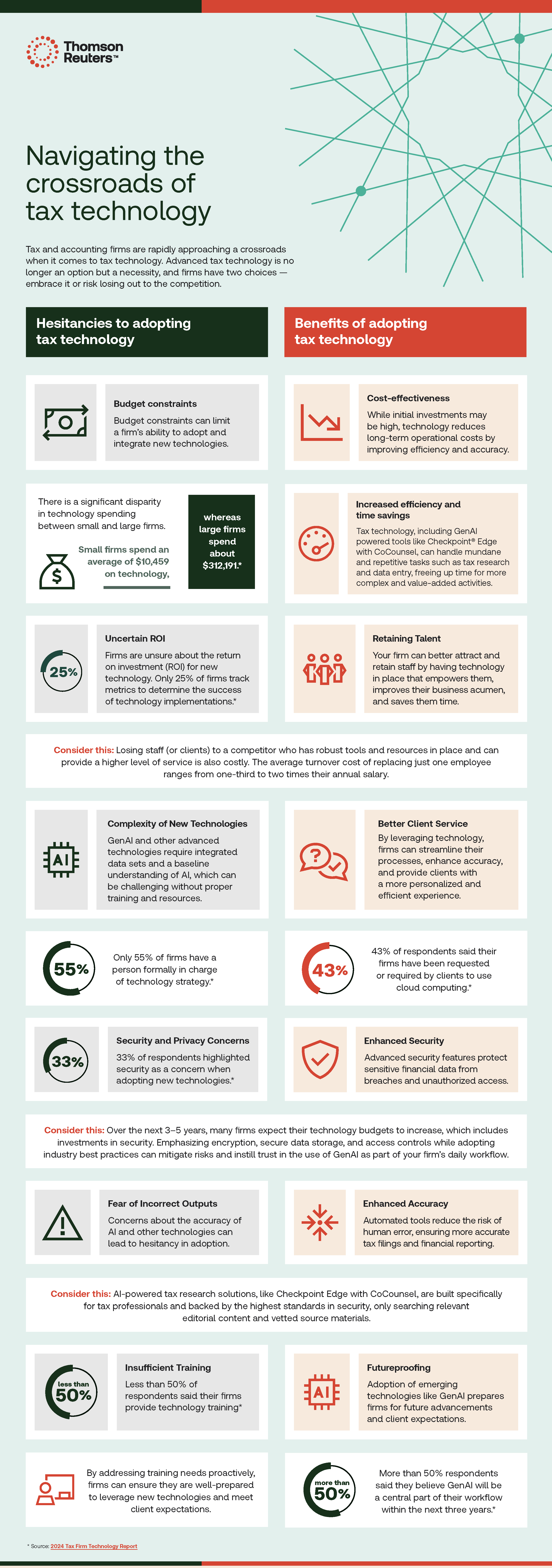

Tax and accounting firms are rapidly approaching a crossroads when it comes to tax technology.

Tax and accounting firms are rapidly approaching a crossroads when it comes to tax technology. Firms are more focused on technology than ever before, but according to the Tax Firm Technology report, they lack the personnel and workflow infrastructure to achieve true technological success.

The future of the tax and accounting industry is being written today — ensure your firm is ready to lead the way. To gain deeper insights and practical strategies for adopting tax technology, download the full Tax Firm Technology Report.

Transform your firm’s tax research with increased efficiency and the latest regulations at your fingertips. Get the trusted answers you need and learn more about Checkpoint Edge with CoCounsel.

|

|

|

|