A look at what deductions are available for the mining, logging, oil, and gas industries.

Jump to:

| What is depletion expense? |

| Who can claim depletion expenses? |

| How to calculate depletion expense |

| Depletion vs. depreciation |

| Managing depletion expenses |

Clients in the mining, timber, and oil and gas industries must invest a lot of time, money, and resources to extract natural resources from the earth and transform them into useful products for consumers.

Excavating natural resources is a costly venture, and helping your clients save money and mitigate their tax liability is important. One method to achieve this is depletion expense.

There are several variables that influence depletion expenses, and this article will explore some of those factors, as well as how to calculate and better manage depletion expenses. Let’s take a closer look.

What is depletion expense?

The IRS defines depletion as the “using up of natural resources extracted from a mineral property by mining, drilling, quarrying stone, or cutting timber.” In accounting, the depletion deduction enables an owner or operator to account for the reduction of the mineral property’s value or basis as a result of the extraction of those natural resources.

To further explain, here’s an example:

A mining company buys mineral rights for $20,000,000 and spends an additional $4,000,000 to develop the land. It expects to extract 600,000 tons of coal. Given this, the depletion rate would be $24,000,000 divided by 600,000, or $40 per ton. In the most recent period, the firm extracted 3,000 tons. The depletion expense would be $120,000.

Who can claim depletion expenses?

A client can claim depletion if they have an economic interest in standing timber or mineral property, as explained by the IRS. Mineral property includes oil and gas wells, as well as mines and other natural deposits, including geothermal deposits. It is important to note that more than one person can have an economic interest in the same timber or mineral deposit. For instance, if the property is leased then the lessee and lessor split the depletion deduction.

According to the IRS, a client can have an economic interest if both of the following apply:

- They have acquired by investment any interest in mineral deposits or standing timber.

- They have a legal right to income from the extraction of the mineral or cutting of the timber and must seek a return of their capital investment.

Be aware that, “A contractual relationship that allows [a client] an economic or monetary advantage from products of the mineral deposit or standing timber is not, in itself, an economic interest,” the IRS stated.

HandbookFederal Depreciation Handbook: The all-in-one resource for quick reference and in-depth coverage of depreciation and other cost recovery tax issues, such as depletion. |

|

How do you calculate depletion expense?

There are two methods to calculate depletion expense: Cost depletion and percentage depletion.

When it pertains to standing timber, cost depletion is the required method. However, for oil and gas wells, mines, other natural deposits (including geothermal deposits), and mineral property, companies generally use the method that gives them the larger deduction.

Cost depletion is more often used by companies and typically provides the most accurate calculations.

Cost depletion method

When using the cost depletion method, the client estimates the total quantity of the resource, calculates the cost per unit of the resource, and then multiplies the cost per unit by the number of units sold in a particular period.

Before using the cost depletion method, the following must first be determined:

- The property’s basis for depletion: This is comprised of acquisition costs, exploration costs, development costs, and restoration costs.

- The total recoverable units of mineral in the property’s natural deposit.

- The number of units of mineral sold during the tax year.

With the above information at hand, look to find the depletion rate per unit using the following formula:

(Depletion base – salvage value) ÷ total units to be recovered = Depletion rate per unit.

Next, figure out the depletion charge for the period by using the following formula:

Units extracted within period x depletion rate per unit = Depletion charge for period.

The steps can then be merged into one formula:

Depletion charge for period = [(depletion base – residual value) / total units expected for extraction] x units extracted during period.

Here is an example of the cost depletion method with oil drilling.

Percentage depletion method

To determine the percentage depletion, a fixed percentage is assigned to the client’s gross revenue. This assigned depletion rate is multiplied by the gross income from the property.

However, the total sum of the deduction cannot exceed 50% (100% for the oil and gas industry) of the client’s taxable income.

For example, if an owner of a coal mine earned $200,000, they could claim a depletion deduction of $20,000 with a 10% depletion rate ($200,000 x 0.1) for the year.

Is depletion an operating expense?

Cost depletion allocates the costs of extracting natural resources and those costs are recorded as operating expenses to lower pre-tax income. Percentage depletion is a tax deduction.

Depletion vs. depreciation

The oil and gas industry may be no stranger to the terms depletion and depreciation, but it is important not to confuse these two non-cash expenses as there are notable differences.

Depreciation is the gradual reduction of a tangible asset’s recorded value over that asset’s useful life.

Depletion, on the other hand, is the actual use and exhaustion of natural resource reserves. There is no fixed useful life or usage period.

Managing depletion expenses

Helping clients in the mining, timber, and oil and gas industries trim costs and mitigate tax liabilities further strengthens your role as a trusted advisor. However, navigating the complexities is no small feat.

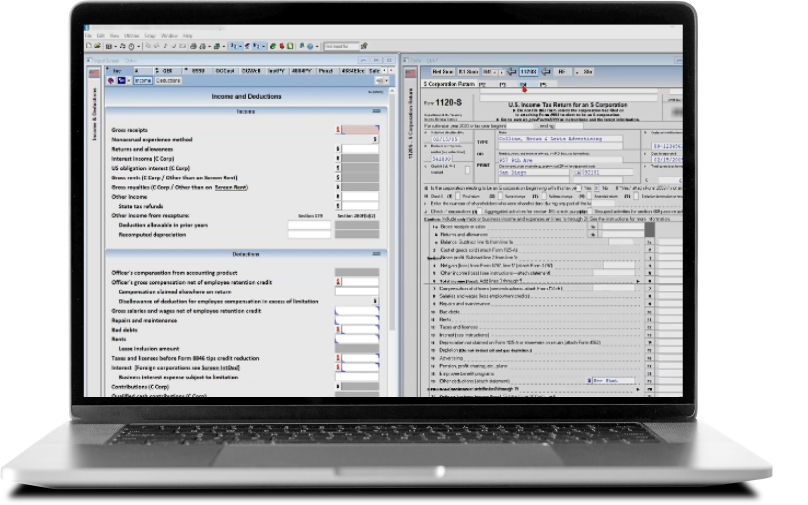

To help clients better manage depletion expenses, consider a comprehensive tax software solution that features an oil and gas module.

Thomson Reuters® UltraTax CS delivers streamlined, consistent data entry for up to twelve oil and gas cost centers and 9,999 wells in 1040, 1041, 1065, and 1120 returns. Furthermore, UltraTax CS calculates and limits percentage depletion, tax preferences for percentage depletion and intangible drilling costs, and tracks for depletion on a detailed, well-by-well basis.

Thomson Reuters can provide the software and expert guidance on depletion and other cost recovery issues (like amortization) to help you better manage your clients’ depletion expenses.

DemoWatch a free demonstration of UltraTax CS professional tax preparation software, or request a live demo tailored to your needs. |

BlogHighlights of the similarities and differences between accounting depreciation and tax depreciation. |