Businesses must innovate and adapt to the changing indirect tax landscape to stay competitive. Corporate tax departments are using technology increasingly as a strategic partner to address these issues. Insight on how indirect tax departments intend to use technology to transform their operations can be found in a recent study conducted by the Thomson Reuters Institute.

Accepting the change brought about by technology

The 2024 report Challenges and Opportunities for Indirect Tax and Compliance draws attention to the changes that indirect tax departments are going through as they transition from being just compliance departments to becoming strategic business partners. The 2023 State of the Corporate Tax Department study describes this shift as going from a reactive to a proactive state.

Corporate tax departments are making these changes thanks largely to indirect tax technology. According to the survey, 58% of participants intend to improve their technological solutions for indirect tax compliance. This shows how sophisticated tools and systems are becoming increasingly necessary to manage the intricacies of indirect taxes. The survey also showed that 36% of organizations are considering creating or investing in artificial intelligence (AI)-based technologies. There is less manual labor needed when using these technologies to help with tax-related duties that can be completed automatically.

Taking advantage of automation

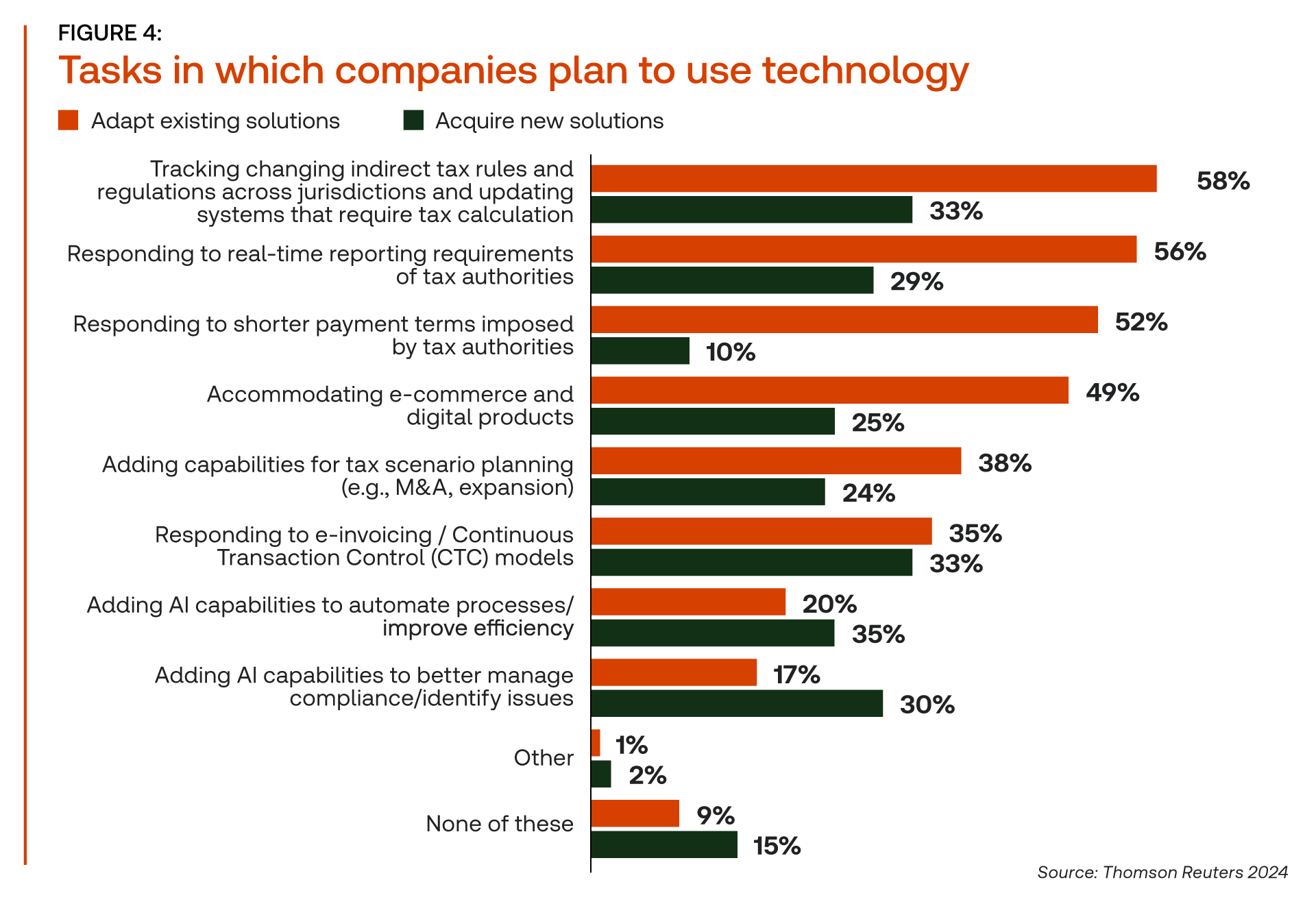

The 2024 study provides a list of how indirect tax departments are planning to deploy and invest in technology. The top 4 use cases and investments are:

- Tracking regulatory changes: Technology is being used to track the constantly changing indirect tax rates and regulations across different regions and to update systems necessary for tax calculations. The survey reveals that 58% of companies intend to change their technology to track these changes and upgrade their systems. In contrast, 33% are considering adopting new solutions.

- Real-time reporting and compliance: Another way that technology is being considered in indirect tax operations is to respond to real-time reporting requirements. Many governments are now requiring businesses to report their indirect tax liabilities in real-time. This can be a daunting task, but technology can help automate the process and make it easier for businesses to comply. 56% of companies intend to modify existing technology for this purpose, and 29% are looking to acquire new technology.

- E-commerce and digital adaptation: Tax departments are integrating e-commerce and digital products into their operations using advanced technology. 49% of the companies surveyed are planning to adjust their current technology, and 25% are looking to invest in new technology.

- Responding to e-invoicing/continuous transaction control (CTC) models: As e-invoicing/continuous transaction control (CTC) models gain adoption globally, businesses are increasingly looking for efficient and automated solutions to maintain compliance and avoid penalties. 35% of companies surveyed are updating their existing technology to comply with this regard. Conversely, 33% are investing in new technology.

Most respondents reported that their companies prefer to enhance or upgrade their existing systems rather than develop or buy new ones. This preference is visible in the ratio of two to one.

Anticipating changes and their impact on operations

Changes driven by technology will affect how indirect tax teams will work in the future. These changes are discussed in the 2024 report. Here’s how these changes will affect their operations:

Shift toward strategic advisory roles

- From preparer to advisor: As automation oversees more routine tasks, tax professionals will shift from being preparers to strategic advisors. This change will allow them to focus on giving strategic advice on governance, risk management, process design, and business partnering.

- Customer-facing roles: Tax professionals will have more time to engage with internal stakeholders, providing insights and advice that can influence broader business strategies.

Increased efficiency and capacity

- Automation and AI: By automating routine tasks and using AI, tax departments can increase efficiency, reduce manual work, and increase capacity. This will allow them to manage their operations more effectively and focus on higher-value activities.

- Real-time information access: An improved technology stack will provide staff with real-time access to tax-related information, allowing for quicker responses to regulatory changes and compliance requirements.

Enhanced compliance and risk management

- Proactive compliance management: AI capabilities will help in predicting and proactively finding compliance issues, allowing for timely interventions, and reducing the risk of non-compliance.

- Accuracy and timeliness: Advanced technology will provide more accurate and timely filings, reducing the risk of penalties for late or inaccurate submissions.

Global management and cross-jurisdictional compliance

- Managing complexity: Tax departments will be better equipped to oversee cross-jurisdictional compliance, providing compliance with varying regulations and supporting global business operations.

- Shared service centers: Many large businesses use global shared services models to manage operations across different regions. This means tax professionals must manage complex tax requirements in various locations.

Data-driven decision making

- Advanced analytics: Technology will enable advanced data analytics, allowing tax departments to make more informed decisions based on comprehensive and accurate tax data.

- Scenario planning capabilities. Teams will be able to assess the tax consequences of strategic decisions more effectively, such as mergers, acquisitions, or expansions.

Upskilling and talent management

- Training and development: Investing in upskilling current staff to understand regulatory changes and apply recent technology will be crucial. This will increase the technical expertise of the tax team and improve overall efficiency.

- Recruiting technology expertise: To support the implementation and management of new systems, there will be an increased focus on recruiting individuals with strong technological backgrounds.

Cost management

- Reducing operational costs: Automation and improved efficiency will help in reducing the operational costs associated with tax compliance. This will allow tax departments to reallocate resources to more strategic areas.

- Minimizing IT support: Robust technology solutions can reduce the dependency on IT support for managing tax technology and data requests, allowing this group to work on projects.

Challenges and Opportunities for Indirect Tax and Compliance report reveals that corporate tax departments are increasingly looking to apply technology to transform indirect tax operations. Key trends include automation, AI, real-time reporting, and e-invoicing. This shift enhances compliance, efficiency, and strategic advisory roles, while reducing operational costs and optimizing resource allocation.

|

Based on a survey of 180 indirect tax professionals, this special report explores how upskilling and automation are emerging as powerful allies.

|

|

|