Tax season is infamous among tax and accounting professionals for its long hours and heavy workload—pains worsened by inefficiencies in your tax workflow.

These inefficiencies put a strain on your existing staff, cost your practice money, and may put you at a competitive disadvantage in attracting and retaining top talent.

But these inefficiencies are fixable thanks to advancements in technology that are making it easier than ever for tax professionals to access the tools to revamp their workflows and eliminate these frustrating inefficiencies.

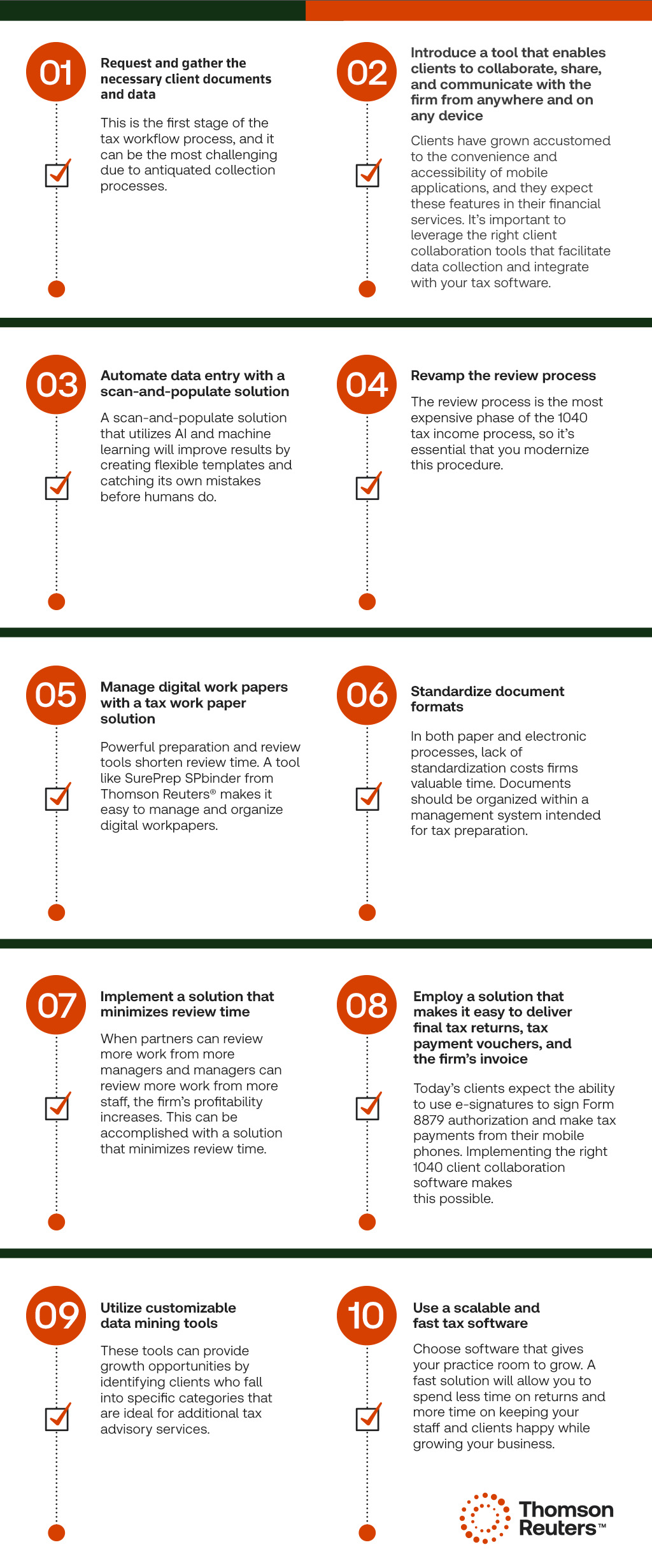

Use this checklist to get started on the path to a seamless 1040 tax workflow and the opportunities that come with it.

Text description of the infographic

Tax season can be a stressful and hectic time for both tax professionals and their clients.

However, by leveraging the right tools and strategies, you can turn it into an opportunity to strengthen your relationships, increase your efficiency, and grow your firm.

By using data analytics, client portals, and scalable tax software, you can provide more value to your clients, streamline your workflows, and stand out from the competition.

Interested in learning more about streamlining your 1040 workflows? Download and read our white paper below:

|

|

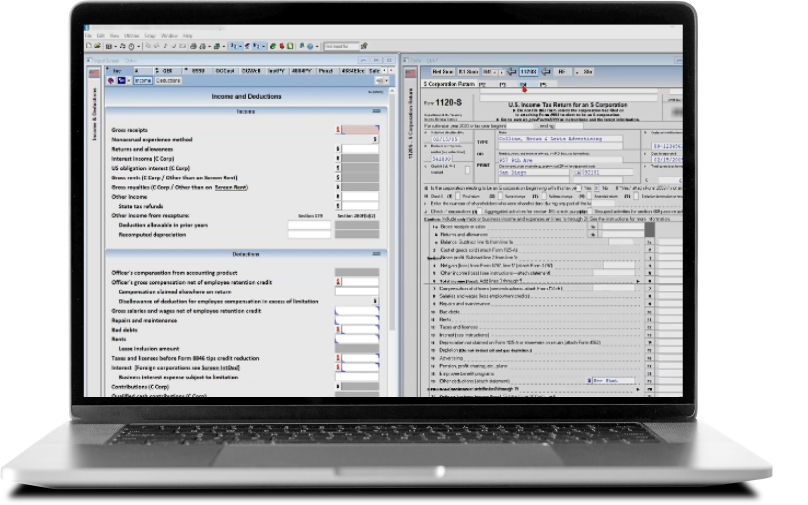

Explore the products below to help streamline your 1040 tax workflow ↓

|

|

|

|