Tax exemption requirements for charities and nonprofits.

Charities and nonprofits must comply with tax obligations in order to maintain their tax-exempt status. Accountants who serve these organizations must fully understand the relevant tax exemptions, filing requirements, and reporting regulations in order to ensure their clients’ financial transparency and compliance.

Let’s take a look at the critical aspects of tax obligations for charities and nonprofits by shedding light on the key forms and regulations that guide their tax-exempt status and take stock of their financial operations.

Jump to ↓

| Do charities get tax exemptions? |

| What to know about Section 501 |

| What is Form 990? |

| How to file taxes for nonprofits |

| What are the 501(c)(3) reporting requirements? |

| Helping clients with Form 990 and charity exemptions |

Do charities get tax exemptions?

Yes. Charities and non-profits, as recognized under the law, often enjoy tax exemptions, allowing them to allocate more charitable contributions from supporters toward their mission. Charity tax exemptions are granted based on the organization’s compliance with specific regulations and its designation under Section 501(c) of the Internal Revenue Code.

Donations to non-charity organizations (i.e., GoFundMe, political donations, etc.) are generally not tax exempt.

What to know about Section 501

Section 501 of the Internal Revenue Code delineates the criteria for organizations to qualify for tax-exempt status. This section includes various subsections, each catering to different types of organizations, such as charitable, religious, educational, scientific, and more.

Nonprofit organizations seeking tax-exempt status must adhere to the guidelines outlined in this section to ensure compliance and eligibility for tax benefits.

What is Form 990?

Form 990 is a key document that tax-exempt organizations, including charities and nonprofits, must file annually with the IRS. It provides comprehensive information about the organization’s activities, governance, and finances, ensuring transparency and accountability.

Smaller organizations may be eligible to file the streamlined Form 990-N (e-Postcard) or the Form 990-EZ, which requires less detailed reporting compared to the standard Form 990.

Book

PPC's 990 Deskbook provides detailed, easy to understand tax return guidance for Form 990 and its related forms

Shop book ↗How to file taxes for nonprofits

Filing taxes for nonprofits involves careful adherence to specific IRS guidelines and regulations. The process typically includes the following key steps:

- Review tax-exempt status. Ensure that the nonprofit organization’s tax-exempt status is up to date. Verify that the organization is still eligible for tax-exempt status and confirm any changes to the IRS guidelines that might impact the filing process.

- Gather financial information. Collect all necessary financial documents, including income statements, expense reports, balance sheets, and any other relevant financial records for the tax year.

- Choose the correct tax form. Select the appropriate tax form based on the organization’s annual gross receipts and total assets. Nonprofits usually file Form 990, Form 990-EZ, or Form 990-N (e-Postcard), depending on the size and nature of their operations. Ensuring the selection of the correct form is crucial for accurate reporting.

- Complete the required forms. Fill out the chosen tax form accurately and thoroughly. Provide detailed information about the organization’s activities, finances, governance structure, and any other relevant data required by the IRS. Pay close attention to specific sections that may require additional schedules or attachments.

- File the tax return. Submit the completed tax return and any required schedules or attachments to the IRS by the designated deadline. Ensure that the filing is done electronically or via mail, depending on the chosen method permitted by the IRS for the specific form being filed.

- Comply with state tax requirements. Depending on the state in which the nonprofit operates, there may be additional state tax requirements to fulfill. Familiarize yourself with the state-specific regulations and obligations and file any necessary state tax forms within the designated deadlines.

- Maintain proper documentation. Keep thorough records of all financial documents, tax returns, and correspondence with the IRS for future reference. Maintaining comprehensive records is crucial for audits or inquiries that may arise from the IRS or other regulatory authorities.

By following these steps and staying informed about any updates or changes in tax laws and regulations, accountants can help charities and nonprofits effectively fulfill their tax obligations while maintaining transparency and compliance with the IRS requirements.

What are the 501(c)(3) reporting requirements?

501(c)(3) organizations, including charitable, religious, educational, and scientific organizations, are subject to specific reporting requirements to maintain their tax-exempt status. These reporting obligations are crucial for ensuring transparency and accountability in their operations. The primary reporting requirements for a 501(c)(3) organization include:

- Form 990 annual information return. Most 501(c)(3) organizations are required to file Form 990, which provides the IRS and the public with detailed information about the organization’s activities, governance, and finances. Form 990 includes sections for reporting revenue, expenses, executive compensation, and other relevant financial data.

- Form 990 schedules and attachments. Depending on the size and nature of the organization’s activities, additional schedules and attachments may be necessary along with Form 990. These schedules provide more in-depth information about specific aspects of the organization’s operations, such as program services, fundraising activities, and governance policies.

- Public disclosure requirements. 501(c)(3) organizations are required to make certain information publicly available, including their annual information returns (Form 990), exemption application (Form 1023), and exemption letter from the IRS. This transparency enables donors, stakeholders, and the general public to assess the organization’s financial health and mission effectiveness.

- State reporting requirements. In addition to federal reporting obligations, 501(c)(3) organizations may be subject to state-specific reporting requirements, depending on the state in which they operate. These requirements may include registering with the state’s charity regulator, filing annual reports, and complying with any state-specific regulations related to fundraising or charitable activities.

By fulfilling these reporting requirements, 501(c)(3) organizations can demonstrate their commitment to financial transparency, accountability, and compliance with IRS and state regulations.

What tax forms do a 501(c)(3) need to file?

In addition to Form 990, 501(c)(3) organizations may need to file Form 1023, which is an application for recognition of exemption under Section 501(c)(3). Ensuring compliance with these reporting requirements is essential to avoid any penalties or loss of tax-exempt status.

Helping clients with Form 990 and charity exemptions

Navigating the complexities of tax forms and charity exemptions can be challenging for nonprofits and charities. As an accountant, your guidance is invaluable in ensuring accurate and timely filing of required documents and helping nonprofits maximize their tax benefits and maintain compliance with IRS regulations.

From seeking tax exemptions under Section 501 to filing essential documents like Form 990 and Form 1023, accountants must prioritize meticulous recordkeeping and accurate reporting for their 501(c)(3) clients., accountants must prioritize meticulous recordkeeping and accurate reporting for their 501(c)(3) clients.

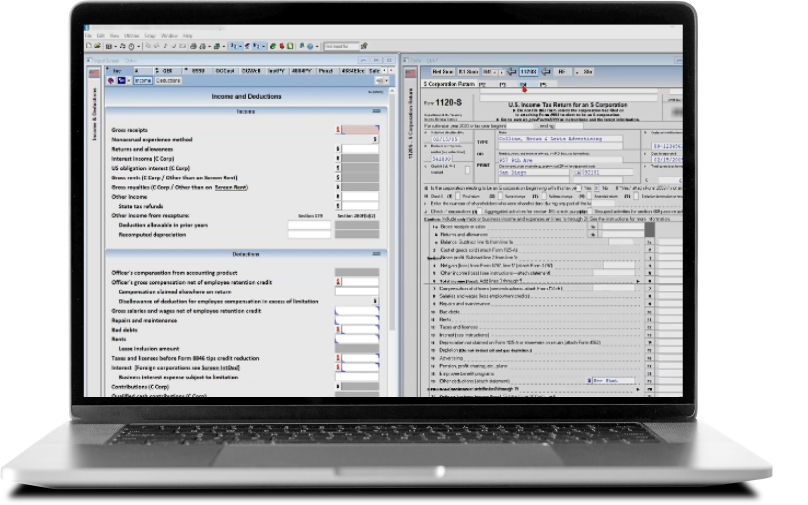

Thomson Reuters UltraTax CS ensures ease of use in filing Form 990 for your non-profit clients. Along with Checkpoint books, including Taxation of Exempt Organizations, your firm can become a trusted partner for nonprofits or charities by optimizing their tax benefits.

By staying abreast of the evolving tax laws and providing professional tax guidance, your firm can support your nonprofit clients in streamlining their tax obligations and focusing more effectively on their charitable missions.

UltraTax CS

Professional tax preparation software to reduce your workflow time and increase your productivity

Learn more ↗