Auditors know there’s never been a more challenging time to monitor and meet evolving regulatory and professional standards changes. How their jobs are performed now requires more than accounting and audit knowledge and skills. In fact, the accounting and audit professions have gradually been drawn into the world of automation and automated technology.

To that end, we’ve prepared audit engagement tips that explore how automated tools and techniques can enhance the processes and steps.

Each audit engagement is unique, but most share the basic components of pre-engagement activities, planning (including risk assessment), performing fieldwork, evaluating, and concluding. To ensure a timely and successful audit, it is critical to establish an overall audit strategy that sets the scope, timing, and direction of the audit.

Jump to ↓

| Audit planning |

| 1. Plan an audit strategy |

| 2. Consider tools to use to conduct fieldwork |

| 3. Evaluate findings and evidence & prepare reports and communications |

| A clear path forward with Thomson Reuters |

Audit planning

After the decision is made to accept an audit engagement and the engagement letter is obtained, audit planning begins. Effective audit preparation involves a deep understanding of the client, its industry, the environment in which it operates, the applicable financial reporting framework, and the client’s system of internal control. This is part of a detailed planning phase, during which the auditing team gathers and documents related audit evidence, performs risk assessment procedures, establishes planning materiality, and develops a tailored initial expectation of audit strategy and significant audit areas.

Today, most companies and industries rely heavily on data, and the ability for auditing teams to examine and analyze the client’s data is necessary. The use of technology at this point can greatly assist in determining the right scope of the data to make it relevant to the intended audit.

1. Plan an audit strategy

Engagement planning starts with creating a strategy for how to approach and execute the audit, and should include the following steps:

- Obtain an understanding of and evaluate the components of the client’s system of internal control.

- Conduct a risk assessment — assess identified risks of material misstatement at the financial statement level, refine the audit strategy, and develop specific overall responses to risks at the financial statement level.

- Assess inherent risk at the relevant assertion level and determine significant audit areas. Determine significant risks and fraud risks.

- Assess control risk by relevant assertion for significant audit areas and conclude on whether the audit strategy will include tests of operating effectiveness of any identified controls in significant audit areas.

- Finally, decide on an audit approach and audit plan. The approach needs to respond appropriately to the combined risks of material misstatement for each relevant assertion for each significant audit area. This critical step can be key to having an effective and efficient audit.

2. Consider tools to use to conduct fieldwork

Fieldwork is part of many of the steps above and includes gathering evidence and statistical and analytical analyses.

Traditionally, proper evidence gathering included physical observation and staff interviews; however, with the shift to remote audit work over the past few years, the way auditors gather evidence has changed. Automated tools and techniques are now used, including the use of cameras and drones to observe inventory counts and video conferencing services to conduct interviews.

Sampling is another common testing method. For example, Thomson Reuters Audit Intelligence Analyze can automate transaction analysis and is a powerful tool for sample selection effectiveness and efficiency.

White paper

Audit from anywhere: Remote audit best practices for a new era of audit teams

Read white paper ↗3. Evaluate findings and evidence & prepare reports and communications

After all the evidence is gathered and the fieldwork is completed, the final pieces of the audit engagement start with evaluating audit findings and evidence to determine whether there is sufficient audit evidence to support the audit opinion. If so, report your findings and make any other required communications, such as internal control communications using cloud-based engagement software that aggregates all information and data, which allows for more thorough analysis and collaboration among team members.

Further, this kind of tool can make vast quantities of data more manageable with much greater accuracy and remove the manual tasks of copying and pasting between applications or cross-referencing data.

A clear path forward with Thomson Reuters

In a recent webinar on future-proofing audit firms, Scott Spradling, Executive Director of Audit Innovation at Thomson Reuters and former auditor at KPMG, said, “Firms need a trusted partner — they don’t have to become experts in all these new technologies. You need somebody that is aggressively and constantly incorporating these new technologies, like AI, generative AI, and the like. But doing it in a way that is practical and cost effective and embedded directly into the [audit] methodology and workflow.”

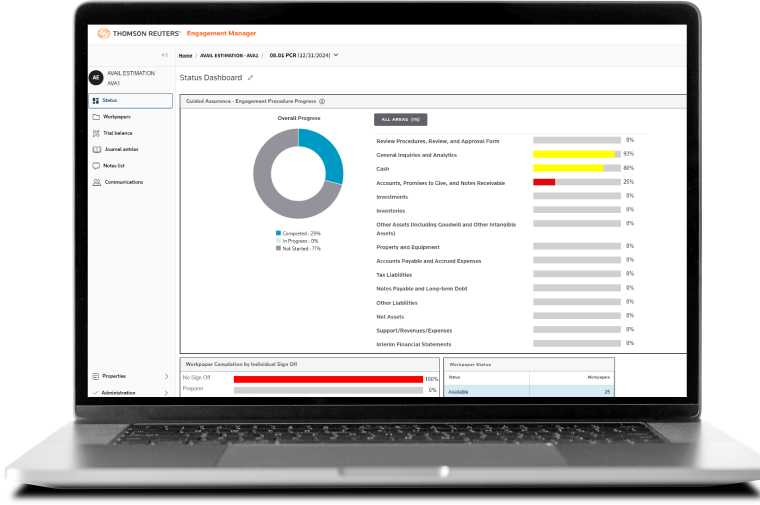

Thomson Reuters PPC audit products assist with establishing and documenting an overall audit strategy. When used with Guided Assurance, part of the Cloud Audit Suite, our fully integrated online engagement solution walks the auditor through the audit process and gives enhanced technological functionality of the tools in a PPC audit guide so the auditor can perform efficient audits that comply with professional standards.

PPC’s Practice Aids, which are available in editable Microsoft Word and Excel formats, include all practice aids found in the PPC audit guide, including AP-10, “Audit Program for General Planning Procedures” and AP-20, “Audit Program for General Auditing and Completion Procedures.” These Audit Programs outline the steps for auditors to perform an audit in accordance with professional standards.

Today, auditors are now finding ways to work differently, and by using the technologies and automation tools that allow them to gather and analyze data, collaborate across teams, and present their findings clearly and more accurately, they are ensuring that these key aspects of remote audit engagements will continue.

To learn more about how to be successful in your audit engagement, check out the Cloud Audit Suite from Thomson Reuters.

Automate your audit workflow with Thomson Reuters Engagement Manager

Audit engagement software