Checkpoint Edge features

Get to know the most intelligent tax and accounting research tool

Increase productivity using Checkpoint Edge — offering unmatched editorial expertise and efficiency tools

Looking for AI that doesn’t just assist—but acts?

Explore CoCounsel, the agentic-AI platform redefining productivity for professionals.

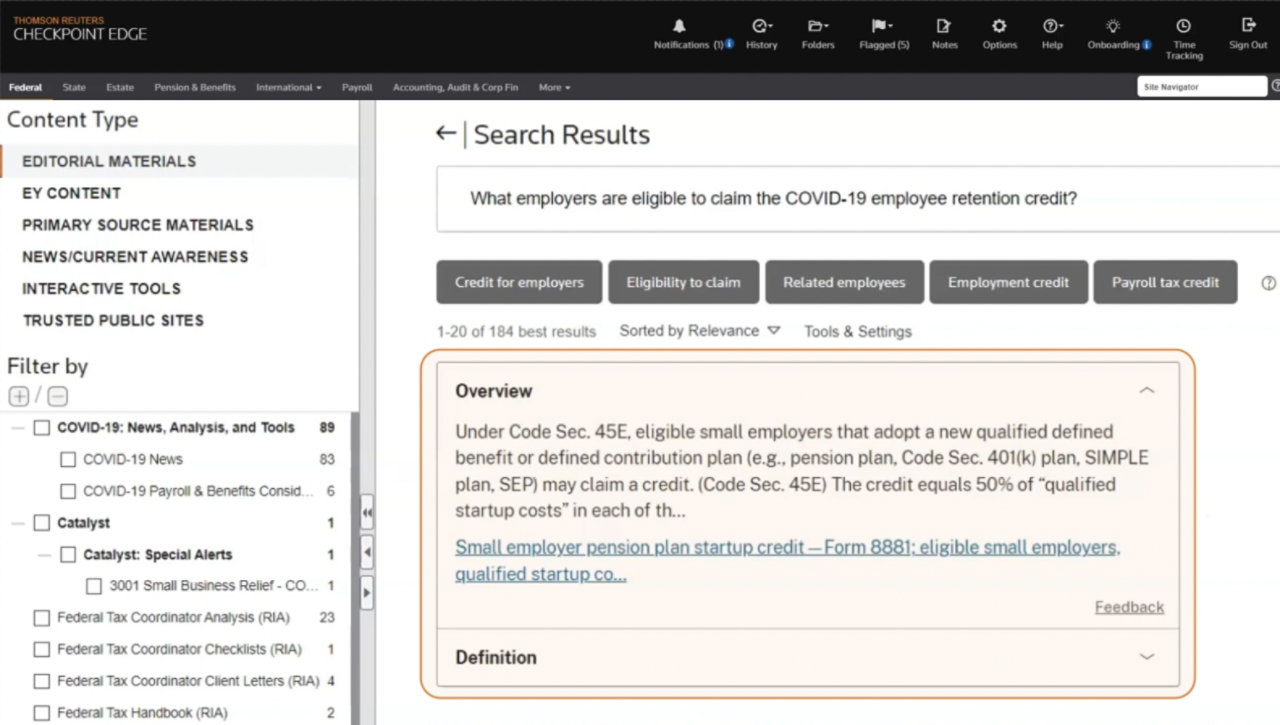

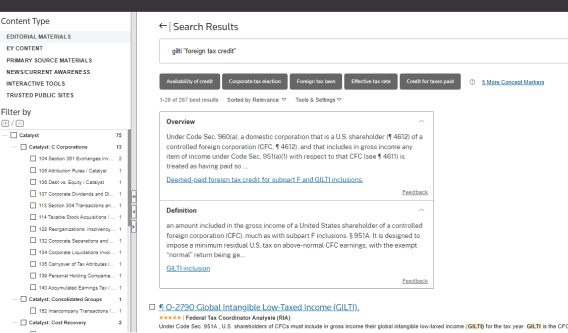

Faster and more accurate search

Checkpoint Edge helps you find answers quickly with advanced technology and search functionality.

Powerful algorithm

Experience Checkpoint Edge, the industry’s most sophisticated AI-powered algorithm, built with larger sources of human-curated data and more diverse sets of features within its machine learning. The typeahead, predictive search feature returns the most targeted results based on full-phrasal, natural-language questions.

Concept markers

Increase your research momentum with dialogue-based research and get quick, on-point search results with markers. Markers represent related or beneficial concepts in your search; clicking on a marker re-sorts your results to include these chosen concepts.

Snapshots

Cut through the noise and find potential answers even faster. Snapshots provide you with quick answers and orient you to unfamiliar topics so you can propel your research forward without having to scan through search results, open documents, and hunt for answers.

Trusted content and resources

Tap into the expertise of internal and external subject-matter experts and editors whose sole focus is delivering relevant and precise analysis and guidance.

Comprehensive and authoritative content

Gain access to the most up-to-date and intuitively organized collections of standards, laws, regulations, caselaw, and agency guidance backed by our rigorous editorial processes.

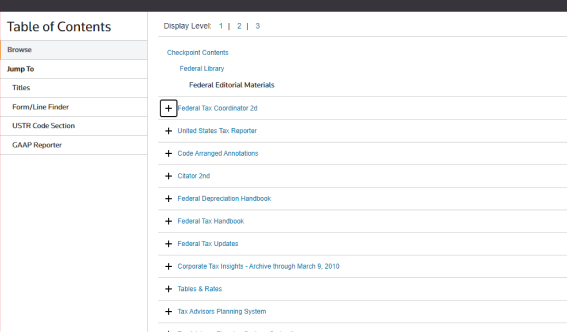

Table of contents

Easily browse and search content sets by practice area. Get quick visibility into your search and access the content and titles you need with front-end filtering and user-friendly functionality.

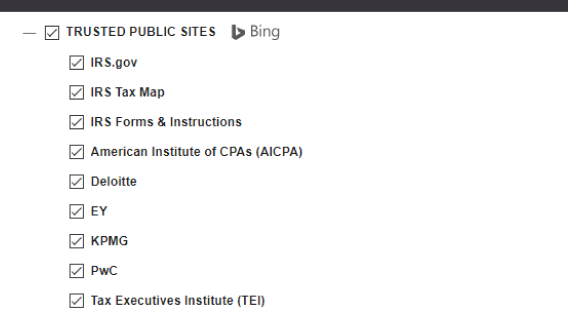

Trusted public sites

Explore verified, reliable, and trusted public sites on Checkpoint Edge. You will gain simultaneous search and access to IRS, AICPA, TEI, the Big 4, and comprehensive state tax agencies — all in one place.

Daily news and fast legislative analysis

Stay informed and get ahead with tax and accounting news delivered to your inbox each morning. Our on-the-ground journalists cover the latest developments from Congress, IRS, FASB, SEC, PCAOB, and other key players. Access in-depth analysis of new tax legislation within 24 hours.

Unparalleled expert insights

Sift through the noise to find what really matters using plain-language explanations, practitioner insights, and practical examples. Checkpoint Edge enables you to quickly pinpoint issues, understand the scope and impact of new legislation, and create custom charts and checklists to fit your needs.

Recommended and related resources

Never hit a dead end in your research workflow! Checkpoint Edge pairs in-depth analysis with related news, commentary, and recommended documents all on one page, so you can work confidently and examine all angles of an issue with ease.

Boost your research and save valuable time with the most extensive, up-to-date collection of tools, including Topic Pages, Advisory Maps, and State Charts.

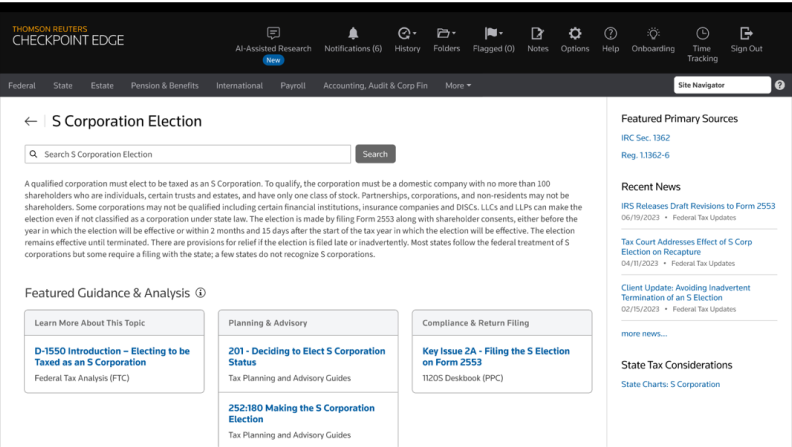

Topic Summary Pages

Easily find your starting point when exploring a specific topic without much background or experience. With Topic Pages available in Checkpoint Edge with CoCounsel, you’ll get the most relevant resources to enhance your knowledge and expedite your research.

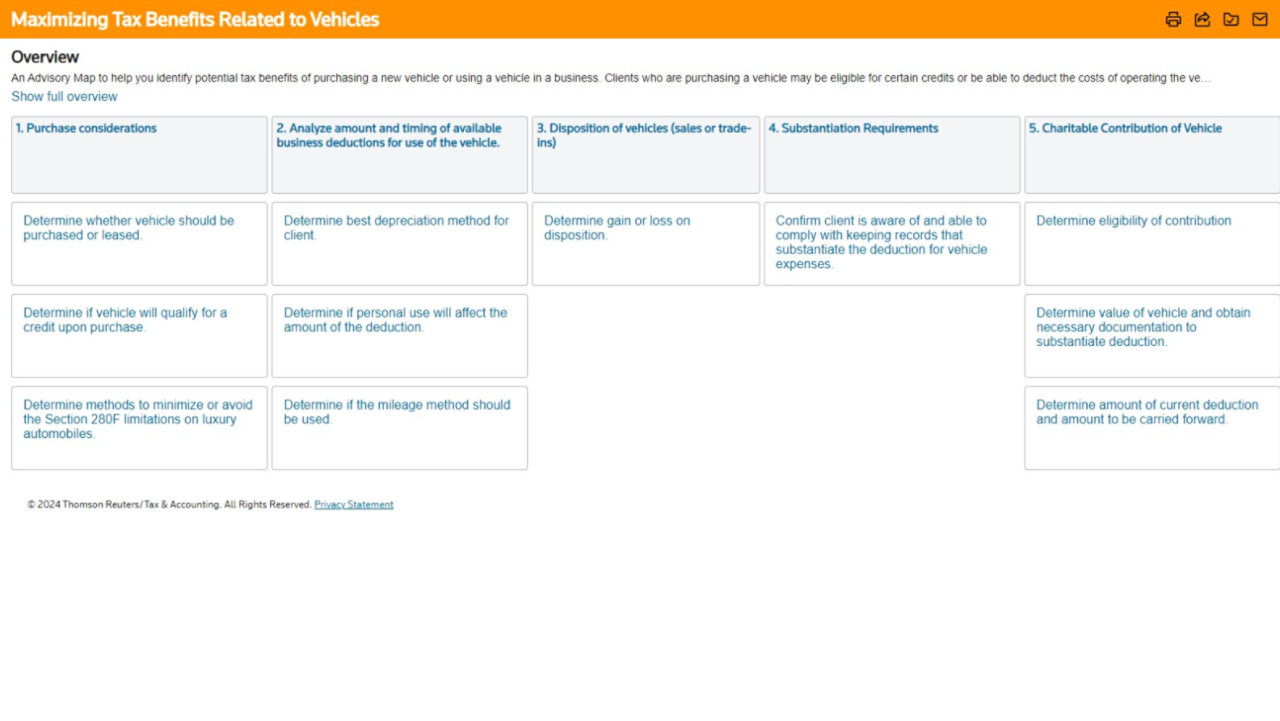

Advisory Maps

Confidently evaluate and determine the best options for your clients with an end-to-end process for delivering specific tax planning and advisory engagements. Named Winner of the 2024 Accounting Today Top New Products, Advisory Maps provides step-by-step guidance and implementation aids for every task and phase of the process.

State charts

State tax research starts in the charts with Checkpoint Edge. Begin your research with multistate tax comparison charts for quick answers and save valuable time with one-click access to our State Tax Reporters for on-point primary law and editorial explanations.

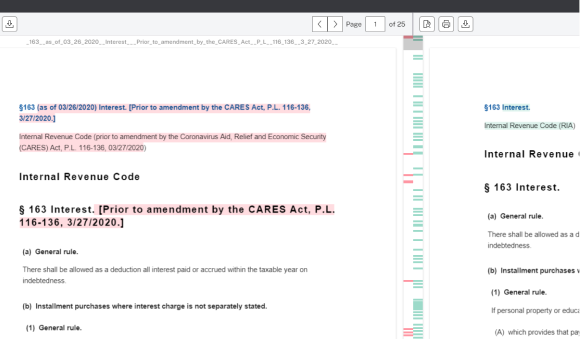

Document comparison

Easily compare official documents from the past six years, including the Internal Revenue Code, treasury regulations, IRS rulings, procedures, and state statutes. You can work with Microsoft Word, Adobe Acrobat, or manual tracking.

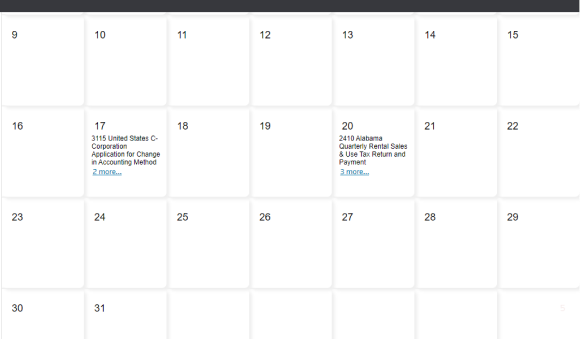

Tax calendar

Use our simple, step-by-step wizard to help you set up calendars with the obligations you’d like to track. Select and personalize criteria such as the return type; calendar type, like fiscal or calendar year; and jurisdictions, including New York City, Puerto Rico, and the U.S. Virgin Islands.

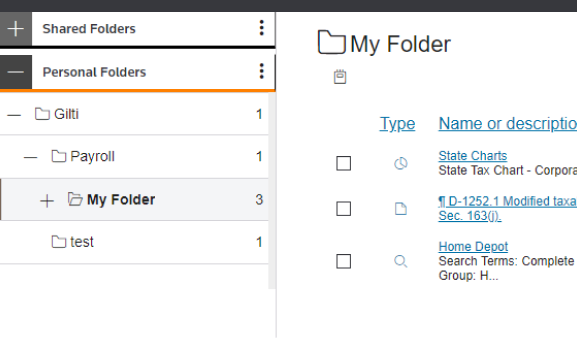

Shared folders

Take your folder system to a new level. Users who save and organize their research documents in personal folders can now share documents at the account level with others who have access to Checkpoint Edge.

Questions about Checkpoint Edge? We're here to support you.

800-431-9025

Call us or submit your email and a sales representative will contact you within one business day.

Contact us