Historically, accounting firms have operated under a transactional billing model, providing once-a-year services primarily focused on tax compliance and reporting. However, with the rise of AI-powered tax technology and increasing client expectations, forward-looking accounting firms are evolving beyond tax compliance to offer year-round, value-added services that capitalize on their unique expertise and address their clients’ overall financial well-being.

With this change also comes a shift in pricing models. To understand which option makes the most sense for your firm, let’s take a deeper look at value-based and fixed-fee pricing structures.

Jump to:

| What is value-based pricing? |

| What is fixed-fee pricing? |

| Pros and cons of value-based vs. fixed-fee pricing |

| What is the impact of AI on pricing models? |

| Unlocking value beyond the billable hour |

What is value-based pricing?

A value-based approach assigns a price based on the value your services bring to the client. The cost varies from client to client because it is based on what the client values most and what they are willing to pay for that value. For instance, some clients may value monthly consultative brainstorming sessions more than bookkeeping services and would be willing to pay more for ongoing accounting advisory consulting on a monthly or quarterly basis.

“To me, the idea of value pricing is that someone is buying a relationship, not a transaction.”

— Paul Miller, President of Business by Design, Edina, MN

Value-based pricing also supports the profitable shift towards an advisory services business model as it fortifies client relationships and compensates you for your knowledge and expertise. Rather than solely completing tax filings or financial reports, your firm can actively engage with your clients throughout the year, offering guidance on topics like tax planning, financial management, and business expansion.

With value-based pricing, you are compensated for your knowledge and use of modern technology rather than giving away advice for free.

What is fixed-fee pricing?

Fixed-fee pricing is a set price that applies to all clients for the same service. Like value-based pricing, you establish this price before work begins.

The fixed fees can serve as a menu of sorts — clients review your offerings and prices and choose which services they want. Fixed-fee structures simplify pricing and billing, however, they don’t offer the same margins as value-based pricing and are often associated with more traditional compliance-based services.

The baseline for developing the fixed-fee pricing menu is to consider the costs — in labor, software, overhead, and more — required to complete each service, then add your firm’s markup. While this may seem like a simple math equation, you must carefully consider all costs or risk fully underpricing a service. As with value pricing, these prices will likely evolve as you better grasp what it costs your firm to complete each task.

Pros and cons of value-based vs. fixed-fee pricing

What is the impact of AI on pricing models?

For accounting firms, AI-powered tax solutions significantly enhances productivity and efficiency while enabling data-driven insight, opening the door to more strategic tax planning and higher-value tasks like predictive analytics. These capabilities bring unique value to your clients and support a value-based pricing approach.

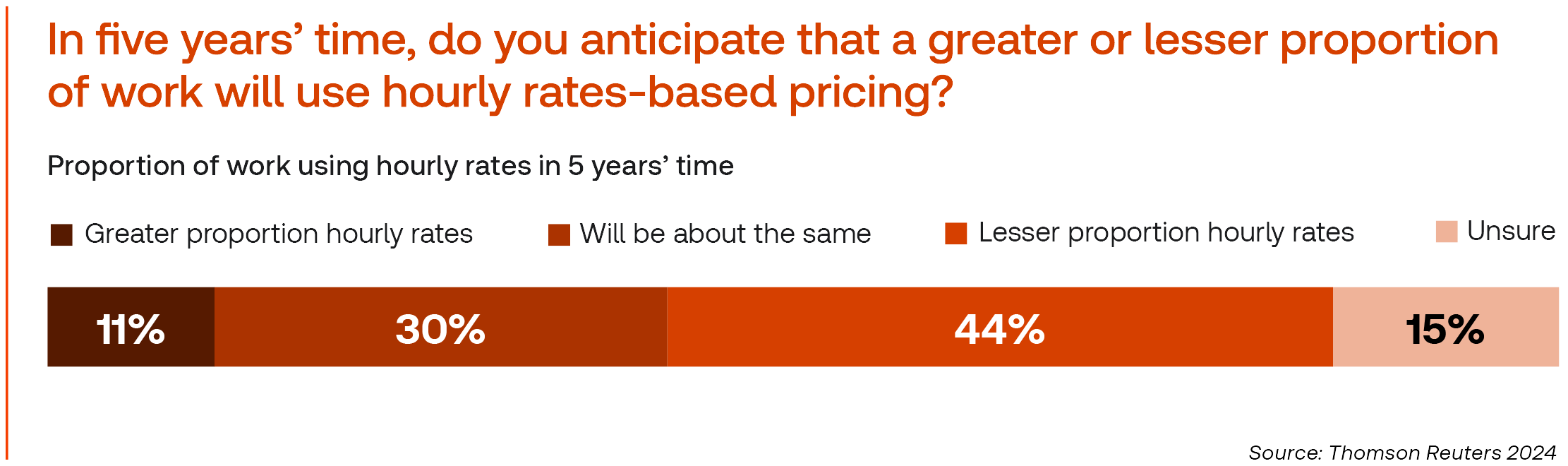

According to Thomson Reuters 2024 Future of Professionals Report, the future lies in embracing value-based pricing. As AI transforms workflow processes, more and more firms are adopting pricing models that reflect their true value to clients and capture the efficiency, expertise, and innovation that AI enables.

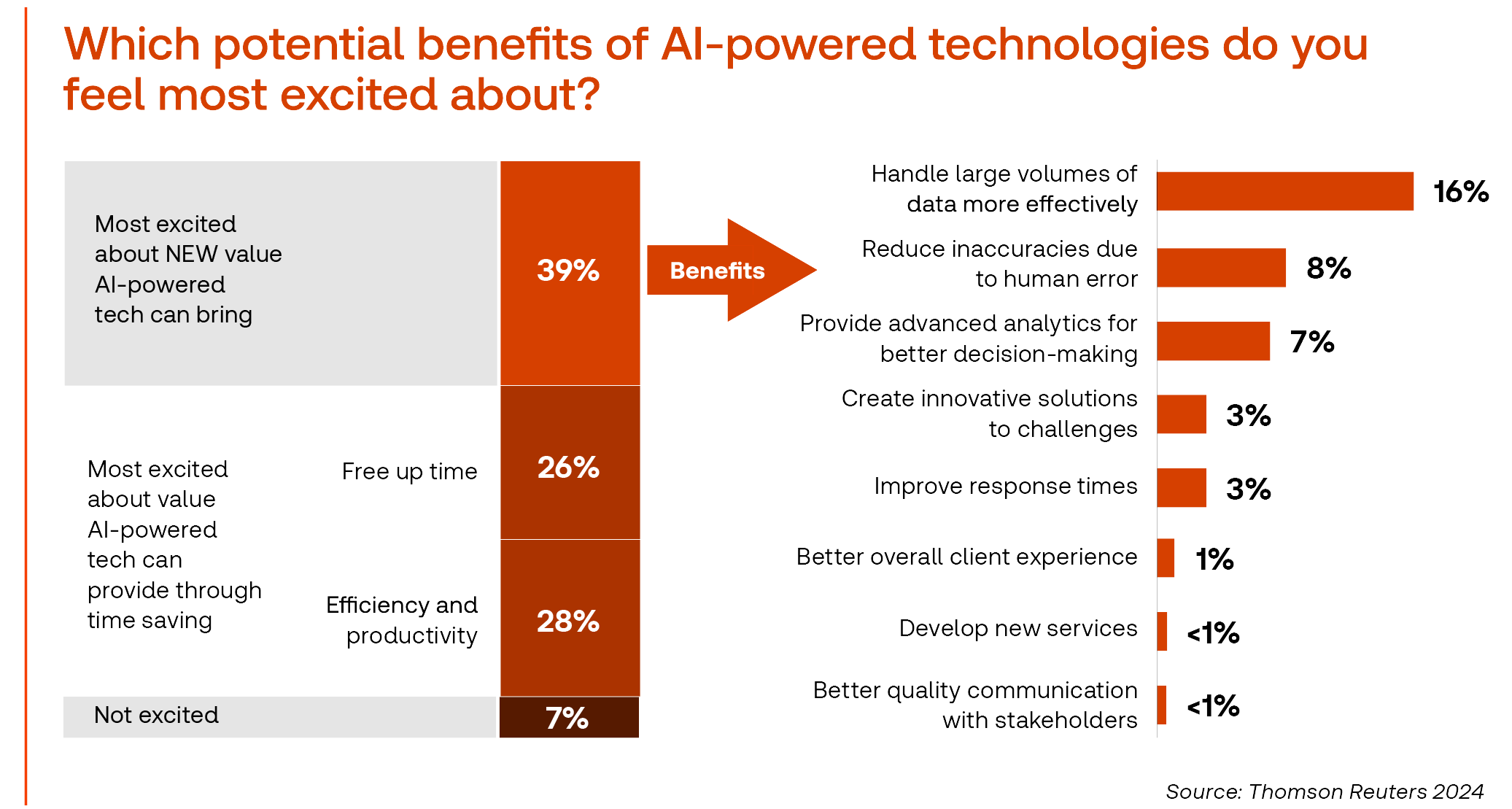

In addition to freeing up time for higher-level work, survey respondents identified opportunities for AI to deliver value in new ways, like handling large volumes of data, improving response times, and reducing human error.

Unlocking value beyond the billable hour

While value pricing has many benefits, perhaps the most significant result is how your clients respond to it. They’re no longer worried about the clock each time they talk to you; instead, they can begin collaborating with you. They become part of the process, with a deeper understanding of your partnership and the value they will receive before work even begins.

The value pricing model creates a lasting bond, establishing longevity for the professional relationship. This partnership allows you to take more time to challenge clients, guide them, and support their overall financial well-being throughout the year.

In an era where technology can more efficiently handle traditional compliance work, establishing enduring and meaningful connections is how your firm can generate more transactions, retain clients, and build a sustainable business.

To learn more about the impact of value-based pricing, download our recent white paper, The case for transitioning your firm to value-based pricing.

To learn more about shifting your firm to an advisory services business model, explore Practice Forward today.