Highlights:

- Tax authorities worldwide are shifting to a digital economy by implementing e-invoicing and Continuous Transaction Controls (CTCs)

- Understanding the differences between e-invoicing and CTCs

- Recognizing the benefits and challenges of e-invoicing

- Requirements for setting up e-invoicing

Jump to ↓

What is the difference between e-invoicing and Continuous Transaction Controls (CTCs)?

How companies benefit from e-invoicing

What is the process for setting up e-invoicing?

The challenges of e-invoicing compliance

A notable trend has emerged over the past few years as tax authorities worldwide embrace the shift to a fully digital economy. This transition is marked by the increasing implementation of e-invoicing systems and continuous transaction controls (CTCs). These measures are being adopted to enhance oversight and gain deeper insights into business transactions, both domestically and internationally

In this three-part series, we will explain e-invoicing, how it works, why it is gaining popularity, what technology and compliance challenges it presents to corporate tax, finance, and IT teams, and share some best practices for doing business in an e-invoicing regime.

The first part of the series will cover the e-invoicing basics that every company needs to know; Part 2 will look in-depth at the compliance challenges of switching to e-invoicing, as well as highlighting the importance of consolidating e-invoicing vendors; and Part 3 will explore some of the regional complexities that companies may encounter, as well as updates on regulatory changes and strategies for keeping up with the reporting requirements that typically accompany e-invoicing/continuous transaction controls (CTC) mandates.

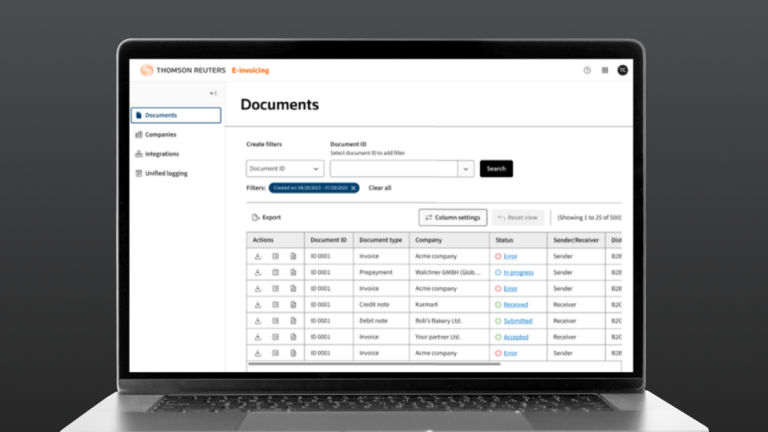

Throughout the series, Nazar Paradivskyy, VP of Regulatory Affairs at Pagero, part of Thomson Reuters, will provide insights on what companies need to know for a seamless transition into this new era of real-time digital tax controls, illustrating how Thomson Reuters ONESOURCE platform connects financial systems directly to Pagero’s smart business network to facilitate compliant e-invoicing globally.

What is the difference between e-invoicing and continuous transaction controls (CTCs)?

E-invoicing is a digitized form of traditional manual invoicing. Instead of using paper, companies send and receive invoices in a digital format such as PDF, XML or use specialized electronic invoicing platforms that automate the issuance, exchange, and payment of invoices. It does not necessarily involve real-time connection to tax authorities.

Continuous transactional controls (CTCs) require businesses to provide transaction data as well, in near or real-time to infrastructures defined by tax authorities. So, instead of reporting aggregated or summarized data long after the event (so-called, post-audit), as in a VAT return or VAT listing, companies must be capable of electronically generating and exchanging data in a way that can both automate invoice processing and tax reporting. Manual methods simply cannot keep up, especially in CTC jurisdictions.

Due to its digital nature, and the growing demand for transparency in business transactions by governments, e-invoicing poses several technical and regulatory hurdles for companies. These challenges include the lack of widespread global standards concerning mandatory data elements, formatting guidelines, and methods of exchanging data.

However, as many countries are free to develop their own rules and technical requirements, this means that companies must understand and comply with each individual country’s rules, regulations, frequency, and data specifications. To meet these requirements, companies often need to upgrade their systems, develop new processes and workflows, acquire new professional skills, and facilitate more communication and information-sharing between key departments.

Why e-invoicing? Why now?

One of the reasons tax authorities are gravitating towards e-invoicing or CTC is that it gives governments a clearer picture of the tax revenue—particularly what they can expect from the business activity. According to Paradivskyy, there are several other reasons why e-invoicing is so appealing to governments.

“As businesses go digital, so do tax administrations,” says Paradivskyy. “Governments realize the power of collecting and analyzing data in real-time, especially to prevent irregularities such as tax fraud or evasion. But that’s not the only reason for the change. Governments also realize that faster, more granular data can bring greater value to society.”

“During the COVID pandemic, for instance, governments that had real-time data could be more surgical about supporting businesses and industries that needed help,” Paradivskyy explains.

How companies benefit from e-invoicing

Governments aren’t the only entities that benefit from e-invoicing; companies can benefit as well. Besides the fact that manual invoicing is time-consuming and can be prone to errors, there is typically a lag time between the time an invoice is properly generated (meaning, fulfilling regulatory and business requirements) and sent to a customer, and the speed at which businesses receive payment.

Automated e-invoicing improves cash flow by eliminating the manual exchange of invoices with customers. Consequently, companies that use e-invoicing save time, experience fewer errors and have better control over their cash flow. Finally, non-electronic invoicing is much more costly to businesses, if handling costs are taken into account, compared to true e-invoicing.

Part 3: How to keep up with the regional complexities of e-invoicing and CTCs →

What is the process for setting up e-invoicing?

Though e-invoicing ultimately saves time and money, setting it up might involve a significant amount of cost, regulatory and technical know-how, and ongoing maintenance. How significant such an investment will be depends, however, on how businesses decide to implement it. Some practices are better than others.

Multinational corporations (MNCs) must incorporate e-invoicing software into their existing ERP and financial systems, connecting them not only with their trading partners, but as well to government infrastructures.

However, the real challenge is making sure the system is being fed the data it needs, and that the proper data codes are being generated in the correct format for each country and trading partner ecosystem in which the company operates. This may involve some restructuring of workflows and processes, as well as more active communication and data transparency between departments. Rules and regulations are constantly changing as well, so the software one chooses should include automatic updates, that are deployed in the least intrusive way for your operations.

The challenges of e-invoicing compliance

In the next blog, we will explore the challenges posed by e-invoicing or CTC mandates in over 80 countries, whereby companies have historically employed various systems to address these evolving requirements, often using disconnected systems or services for different regions. With the emergence of new e-invoicing or CTC mandates, there’s a growing demand for a unified solution that not only caters to current needs but also allows for streamlined operations across all countries, eliminating the need for separate, independent solutions.

“Businesses should assume that e-invoicing mandates are here to stay,” says Paradivskyy. “Being reactive will be costly, so companies should be reviewing their existing systems and processes, and partnering with a reliable network vendor to support them in this transformational journey.”

Additional resources:

- White paper: E-invoicing compliance: A world of complex challenges for global organizations

- Blog: How corporations can save on the growing costs and complexity of compliance

- Blog: Enhancing e-invoicing compliance and efficiency: A new ERP integration for corporate tax professionals

- Blog series: E-invoicing hub

- Infographic: 4 steps to navigating complex e-invoices for compliance

- Press release: Thomson Reuters Successful Acquisition of Pagero Paves the Way for Significant Growth Opportunities