How to avoid the yearly last-minute filing rush by convincing your clients to file early.

A proactive approach to filing taxes not only streamlines the workflow but also offers benefits that can greatly improve both the accountant’s and client’s experience. By embracing early e-filing, accountants can avoid the stress and potential errors associated with last-minute submissions, ensure better data security, and ultimately provide more time for valuable advisory services that help clients achieve their financial goals.

This blog dives into the numerous advantages of early e-filing, highlighting how it transforms the traditional tax filing process into a smoother, more secure, and client-centric endeavor. We will explore how early e-filing helps accountants manage their workload more effectively, reduces the likelihood of client e-file rejections, and expedites the refund process.

Jump to ↓

| When does early e-filing start? |

| Avoid the last-minute filing rush |

| Minimize client e-file rejections |

| Receive faster refunds |

| Maintain data security in tax returns |

| More time for advisory services |

| How to convince clients to e-file early |

When does early e-filing start?

The IRS usually starts accepting tax returns for the new season on the 4th Monday of January. That would make January 26 the first day of filing this year.

Avoid the last-minute filing rush

In the world of accounting, the end of the tax season is often characterized by a frantic rush to meet filing deadlines. This last-minute scramble can lead to a host of issues, from increased errors to overwhelmed staff. By adopting early e-filing, accountants can significantly reduce these challenges and create a more efficient and effective workflow.

One of the primary benefits of early e-filing is the reduction in the risk of errors and omissions. When accountants are not pressed for time, they can meticulously review each return, ensuring all necessary information is accurate and complete. This not only minimizes the likelihood of mistakes but also builds trust with clients, who can be confident in the accuracy of their tax filings.

Another advantage of early e-filing is the elimination of manual data entry. Automated systems can efficiently handle the input of financial data, reducing the burden on accountants and freeing up their time for more strategic tasks. This automation also helps to reduce human error, further enhancing the accuracy of tax returns.

Minimize client e-file rejections

When it comes to ensuring a smooth tax season, minimizing the risk of client e-file rejections is crucial. Rejections can cause significant delays and inconvenience, undermining the efficiency that accountants strive for. One of the primary strategies to avoid rejections is through thorough verification of client data. By not being pressed for time to review each piece of information, accountants can catch inconsistencies or inaccuracies before they lead to a rejection.

Another critical step is ensuring that all necessary forms are included in the e-file submission. Missing forms are a common reason for rejections, and accountants can mitigate this risk by maintaining a comprehensive checklist of required documents.

Accountants can also leverage tools like UltraTax CS to monitor refund statuses, which adds an extra layer of assurance to the e-filing process. By keeping track of refund statuses, accountants can promptly address any issues that arise, ensuring that clients receive their refunds in a timely manner.

Receive faster refunds

One of the most compelling advantages of early e-filing is the expedited refund process it offers to clients. Unlike traditional paper methods that can take weeks or even months to process, e-filing significantly reduces the turnaround time. This efficiency is a direct result of the automated systems that handle the submission and verification of tax returns, ensuring that the process is both swift and secure. For accountants, this means that they can provide their clients with a faster and more reliable service, setting them apart in a competitive market.

Moreover, early e-filing facilitates quicker refunds through the convenience of direct deposit. By opting for this method, clients can receive their refunds directly into their bank accounts, eliminating the need for paper checks and the potential delays associated with postal services.

|

|

Maintain data security in tax returns

In the digital age, the secure handling of sensitive information is a top priority for accountants. One of the most significant advantages of early e-filing is the enhanced data security it offers over traditional paper filing methods. Digital transmission of tax returns ensures that sensitive client information is protected through multiple layers of encryption and secure protocols, significantly reducing the risk of data breaches and unauthorized access.

E-filing platforms, such as those provided by UltraTax CS and the IRS, employ robust security measures to safeguard taxpayer information. These systems utilize advanced encryption technologies to protect data both in transit and at rest. Additionally, they implement stringent authentication protocols, ensuring that only authorized personnel can access and modify tax returns. These measures provide a level of security that is virtually impossible to achieve with paper-based filing, where documents can be lost, misplaced, or intercepted.

Moreover, early e-filing helps mitigate the risk of identity theft, a growing concern in the financial sector. By submitting tax returns electronically, accountants can reduce the chances of fraudulent activity. Electronic systems often include built-in verification processes that quickly identify and flag suspicious activity, allowing for prompt intervention. This proactive approach not only protects clients’ financial interests but also builds trust and confidence in the accounting firm’s commitment to security.

For accountants, the peace of mind that comes with knowing client data is secure is invaluable. With the security advantages of early e-filing, accountants can focus on providing high-quality service without the constant worry of data breaches. This shift to a more secure and efficient filing process ultimately benefits both the accountant and the client, fostering a relationship built on trust and reliability.

More time for advisory services

Early e-filing doesn’t just streamline administrative tasks; it fundamentally transforms the role of accountants from reactive compliance specialists to proactive business advisors. By completing tax filings well ahead of deadlines, accountants can shift their focus from routine compliance to more strategic and valuable advisory services. This shift allows accountants to dedicate more time to understanding their clients’ unique financial situations and offering tailored advice that goes beyond mere tax preparation.

With the administrative burden lifted, accountants can now engage more deeply with their clients, identifying potential challenges and opportunities sooner. For instance, early e-filing allows for in-depth analysis of financial data, which can uncover areas for cost-saving, revenue growth, and risk management. By offering these insights early in the financial year, accountants can help their clients make informed decisions that drive business growth and success.

How to convince clients to e-file early

- Emphasize the convenience and speed of e-filing.

- Explain that early filing reduces the risk of identity theft, as it gets your client’s return in before any potential fraudsters can file a fake one.

- Highlight the faster refund turnaround, which can be especially beneficial for clients who are counting on that money for financial obligations or investments.

- Point out that filing early allows more time to address any issues or questions that may arise, ensuring a smoother and less stressful tax season.

By presenting these advantages clearly and confidently, you can help your clients see the value in getting their taxes done early.

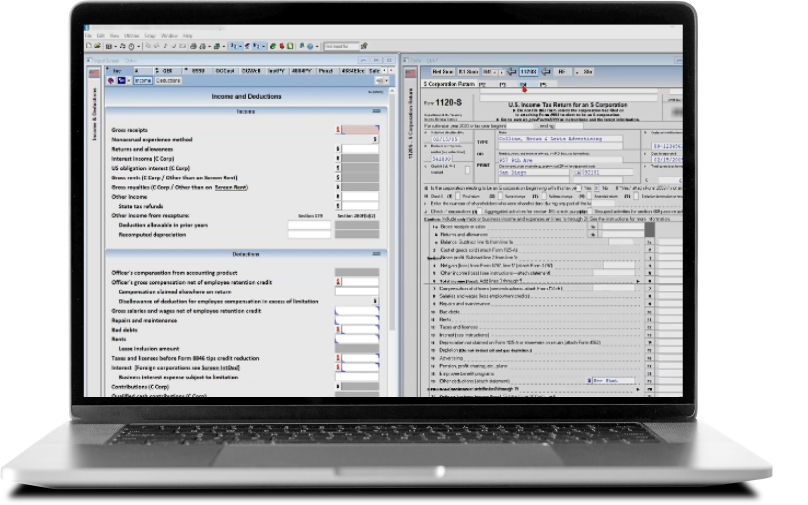

E-file early with confidence by using Thomson Reuters UltraTax CS. UltraTax offers a full line of federal, state, and local tax programs including 1040 individual, 1120 corporate, 1065 partnership, 1041 estates and trusts, multi-state returns, and more to handle all client opportunities. With the e-file dashboard, you can get a complete view of all your clients and current e-file status, and the dashboard allows you to see the status of returns your firm has filed.

UltraTax CS

Professional tax preparation software to reduce your workflow time and increase your productivity

Learn more ↗