It’s back to business fundamentals for many tax and accounting firms as 2024 shapes up to be a year of re-assessment and re-building, according to the Thomson Reuters Institute 2024 State of Tax Professionals Report.

Jump to:

| A deeper look at efficiency and automation |

| The intersection of challenges and priorities in tax workflows |

| A bright future awaits in workflow for tax professionals |

According to the survey, firms are taking stock of their strengths and weaknesses this year — and moving forward with concrete plans to fortify their operations. From continuing efforts to streamline workflows to leveraging automation, tax and accounting professionals are taking steps to hire and train the best people, expand offerings, and re-evaluate pricing models in an ongoing effort to boost revenue and better meet client needs.

Respondents to this year’s survey listed their top priorities as:

1. Efficiency & automation

2. Talent retention & hiring

3. Pricing & revenue

4. Client services

5. Firm growth & strategy

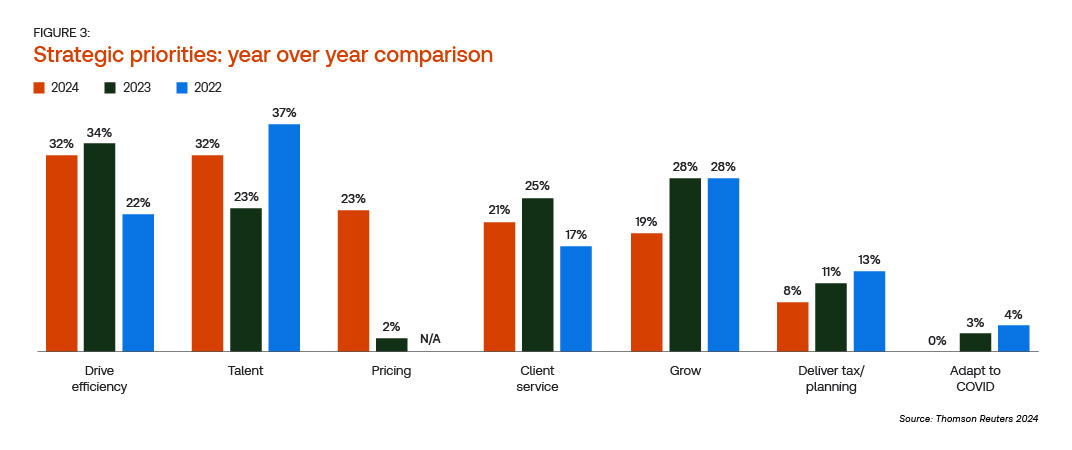

Not surprisingly, the renewed focus on business dynamics in 2024 was reflected in a modest reshuffling of priorities over prior years.

While driving efficiency remains the top strategic priority in 2024, as it was in our last survey, a broader acceptance of automation and an increasing interest in AI-enabled tools has emerged as it has in virtually every other industry.

In addition, talent re-asserted itself as a priority this year as many tax and accounting firms are now directing more of their energies toward hiring, training, and retaining quality people, as well as cultivating a healthier, more sustainable work culture.

A deeper look at efficiency and automation

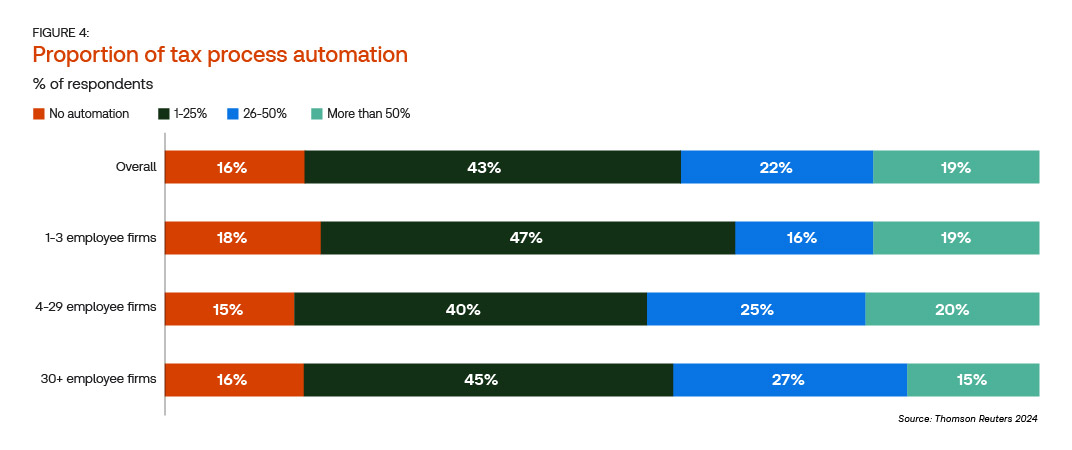

It’s no secret that tax and accounting firms have increasingly turned to automation as the primary strategy for streamlining operations in recent years. While routine manual tasks, audit documentation, and back-office functions like procurement and accounts payable are often the initial focus of these automation efforts, larger firms have extended this approach to handle the vast volumes of data generated by complex corporate tax returns.

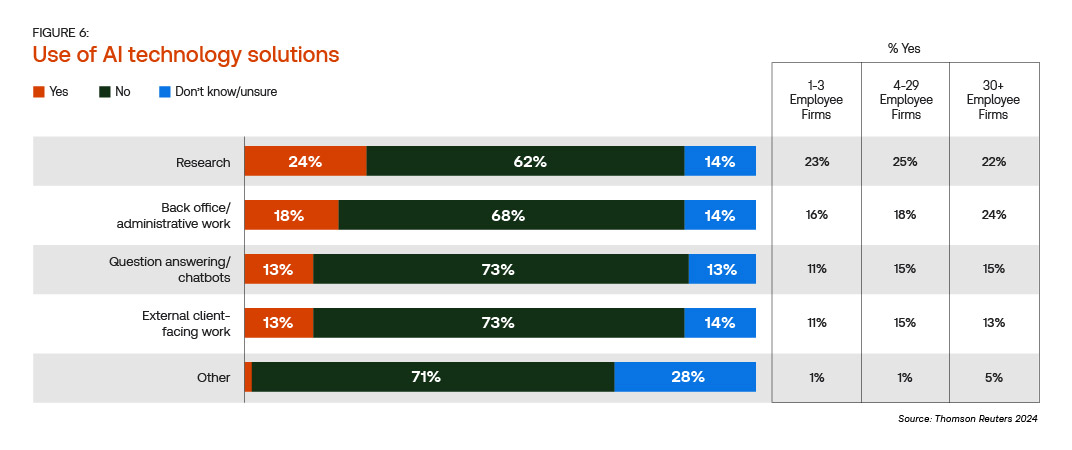

Even with its ability to quickly analyze large datasets, the use of AI solutions to drive efficiency gains was still relatively low at most tax and accounting firms. Fewer than one-quarter (24%) of respondents said their firms use AI at all; and among those that do, the most common usage was for research.

However, 35% of respondents to this year’s survey said their firms would be investing in some form of AI over the next two years, although few (7%) cited AI as a top investment priority.

For accounting firms who have not yet implemented AI-enabled tax solutions, an opportunity emerges to be a frontrunner in harnessing this powerful technology to boost efficiency, enhance insight, and better serve clients.

For accounting firms who have not yet implemented AI-enabled tax solutions, an opportunity emerges to be a frontrunner in harnessing this powerful technology to boost efficiency, enhance insight, and better serve clients.

The intersection of challenges and priorities in tax workflows

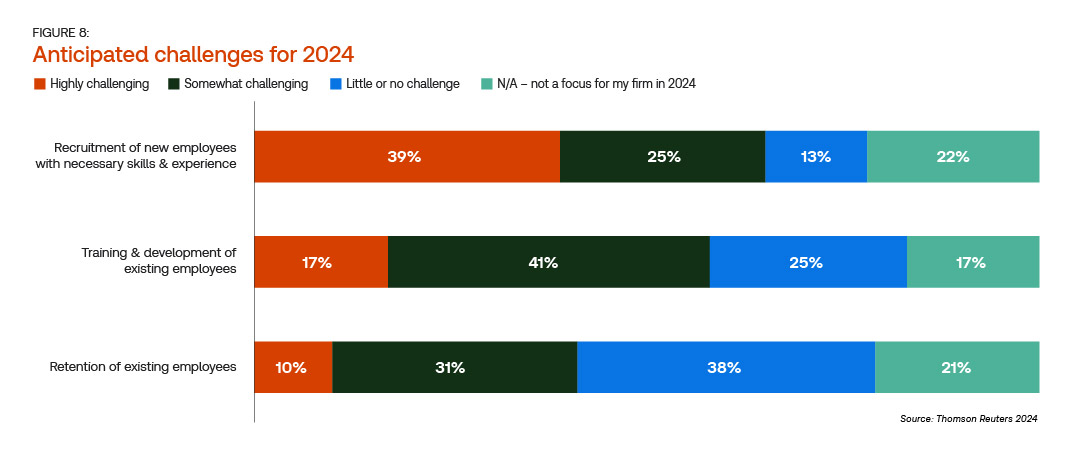

As evidenced in the survey, the challenges and priorities of tax and accounting professionals often intersect. Streamlining operations and finding more efficient workflows may have taken the top spot, but it was followed very closely by hiring, training, and retaining top talent.

Indeed, finding candidates with the necessary tax experience and technical skills is perhaps the most daunting challenge that accounting firms face today. Given the shortage of qualified talent, 39% of respondents said recruitment in 2024 was likely to be highly challenging. Moreover, 58% of respondents said they thought training and development of existing employees would be either highly or somewhat challenging, and 41% said the same about retention of existing employees.

Interestingly, pricing catapulted into the No. 3 slot this year with 23% of respondents referencing their pricing model as a top priority. Such a dramatic jump suggests that the trend away from hourly billing has gathered steam to the point at which pricing models have become a strategic tool in the quest to boost revenue.

Interestingly, pricing catapulted into the No. 3 slot this year with 23% of respondents referencing their pricing model as a top priority. Such a dramatic jump suggests that the trend away from hourly billing has gathered steam to the point at which pricing models have become a strategic tool in the quest to boost revenue.

The pricing model gaining the most traction in 2024 is value-based pricing, in which charges are based on expertise, guidance, and results, rather than time spent. This is likely an indicator of the move away from strictly compliance-based tax preparation and into the profitable (and rewarding) world of advisory services.

A bright future awaits in workflow for tax professionals

Even amidst an ever-evolving tax code and the constant push to do more in less time, today’s tax and accounting professionals are finding new and creative ways to not only survive but thrive.

Encouragingly, a majority of respondents to this year’s survey indicated that their firms’ revenues over the past year rose more than 20%. Most said that their firms were planning to continue pursuing their strategic goals on multiple fronts — so there is every reason to believe that the profession is well-positioned to weather any storm and tackle whatever challenges lie ahead.

To learn more about the priorities and challenges for tax and accounting firms in 2024, download your copy of the report at thomsonreuters.com/en-us/posts/tax-and-accounting/tax-professionals-report-2024.