FAQs about a tariff mitigation strategy that's gaining traction.

Highlights

- Tariff engineering is an increasingly adopted strategy for reducing U.S. import duties through custom product design.

- Legal compliance, cross-functional collaboration, and thorough documentation are critical for defensible tariff engineering outcomes.

- AI-powered classification tools and governance technology are key for managing risk and scaling tariff engineering programs.

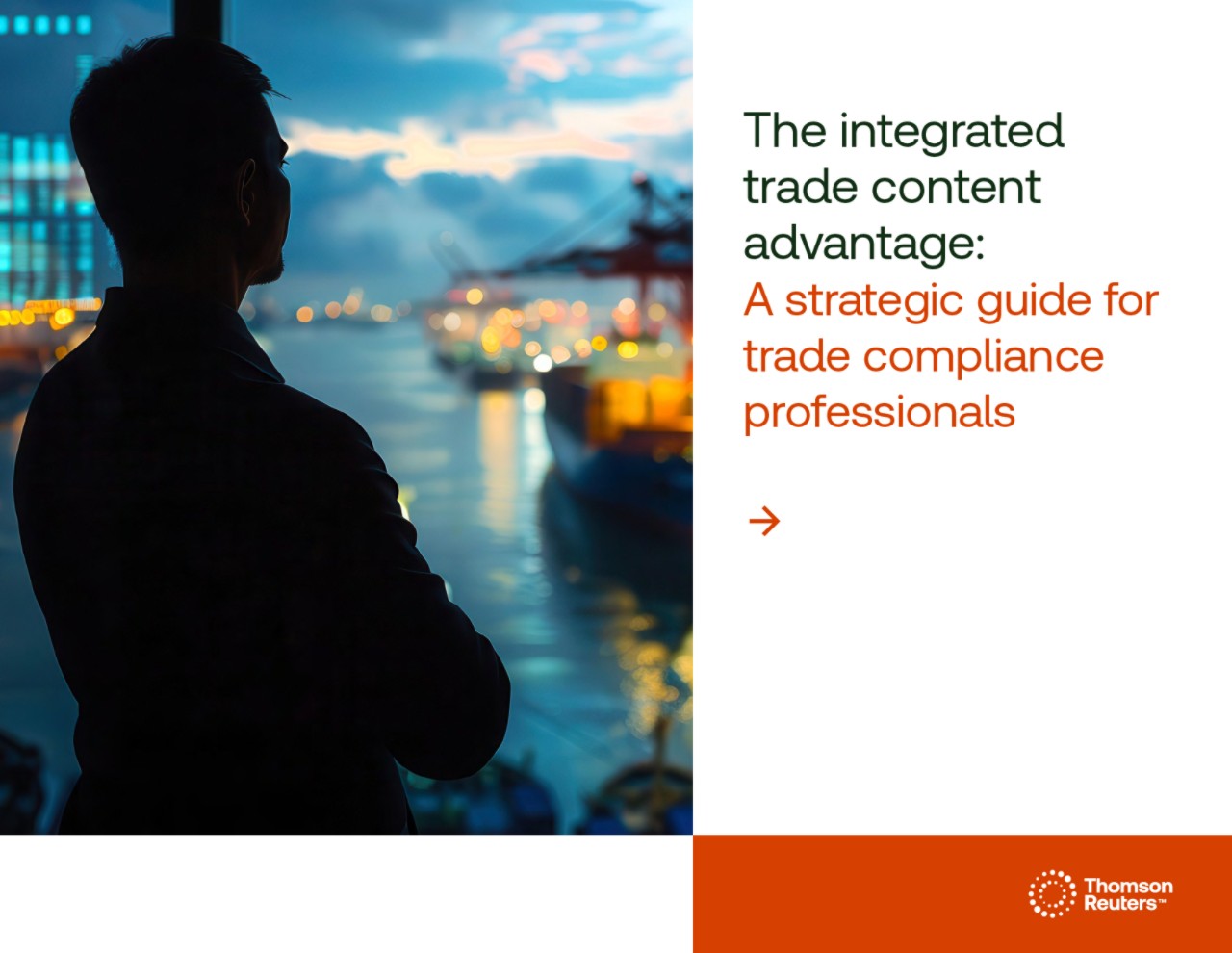

With U.S. tariffs driving structural changes in supply chains, more companies are exploring tariff engineering and related strategies to stay competitive. According to the Thomson Reuters Institute 2026 Global Trade Report, 46% of organizations are considering or already using tariff engineering as a mitigation strategy for U.S. tariffs.

Jump to ↓

How does tariff engineering impact the development of new products?

What are the risks of tariff engineering?

Technology to support tariff engineering

What is tariff engineering?

Tariff engineering is the deliberate modification of a product through design, materials, or construction, so that at the time of importation, it fits within a more favorable tariff classification or duty treatment — without misrepresenting the product or providing false information to customs and staying well within international trade regulations.

In practice, this can involve:

- Adjusting materials or components to move a product into a Harmonized Tariff Schedule (HTS) subheading with a lower duty rate.

- Modifying product assemblies to qualify under different rules of origin or preferential programs, such as free trade agreements.

- Structuring kits or sets so that their “essential character” drives classification toward a lower duty exposure.

Take this situation for example: An apparel manufacturer ships fully assembled men’s suits into the U.S., which are classified and taxed as complete garments at a relatively high duty rate. After analysis, the trade and product teams decide to ship the jackets and trousers separately, each packed and invoiced as individual garments with distinct SKU numbers and labeling.

Because customs classifies them as separate items rather than a suit, each piece falls under its own HTS subheading with a lower combined duty impact than the original “suit” classification. The products and documentation accurately reflect this change, so the new treatment is based on the actual condition of the goods at import.

For global trade professionals, tariff engineering is not about “creative paperwork.” It’s about influencing real-world product design and supply-chain decisions early enough that the imported article, as presented to customs, legitimately meets the requirements of a different tariff treatment.

Is tariff engineering legal?

Tariff engineering sits in a narrow but recognized space in customs law. Broadly, it is lawful to structure products and transactions to reduce duties, so long as you do so before the product leaves the port of export and the imported product is exactly what you declare. It is not lawful to misdescribe the product, provide incomplete or misleading specifications, or manipulate documentation to obtain a duty benefit that the physical product does not support.

Key legal touchpoints (jurisdiction-specific details will vary):

Tariff classification rules

Customs authorities classify goods based on the condition as imported, using the General Rules of Interpretation (GRIs), section and chapter notes, explanatory notes, and binding rulings. If you design a product so it genuinely complies with the GRIs and relevant legal notes of a lower-duty heading or subheading, a properly supported classification generally falls within accepted practice.

Anti-avoidance and fraud concepts

Authorities will challenge structures that:

- Add or remove trivial components solely to force a different classification, where those changes do not alter the product’s identity or function in a meaningful way.

- Split shipments or manipulate packaging to evade thresholds or quantity-based measures.

- Present misleading invoices, specifications, or origin data.

Binding rulings and advanced decisions

Many jurisdictions offer advance classification or origin rulings. These can provide legal certainty for a tariff engineering strategy — but only if the description of the goods and manufacturing process is complete and accurate. Omissions can invalidate protection.

Substance over form

Customs generally apply a substance-over-form principle: the real characteristics and use of the article matter more than how you describe them. A strategy is more defensible when it:

- Reflects a commercial reality (e.g., a product feature that customers actually use), and

- Has internal documentation showing cross-functional review (legal, tax, engineering, supply chain).

Bottom line for compliance managers: tariff engineering is lawful when you are altering what you import, not merely how you describe it. The risk profile rises sharply when changes are cosmetic or driven by paperwork alone.

Harmonized Tariff Schedule of the U.S. (HTSUS)

The essential government-issued import tariff manual for use in classifying imported merchandise for rates of duty, quota, restrictions, and special programs.

Shop product ↗How does tariff engineering impact the development of new products?

The 2026 Global Trade Report notes that trade functions are gaining more influence over procurement and product decisions as tariffs reshape cost structures and supply chains. Tariff engineering is one reason trade teams are being pulled into these conversations earlier.

For product development, this means:

1. Earlier involvement of trade compliance in design

Historically, engineering and product management might finalize designs and only later ask trade to classify parts. Today, tariff engineering encourages:

-

- Early-stage reviews of bill of materials (BOMs) from a tariff and origin perspective.

- Scenario modeling on alternative materials or manufacturing locations.

- Decision checkpoints that include classification and duty-cost signoffs.

2. Material and component selection

Choices such as “steel versus aluminum,” “assembled versus unassembled,” or “fully finished versus semi-finished” can drastically change classifications and duty rates. Trade teams can supply side-by-side HTS and duty rate comparisons for different design options, as well as country-of-origin outcomes for different sourcing or processing routes.

3. Commercial strategy and pricing

Tariff engineering affects landed cost, which feeds into pricing, margin, and competitiveness. The Global Trade Report notes that nearly 40% of companies may absorb tariff costs rather than passing them on to customers. Reducing duty exposure through product design becomes one of several tools to protect margins without constant price changes.

4. Product portfolio decisions

Some organizations use tariff analysis to rationalize SKU portfolios, retiring or reconfiguring products with unfavorable duty profiles. Businesses may also design “tariff-aware” versions of existing products for certain markets.

5. Documentation and repeatability

Every tariff-engineered decision needs thorough validation:

-

- Technical drawings and specifications that support the classification logic.

- Internal memos or rulings that explain why a specific heading applies.

- Version control to ensure product changes don’t silently invalidate earlier analysis.

- Legal review

Done well, tariff engineering moves trade compliance from a reactive “cost of doing business” function into an active partner in product and supply-chain strategy.

What are the risks of tariff engineering?

Tariff engineering can deliver real savings, but the risk profile is significant if governance is weak. Key categories for compliance managers include:

1. Regulatory and financial risk

- Reclassification and back duties: Customs may reclassify goods, leading to retroactive duty assessments, interest, and penalties.

- Penalties for negligence or fraud: If customs finds that descriptions were incomplete, misleading, or deliberately crafted to avoid accurate classification, penalties escalate quickly.

- Denied refunds or drawback: Aggressive structures can jeopardize refund claims if authorities consider the underlying classification invalid.

2. Operational risk

- Border delays and holds: Classification disputes or perceived inconsistencies may trigger inspections, document requests, and delays, affecting delivery times and customer commitments.

- Complex BOM and variant management: Maintaining multiple tariff-engineered variants of a product can strain engineering, procurement, and ERP teams if not tightly controlled.

3. Governance and control risk

- Country-specific classification outcomes: The same product can legitimately be classified differently across countries due to local tariff interpretations. A fully qualified U.S. HTSUS and even a CBP binding ruling apply only to U.S. imports and do not necessarily carry legal standing elsewhere—creating governance and control risk if teams assume global alignment in classifications or customs messaging.

- Loss of institutional knowledge: If key classification experts leave and documentation is weak, organizations struggle to explain why a product was classified a certain way.

- Audit trail gaps: Without clear records, it becomes difficult to show that decisions were made in good faith based on available data and guidance.

4. Reputational and strategic risk

- Regulator perception: A pattern of high volume reclassifications can attract scrutiny and increase the chance of audits across the organization’s full footprint.

- Customer and partner concerns: Supply-chain partners may hesitate to rely on tariff-engineered products if they fear future reclassifications, duty shocks, or disrupted flows.

To manage these risks, organizations should:

- Integrate legal, trade, tax, and engineering reviews into a formal governance process.

- Seek advance rulings for any product where certainty is needed, such as high-value or high-volume products.

- Use technology that standardizes classification logic and provides a consistent audit trail across markets.

Technology to support tariff engineering

With tariffs reshaping supply chains and 40% of trade departments exploring AI or blockchain tools, supporting tariff engineering with strong technology is becoming standard practice rather than a luxury. The goal is to give trade teams better visibility into duty exposure, classification scenarios, and regulatory changes — and to document decisions in a way that stands up to scrutiny.

Key technology needs for tariff engineering and classification engineering include:

- Standardized HS/HTS and ECCN classification workflows

Centralized processes help ensure that product data, classification logic, and audit trails are consistent across countries and business units. - Global content and continuous regulatory updates

Tariff engineering often hinges on detailed tariff schedules and local rules of interpretation. Systems track changes to HS numbers, other government agency requirements, and duty rates across jurisdictions. - Scenario analysis and productivity tools

Teams need tools that can quickly propose likely classifications, surface similar items, and help analysts review large product catalogs without being buried in manual research.

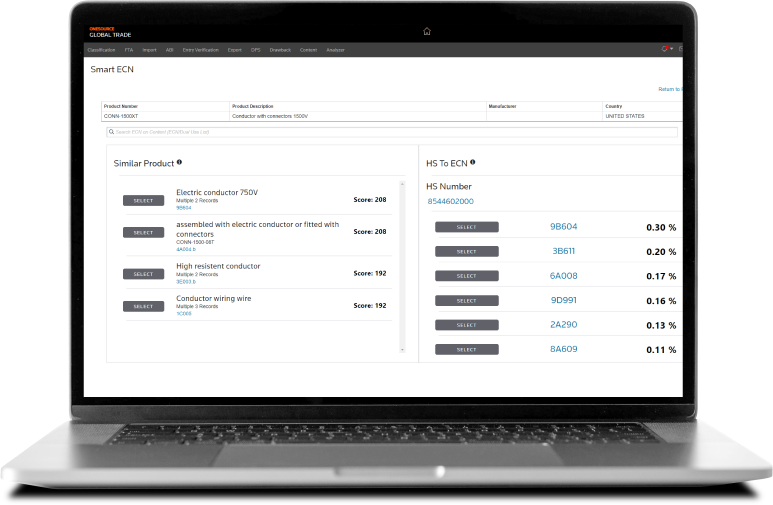

HS and ECCN classification software

Thomson Reuters ONESOURCE Global Classification AI supports trade teams by making classification work more consistent and auditable. It recommends possible HS and ECCN classifications with confidence scores and similar-item matches, helping reviewers compare scenarios, evaluate options, and run faster “what-if” analysis across different product designs.

The solution centralizes product data and workflows and is backed by global trade content for more than 220 countries and territories. It also maintains a clear audit trail of decisions and supporting documents for tariff‑engineered products while managing tasks across teams, so large classification projects move forward with control.

Organizations such as Georgia-Pacific have reported reducing time spent on product classification by 50% with ONESOURCE Global Classification AI. As more organizations adopt tariff engineering, tools like ONESOURCE Global Classification AI give trade teams the content, review, and audit support they need to run these strategies as part of a disciplined global compliance program.

ONESOURCE Global Classification AI

Automate your Harmonized System (HS) and Export Control Classification Number (ECCN) classifications

Request free demo ↗