Tax teams prepare tax provisions by gathering data, performing calculations, and entering the results into forms. However, corporate tax teams find it difficult to automate this process. With the help of Application Programming Interfaces (APIs), these teams can revisit their year-end workflow with an eye to making it more efficient.

What are APIs and how do they work?

APIs give developers powerful tools to create and maintain applications. They are sets of programming instructions that let two software programs communicate. APIs can build things like simple interface functions into complex data-driven applications and let developers easily integrate two software programs.

APIs provide access to data and allow users to send requests to modify existing data. For example, a developer could use an API to send a request for updated stock prices from another application’s database. The developer’s application would then use the response and display it accordingly. They are a great way to connect applications and make data accessible across different platforms.

APIs have rules. For two software programs to work together, there must be specific protocols. This includes authentication methods, transmission protocols, and rate limits. For example, if two programs want to exchange data, they must define how the data will be formatted and how it will be sent.

What are the benefits of tax provision software?

Tax professionals use tax provision software such as to solve the technical and process issues involved in calculating your income tax provision. Tax provision software employs advanced algorithms and automation, minimizing the risk of errors and providing accurate calculations. The software streamlines the tax provision process, reducing the time and effort required for manual data entry and calculations. Designed to adhere to tax regulations and guidelines, tax provision software helps in avoiding penalties.

Tax provision software

Automate your corporate financial close with ONESOURCE Tax Provision

Learn more ↗How can tax provision APIs streamline calculations?

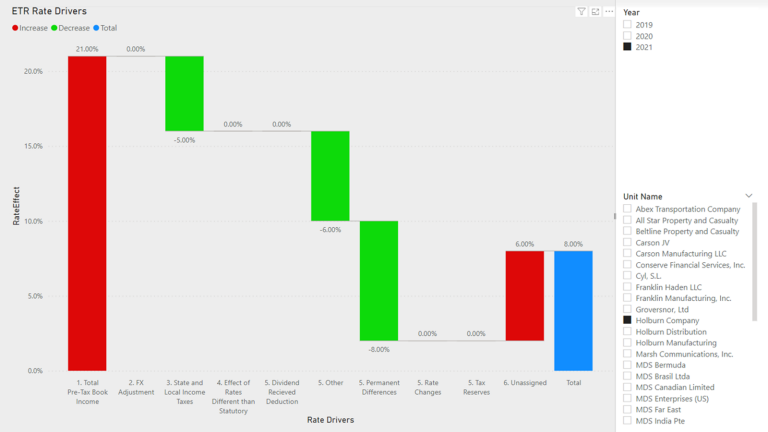

Tax provision APIs, when working in conjunction with tax provision software, can help overcome several challenges associated with tax provision calculations and reporting. Some of the key challenges that tax provision APIs can address include:

- Manual time-consuming processes: Tax teams need to combine different calculations from different jurisdictions or different legal entities. Using APIs, provision calculations are automated, saving tax professionals time and effort, while also reducing the risk of error. API-powered provisioning processes can be more accurate, secure, and efficient than traditional manual methods.

- Data integration: Tax provision calculations require data from multiple sources, such as financial systems, general ledgers, payroll systems, and tax forms. APIs facilitate the seamless integration of data from these disparate sources, eliminating the need for manual data transfer and reducing the risk of errors. Additionally, APIs provide a way for tax professionals to access real-time data for analysis, which can help them make better decisions about their company’s tax liabilities.

- Data consistency and audit trail: For a company, tax provisioning is the most looked-at process due to its impact on the financial statements. APIs enable consistent data capture and provide an audit trail of the calculations performed. This audit log allows for transparency, traceability, and compliance with regulatory requirements, as well as providing a means of future-proofing the tax provisioning process.

- Scalability: In organizations with multiple entities or subsidiaries, consolidating tax provision data can be a challenge. APIs can handle large volumes of data, making it easier to scale tax provision processes across various entities and enable consolidated reporting. Furthermore, APIs can be configured to return data in a format that is easy to understand and use, making it easier to make decisions based on tax provision data.

- Collaboration and communication: APIs can facilitate collaboration between tax professionals and other stakeholders by providing access to real-time tax provision data. This shared perspective improves communication, enhances decision-making, and streamlines the overall tax provision process.

Where to find more information on tax provision APIs

To gain a better understanding of how APIs can be used, it is important to find reliable information on the topic. Fortunately, Thomson Reuters has several resources that explain features and capabilities. See below for our list: