Indirect Tax software

Automate indirect tax and e-invoicing globally

One Thomson Reuters platform to calculate, validate, and report — built for scale and audit readiness

End-to-end workflow automation

Seamlessly integrate tax determination, e-invoicing, and compliance reporting in one unified platform. Eliminate data silos and manual handoffs while maintaining accuracy across your entire indirect-tax life cycle.

Accurate, real-time tax calculations with ONESOURCE Determination

Classify products and services with generative AI

Apply the right tax to every transaction

Automatically track and apply exemption certificates

Automated e-invoicing reporting with ONESOURCE

Pagero E-invoicing

Create and clear e‑invoices

Distribute e‑invoices

Receive and validate e‑invoices

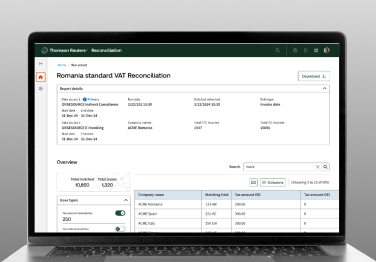

Seamless data reconciliation with ONESOURCE Reconciliation

Align e-invoicing, VAT return, and ERP data

Match transactions and resolve variances

Track exceptions through to closure

Global compliance filing with ONESOURCE

Indirect Compliance

Run automated checks

Produce statutory indirect tax reports

E-file returns

Advance with confidence

Discover how ONESOURCE gives you the competitive advantage to scale globally, minimize risks, and automate with ease while also arming you with the strategic foresight to drive business growth.

Turn compliance burden into strategic clarity

Transform manual processes and disconnected systems into seamless automation. Cloud-native ONESOURCE keeps you ahead of changing regulations with complete enterprise resource planning (ERP) integration. No downtime, no stress. Instead of just keeping up with compliance, your team can focus on what matters most — driving strategic value and accelerating business growth.

Choose agility — experience the value of a single automated compliance solution

Future-proof your tax operations

Stay current with more than 68,000 tax authorities across 205 jurisdictions.

Automate 95% of indirect tax tasks with advanced integrations.

Eliminate errors and drastically reduce audit risk by up to 75%.

Detect anomalies and gain data-driven insights with generative AI.

Hear from our customers

"With ONESOURCE, we've transformed our tax operations—delivering faster, more accurate results for our clients."

Heena Shah

Global Head of Tax, Tech Mahindra

"For me personally, it's shifted a process that used to be reactive to being proactive. The process just works in the background."

Kevin Escott

Senior Director, JLL

"We have been able to fulfill our invoicing-related tax and legal requirements in all 29 countries."

Mihai Chiriac

Program Manager, Hewlett Packard Enterprise

Automate tax determination, calculation, and compliance for all business transactions

ONESOURCE Determination

Market-leading global tax determination software that automates tax calculations. Report on sales and use tax, GST, VAT, and excise tax using the latest rates and rules.

ONESOURCE Pagero

Comply with global e-invoicing mandates by leveraging a fully integrated, electronic invoice compliance solution — one solution spanning the globe, simplifying complexity for tax, e-invoicing, and continuous transaction controls.

ONESOURCE Indirect Compliance

Automate your company's sales and use tax, GST, and VAT compliance and expedite your global indirect tax compliance obligations. Move beyond complicated, country-specific spreadsheets to stay compliant across the globe.

ONESOURCE Reconciliations

ONESOURCE Reconciliations software automates e-invoice reconciliation, detecting discrepancies, and ensuring full compliance. Request a free demo today.

Ready to move ahead with agility?

Connect with our tax technology experts to see how ONESOURCE can deliver end-to-end automation for your organization.

Questions about our products and services? We’re here to support you.

Contact our team to learn more about our tax and accounting solutions.

Contact us