What to know about tax credit equity investments.

Accounting professionals with equity investor clients who are involved with projects to receive income tax credits and other income tax benefits need to have a clear understanding of the proportional amortization method (PAM), especially in light of recent changes.

In March 2023, the Financial Accounting Standards Board (FASB) issued an Accounting Standards Update (ASU) aimed at improving the accounting and disclosures for investments in tax credit structures. The news made headlines as it expanded the use of the proportional amortization method for certain tax credit equity investments.

For public business entities, the amendments are effective for fiscal years beginning after Dec. 15, 2023, including interim periods within those fiscal years. All other entities will have an extra year to adopt the changes, which will be effective for fiscal years beginning after Dec. 15, 2024, including interim periods within those fiscal years.

Are your business clients ready? Strengthen your role as a trusted advisor by helping clients navigate the changes and better understand the potential implications.

Jump to ↓

| What is the proportional amortization method? |

| What are LIHTC investments? |

| What conditions must be met to apply the proportional amortization method? |

| Accounting for tax equity investments |

| Implementing ASU 2023-02 |

What is the proportional amortization method?

Under the proportional amortization method, entities are able to amortize the cost of an equity investment in relation to the overall proportion of tax credits it garnered during that period vs. the total tax credit it expects to obtain over the life of the investment. The investment amortization and tax benefits are presented on a net basis in the income tax line item of the income statement.

Prior to the FASB-issued Standards Update, only low-income housing tax credit (LIHTC) investments could apply the proportional method. Those investments that earned income tax credits and other income tax benefits through other tax programs had to instead use the equity method. Accountants, however, argued that the equity method proved too difficult and did not fairly represent the profitability or the economic characteristics of the investments.

As a result of the changes, this has now been expanded to include more federal and state tax credit investment programs. The new ASU enables other tax credit programs beyond LIHTC investments to qualify for the proportional amortization method.

Proportional amortization method example

To further explain, consider the following proportional amortization method example, which illustrates how a client may apply the method:

At the beginning of the first year of eligibility for the income tax credit, your client invests $102,000. Under a tax credit program, the partnership will obtain income tax credits.

The straight-line method is used to calculate the depreciation expense over a 10-year lifespan. The client’s tax rate is 40%, and the income tax credits will be received over a four-year period. To keep it simple, let’s assume the residual value of the investment will be zero.

In this scenario, the client will recognize an annual income tax benefit of $3,600 in the first four years of the investment (comprising of gross income tax benefit of $24,000 minus the amortization of the initial investment $20,400). In the remaining years (5 through 10), the client will recognize an annual income tax benefit of $600. Over the 10 years, this totals $18,000. The pre-tax income would include the non-income tax-related benefits.

What are LIHTC investments?

Given that affordable rental housing projects often lack enough profit to warrant an investment, the LIHTC program was developed to incentivize private developers and investors. LIHTC is an indirect federal subsidy that is used to finance the construction and rehabilitation of low-income affordable rental housing.

How does it work? By providing financing to develop affordable rental housing, investors, in turn, receive a dollar-for-dollar reduction in their federal tax liability. Their equity contribution subsidizes low-income housing development, which enables some rental units to rent at below-market rates. Investors then receive tax credits paid in annual allotments, which is typically over a 10-year period.

Since it began in 1986, the LIHTC program has fueled the development of more than 2.5 million affordable multifamily units.

What conditions must be met to apply the proportional amortization method?

As outlined by FASB, there are certain conditions that need to be met in order to qualify for the proportional amortization method. These conditions include:

- Income tax credits allocable to the equity investor will likely be available.

- The investor cannot exercise significant influence over the operating and financial policies of the project.

- Essentially all of the projected benefits are from income tax credits and other income tax benefits.

- The investor’s projected yield, which is based solely on the cash flows from the income tax credits and other income tax benefits, is positive.

- For both legal and tax purposes, the investor is a limited liability investor in the limited liability entity, and the investor’s liability is limited to its capital investment.

Accounting for tax equity investments

When applying the proportional amortization method for a qualifying equity investment, the initial cost of the investment is amortized in proportion to the income tax credits, as well as any additional tax benefits the client may receive. The income tax credits, as well as the amortization, are recorded in the income statement as part of the income tax expense (benefit).

Additional changes from the March 2023 FASB Update include:

- All qualifying equity investments accounted for using the proportional amortization method are required to use the delayed equity contribution guidance. This requires that a liability be recognized for delayed equity contributions that are unconditional and legally binding, or for equity contributions that are contingent upon a future event when that contingent event becomes probable.

- Entities must disclose information in annual and interim reporting periods for tax equity investments. This includes information on: 1) the effect of its tax equity investments and related income tax credits and other income tax benefits on its financial position and results of operations, and 2) the nature of its tax equity investments.

Implementing ASU 2023-02

Changes are fast approaching for equity investors who are involved with projects to receive income tax credits and other income tax benefits. As a trusted advisor, help ensure that your business clients are prepared and understand the potential impacts.

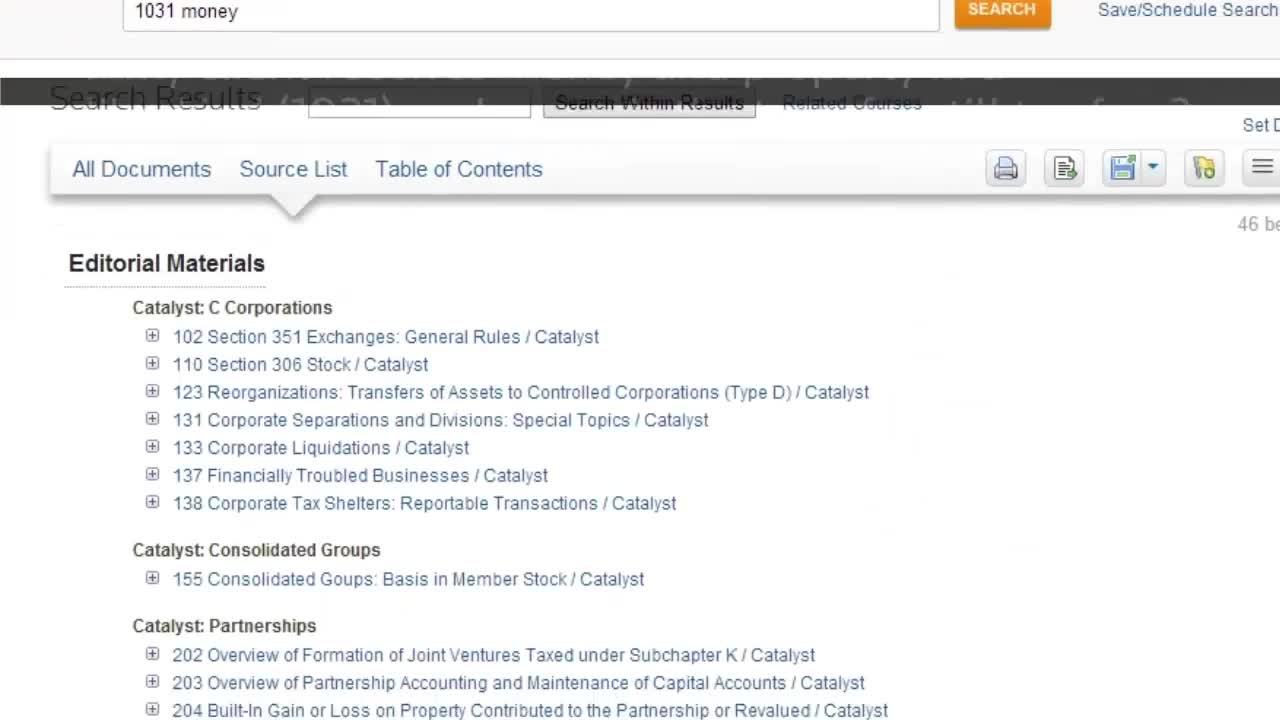

Turn to a solutions provider that can deliver expert guidance on amortization and other cost recovery issues your firm needs to better serve business clients. Thomson Reuters Checkpoint Catalyst covers the most important and frequently encountered topics for practitioners with business income-related tax issues. By leveraging Checkpoint Catalyst, you’ll have the powerful insights and robust tax research tools your firm needs to keep pace with new Accounting Standards Updates.

Video

Checkpoint Catalyst: Experience the difference of an integrated research workflow

Watch video ↗