Jump to:

| Why professionals should use GenAI |

| Using GenAI to enhance work |

| Using GenAI responsibly and ethically |

| Choosing a secure AI assistant |

|

2024 GenAI in Professional ServicesDiscover perceptions, usage, and impact on the future of work

|

As interest in generative AI (GenAI) continues to grow, tax firm and corporate tax professionals are expressing concerns about its ethics, security, privacy, and accuracy.

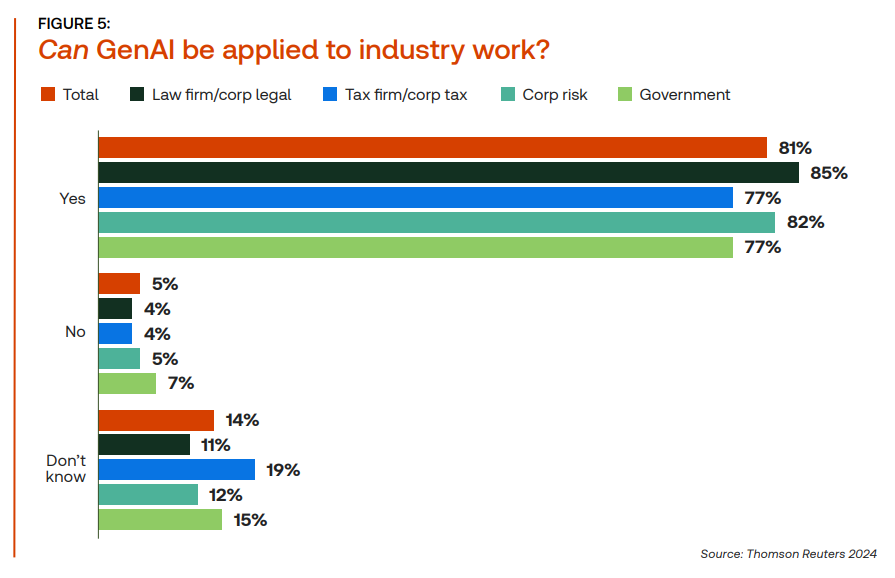

There’s no doubt that tax professionals have generally positive perceptions of GenAI. According to the Thomson Reuters Institute’s 2024 GenAI in Professional Services report, 77% of tax firm and corporate tax professionals believe that GenAI can be applied to their work.

But should it be applied to their work? That’s a question we’ll address as we examine tax professionals’ perceptions of GenAI and the considerations they should keep in mind to use GenAI tools responsibly, ethically, and successfully. The upshot: It’s essential that professionals be proactive in mitigating GenAI’s potential risks.

Why professionals should use GenAI

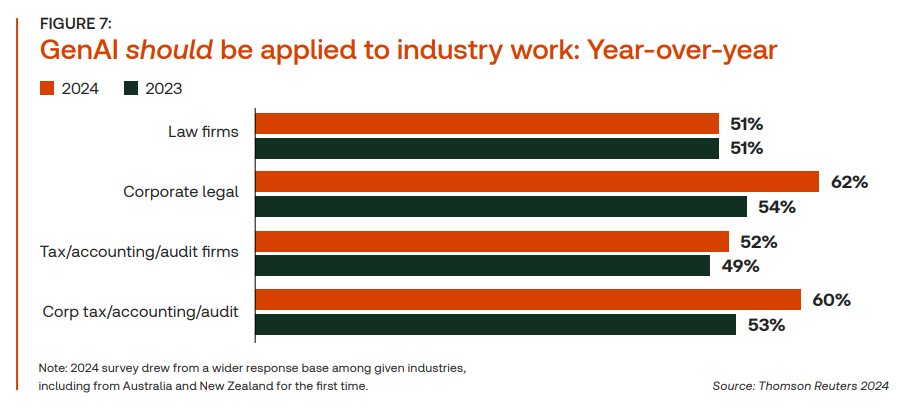

When those surveyed in the 2024 GenAI in Professional Services report, 52% of tax firm professionals and 60% of corporate tax professionals said that GenAI should be applied to industry work. These figures represent an increase from a 2023 survey, from 49% (tax firm) and 53% (corporate). As GenAI continued to impact the tax profession, perceptions of GenAI have become notably more positive in the past year.

Tax professionals state that they should use GenAI tools despite concerns because it can increase efficiency and productivity. These benefits include automating routine tasks and conducting tax research more quickly and accurately. Partnering with AI-powered software can help automate essential but tedious tasks such as data entry and invoice processing. It also can provide faster and more accurate calculations, classifications, and filings. These capabilities can free up valuable time so that professionals can focus on higher-value activities, including tax compliance, reporting, and planning.

These positive perceptions also are an acknowledgment that GenAI has already begun transforming the tax and accounting profession. According to the 2024 GenAI report, the top reason tax professionals cite for using GenAI is increased efficiency and productivity. One of the ways GenAI provides this is through the power of enhanced data analysis. With its ability to process vast amounts of data rapidly, GenAI can quickly identify often-hidden patterns, anomalies, and trends. This enables tax professionals to make more informed decisions and deliver strategic insights to their clients or companies. In short, GenAI is likely to reshape every aspect of tax and accounting work.

Using GenAI to enhance work

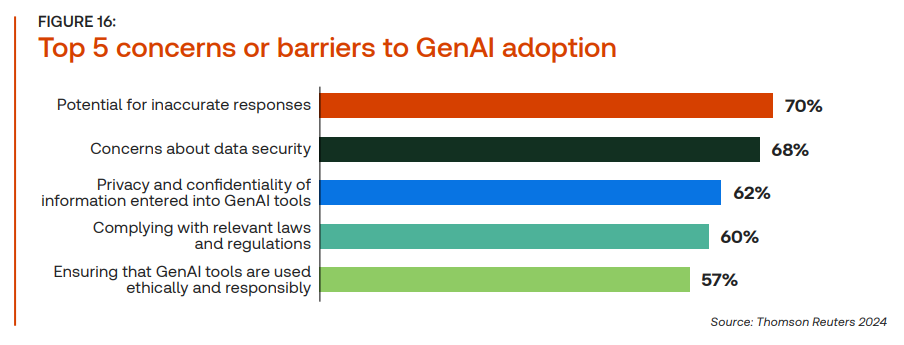

Still, general perceptions of GenAI among professionals also include a great deal of GenAI skepticism toward inaccuracy, security, privacy, regulations, and ethics. In the 2024 GenAI report, 70% of general respondents stated they have concerns about GenAI’s potential for inaccurate responses. And more than half (57%) cited concerns about the technology’s responsible and ethical use.

The main reason tax respondents believe they should not apply GenAI to the work is its lack of human touch and human intuition. One of the common perceptions of GenAI (though it’s a bit less common than it used to be) is that it will get so good that it will “replace” skilled professionals. With the use and understanding of GenAI growing, it’s becoming clear that it won’t supplant professional expertise. That’s not a disadvantage.

It does mean, however, that GenAI needs to be used alongside the work it does best rather than to replace the work. GenAI should be used thoughtfully. Moreover, these perceptions shouldn’t keep professionals from incorporating GenAI into their work. True, it can’t replace professional expertise. Nor should it.

When chosen carefully, a GenAI tool can help manage risk. It can handle necessary but time-consuming tasks so that professionals can focus their expertise on value-added work, such as tax optimization and tax risk management. It also can help them clarify and manage the increasing complexity and volatility of tax law and regulation. For instance, GenAI can help tax professionals mitigate the risk of non-compliance with national and international regulations.

One reason why tax and accounting professionals are resistant is that they’re unsure of how to start putting GenAI to work. There’s a high value to using a GenAI assistant. A GenAI assistant has many benefits that a tax professional can take advantage of.

If chosen carefully, a GenAI tool can elevate a tax professional’s workflow, allowing professionals to focus on more profitable uses of their time. In addition to those just mentioned, these applications can include developing strategic advisory services and building and strengthening client relationships. It should be clear, then, that GenAI won’t replace expertise—it can enhance it.

CoCounsel: The GenAI for professionalsTrained by industry experts, ours is the only GenAI assistant built on 150 years of authoritative content

|

|

Using GenAI responsibly and ethically

Again, the fact that there are risks and challenges involved with GenAI doesn’t mean that tax professionals should sidestep the issue and simply avoid using it. Given all the ways that GenAI can help make their work more productive and profitable, a better approach is to become familiar with the ethical considerations and challenges of GenAI to mitigate its risks and reap its benefits.

Here are some recommendations for how tax professionals can use generative AI (GenAI) responsibly and ethically in their work:

- Transparency and disclosure: Tax professionals should clearly disclose to clients when they are using GenAI tools and the extent to which the output has been generated or assisted by AI. This promotes transparency and allows clients to make informed decisions.

- Human oversight and review: GenAI output should not be blindly accepted or relied upon, especially for critical tax matters. Human tax professionals should carefully review and validate any AI-generated content or recommendations to ensure accuracy, compliance, and appropriateness for the specific client situation.

- Data privacy and security: When using GenAI tools, tax professionals must ensure that client data and sensitive information are properly protected and that the AI systems adhere to data privacy and security best practices.

- Ethical principles: The use of GenAI should align with the ethical principles and professional standards of the tax industry, such as maintaining client confidentiality, avoiding conflicts of interest, and upholding integrity and objectivity.

- Continuous learning and updating: Tax laws and regulations are constantly evolving, and tax professionals should ensure that the GenAI models they use are regularly updated with the latest information and trained on accurate data sources.

- Bias awareness and mitigation: Tax professionals should be aware of the potential for biases in GenAI systems and take steps to mitigate them, such as using diverse training data and monitoring for unfair or discriminatory outputs.

- Liability and responsibility: Clear guidelines should be established regarding the liability and responsibility associated with the use of GenAI in tax work, ensuring that tax professionals remain accountable for their professional judgments and recommendations.

- Competence and limitations: Tax professionals should understand the capabilities and limitations of the GenAI tools they use and refrain from using them in situations where human expertise and judgment are essential or where the AI’s performance may be unreliable.

By adhering to these principles, tax professionals can leverage the benefits of GenAI while maintaining ethical standards, protecting client interests, and upholding the integrity of the tax profession.

Choosing a secure AI assistant

Professionals can mitigate many of the potential risks of AI by choosing GenAI tools developed specifically for their profession. One major risk is the sources of the data that a GenAI tool uses for “training” itself to provide usable data and research. Unfortunately, in many cases, the data it uses may be inaccurate. That’s an obvious problem for tax professionals since accuracy and precision are fundamental to their practice (not to mention their reputations). And if the data the tool uses is retrieved unethically, it can place a tax practitioner at risk of violating professional ethics.

In determining the most beneficial GenAI tool, professionals want to ensure that the AI assistant’s developer has experience in or at least demonstrable knowledge of the professional’s field. A truly valuable AI assistant should access reliable information when the professional’s needs involve trends, data, and other types of research.

An AI assistant, and the company providing it, should also be able to prove that the tool will become even more helpful, accurate, and efficient in the future, evolving as one’s profession evolves. A question any professional should ask should be, will this tool help me uncover insights and meet challenges for situations that have yet to arise?

Public vs private AI

How can professionals minimize these risks? As they conduct due diligence on potential GenAI tools, they should include in their considerations the distinction between public AI and private AI. Simply stated, public AI accesses the entire internet for research and data. As a result, it may inadvertently access and make use of false information or private data. Private AI uses databases that have been developed to access specific and trusted sources of data and research. By adopting a GenAI platform grounded in expert data from reliable sources, a tax professional can ensure precision, accuracy, and efficiency in his or her tax research.

What to look for in an AI assistant

Not all AI tools are created equal. Tax and audit professionals must conduct thorough research to minimize their exposure to potential tax and accounting AI risks. With Thomson Reuters’ CoCounsel, tax and accounting professionals can do just that and more.

- Improve the speed of the research phase by finding the summarized answers you need quickly.

- Increase confidence in AI-assisted answers with links to relevant editorial content and source materials from a broad collection of data sets and expert knowledge of Checkpoint Edge.

- Enable senior staff to redirect their efforts toward higher-value work while junior staff learn and develop good question techniques with AI-assisted research.

This tax-specific private GenAI assistant can perform sophisticated research and analyze dense, voluminous information — and then deliver reliable, accurate, and thorough answers as quickly as you need them. It has been trained by industry experts to handle essential but repetitive tasks so that professionals can focus on more profitable uses of their time. With the latest technology, you should be able to clarify the complex.

|

2024 GenAI in Professional ServicesDiscover perceptions, usage, and impact on the future of work

|