Form 1042-S, an essential information return in the realm of tax reporting, serves as a meticulous record of income paid to foreign individuals and entities.

Jump to:

| What is Form 1042-S? |

| Who needs to file Form 1042-S? |

| What information does Form 1042-S contain? |

| Do I need to report Form 1042-S? |

| How to file Form 1042-S |

| The importance of Form 1042-S |

Form 1042-S, an essential information return in the realm of tax reporting, serves as a meticulous record of income paid to foreign individuals and entities.

While it may not boast the same level of recognition as its more illustrious counterparts, such as the W-2 form, its significance cannot be understated.

In this blog, we will explore the intricacies of Form 1042-S, exploring its purpose, who is required to file it, and the crucial information it contains.

What is Form 1042-S?

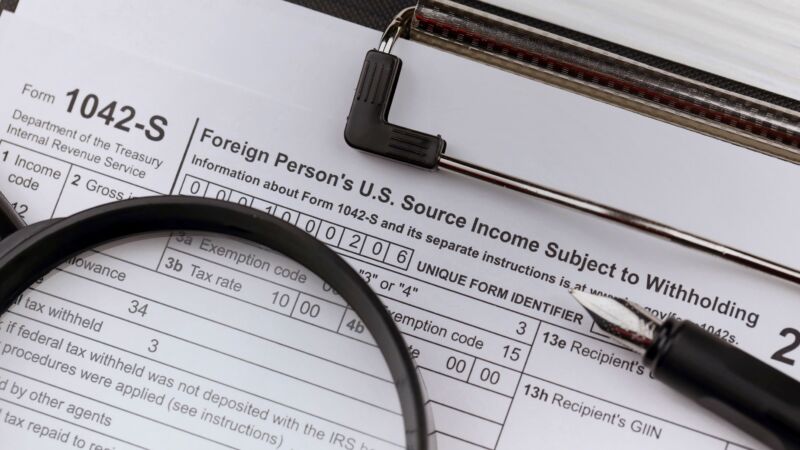

Form 1042-S is an information return used to report income paid to foreign persons, including non-resident aliens, foreign corporations, and other foreign entities.

It is also used to report tax withheld on certain income, such as wages, scholarships, fellowships, and other types of income paid to foreign individuals or entities.

Who needs to file Form 1042-S?

If you are a withholding agent, which includes U.S. businesses, universities, and other organizations making payments to foreign individuals or entities, you are required to file Form 1042-S. Additionally, if you are a non-resident alien or a foreign corporation receiving income from U.S. sources, you may also receive a Form 1042-S from the withholding agent.

What information does Form 1042-S contain?

Form 1042-S provides a comprehensive summary of income paid to foreign persons and the amount of tax withheld. Here are some key details included in the form:

- Recipient Information:

- Name, address, and taxpayer identification number (TIN) of the recipient.

- Country of residence for tax purposes.

- Type of recipient (individual, corporation, etc.).

- Income Codes:

- Each type of income is assigned a specific income code, such as wages (Code 18), scholarships (Code 16), or royalties (Code 15).

- The income code helps the recipient determine the nature of the income received.

- Income and Withholding Amounts:

- The form provides details of the income paid to the recipient during the tax year.

- It also includes the amount of tax withheld by the withholding agent.

- Treaty Benefits:

-

- If the recipient is eligible for any tax treaty benefits, the form will indicate the applicable treaty and the reduced withholding rate, if any.

Do I need to report Form 1042-S?

As a recipient of Form 1042-S, you may wonder if you need to report this information on your tax return. The answer depends on your individual circumstances. Here are a few scenarios to consider:

- Non-Resident Aliens:

- If you are a non-resident alien and received a Form 1042-S, you generally need to report the income on your U.S. tax return.

- However, if the income is exempt from U.S. tax under a tax treaty, you may not need to report it.

- Foreign Corporations and Entities:

- Foreign corporations and entities that received income from U.S. sources may need to report the income on their tax returns in their home country.

- It is important to consult with a tax professional or refer to the tax laws of your home country to determine reporting requirements.

- U.S. Withholding Agents:

- If you are a U.S. withholding agent, you must file Form 1042-S with the IRS, regardless of whether the recipient needs to report the income on their tax return.

How to file Form 1042-S:

Filing Form 1042-S involves several steps to ensure accurate reporting and compliance. Here is a general outline of the filing process:

- Gather Information:

- Collect all relevant information, including recipient details, income codes, income amounts, and withholding amounts.

- Complete Form 1042-S:

- Use the official IRS Form 1042-S and follow the instructions provided.

- Ensure accurate and complete information is entered for each recipient and income type.

- Submit to the IRS:

- File Form 1042-S electronically through the IRS’s FIRE (Filing Information Returns Electronically) system.

- The deadline for filing Form 1042-S is March 15th of the year following the tax year.

The importance of Form 1042-S

In the complex realm of tax reporting, Form 1042-S assumes a critical role as a stalwart guardian of accuracy and compliance.

Whether one finds themselves in the capacity of a non-resident alien, foreign corporation, or U.S. withholding agent, a comprehensive understanding of reporting obligations and adept navigation of the filing process are of paramount importance.

Visit our GoSystem Tax 1042 help page or ONESOURCE 1042 help page for more information on how to e-file.

|

BlogWhat accountants need to know about Form 1042 filing requirements Take a closer look at who must file Form 1042, the connection with Forms 1042-S and 1042-T, changes on the horizon, and more. |

DemoComplete demo: See how GoSystem Tax RS provides a sophisticated web-based system that provides the power to handle your most complex tax scenarios. |

|