Overview of credits for heating and cooling, water heating, building products, and more.

As the world increasingly embraces sustainable practices, energy efficient tax credits serve as powerful tools to motivate individuals and businesses to adopt eco-friendly measures.

Recognizing this, the IRS offers tax incentives to homeowners and businesses to adopt energy efficient heating and cooling systems, water heaters, windows, doors, insulation, and more. The IRS also recognizes products and practices endorsed by ENERGY STAR, simplifying energy-efficient options for consumers.

Because tax credits are available for a wide variety of energy efficient upgrades, accountants play a pivotal role in guiding clients through claiming these tax credits, ensuring compliance with eligibility criteria, and meeting documentation requirements.

Let’s take a detailed look at the Energy Efficient Home Improvement Credit, ENERGY STAR, and various other tax credits, so you can better empower your clients to make environmentally conscious choices while maximizing tax benefits.

Jump to ↓

What is the Energy Efficient Home Improvement Credit?

How to claim energy efficient tax credits from ENERGY STAR

Staying up to date with energy efficient tax credits

What is the Energy Efficient Home Improvement Credit?

The Energy Efficient Home Improvement Credit is a tax incentive designed to encourage homeowners to make energy-efficient upgrades to their properties.

The expenses below may qualify if they meet certain requirements:

- Exterior doors, windows, skylights and insulation materials

- Central air conditioners, water heaters, furnaces, boilers and heat pumps

- Biomass stoves and boilers

- Home energy audits

The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation:

- 2022: 30%, up to a lifetime maximum of $500

- 2023 through 2032: 30%, up to a maximum of $1,200 (heat pumps, biomass stoves and boilers have a separate annual credit limit of $2,000), no lifetime limit

These enhancements not only contribute to a greener planet but also result in long-term cost savings for homeowners through reduced energy bills. Accountants play a crucial role in guiding clients through the eligibility criteria, calculating the credits, and ensuring compliance with the tax code.

What is ENERGY STAR?

ENERGY STAR is a joint program of the Environmental Protection Agency (EPA) and the Department of Energy (DOE) aimed at helping consumers and businesses adopt energy-efficient products and practices.

Products with the ENERGY STAR label meet strict energy efficiency guidelines set by the EPA. Understanding the significance of ENERGY STAR is essential for accountants, as it forms the basis for several energy-efficient tax credits.

How to claim energy efficient tax credits from ENERGY STAR

To claim the Energy Efficient Home Improvement Credit for appliances that meet applicable ENERGY STAR requirements, you must file Form 5695, Residential Energy Credits Part II, with your tax return to claim the credit. The credit must be claimed for the tax year when the property is installed, not just purchased.

Blog

For more information on claiming green tax credits, see our guide to environmental IRS forms.

Read the guide ↗Heating and cooling tax credits

Heating and cooling systems are major contributors to household energy consumption. Upgrading to ENERGY STAR certified systems can make homeowners eligible for up to $3,200 in tax credits annually to lower the cost of energy efficient home upgrades.

Accountants should guide clients through the documentation required to claim these credits for energy-efficient HVAC systems, ensuring compliance with the eligibility requirements.

Water heating tax credits

Water heaters, air conditioners, and certain stoves qualify for a 30 percent tax credit when you upgrade to ENERGY STAR certified models. Accountants should assist clients in understanding the eligibility criteria and documenting the installation of energy-efficient water heating systems.

Building products tax credits

For homes and apartments acquired on or after January 1, 2023, the tax credit for home builders is specifically tied to certification to an eligible version of the relevant ENERGY STAR program requirements for single-family, manufactured, and multifamily homes, and the tax credit has been extended through 2032.

Commercial building owners that increase their energy efficiency by at least 25 percent will be able to claim a deduction, with bonuses for higher efficiency improvements.

In addition, eligible contractors who build or substantially reconstruct qualified new energy-efficient homes may be able to claim tax credits up to $5,000 per home. The amount of the credit depends on factors including the type of home, its energy efficiency, and the date when the home is acquired.

Building owners who place in service energy efficient commercial building property (EECBP) or energy efficient commercial building retrofit property (EEBRP) may also be able to claim a tax deduction. An increased deduction may be available for increased energy savings or meeting prevailing wage and apprenticeship requirements.

Residential Clean Energy Tax Credit

The Residential Clean Energy Credit equals 30% of the costs of new, qualified clean energy property for your home installed anytime from 2022 through 2032. The credit percentage rate phases down to 26 percent for property placed in service in 2033 and 22 percent for property placed in service in 2034. You may be able to take the credit if you made energy saving improvements to your home.

The credit is nonrefundable, so the credit amount you receive can’t exceed the amount you owe in tax. You can carry forward any excess unused credit, though, and apply it to reduce the tax you owe in future years. Do not include interest paid including loan origination fees.

The credit has no annual or lifetime dollar limit except for credit limits for fuel cell property. You can claim the annual credit every year that you install eligible property until the credit begins to phase out in 2033.

Staying up to date with energy efficient tax credits

Accountants, serving as trusted advisors, play a vital role in guiding clients through changes to existing tax credits, new incentives, and evolving ENERGY STAR guidelines. By regularly updating your knowledge on energy-efficient tax credits and keeping an eye on legislative changes, you can help your clients better understand eligibility criteria, new incentives, and plan for future sustainable investments.

With legislation constantly evolving, staying abreast of topics like renewable energy tax incentives or electric vehicle tax credits can be complex. By understanding the details of these tax credits at both the state and federal levels, you can help your clients make informed decisions that save them money and support the environment.

Stay up to date with green tax initiatives by utilizing Thomson Reuters Checkpoint Edge, a cutting-edge tax research tool informed by 680+ highly-qualified editors and outside practitioners.

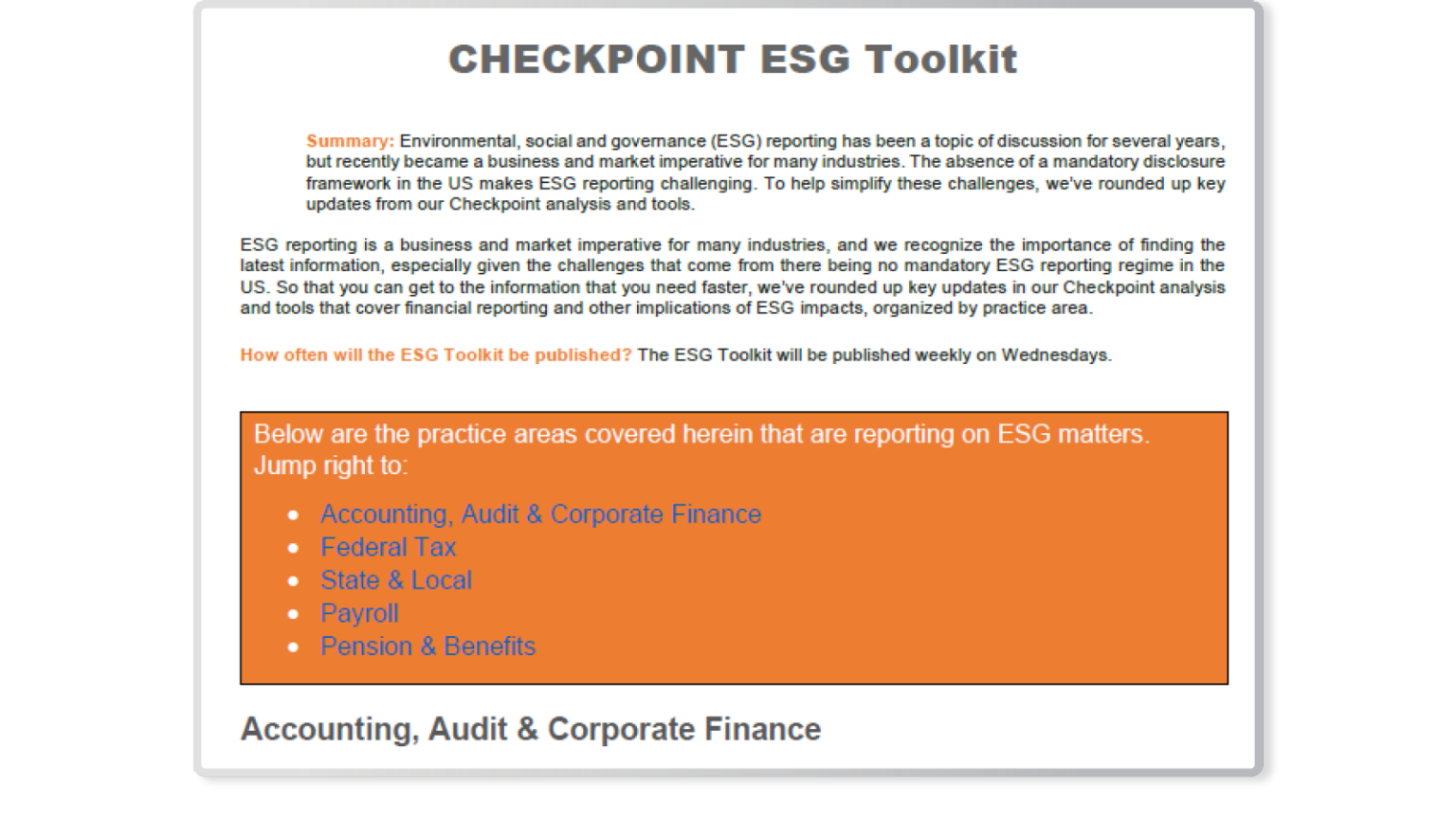

Additionally, Thomson Reuters ESG solutions, including Checkpoint ESG Toolkit, helps equip tax, corporate, risk, and legal professionals to navigate environmental-related tax credits and incentives while ensuring compliance.