As AI becomes an integral piece of everyday workflow for professionals across all industries, many accounting firms are finding ways to leverage this game-changing technology for increased efficiencies, deeper insights, and a competitive edge.

Jump to ↓

| Understanding AI’s impact |

| Step 1: Cultivating an AI-savvy culture |

| Step 2: Developing an AI roadmap |

| Step 3: Implementing AI responsibly |

| Are you ready to become an AI-ready firm? |

As AI becomes an integral piece of everyday workflow for professionals across all industries, many accounting firms are finding ways to leverage this game-changing technology for increased efficiencies, deeper insights, and a competitive edge.

But as an accountant, where do you begin in building an AI-ready firm? Let’s take a look at AI’s impact on the accounting profession, how to cultivate an AI-savvy culture, and best practices for developing an AI roadmap that supports growth and innovation responsibly.

Understanding AI’s impact

There is no doubt that AI is poised to transform the tax and accounting career landscape by unleashing operational efficiencies never before seen. In fact, according to the Thomson Reuters Future of Professionals Report, respondents predicted that AI could free up as much as four hours a week within the next year. That’s an extra 200 hours per year of additional time.

When it comes to freeing up time, AI delivers the ability to handle large volumes of data, improve response times, and reduce human error. In fact, one of the primary benefits of integrating AI into your firm’s daily workflow is that AI-enabled tax software can analyze vast volumes of financial data in a fraction of the time it would take a human accountant — identifying patterns, anomalies, and trends with ease.

On top of those benefits, AI-powered tax research can help staff find targeted search results in less time. By providing professionally summarized answers, complete with citation links to relevant editorial content and source materials, even junior staff can quickly answer complex client questions with confidence.

Step 1: Cultivating an AI-savvy culture

While the benefits of AI are clear, putting this technology into practice requires a holistic approach. Fostering a workplace environment that embraces continuous learning and adaptation to new technologies ensures that your staff is prepared to leverage AI tools effectively.

As evidenced in the recent State of the Tax Professionals Report, recruiting and retaining new professionals is a top priority given the shortage of tax and accounting talent and a shrinking labor pool. That’s why many accounting firms are now directing more of their energies toward hiring, training, and engaging high-performing staff, as well as cultivating an AI-savvy work culture.

Not only is culture important, but AI must align with your accounting firm’s business goals. AI should not be adopted for its own sake but with clear objectives like improving efficiency, enhancing client service, and driving growth.

It’s equally as important to invest time and resources into upskilling your staff with AI-related training programs, webinars, and workshops to improve their understanding of AI tools and their applications.

Most importantly, however, is that nothing beats practical, hands-on learning. Offering access to AI-powered tax research tools or industry-specific cloud-based audit suites allows your staff to experiment and learn through experience. And you can rest easy knowing that professional-grade tax research solutions (as opposed to publicly available platforms ) are backed by the security measures necessary for the tax and accounting profession.

|

|

Step 2: Developing an AI roadmap

According to the Future of Professionals Report, 77% of respondents believe AI will have a transformational or high impact in the next five years, with an average of 56% of all professionals’ work set to use new AI-powered technologies in five years.

While the future of AI in tax research is certainly promising, it’s important to understand the benefits and challenges to successfully harness the power of AI for a competitive edge.

To build an effective AI roadmap, consider the following steps:

- Pilot smaller AI projects in specific areas within the firm.

- Gather insights and refine processes before taking it firm-wide.

- Consider engaging with clients by explaining how AI tools help provide faster, more accurate, and personalized services. This can also open the door to additional revenue streams, like advisory services.

Remember: Transparency builds trust—and a forward-thinking AI approach can become your firm’s competitive edge.

Step 3: Implementing AI responsibly

Despite the clear benefits, the adoption of AI brings with it ethical considerations and the need for standards that ensure it is used responsibly.

Publicly available generative AI platforms pull data from across the internet. This means that answers may be inaccurate, out-of-date, or quite simply unverified. This can lead to accuracy, privacy, and security concerns, not to mention the possible financial impacts and reputational damage that can come with unvetted tax research.

However, an industry-specific AI-powered tax research platform enables your firm to implement AI responsibility, eliminating concerns over accuracy and data security.

Are you ready to become an AI-ready firm?

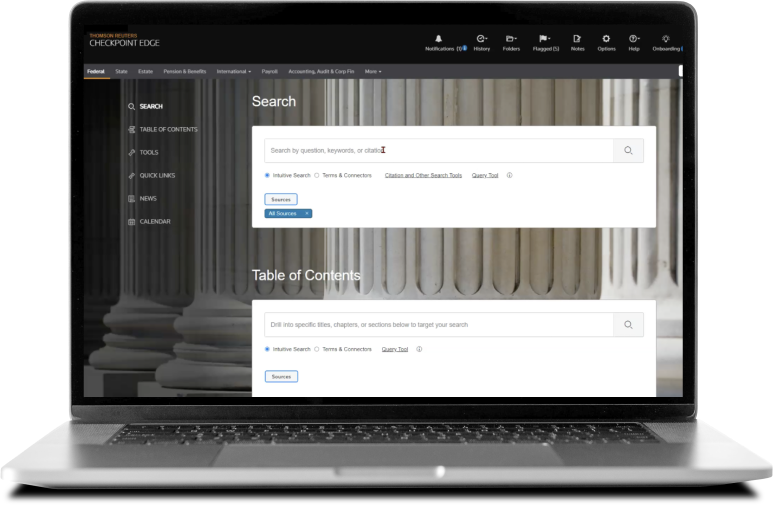

Checkpoint Edge with CoCounsel is an industry-specific, professional grade, GenAI assistant built specifically for tax and accounting professionals.

With a conversational interface, it delivers straightforward answers to even your most challenging questions – just as if you were speaking directly to a subject matter expert or trusted advisor.

Built on Checkpoint’s legacy of authoritative guidance and award-winning editorial expertise, Checkpoint Edge with CoCounsel is always up to date with the latest in tax policy and regulation. Alongside expert commentary and unique insight, staff at every level can find insightful and accurate answers to even the most complex tax questions on their own.

Checkpoint Edge with CoCounsel

Enhance your tax research and get targeted search results in less time

Learn more ↗