E-invoicing compliance software

From invoicing to insight with ONESOURCE Pagero

Accelerate growth with trusted, automated e-invoicing software that streamlines global compliance processes to unlock valuable business insights

What can ONESOURCE Pagero do for you?

Simplify compliance with an end-to-end solution

Stay ahead of regulatory changes by streamlining and automating key processes from data collection and tax determination to accounts payable and accounts receivable, compliance reporting, and e-invoicing.

Request free demo

Have questions?

Contact a representative

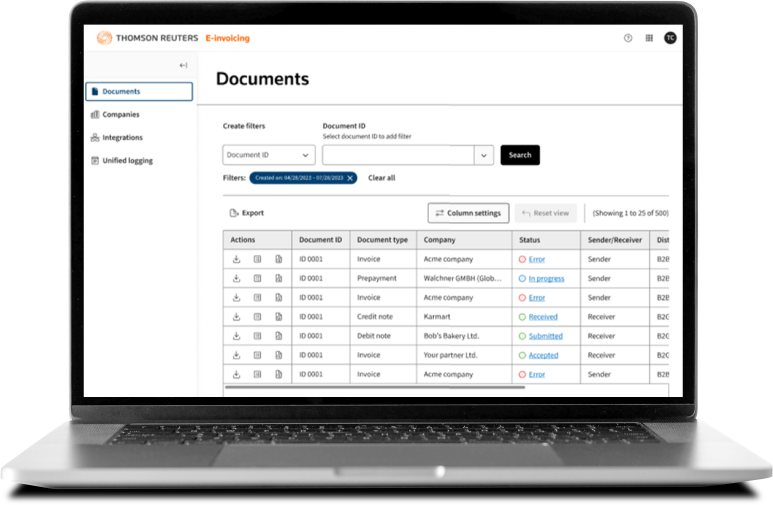

Increase efficiency with centralized data

Save time and resources by centralizing tax data across different entities and jurisdictions into a single, automated solution that reduces manual tasks and enhances data integrity.

Request free demo

Have questions?

Contact a representative

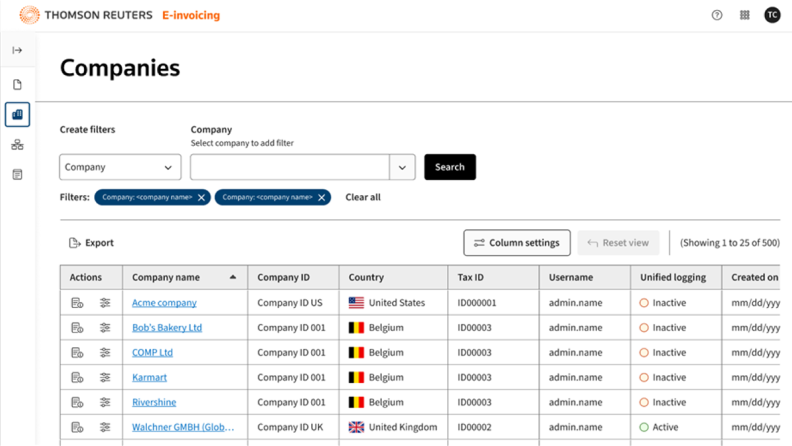

Scale operations with integrated partnerships

Improve efficiency on future rollouts by up to 250% with prebuilt integrations across primary partners, shared user interfaces, and global capabilities.

Request free demo

Have questions?

Contact a representative

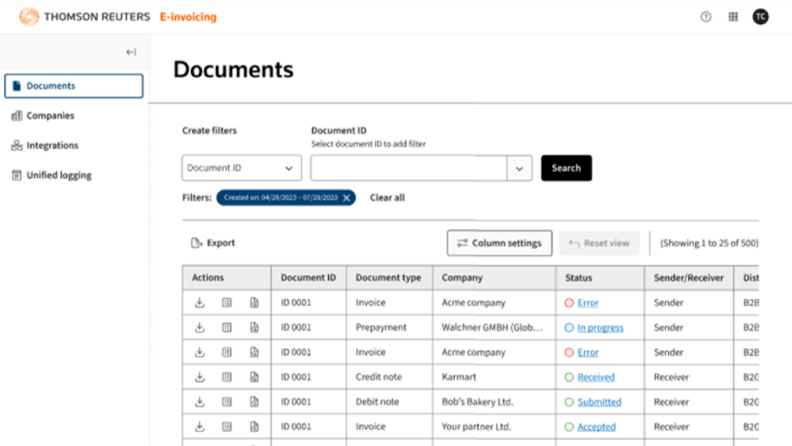

A simplified platform for strategic progress

Cut through complexity and reduce costs

Tax and finance can spend less time on manual tasks with fully automated e-invoicing, while IT teams benefit from a reliable, cloud-native solution that reduces operational costs and can save up to 41,000 hours of effort.

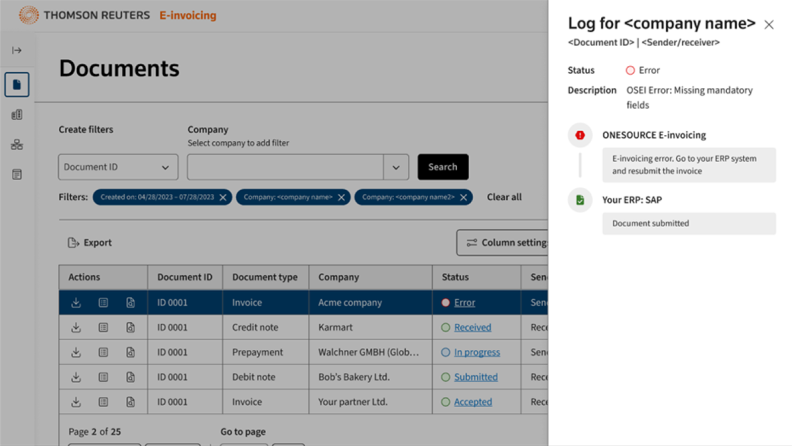

Unlock real-time insights and improve efficiency

Seamless integration and real-time monitoring across company enterprise resource planning and financial systems enhance accuracy and keep pace with multiple cross-border tax requirements and regulatory changes.

Build a global network and transform invoicing

This single, open global network solution transforms the accounts payable and accounts receivable process by linking customers, suppliers, and regulators, saving up to 81% on invoice processing.

The freedom to innovate and improve with confidence

Discover the future of e-invoicing

See how the power of the world’s leading reporting platform and the largest e-invoicing network combine to transform your business.

Cut through global complexity, mitigate risk, and embrace the future of e-invoicing

Accelerate compliance and facilitate business growth with trusted e-invoicing from ONESOURCE Pagero.

Questions about ONESOURCE Pagero? We're here to support you.

888-885-0206

Call us or submit your email and a sales representative will contact you within one business day.

Contact us