In our everyday lives, AI-powered personal assistants help us with a wide range of tasks — from directions to weather to calendar management — using advanced technologies like natural language processing (NLP), machine learning, and other generative AI methods that comprehend and respond to inputs in a human-like way.

Jump to:

| What if tax research didn’t have to be so difficult? |

| Meet Checkpoint Edge with CoCounsel: Your new GenAI tax assistant |

| A better starting point for tax research |

| Real-world applications and benefits for tax professionals |

| Ready to get started with a generative AI tax assistant? |

In our everyday lives, AI-powered personal assistants help us with a wide range of tasks — from directions to weather to calendar management — using advanced technologies like natural language processing (NLP), machine learning, and other generative AI methods that comprehend and respond to inputs in a human-like way.

For tax and accounting professionals, AI assistants can be transformative, enabling efficient task completion, automation, and enhanced decision-making. However, many accountants are still hesitant to adopt this technology due to concerns around accuracy, security, and privacy.

To mitigate these concerns, forward-looking accounting professionals are turning to an industry-specific AI-powered tax research solution that is grounded in data from trusted experts and reliable sources, as opposed to public options that pull information from across the internet.

To fully understand the benefits, let’s take a look at the current state of tax research and how generative AI can have a revolutionary impact on accuracy and efficiency.

What if tax research didn’t have to be so difficult?

Professional tax research often involves multiple searches, a painstaking review of relevant materials, and a cited summary presented in a format that clients and colleagues can understand. Needless to say, this process can take hours, even for an experienced tax researcher.

With time and resources often already strained for many accounting professionals, the failure to properly substantiate tax positions, respond to questions in a timely manner, or proactively advise clients could result in reputational damage, fines, and penalties. But there is a better way.

A generative AI-enabled tax research assistant can automatically deliver professionally summarized answers along with links to relevant editorial content and source materials. With a synopsis of relevant law grounded in trusted content, you can reduce the chance of inaccurate answers and misguided decision-making, thus minimizing risk to your clients and business—all while saving precious time and resources.

Meet Checkpoint Edge with CoCounsel: Your new GenAI tax assistant

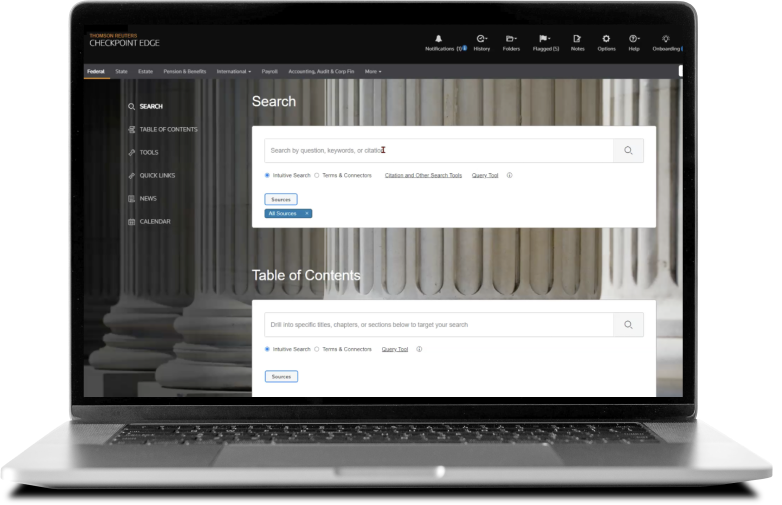

Introducing Checkpoint Edge with CoCounsel, a generative AI tax research assistant that ensures fast, easy-to-read answers grounded in reliable and vetted sources. With an intuitive interface, it delivers straightforward responses to questions as if speaking directly to a trusted subject matter expert or advisor.

Here’s how it works:

-

- Simply pose a question in everyday language.

- Receive the most relevant answer, complete with citations from and links to trusted flagship content on Checkpoint for easy validation.

- Copy and paste the summarized and cited response into your communications with clients or colleagues.

- Move on to higher-value work.

By automatically delivering professionally summarized answers along with links to relevant Checkpoint Edge editorial content and source materials, even seasoned researchers will save time and improve their professionalism and responsiveness with clients.

But perhaps the biggest impact is for junior staff who are empowered to conduct their own research with less supervision from senior colleagues. Mentoring isn’t replaced, but junior staff can upskill themselves and have more informed, productive conversations with their managers.

|

|

A better starting point for tax research

As a tax professional, you may often default to using publicly available platforms like ChatGPT and Google for tax research because that’s where you’re comfortable. However, answers from such solutions are based on data pulled from across the internet and may be inaccurate, out-of-date, or quite simply unverified or unable to be verified. This can lead to accuracy, privacy, and security concerns, not to mention possible financial impacts and reputational damage.

Checkpoint Edge with CoCounsel is a better starting point for tax research. AI-generated responses presented alongside supporting Checkpoint materials reduce research time and propel users forward with:

-

- Research automation. A personal AI assistant designed to help tax professionals do their work more efficiently.

- Trusted content. Accurate and high-quality results synthesized from trusted up-to-date Checkpoint content.

- Clear audit trail. Clarity on how a response/answer was formed with cited sources.

In one motion, you can find easy-to-digest answers synthesized from trusted Checkpoint Edge resources, along with citations for fast verification.

Real-world applications and benefits for tax professionals

With so much information at our fingertips, many of us question whether personal AI tax assistants actually create greater efficiency. And the answer is yes.

The combination of powerful algorithms and vast datasets enables AI to understand and respond to our questions in a more nuanced and situation-based way. This revolutionizes daily work for professionals across all industries, including tax and accounting.

If you’re still not convinced, here are just some of the many daily use cases for Checkpoint Edge with CoCounsel.

-

- Use the AI-assisted research feature to get straightforward and direct answers to help vet tax positions, tackle complex tax questions, and empower junior staff to find their own answers.

- Answer client questions in real-time rather than getting back to them later.

- Bolster existing tax or accounting knowledge without having to pour over multiple references and layers of content.

- Finish drafting work faster with insights and trusted content all in one place.

- Spot key risks and resolve questions using powerful summaries from thousands of documents, created in a matter of seconds.

Ready to get started with a generative AI tax assistant?

If you’re ready to leverage generative AI to redefine your tax research workflow, explore Checkpoint Edge with CoCounsel today!

|

Tax research toolGet in touch and get answers. Explore Checkpoint Edge with CoCounsel! |

BlogRedefine your work with AI-Assisted Research on Checkpoint Edge with CoCounsel |