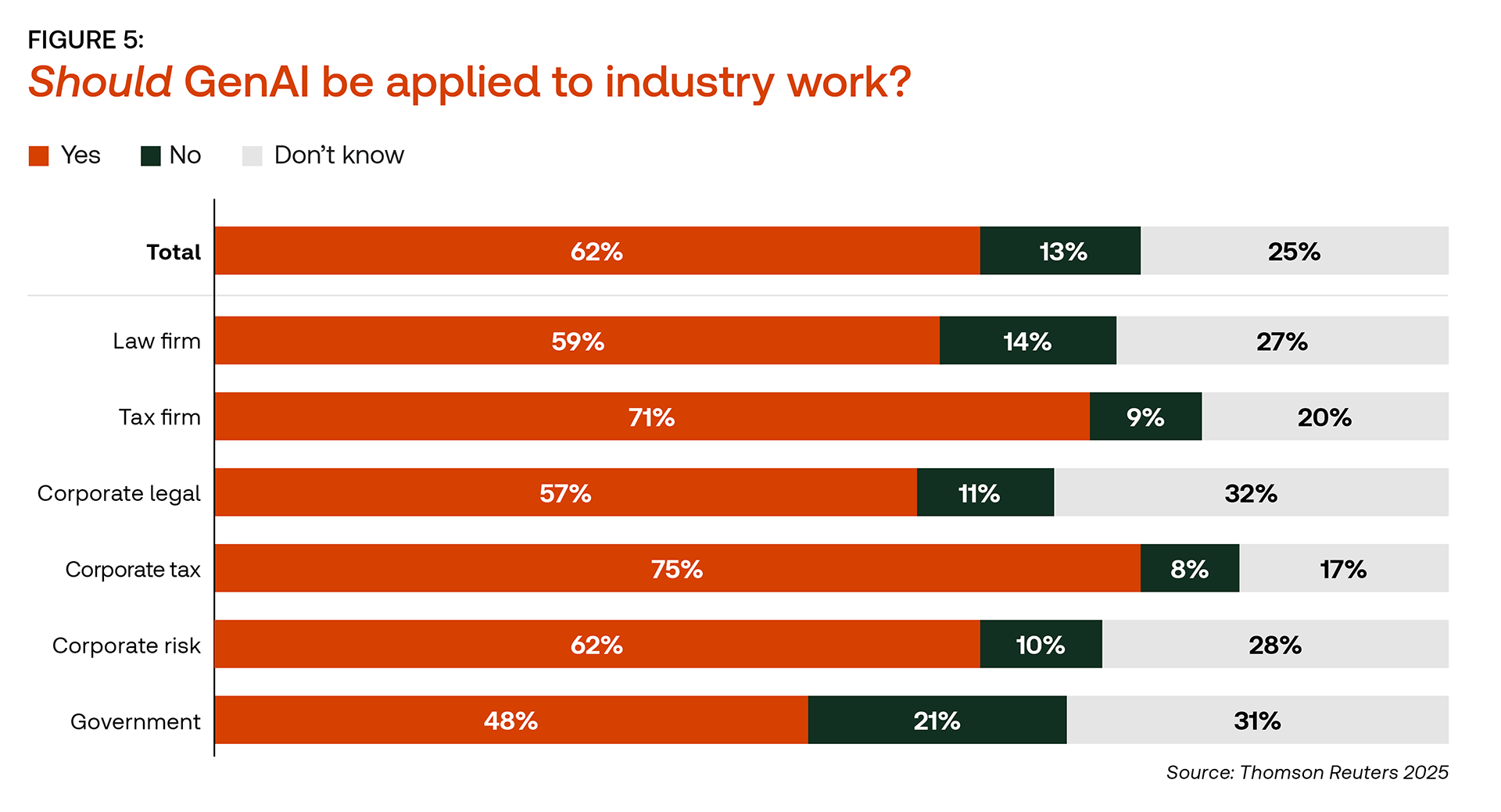

Yes, AI can perform many accounting tasks, such as automating data entry, processing invoices, reconciling financial statements, and generating reports. Today’s professionals agree with this assessment: 71% of tax respondents from the Thomson Reuters Institute report say GenAI should be applied to industry work.

However, human accountants still play a crucial role in strategic financial planning, complex analysis, and decision-making. AI tools are designed to complement and support accountants, not replace them entirely.

Using AI to innovate

Developing a knowledge base about AI will help you understand what it can — and cannot — do to assist your firm, as well as help allay any fears you might have about accounting jobs being replaced by the technology.

If you’re looking to explore the world of AI in accounting, join the AI @ Thomson Reuters community. Here, you can connect with experts, learn about the latest AI trends, and unlock the full potential of AI in your accounting practice.

CoCounsel: Your trusted AI partner

One agentic AI assistant for tax, audit, and accounting professionals.

Learn more ↗