Your firm's efficiency and profitability goals might become a reality with the right AI solution.

Highlights

- Ready to Review handles the most time-consuming steps of the tax prep process

- Firms can process more returns without adding staff

- Tax prep automation can pave the way for more advisory engagements

Tax season has always been synonymous with long hours, manual data entry, and the constant pressure to meet tight deadlines. But what if AI could eliminate your biggest tax return preparation pain points?

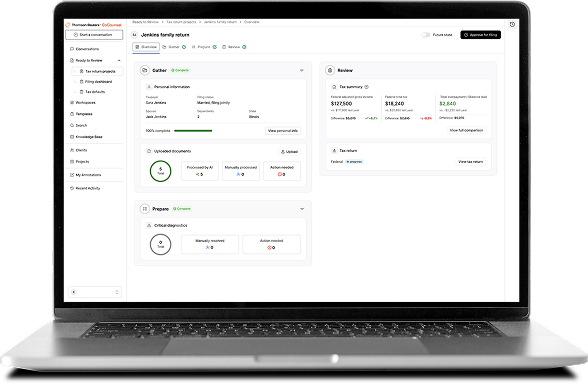

Enter Thomson Reuters Ready to Review, an agentic AI-powered tax workflow solution designed to automate the most time-consuming steps of the tax process. Built on the Thomson Reuters CoCounsel platform, it takes tax preparation automation to a new level, giving professionals a completed return that’s ready for review before a human even touches it. Let’s take a look at how it works.

Jump to ↓

How does Ready to Review work?

What are the key features of Ready to Review?

Why AI-powered tax preparation matters to firms

The future of AI tax return preparation is here

What is Ready to Review?

Ready to Review takes AI tax return preparation to a new level, leveraging multiple AI agents to automate the Gather and Prepare stages of your workflow. It uses source documents and prior year tax returns to extract, categorize, and populate data into the current-year return. Professionals then have more bandwidth to focus on strategic advisory work rather than inputting data and organizing workpapers for hours on end.

Ready to Review currently handles 1040 returns and will soon be expanding to business returns. Ready to Review’s AI automates W-2 income, prior year returns, and a growing list of source documents set to expand throughout Q1 2026. This phased approach ensures firms can immediately benefit from automation while preparing for broader capabilities in 2026.

How does Ready to Review work?

Think of Ready to Review as a virtual tax preparer in your office. It goes through the same tax return preparation steps with context-based problem solving powered by agentic AI. Here’s a walkthrough of its process:

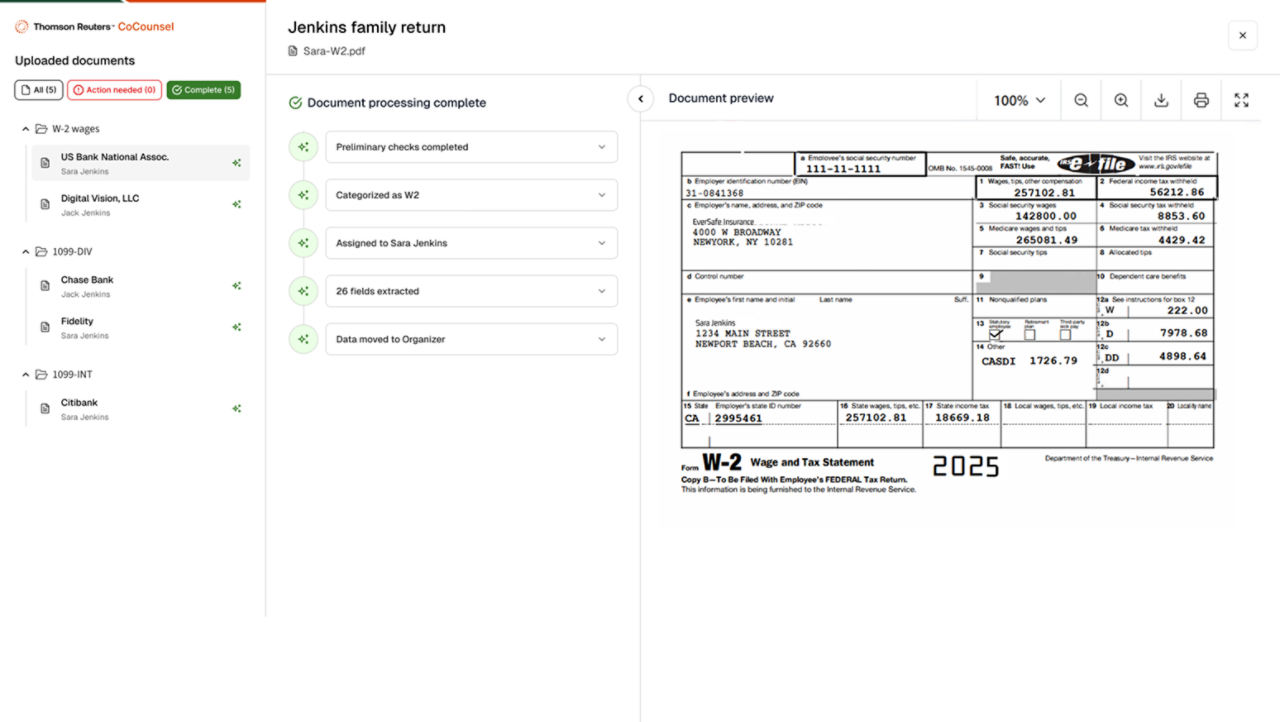

- Upload documents: The tax professional uploads all relevant source documents.

- AI agents take over: Our system scans the documents (along with the prior year tax return), and extracts, categorizes, and populates data into the current-year return.

- Data processing: Information is processed by the integrated tax software for federal, state, and local compliance.

- Diagnostics and comparison: After processing data, AI flags outliers for the tax professional to review.

- Return ready for review: The result is a fully populated tax return, ready for the professional’s final review and e-filing.

What are the key features of Ready to Review?

Unlike generic AI tools, Ready to Review is purpose-built for AI tax return preparation and backed by trusted tax expertise. Here are some of the features that make it special:

- Automated document extraction and verification: Uses agentic AI to scan client documents and prior-year returns, extract relevant data, and categorize information automatically. This automation eliminates manual data entry, reduces errors, and ensures that nothing gets overlooked.

- Single-platform simplicity: No more switching between multiple programs during tax prep. Ready to Review condenses the entire preparation process into one application.

- Scalable and reliable tax engine: Ensures accuracy and efficiency regardless of your return volume. Teams can take on more work without compromising performance.

These features combine to create a seamless, end-to-end workflow that minimizes manual intervention.

Why AI-powered tax preparation matters to firms

Many of the industry’s biggest pain points stem from manual tax return preparation. Here’s how automating that process to an unprecedented degree can benefit your firm:

Smoother busy seasons

Condensing the tax process into a faster, review-driven engagement makes chaotic busy seasons manageable. By spending less time per return, your team can enjoy shorter workdays, less stress, and better work-life balance.

Fewer staffing pains

For years now, the tax space has seen more professionals retiring than entering the industry, leaving a massive talent gap. Ready to Review helps firms process large return volumes within their staffing limitations. That means you can grow your practice without having to proportionally scale your team.

More advisory opportunities

By reducing time spent manually entering data and indexing workpapers, professionals can concentrate on work that really lets their skills shine. With Ready to Review’s AI-powered tax return preparation, teams have the bandwidth for consultative and tax planning engagements that deliver more value to clients and bigger profits to firms.

The future of AI tax return preparation is here

Ready to Review represents a major leap forward in AI tax return preparation. By automating the most time-consuming steps, it empowers firms to overcome staffing challenges, improve accuracy, and focus on what truly matters—client relationships and strategic growth.

To learn more about Ready to Review and see how it fits with your firm’s workflow, check out our product page for details, use cases, and a video demo. To get started using the product yourself, sign up for a free demo.

See Ready to Review in action!

Request a free demo to see how Ready to Review works with your workflow.

Get free demo ↗