Among the changes that the IRS has decided to make for 2017 tax year is a change to Form 1098-T, an important record for educational institutions such as universities as well as for their students.

Eligible educational institutions file Form 1098-T for each student they enroll and for whom a reportable transaction is made. They do this by sending the form to students and those who have dependent students. These recipients, in turn, use Form 1098-T to claim an educational credit on their personal income taxes, Form 1040 or 1040A.

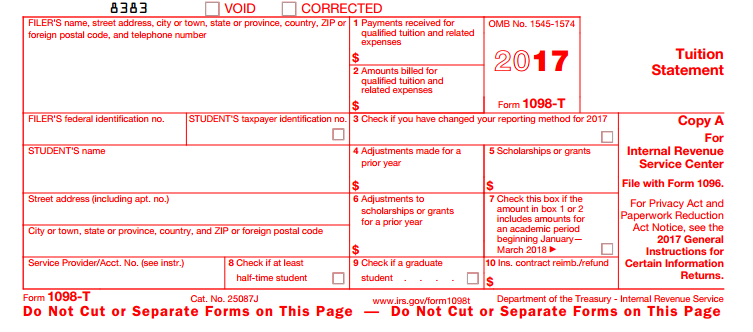

Up until now, student expenses could be reported by either disclosing payments received (Box 1 below) or amounts billed (Box 2).

That second option was problematic. When receiving the form from colleges, individual filers tended to accidentally misreport their college expenses when benefits such as scholarships were involved. The compliant way to report tuition cost was to subtract any scholarship amount from the total amount billed. Too many filers were not doing this. Instead, they were failing to subtract the scholarship amount from the total amount billed, leading to inaccurate reporting of the funds the university had received.

For the 2017 tax year, the IRS will prefer users use Box 1 and will give “limited penalty relief” for users who continue to use Box 2. Moving forward, Box 2 will be grayed out so that filers will be unable to make this mistake moving forward.

The issue here, from the university’s perspective, is that most of them print their own forms. Many universities do this reporting in-house on legacy systems and we predict many will struggle to change their in-house tax programming to accommodate this change.

The IRS plans to shade out Box 2, and may grant universities a year of relief from complying with this change, which the universities have asked for. But, regardless, universities need to redesign their programming to start reporting via Box 1 only.

This change will impact a lot of people. All accredited colleges and universities use Form 1098-T, and all students — full-time and part-time, at all levels — receive them. That amounts to more than 2,600 institutions and more than 20 million students, according to the Association of American Colleges and Universities and the Department of Education, respectively.

It will also pose logistical challenges for universities.

First, universities are not able to use the IRS TIN Matching System because there is no backup withholding element to the form. This means, effectively, that universities do not have a good way to double-check the filings to see if the taxpayer ID numbers expressed are accurate.

Relatedly, the IRS has added a checkbox in the Students Taxpayer box on Copy A of the form. By checking this box, the university certifies, under penalty of perjury, that it has followed the TIN solicitation rules and to the best of its knowledge the information is correct. This is a substantial risk.

Furthermore, many universities currently print their own 1098-T forms and use the IRS FIRE system to file them. This is an example of the kind of manual reporting process many private-sector filers are fixing with automation because the FIRE system will soon be replaced. When it is upgraded or no longer used in its current iteration, universities will be required to file in an XML format.

Doing this now would effectively kill two birds — the omission of Box 2 and the antiquated, manual process of printing and mailing their own forms — with one stone.

For more information on 1098 compliance and the solutions offered by Thomson Reuters ONESOURCE, please visit tax.thomsonreuters.com/1099 or contact us for more information.