Determine the appropriate tax depreciation for cars used for business.

Running a successful small business is hard work and expensive. Every penny counts, so finding ways to help your clients leverage every tax deduction they are entitled to is a win for your clients and your firm.

One tax saving that some business clients may not be familiar with is vehicle tax depreciation. If your client owns a vehicle, or several vehicles, that they use for business, it is likely they will qualify for deductions on their taxes.

Helping your clients better understand vehicle tax depreciation and the savings they may be entitled to will help strengthen your client relationships and your role as their trusted advisor.

Jump to ↓

| Can you deduct vehicle depreciation on taxes? |

| Are vehicles a five year depreciation? |

| How do you calculate vehicle depreciation for taxes? |

| What is the standard mileage rate? |

| How does Section 179 deduction work for vehicles? |

| Managing vehicle tax depreciation with software |

Can you deduct vehicle depreciation on taxes?

In general, if clients have a vehicle they use for business purposes, then the answer is yes.

Tax depreciation is the recovery of the cost of property, such as a business vehicle, over a number of years. A portion of the cost is deducted every year until the taxpayer fully recovers the cost. However, when it comes to certain property, such as vehicles, there are special rules and limits for depreciation that must be considered.

Any vehicle (including trucks, vans, and cars) that is used for business purposes can typically qualify for tax deductions, if certain requirements are met. These include:

- The vehicle is used for business purposes at least 50% of the time.

- It is used within the United States.

- It is not used for hire, like a car rental service.

- The taxpayer claiming the deductions is the owner of the vehicle.

If your client uses a vehicle solely for business purposes, they may deduct its entire cost of ownership and operation (subject to limits). However, if they use the vehicle for both business and personal purposes, they can only deduct only the cost of its business use.

|

|

Are vehicles a five-year depreciation?

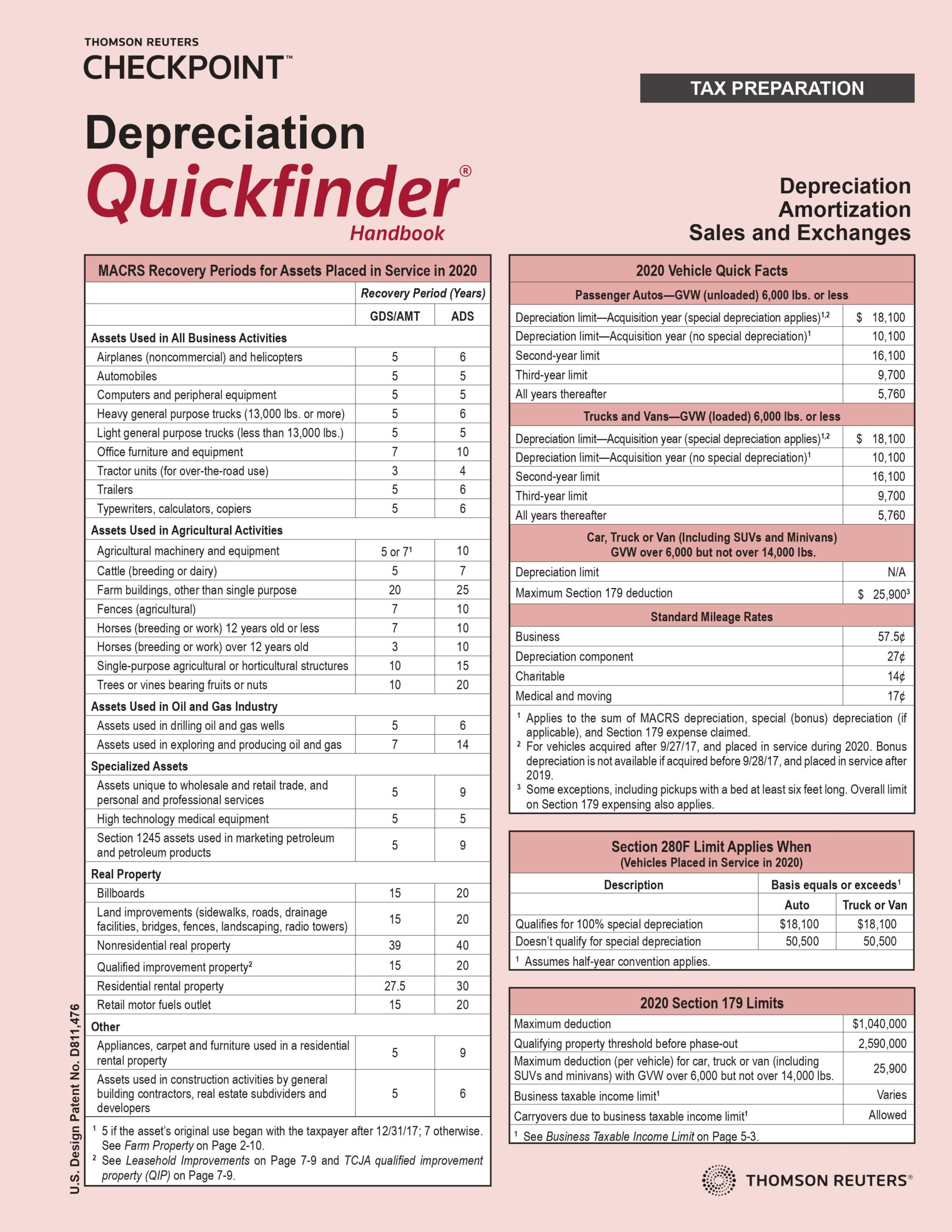

Under the Modified Accelerated Cost Recovery System (MACRS), vehicles are classified as a five-year property. In other words, the standard depreciation schedule is five years.

According to the IRS, taxpayers can actually depreciate the cost of a car, truck, or van over a period of six calendar years. Why? Because a vehicle is “generally treated as placed in service in the middle of the year, and you claim depreciation for one-half of both the first year and the sixth year.”

The maximum amount that can be deducted is limited and depends on such factors as the year the client placed the vehicle in service.

How do you calculate vehicle depreciation for taxes?

In general, there are two primary methods for calculating vehicle depreciation for taxes: MACRS (declining balance method) and straight-line depreciation. Let’s take a closer look.

MACRS

If the vehicle was placed into service after 1986 and is used for business reasons at least 50% of the time, then the MACRS method will be used.

When calculating the depreciation, the client must provide you the following details:

- What is the price paid for the vehicle, plus any registration costs, fees, taxes, etc.? This is the basis of the vehicle.

- What percentage of the vehicle is used for business? Multiply the basis by the percentage.

- What is the date the vehicle was placed in service? The IRS states that the maximum amount that can be deducted each year depends on the date the client acquired the passenger automobile and the year they placed it in service.

Once you have this information, use IRS Form 4562 to calculate the depreciation. To determine the annual depreciation allowance for the vehicle, refer to IRS Publication 946.

To illustrate vehicle depreciation, consider this example:

Your business client buys a car that was placed in service on Jan. 1, 2024. The basis (purchase price + additional fees and taxes) of the vehicle is $50,000. The percentage it was used for business is 60%. The basis to be used for depreciation is $30,000.

As noted earlier, vehicles are classified as a five-year property under MACRS. Using the 200% declining rate, you get to a 40% depreciation rate (200 / 5 = 40% depreciation rate). Now take 40% of the $30,000 basis to obtain the deduction. In this example, the deduction is $12,000.

See page 32 of IRS Publication 463 for a MACRS Depreciation Chart and more examples.

Straight-line depreciation

There are situations when straight-line depreciation is required.

For instance, if the standard mileage rate is used in the year the client placed the car in service and then changed to the actual expense method in a later year — before the car is fully depreciated — then straight-line depreciation must be used over the rest of the useful life of the car. There are limits on how much depreciation you can deduct.

And if the business use of the vehicle is less than 50%, then the straight-line depreciation method must be used. To calculate this, the depreciable basis is divided evenly across the useful life of the vehicle.

What is the standard mileage rate?

As recently announced by the IRS, the business standard mileage rate for 2024 is 67 cents ($0.67) per mile.

Standard mileage rates can be used instead of calculating the actual expenses that are deductible. For example, you can use the business standard mileage rate instead of determining the amount of fixed and variable expenses that are deductible as business expenses.

How does Section 179 deduction work for vehicles?

Section 179 enables a business owner to recover all or part of the cost of qualifying property, like a business vehicle, up to a certain determinable dollar limit, in the taxable year they placed it in service.

The Section 179 deduction and depreciation limit on a passenger automobile (including trucks or vans) used for your business and put into service in 2024 is either $20,400 (with special depreciation allowance) or $12,400 (without special depreciation allowance).

Vehicles must be used for business purposes at least 50% of the time to qualify for Section 179. If the client uses the vehicle for more than 50% but less than 100% business purposes, the allowable deduction must then be calculated.

Managing vehicle tax depreciation with software

Stop spinning your wheels trying to manage vehicle tax depreciation. Vehicle tax depreciation can be confusing and time-consuming to navigate without the right tools and resources in place.

Leveraging comprehensive depreciation software, such as Thomson Reuters Fixed Assets CS, enables practitioners to work smarter and faster with unlimited depreciation treatments, automatic federal and state depreciation calculations, customized reporting, and more.

Turn to Thomson Reuters to get expert guidance on tax depreciation and other cost recovery issues to help your firm work more efficiently.

Depreciation accounting software

Fixed Assets CS calculates an unlimited number of treatments — with access to any depreciation rules a professional might need for accurate depreciation.

Learn more ↗

UltraTax CS

Professional tax preparation software to reduce your workflow time and increase your productivity

Learn more ↗