Each tax season, common themes emerge. With lingering COVID-era tax benefits, recently enacted federal legislation, and related tax credits, the effort and time dedicated to tax research represents a significant hurdle for many professionals in the tax and accounting field. This year is proving to be no different.

Jump to:

| Understanding the ERC |

| Navigating the ERC with expert insights |

| Transform tax season research with Checkpoint Edge |

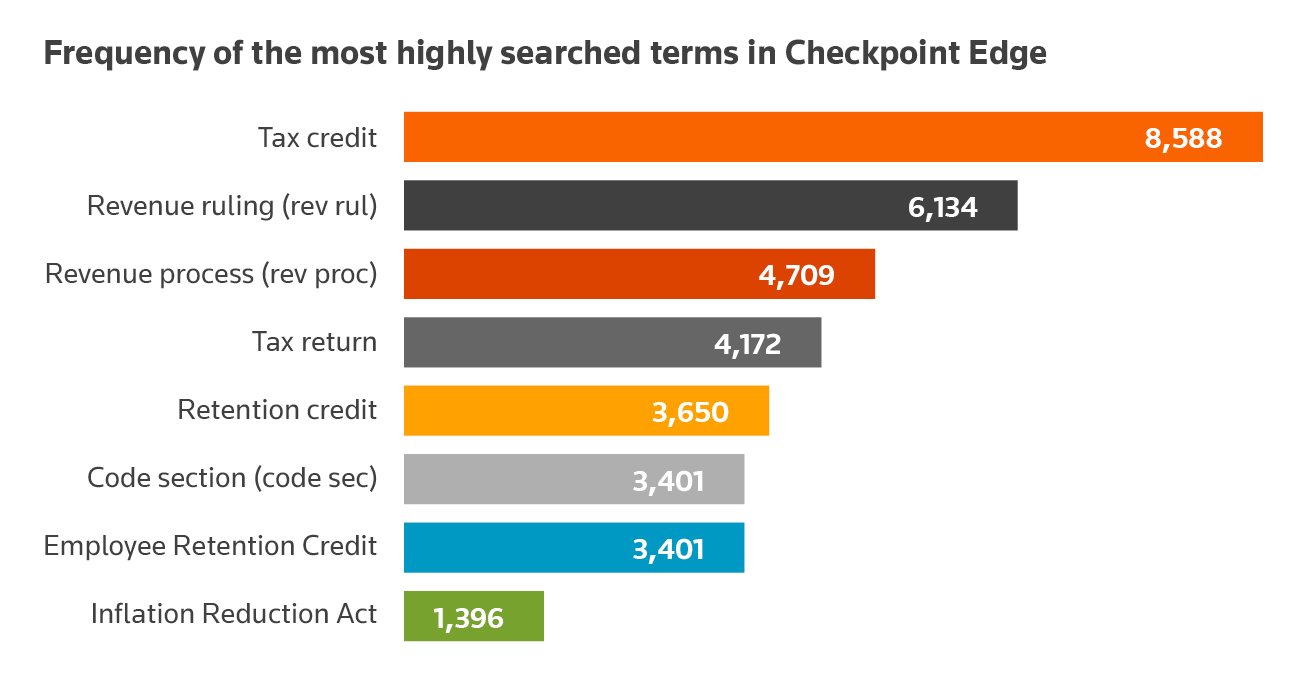

So, what are users searching for this tax season? According to our most recent analysis, some of the most searched terms within Checkpoint Edge are tax credits, Employee Retention Credit (ERC), and the Inflation Reduction Act (IRA).

To effectively address these subjects and more, tax and accounting experts today must have comprehensive and current tax research tools and expert editorial analysis at their disposal.

Let’s take a look at the answers behind one of these hot topics (the Employee Retention Credit) and then learn how a trusted tax research solution can transform research workflow and offer expert insights into the topics that are top of mind for accountants and clients.

Understanding the ERC

It is no secret that the Employee Retention Credit has been challenging for employers who struggle to understand complex eligibility requirements and the process to claim the tax credit, and for the IRS who continues to process a large volume of claims, many of which are dubious, despite the expiration of the credit.

Because the ERC expired for most employers on September 30, 2021, the credit is claimed by submitting an amended employment tax return on Form 941-X. However, Form 941-X may currently only be submitted by paper, increasing processing times. (It should be noted that planned changes are coming in June of 2024.) The IRS is dedicating some of the nearly $80 billion in funding from the Inflation Reduction Act of 2022 to offer more electronic filing options for business and employment tax returns, including Form 941-X.

Despite IRS guidance, revenue rulings, and procedures on the credit, aggressive marketing has led to a flood of invalid claims filed retroactively that has led to a massive backlog. This led the IRS to call a halt of new claims processing on September 14, 2023, and the moratorium continues to remain in effect. In the meantime, the IRS renewed calls for businesses to review their eligibility for the ERC as the agency’s Criminal Investigations team begins a series of educational sessions for tax professionals. The IRS has also established a withdrawal process for businesses that wish to withdraw an unprocessed invalid ERC claim as well as a Voluntary Disclosure Program for businesses who received a credit for an invalid claim and wish to return the proceeds to avoid penalties and interest (expires March 22, 2024).

How to claim the ERC

The ERC is an incredibly complex credit, and there are very specific eligibility requirements involved with claiming it. Employers can claim the ERC on an original or amended employment tax return for qualified wages paid between March 13, 2020, and Dec. 31, 2021. However, to be eligible, employers must have:

- Sustained a full or partial suspension of operations due to orders from an appropriate governmental authority limiting commerce, travel, or group meetings because of COVID-19 during 2020 or the first three quarters of 2021,

- Experienced a significant decline in gross receipts during 2020 or a decline in gross receipts during the first three quarters of 2021, or

- Qualified as a recovery startup business for the third or fourth quarters of 2021.

Employers who did not claim the ERC on an originally filed quarterly payroll tax return in 2021 can claim the credit by filing an amended return for each quarter for which they were eligible for the credit. Employers who wish to claim the ERC must file amended returns for any quarter ending in 2021 no later than April 15, 2025. Employers who file an annual payroll tax return can file an amended return using Form 944-X or 943-X to claim the credits.

Employers claiming the credit on an amended payroll tax return may also need to file an amended income tax return for the tax year in which the credit is claimed. Employers should also ensure that wages taken into account for the COVID-19 employee retention credit were not taken into account for other credits.

Navigating the ERC with expert insights

With an understanding of the complexities of the Employee Retention Credit, having an understanding about how to navigate its intricacies is of equal importance. Amidst the challenges posed by navigating eligibility criteria, processing procedures, and taking advantage of programs currently available for those who submitted invalid claims, a reliable research solution becomes indispensable. This is where many professionals find Checkpoint Edge to be an invaluable tool.

With comprehensive resources and expert analysis, Checkpoint Edge can shed light on the intricacies of the ERC, providing valuable insights and practical guidance. From understanding eligibility requirements to navigating the details of claiming the credit, leveraging Checkpoint Edge can deepen your understanding of the ERC and elevate your expertise in tax research.

With an intuitive platform, users gain access to a wealth of information tailored to demystifying the ERC. From explanations of eligibility criteria to guides on claiming the credit, Checkpoint Edge equips professionals with the information they need to navigate the complexities of tax law with ease.

Transform tax season research with Checkpoint Edge

When it comes to tax trends and hot topics, the only constant is change. To succeed, today’s accountants require a tax research platform that offers in-depth analysis with related news, commentary, and recommended documents that seamlessly integrate within their workflows, so research work can be completed quickly and confidently.

Powered by AI and machine learning, Checkpoint Edge transforms your workflow with fast, trusted answers from fully vetted sources on a wide variety of tax topics. Gain access to the most up-to-date and intuitively organized collections of standards, laws, regulations, and agency guidance backed by rigorous editorial processes.

With verified, reliable, and trusted public sites, Checkpoint Edge offers simultaneous search and access to IRS, AICPA, TEI, the Big 4, and comprehensive state tax agencies — all in one place. Plus, get in-depth analysis of new tax legislation within 24 hours and trending tax topics delivered to your inbox each morning.

If you’re ready to stay ahead of the game, anticipate your clients’ needs, and deliver extra value by sharing insights on the tax topics and trends that affect your clients most, request a free trial of Checkpoint Edge today.

|

How to utilize generative AI to excel your tax and accounting services Learn how generative AI can help you create new insights, solutions, and opportunities for yourself and your clients. |

Product Page Product Page

An accounting and tax research tool powered by AI and machine learning to get targeted search results in less time. |