Jump to ↓

| Specific challenges related to auditing cryptocurrency transactions |

| Managing access and security in crypto audits |

| What can accountants do to prepare for crypto audits? |

| What is an auditor’s responsibility in crypto audits |

| What should accountants look for in cryptocurrency audit software? |

| Audit solutions for accounting firms |

Specific challenges related to auditing cryptocurrency transactions

With the introduction of Accounting Standards Update 2023-08, Subtopic 350-60, the landscape for accounting, audit, and assurance of cryptocurrency is evolving. This update provides guidance for financial statement reporting, effective for fiscal years beginning after December 15, 2024, requiring crypto assets to be measured at fair value, with changes recognized in net income each reporting period.

This new guidance mandates several key GAAP requirements:

- Measuring cryptoassets at fair value

- Recognizing changes in value in income every reporting period

- Ensuring proper disclosures in financial statements

These standards are designed to improve the accuracy and reliability of financial reporting for companies holding cryptoassets.

Despite this advancement, challenges remain due to the unique technological aspects of blockchain and cryptocurrency transactions, which can complicate auditing and increase risks of material misstatement.

As the crypto market continues to grow, auditors must adapt their approaches to address these new challenges. After all, auditors have critical responsibilities in verifying fair value measurements, recognizing changes in value, and ensuring the accuracy of disclosures. Compliance with these GAAP requirements during financial audits is essential to maintaining the integrity of financial statements.

Managing access and security in crypto audits

An important aspect of auditing cryptoassets involves managing access controls.

This includes not only preventing inappropriate access but also ensuring there is no loss of access to critical crypto assets. The loss of access, such as losing private keys, poses a significant risk and can impact the integrity of financial reporting. Auditors must verify that access is maintained throughout and after the audit period to avoid any reputational damage from lost access.

What can accountants do to prepare for crypto audits?

Understand crypto technology

It’s important to note that while crypto transactions on the blockchain are not entirely anonymous, they are pseudonymous. They are identified by their wallet addresses rather than by personal information such as legal names or ID numbers. However, blockchain technology still enables accountants and auditors to access crypto information in real time, allowing them to obtain necessary data without waiting for clients to provide it.

Additionally, auditors need to understand the specific risks associated with cryptoassets. The Public Company Accounting Oversight Board (PCAOB) emphasizes the importance of risk assessment and tailored audit responses when dealing with cryptoassets.

Managing crypto compliance

While capital gains and losses are significant for tax compliance, auditors must also consider the broader implications of crypto events and transactions for financial statement (GAAP) reporting. Auditing crypto activities presents unique challenges, especially given that cryptocurrency wallets, which most clients possess, are not inherently designed with financial reporting in mind.

The main hurdle is to audit crypto data across multiple wallets, exchanges, and transactions to ensure completeness and accuracy of reported balances and activities.

Another critical check is ensuring that your firm still has access after the close of the financial period. Issuing an audit report only to discover that keys have been lost can severely impact your firm’s reputation. Unique audit risks related to cryptocurrency

Cryptocurrency audits present several unique risks that auditors must address:

- Ownership and control verification: Due to the cryptographic nature of blockchain, verifying that an entity has control over reported crypto assets can be challenging.

- Valuation challenges: The volatile nature of cryptocurrency markets and the existence of multiple exchanges can make valuation complex.

- Completeness of transaction records: Ensuring all crypto transactions are captured and properly recorded requires specialized procedures.

To address these risks, auditors may need to employ new techniques and tools, such as:

- Use of blockchain analysis tools to trace transactions and verify balances.

- Procedures to verify ownership/control of crypto assets, such as requesting signed messages from wallet addresses.

- Approaches to auditing crypto valuations, including assessing the appropriateness of pricing sources.

- Testing completeness of crypto transaction records by reconciling on-chain and off-chain data.

What is an auditor’s responsibility in crypto audits

Financial statement accuracy and reliability heavily depend on the work of auditors, especially concerning cryptoassets. Their main task is to spot and evaluate the risks of significant misstatements in financial reports, whether due to errors in reporting fair market value (FMV) on the balance sheet or other issues. With the introduction of more concrete accounting standards, this aspect should improve.

This task requires auditors to maintain a sharp eye, exercise skepticism, and possess a deep understanding of the company’s landscape, particularly the intricacies of crypto transactions.

Auditors must also scrutinize the accounting policies and disclosures related to a company’s crypto activities. This means taking a close look at how cryptoassets are recognized, measured, presented, and disclosed. They also need to assess the company’s internal controls, paying special attention to how private keys are protected and how blockchain technology is used as audit evidence.

Audit reporting considerations on cryptocurrency

When conducting audits involving cryptocurrency holdings or activities, audit professionals must carefully consider specific elements to be reflected in the audit report. For example:

- Use of emphasis of matter paragraphs for material crypto holdings or activities

- Communicating key audit matters related to cryptocurrency, if applicable

By addressing these cryptocurrency-specific considerations in the audit report, auditors provide enhanced clarity regarding the financial implications of cryptocurrency transactions and holdings.

This approach not only ensures compliance with professional standards but also increases the utility of the audit report for stakeholders navigating this complex and evolving area of finance.

What should accountants look for in cryptocurrency audit software?

In light of these audit reporting considerations, utilizing specialized cryptocurrency audit software is essential. Such tools significantly enhance the accuracy and security of the auditing process.

Here’s what to look for in cryptocurrency audit software:

- AICPA SOC 1 & 2 audited tax software. Ensures verification of internal controls endorsing industry-leading data security.

- Client and team management. Structured team access that provides visibility into the status of where a client is in the workflow process.

- Complete fee accounting. Capability to account for fees allows wallet and exchange cost basis calculation to minimize tax.

- Current year gains and losses. Up-to-the-minute reporting promotes client engagement with tax planning and advisory services around their crypto assets.

- Transaction matching. Automatically trace when holdings move between wallets and exchanges and track the cost basis to ensure clients returns are accurate.

- Exclusive integration. Reporting can be easily imported into your tax preparation software.

|

|

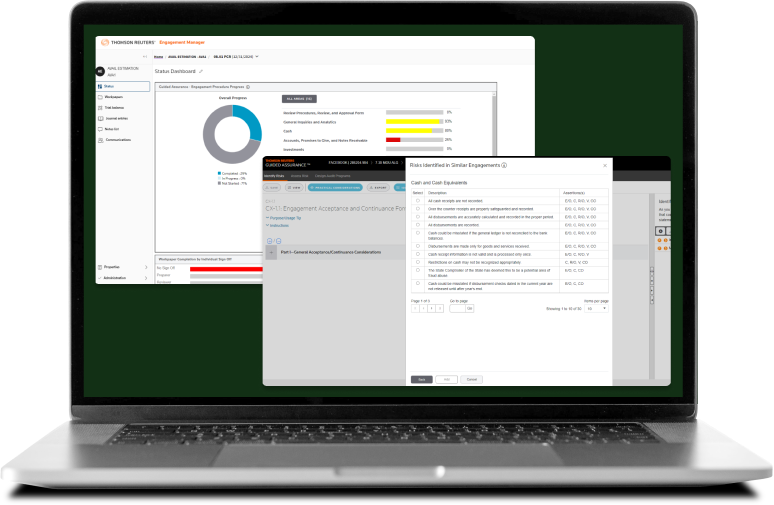

Audit solutions for accounting firms

From auditing crypto to helping clients with transparency in ESG initiatives, accountants can take advantage of the latest advances in technology and automation to succeed in today’s complex landscape.

For audit professionals, staying ahead of the curve is crucial. This means:

- Continuously updating your knowledge of cryptocurrency technology and regulations

- Developing tailored audit approaches for crypto-specific risks

- Investing in specialized software tools designed for cryptocurrency audits

- Enhancing your firm’s capabilities to offer value-added services in the digital asset space

By taking these proactive steps, accounting firms can not only mitigate regulatory risks but also capitalize on new opportunities in the rapidly evolving world of digital assets. As client needs in this area grow, firms that have developed expertise in cryptocurrency audits will be well-positioned to provide high-quality, reliable services.

|

|