U.S. Customs and Border Protection (CBP) is struggling to manage the surge in low-value imports, particularly from China, that fuel the e-commerce boom. CBP processed 1 billion de minimis shipments in 2023, a 53% increase from 2022. Additionally, CBP has processed an estimated 705 million by mid-year 2024. This exponential growth strains CBP’s resources and raises concerns about security and fair trade.

In 2016, to facilitate the growing e-commerce market and address limitations in CBP staffing resources, the U.S. raised the de minimis threshold – the value below which imports are exempt from duties and taxes – from $200 to $800. This change, along with the e-commerce boom, led to a significant increase in low-value shipments, posing challenges for CBP’s screening capabilities. The Obama administration also saw the increase as a way to “foster international trade and boost economic activity.”

CBP worries about the potential for smuggling illegal goods like counterfeit products and fentanyl through these low-value channels. It is estimated by CBP, that over 90% of all import transactions enter the U.S. using the de minimis rule, accounting for 90% of illegal narcotics, agricultural goods and counterfeit seizures by CBP. Additionally, some argue that Chinese companies exploit the de minimis system to gain an unfair advantage by avoiding tariffs and undercutting U.S. businesses.

To address these concerns, CBP recently suspended customs brokers who failed to comply with regulations and is seeking more accurate data from all parties involved in the import process. Lawmakers are also considering several pieces of legislation including bills to restrict the de minimis benefit for Chinese imports (and imports from other non-market economies), as well as possibly implement a “reciprocal” de minimis structure, or simply eliminate the de minimis rule completely. However, businesses are worried that stricter regulations could increase costs and disrupt the e-commerce market.

Understanding the de minimis threshold loophole and CBP’s challenge

The de minimis threshold, intended to simplify customs procedures for low-value goods, has become a target for companies seeking to avoid import duties. Critics argue that China, in particular, exploits this loophole.

CBP struggles to keep pace with the e-commerce surge due to limitations in personnel and technology. Additionally, reliance on limited data from carriers makes it difficult to identify suspicious packages. Further challenges include:

- Not enough oversight, controls or trade reciprocity for the millions of shipments entering the U.S. daily.

- Existing loopholes make it easier to import harmful products and illegal goods as it is impossible to track and verify the contents of packages, and whether they are a product of intellectual property theft, forced labor, or dangerous to the consumer.

- Incorrect manifesting: Misclassification of goods under customs regulations can lead to delays, incorrect duty assessments, or even seizures.

- Misdelivery: Incorrect information on manifests can result in premature deliveries, causing logistical problems and potential security risks.

- Undervaluation: Intentionally undervaluing imported goods to avoid paying appropriate duties is a growing concern.

- Power of attorney errors: Mistakes in assigning power of attorney for customs clearance can cause delays and disruptions.

- There is a large imbalance between the US $800 de minimis value for importing into the US compared to other countries such as Canada at CAD150, China at $7, UK at £135 and EU at €150. It should be noted that future EU Customs modernization is considering elimination of de minimis.

How to handle e-commerce surges

Global trade professionals can minimize issues by ensuring complete and accurate data is maintained and reported, such as:

- Accurate product descriptions: Provide detailed descriptions, including materials, uses, and country of origin

- Harmonized Tariff System (HTS) code classification: Identify the correct HTS code for your goods (to the 10th digit), a universally used system for classifying globally traded products.

- Declared value: Declare the full commercial value of your shipment, which should reflect the proper transaction price paid to the seller according to the agreed-upon transaction value method.

- Proper power of attorney: Ensure a valid power of attorney appoints a customs broker (when not self-filing) to act on your behalf during clearance.

_____________________________________________________________________________________________

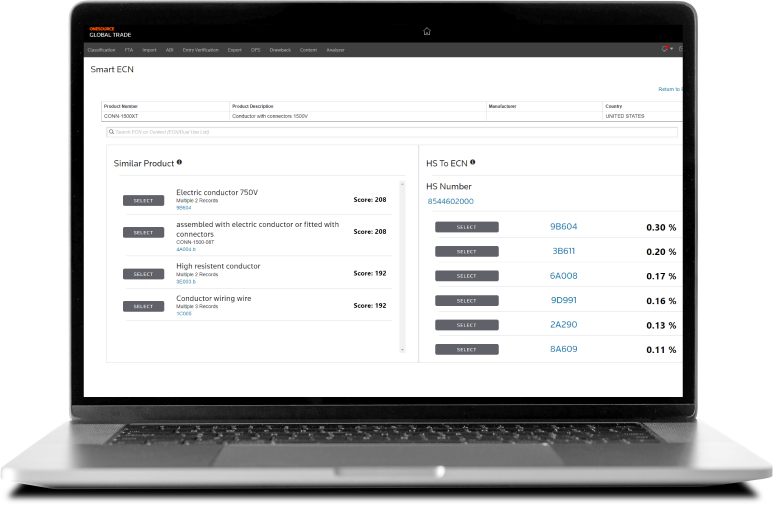

Automate your Harmonized System (HS) and Export Control Classification Number (ECCN) classifications with accurate codes and duty rates to stay compliant

_____________________________________________________________________________________________

Where should this information be recorded?

While the customs entry serves as the official record for authorities, much of this data is typically stored in additional systems for internal use and future reference. These can include:

- Global Trade Management (GTM) systems: Designed to capture and house import data, validate shipments before entry, and ensure data completeness.

- Product databases: Systems like Global Catalog (GC) can hold detailed product information like materials, uses, and country of origin, facilitating accurate descriptions of customs entries.

Alternative solutions to the de minimis challenges are being debated:

- Restricting de minimis for China: Congress is considering proposals to eliminate the de minimis benefit for Chinese imports

- Restricting de minimis for all non-market economies

- Improved data collection before shipment arrival: CBP is pushing for more accurate and complete data earlier from all parties involved in the import process.

- Risk-based targeting: Implementing risk profiles for e-commerce sellers could help CBP focus its resources on high-risk shipments. Discussions have been raised on allowing e-commerce platforms to join the CTPAT program, dependent on meeting specific requirements.

Staying informed about de minimis changes

De minimis restrictions typically don’t change by product, but trade conflicts can indirectly affect how they are applied. Here’s how to stay informed:

- Monitor government websites: Regularly check the CBP website and Federal Register for updates on de minimis thresholds.

- Subscribe to industry news sources: Trade publications and logistics news can offer insights on how trade conflicts might affect e-commerce imports and De Minimis enforcement.

- Consult trade law firms, trade consultants or customs brokers: Seek guidance from professionals specializing in customs compliance for tailored advice.

By following these strategies, businesses can ensure their imports comply with de minimis regulations and comply with de minimis regulations while efficiently managing the surge of e-commerce.

The future cost of e-commerce imports

The future cost of e-commerce imports is uncertain. Balancing security concerns with facilitating legitimate trade will be a key challenge for policymakers and trade compliance professionals.

Leveraging global trade software : Disrupted trade landscapes demand a comprehensive tax solution for streamlined compliance. Holistic product suites like ONESOURCE Global Trade empower tax professionals, ensuring they adapt to evolving regulations and foster seamless collaboration across departments. This keeps organizations compliant and thriving in changing global markets.