Information Reporting and ACA Compliance

Boost productivity and automate information reporting

Simplify the process of tracking down contractors, vendors, clients, and payees each year with automated tools while simplifying ACA compliance and reporting

Identify tax reporting activities and stay one step ahead

These automated Thomson Reuters ONESOURCE solutions help companies meet their compliance needs — no matter how many payees you manage.

ONESOURCE ACA Compliance Reporting - Form 1095-B

Stay compliant with a 1095-B software solution that manages the entire tax filing process. Handle the new Affordable Care Act (ACA) tax information reporting and reduce the risk of expensive ACA penalties.

ONESOURCE ACA Compliance Reporting - Form 1095-C

Stay compliant with new Affordable Care Act (ACA) regulations through an intuitive 1095-C software. Large employers can prep, track, and manage all their employees’ forms about the health care coverage and report it to the IRS.

ONESOURCE ACA Reporting and Compliance Solution for Advisors

Guide clients through Affordable Care Act (ACA) compliance through this ACA reporting software. Streamline preparation, form distribution, and penalty abatement in one centralized, secure hub.

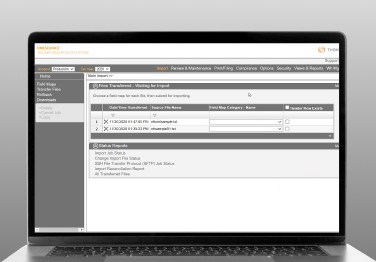

ONESOURCE Tax Information Reporting

Meet federal and state regulations with e-filing for all U.S. states, Puerto Rico, and Canada. Track withholdings, B-notices, penalty notices, W-8 and W-9 forms, TIN data, and penalty abatements with a tax information reporting software.

Discover more about our ONESOURCE solutions

Questions about our products and services? We’re here to support you.

Contact our team to learn more about our tax and accounting solutions.

Contact us