In the digital age, tax executives must shift from traditional tax roles in order to be ready for changes that are coming to the industry. Traditional tax roles often include planning to decrease tax liability and increase cash flow, traditional reporting to ensure compliance with current laws and regulations, and analyzing risk to manage exposure appropriately.

While these traditional roles are a fundamental part of the tax department of the future, tax professionals need to meet new expectations by adopting technology, increasing efficiency, and focusing on strategy to position the organization for any challenges it might face as tax compliance evolves to become increasingly burdensome and complex.

The challenge for tax professionals is finding the time to focus on strategic objectives when their plates already are filled with traditional tax functions. Process improvements and better time management come when manual burdens are reduced. Automating processes, standardizing work functions, and implementing technology solutions to elevate roles can allow those in upper-level roles to focus on strategic objectives. They can also create opportunities at lower levels to move people beyond routine data entry and basic repetitive tasks.

Needs for a tax department of the future

Traditionally, technical tax skills have been prioritized, but as tax practices evolve in the digital age, skills like data management, knowledge of information security, global project management, process improvement and optimization, and people management and development have become more important. Practitioners fresh out of college have different expectations than those who emerged 5 to 10 years ago. Many are eager to advance their skills as quickly as possible and are less tolerant of going through the traditional activities or motions that have long been the foundation of traditional tax departments.

Organizations that invest in alternative investments and receive K-1s must engage in large amounts of repetitive data entry work to translate PDF or paper copies of K-1s into meaningful data to use in a tax return. This work is especially cumbersome and can be exceptionally time consuming, depending on the size of the portfolio.

Thomson Reuters is offering the Thomson Reuters K-1 Analyzer platform to help reduce this burden, simplify and centralize the process, strengthen data integrity and security, and provide the opportunity for all roles in a tax department to get out of the weeds of data entry and be able to focus on strategic objectives. These improvements can result in happier and more engaged staff, more productive and effective senior level employees, and deeply knowledgeable executives who can focus more on advising and steering the organization than simply complying with mandatory reporting.

The K-1 issue: A big problem is getting bigger

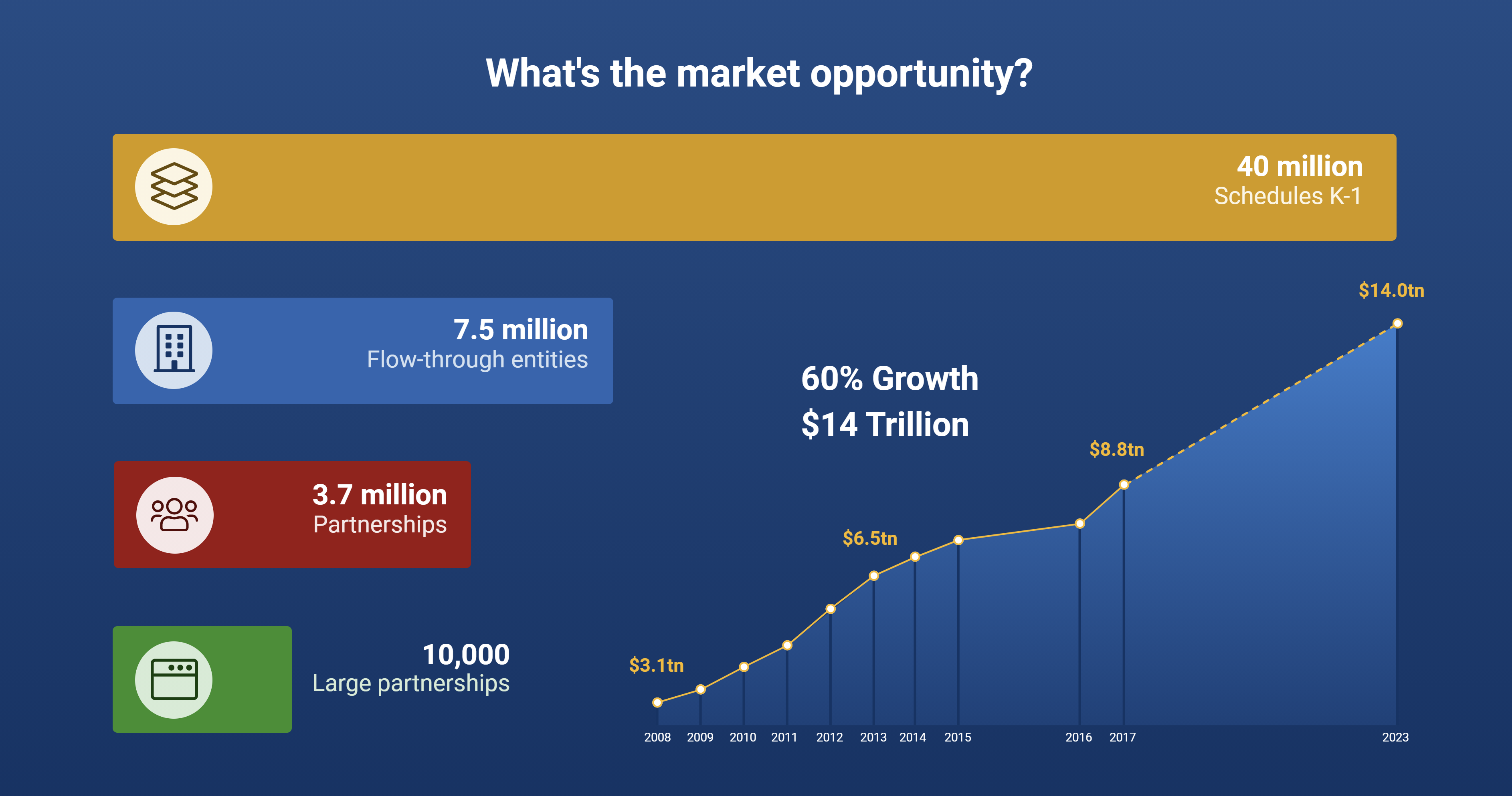

The alternative investment industry is expected to grow by 60% by 2023, reaching $14 trillion in assets in five years, according to new research from Preqin, an alternative investment industry data provider. This explosive growth means nearly 40 million K-1s could be produced and distributed to investors as the industry grows.

The traditional method of preparing and distributing K-1s often has led to massive spreadsheet-based workpapers, huge amounts of paper produced, and significant hours spent by partnerships converting digital data into paper or PDF K-1 packets to send to investors. In turn, investors then spend significant time converting the paper-based data back into digital data.

The K-1 of the future will eliminate the paper conversion process and allow K-1 producers to communicate directly with K-1 recipients to eliminate the translation of digital data into physical mediums.

K-1 Analyzer: The first step toward a digital K-1

The Thomson Reuters K-1 Analyzer is the start of a vision to digitize the entire K-1 process by providing a platform for recipients to automatically collect data electronically from PDF K-1 packets by using cutting-edge machine learning and artificial intelligence technology.

This process effectively cuts the burden of consuming PDF or paper-based K-1 packets from hours or weeks down to seconds or minutes. The software reads and processes federal, state, and foreign information from K-1 PDFs, loads it into an easy-to-use, intuitive, and friendly format to organize, analyze and review, and then exports the data directly into tax return software. The Thomson Reuters K-1 Analyzer can save users time by significantly reducing the data entry burden. This allows users to spend more time focusing on value-added activities for their organization or performing a deeper and more comprehensive risk analysis to help effectively manage their organization’s tax burden as a result of alternative investments.

Tax professionals should ask themselves whether the routine way of working is really the most effective or if it’s just what they’re used to. Technology waits for no one.

Tax departments need to investigate ways to automate internal processes and adopt existing or future technology solutions. Those that don’t could run the risk of falling behind in the industry, compounding work that ultimately will require such technology. This shift is especially true in the world of K-1s, and firms should consider not just where technology is today, but where technology will be two or three years from now.

To learn more about software that allows you to extract, review, and aggregate complex K-1 information, visit tax.thomsonreuters.com/us/en/k-1-analyzer