Finding ways for people to work smarter is a key goal of many organizations today. In the corporate tax space, just as the regulatory compliance landscape becomes more challenging and reporting requirements become more demanding, technology is advancing rapidly to crunch vast amounts of data in no time and streamline labor-intensive processes.

AI in tax compliance is a top priority

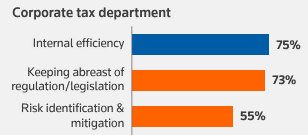

Artificial intelligence (AI) is a game changer for improving efficiency, cited as the top priority of tax and accounting professionals in our recent Future of Professionals report, with 75% of respondents in corporate tax teams rating it as a key concern.

Clearly, unlocking time savings should not come at the expense of quality tax work. AI is adept at supporting both. Capabilities such as machine learning, generative AI, and advanced data analytics algorithms can be used to help tax professionals deliver accurate, timely calculations, tax filings and reports, and create clearer visibility to help ensure compliance with tax rules.

There are many ways in which AI can reduce the time taken to perform tasks while leaving professionals better informed about tax status, and freeing them up to undertake higher-value, more intellect-intensive work.

AI can make sense of data – fast

Many organizations are awash with data – but it’s not necessarily all stored systematically, ready for easy analysis. Data may be found in disparate places – in shared drives, on individual PCs, in emails, spreadsheets, Word documents, and PDFs. Identifying and extracting it can be difficult, let alone categorizing it and analyzing it.

AI can sift through all of these, collating data into meaningful categories, validating it, distilling it, slicing and dicing it, and presenting it in an understandable format so that the data and analytics you need for a particular tax report, to make sure you’re in line with your various tax obligations, is readily at hand.

Making many manual tasks a thing of the past

AI-powered automation is becoming more and more prevalent, with the majority (60%) of respondents to the Thomson Reuters 2024 Corporate Tax Department Technology Report estimating that between 10% and 50% of their tax departments’ work processes are now automated.

Eliminating repetitive, manual tasks is a critical driver of efficiency gains. Why waste time doing and redoing relatively basic jobs like data entry, and even higher-level work like document review, tax calculations, and compliance checks, when tech tools can do it quicker, more comprehensively, and with less risk of human error?

Tracking regulations with ease through AI-powered tax compliance

Tax-related regulation and legislation are evolving all the time: AI can help you keep up. This is vital, since tax authorities around the world are frequently working more closely together to share information, and rules are generally becoming more complex, while for those with multinational operations, there’s a patchwork of different regulations to comply with globally.

No wonder that staying abreast of regulatory changes comes a close second behind efficiency as a top priority, as the graph above shows. Corporate tax departments that can do so efficiently can effectively kill two birds with one stone.

AI can enable you to spend less time on compliance tasks by monitoring and alerting you to changes in legislation, providing guidance on what the implications and obligations are, making recommendations, or providing straightforward analysis of complex codes and concepts.

Effortlessly enhancing transparency in tax compliance

AI can be deployed to follow rules-based procedures to undertake, and automatically track and record tax activities and outcomes. In this way, it can create well-documented audit trails and help provide clear disclosures to relevant stakeholders, including shareholders and internal leadership as well as regulators and auditors. So you have the assurance that tax-related actions always comply with the relevant regulations, you can demonstrate why certain decisions were made, and you can mitigate risk –all with fewer interventions required on your part.

Ultimately, increasing efficiency is about making processes friction-free: easing laboriousness, reducing repetition, and simply providing more clarity so that corporate tax professionals can get on with their jobs in a more streamlined and effective fashion. Productivity can be increased without people having to work harder – it’s just a question of giving them the right tools to make it easier for them to do good work. And with the sector under greater pressure than ever to report more frequently and in more detail, meet ever-tightening regulations, and reduce risk, these are important considerations.

_____________________________________________________________________________________________

Discover how Thomson Reuters is harnessing the power of AI.

______________________________________________________________________________________________