The draft 2020 W-4 Form has been released. This draft version allows comments through July 1 and has been significantly revised, including removing the personal allowance worksheet, to comply with the Tax Cuts and Jobs Act.

On May 31, 2019, the IRS issued an early release draft version of the 2020 Form W-4 (Employee’s Withholding Allowance Certificate) [IR-2019-98, 5/31/19]. It is intended to “make accurate withholding easier for employees,” starting next year.

It has been a long road for the IRS regarding the implementation of a substantively revised Form W-4 that fully complies with the provisions of the Tax Cuts and Jobs Act (TCJA), enacted in late-December 2017. Some TCJA withholding tax changes include doubling the standard deduction, changing the tax rates and brackets, and eliminating personal exemptions.

For tax year 2018, the IRS postponed a more significant revision of Form W-4 due to time constraints. The 2018 version, issued in late-March 2018, did revise the credit section of the personal allowance worksheet and added boxes 8, 9 and 10 for employers to complete if they are sending the form to the State Directory of New Hires.

For tax year 2019, the IRS issued a draft version of Form W-4 in early-June 2018, but began receiving feedback from the payroll community during the initial comment period that the form was too complex. The American Payroll Association made recommendations to the IRS for improvements and the American Institute of CPAs said the form needed to be simplified.

Following a second comment period, more issues from the payroll community, and concerns for a timely release of the final 2019 version, the IRS decided to postpone the major revisions to Form W-4 until the 2020 tax year and issued a tax year 2019 version of the form that was similar to the 2018 version.

The draft 2020 W-4 Form

During the March 7, 2019 IRS payroll industry telephone conference call, Scott Mezistrano, IRS Industry Stakeholder Engagement and Strategy, stated that a draft version of the 2020 Form W-4 will be released by the end of May 2019. And on May 31, 2019, the IRS issued the 2020 draft along with a corresponding news release and list of frequently asked questions (FAQs) for both employers and employees.

“The primary goals of the new design are to provide simplicity, accuracy, and privacy for employees while minimizing the burden for employers and payroll processors,” said IRS Commissioner Chuck Rettig.

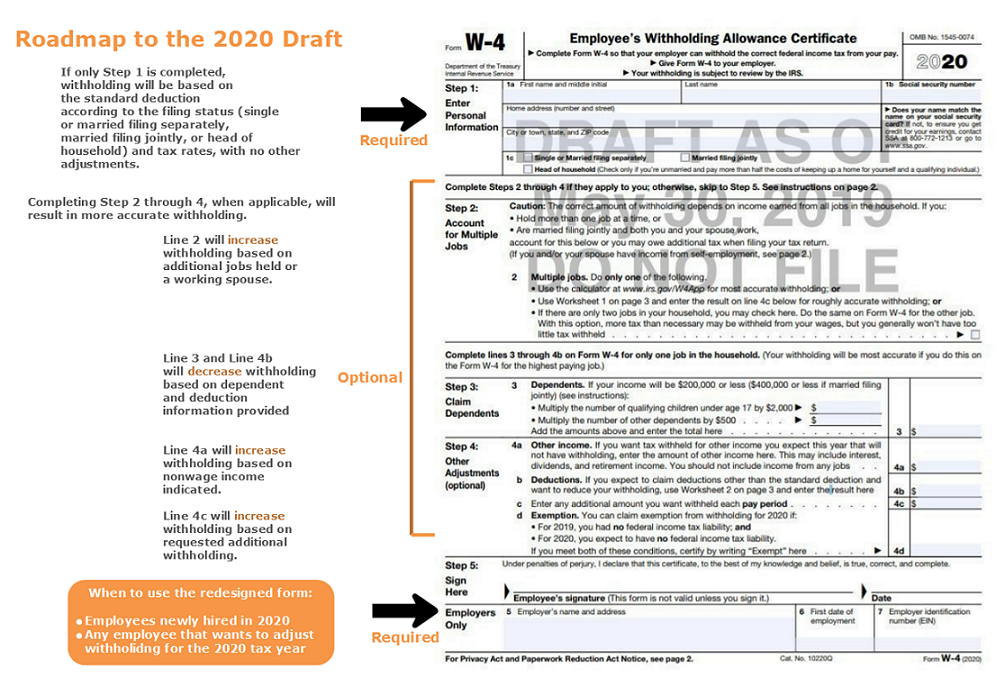

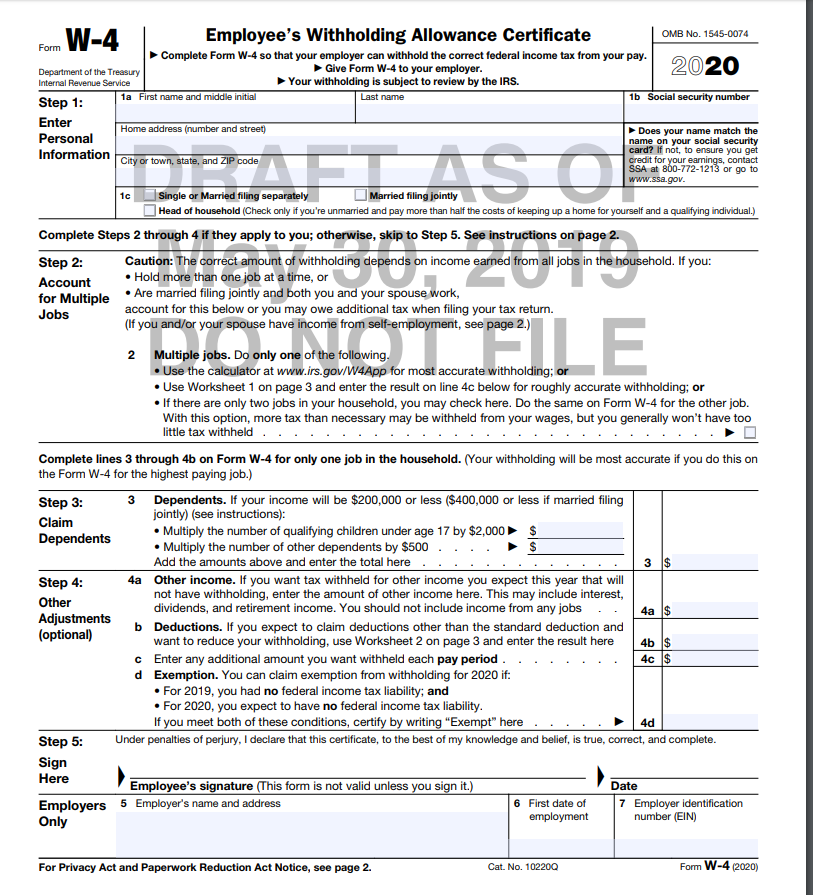

The 2020 draft is significantly different for the 2019 and 2018 versions. The form now contains a series of the following five steps for employees to complete (or skip if they do not apply): (1) personal information, (2) account for multiple jobs, (3) claim dependents, (4) other adjustments (optional), and (5) signature and date under penalties of perjury. Only Steps 1 and 5 are required.

There is also an employer’s only section (similar to the 2019 and 2018 versions) for an employer’s name, address, employer identification number, and a box to indicate the first date of employment for the employee. This allows an employer to use Form W-4 for new hire reporting purposes.

In addition, the 2020 draft Form W-4 adds a worksheet and table to use if the employee has multiple jobs (see Multiple Jobs below). A second worksheet is also added for employees who expect to claim itemized deductions other than the basic standard deduction.

No More Withholding Allowances

The 2020 draft Form W-4 no longer uses the concept of withholding allowances, which was previously tied to the amount of the personal exemption. Due to changes in the law, personal exemptions are no longer a central feature of the tax code. The IRS said this was done to increase transparency, simplicity and accuracy. Previously, the value of a withholding allowance was tied to the amount of the personal exemption. But due to the TCJA tax law changes, an employee cannot claim personal or dependency exemptions.

Draft 2020 W-4 Form Instructions

The IRS said it will be releasing draft employer instructions related to the 2020 draft Form W-4 and additional information in the next few weeks. The IRS provided a link to Publication 15-T (Federal Income Tax Withholding Methods), which will include such information when available.

Employer/Employee FAQs

The IRS list of 2020 draft Form W-4 FAQs for both employers and employees explain that, beginning in 2020, all new employees must use the redesigned Form W-4. Employers may ask their employees hired before 2020 to submit a new Form W-4, but employees are not required to submit a new form merely because of the redesign. Employers will continue to compute withholding based on the information from the employee’s most recently submitted Form W-4. If an employee hired prior to 2020 wishes to adjust withholding, the employee must use the redesigned form.

The IRS notes that employer software will not necessarily need two systems (one for forms submitted prior to 2020 and one for forms submitted after 2020) to process Forms W-4 because the same set of withholding tables will be used for both forms. The tables can be applied separately to systems for new and old forms. It is also an option to have a single system based on the redesigned form by entering zero or leaving blank information for old forms for the data fields that capture information on the redesigned form but was not provided under the old design. The IRS said additional information will be provided on the payroll calculations needed based on the data fields on the new and old forms.

In addition, there will be an adjustment for nonresident aliens and the IRS will provide instructions in Publication 15-T on the additional amounts added to wages to determine withholding. Nonresident alien employees should continue to follow the special instructions in Notice 1392 (Supplemental Form W-4 Instructions for Nonresident Aliens) when completing their Forms W-4.

Multiple Jobs

Accounting for multiple jobs (Step 2) is a new feature for employees on the 2020 draft Form W-4. According to the IRS, if an employee has more than one job at a time or is married filing jointly, and both the employee and the employee’s spouse work, more money should usually be withheld from the combined pay for all the jobs than would be withheld if each job was considered by itself.

Withholding adjustments are usually made to avoid owing additional tax, and potential penalties and interest, when an employee files a tax return. This did not change with recent TCJA tax law changes. The IRS explains that prior Form W-4s accounted for multiple jobs using detailed instructions and worksheets that many employees may have overlooked.

For the 2020 draft Form W-4, if an employee has multiple jobs, there are three options to consider in Step 2. One is to use the IRS withholding calculator. The second is to use Worksheet 1 on page three and enter the result on line 4c. The third option is if there are only two jobs in the employee’s household (less accurate, but an employee generally won’t have too little tax withheld).

What the 2020 W-4 Form Looks Like

This is a first early look. Here is what it looks like as of now:

Let’s review the major differences in the new 2020 W-4.

Step 2 – Account For Multiple Jobs

Step 2 asks if you hold more than one job or are married filing jointly and your spouse also works.

Either use the paycheck calculator the IRS hosts (not available for 2020 as yet) or follow the worksheet attached to the 2020 W-4 (see below). This, in my opinion, is complicated – especially if both spouses make $100,000 or more.

Step 2 also includes a check box that eliminates the need for the paycheck calculator or the worksheet – as of now I am not sure what impact the box has on withholding. This will be explained later when more information is available.

Step 3 – Dependents

To be filled out for ONLY the highest paid job and only if your income is $200k or less (400k if married filing jointly).

- Qualifying children – each child is worth $2,000

- Other dependents – each other dependent is worth $500 – also explained in the instructions, but not on the W-4 Form, is other tax credits.

Step 4 – Other Adjustments

- Other estimated income – this would be for example stock sale gains, interest income, 1099 income where no withholding has occurred.

- Deductions – If itemizing on 1040 – enter the amount (use Worksheet 2)

- Any additional withholding you want withheld

- Exemption – if claiming exempt – you must write the word EXEMPT in 4d

Remember, this is only a draft and there may be changes coming around Labor Day. The final 2020 W-4 form will be released when the 2020 rates are announced, usually in early December.

Second Draft

The IRS has said that it typically does not release draft forms until it believes it has incorporated all changes. However, with the 2020 Form W-4, the IRS anticipates it is likely the form will change before being released as final and a new draft version (nearly final version) will be posted in mid-to-late July 2019.

Comments

The IRS is providing the 2020 draft version of Form W-4 for information, review, and feedback. Comments about the 2020 draft Form W-4 may be submitted to: WI.W4.Comments@IRS.gov. The deadline for comments is July 1, 2019.

2020 W-4 roadmap provided by Debbie Tam

Flexible payroll solutions that are as unique as your firm

“Increase profits, strengthen existing client relationships, and attract new clients with our trusted payroll solutions that accommodate in-house, outsourced, or hybrid models.

Or, shop for payroll information solutions designed to help you find trusted answers quickly on our store.”