The landscape of tax and accounting is undergoing a significant transformation, driven by rapid technological advancements.

Jump to ↓

| The strategic importance of technology in tax firms |

| Challenges in technology adoption |

| Preparing for the future: Trends and predictions |

| Embracing technology for competitive advantage |

The landscape of tax and accounting is undergoing a significant transformation, driven by rapid technological advancements.

As firms grapple with the integration of new technologies, the recent Tax Firm Technology Report sheds light on the critical role technology plays in shaping firm strategies.

Let’s explore the importance of up-to-date technology for tax firms, the challenges tax firms face with technology, and how tools like UltraTax CS and Checkpoint Edge with CoCounsel can help provide a competitive advantage and prepare your firm for the future.

The strategic importance of technology in tax firms

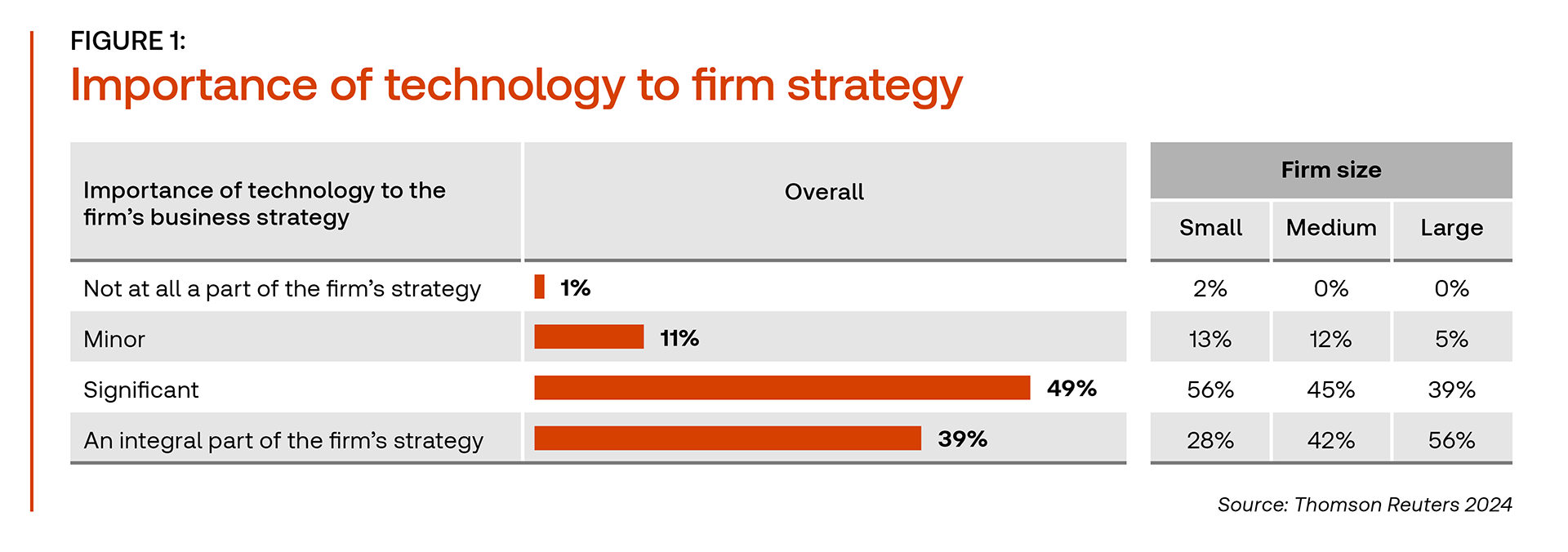

The recent Tax Firm Technology Report underscores the growing recognition of technology as a pivotal element in the strategic framework of tax and accounting firms. Despite this recognition, practical implementation lags, with only half of the firms having a dedicated technology strategy leader.

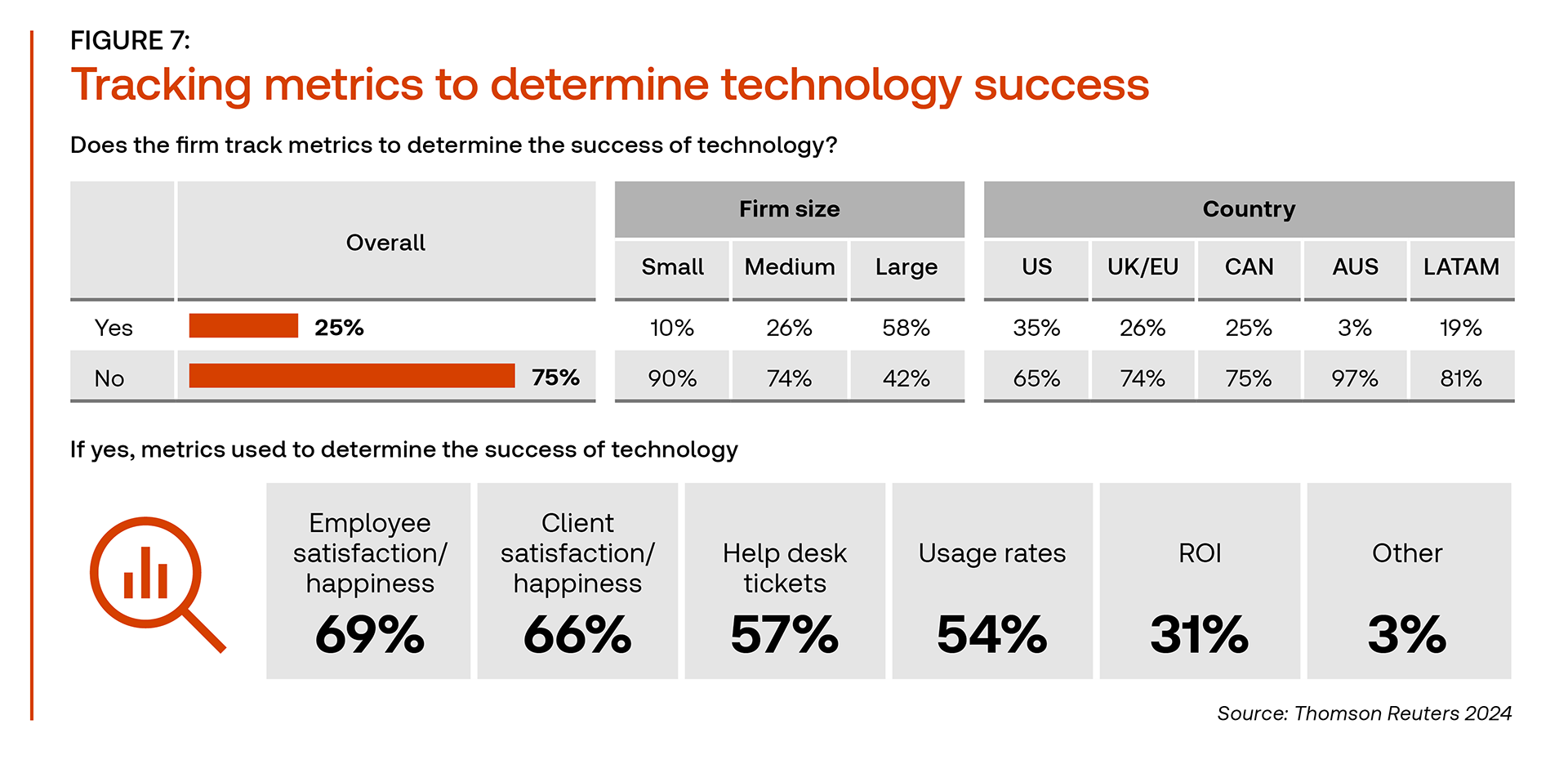

The lack of robust metrics to gauge technology success further complicates this scenario, with only a quarter of firms employing formal metrics. The anticipation around Generative AI (GenAI) is high, with many firms exploring its potential to revolutionize their operations.

However, the gap between the perceived importance of technology and its effective deployment highlights a critical area for development, particularly in training and strategic personnel allocation.

Challenges in technology adoption

The integration of new technologies in tax and accounting firms can be a complex and daunting task. Several key challenges must be addressed to ensure a successful transition.

- Infrastructure and personnel: A significant barrier to technology adoption is the lack of adequate personnel and workflow infrastructure tailored to support technological advancements.

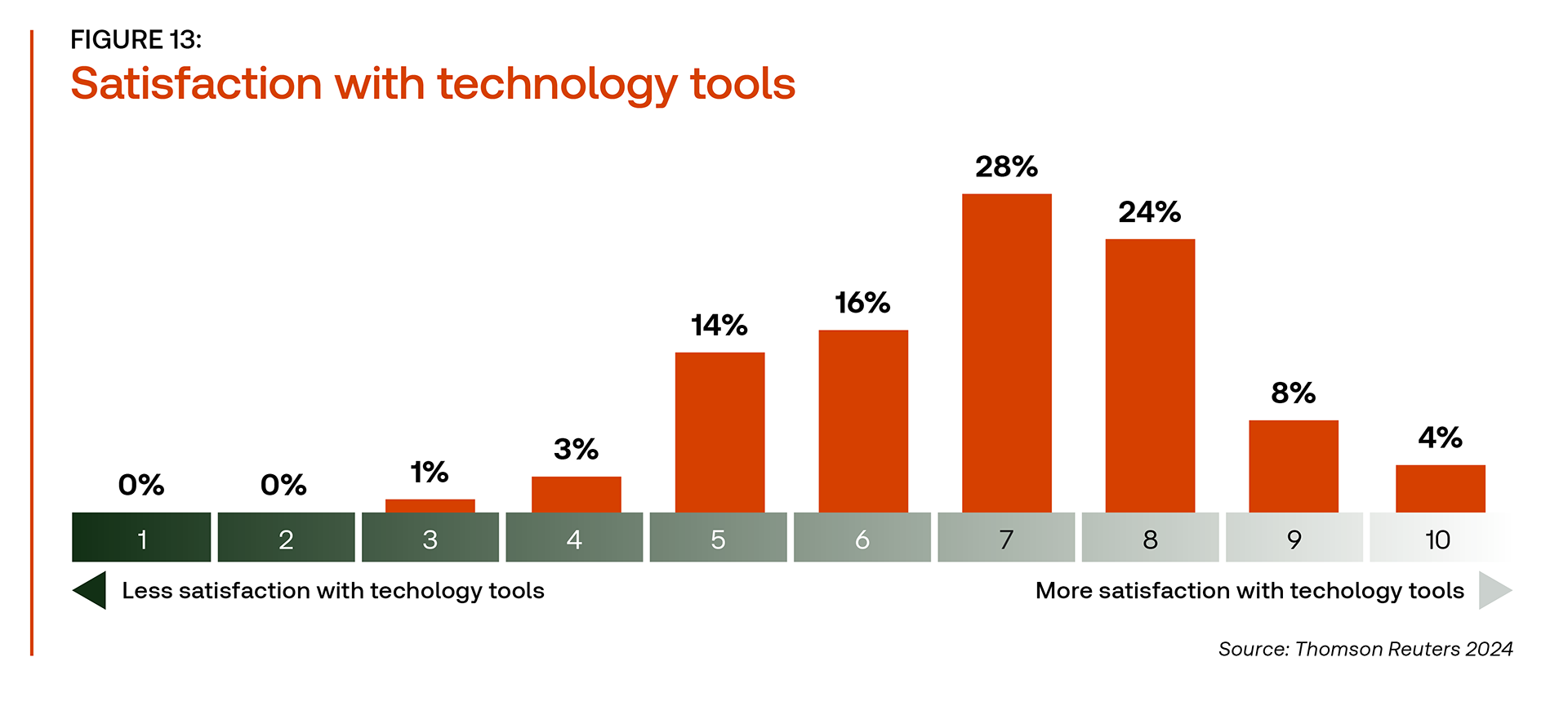

- Metrics for success: Only a minority of firms have established metrics to track the success of their technology, leading to dissatisfaction with current systems and making it difficult to measure the effectiveness of new technologies.

- GenAI integration: The integration of GenAI adds complexity by requiring an understanding and integration of data sets.

- Technology training and spending disparities: Many firms feel underutilized in their technological capacity. This can lead to a significant gap in the ability to leverage technology effectively.

By acknowledging and addressing these challenges, tax and accounting firms can better navigate the adoption of new technologies, such as UltraTax CS and Checkpoint Edge with CoCounsel, and unlock their full potential.

Preparing for the future: Trends and predictions

The future of tax technology appears promising, with anticipated growth in capabilities and budgets, especially within larger firms. This projection is supported by findings from the recent Tax Firm Technology Report.

Key takeaways include:

- Over 80% of firms predict enhanced technological capabilities and budget increases within the next three to five years.

- Client demands for efficiency and cost reduction are driving the adoption of GenAI as a central component of future workflows.

- A significant challenge to successful technology implementation is the ongoing lack of adequate technology training and well-defined success metrics. This highlights the importance of strategic planning during technology adoption.

Firms can address these challenges and leverage the evolving technological landscape by utilizing solutions like Checkpoint Edge and UltraTax CS.

- UltraTax CS delivers robust direct tax compliance features, effectively addressing common tax technology implementation challenges.

- Checkpoint Edge with CoCounsel seamlessly integrates with existing workflows to enhance efficiency and leverage GenAI capabilities for modern tax practices.

By utilizing both solutions, firms can remain at the forefront of the rapidly evolving tax technology landscape, ensuring comprehensive compliance and improved operational efficiency.

Embracing technology for competitive advantage

As the recent Tax Firm Technology Report illustrates, the integration of advanced technologies like UltraTax CS and Checkpoint Edge with CoCounsel is crucial for tax firms aiming to stay competitive in a rapidly evolving industry.

By harnessing the power of these advanced tools, firms can significantly enhance their strategic capabilities, overcome common adoption hurdles, and future-proof their operations against impending technological advancements. To remain at the forefront of the tax technology revolution, firms must continue to invest in and leverage these innovative solutions.

|

|

Recommended solutions from Thomson Reuters:

Checkpoint Edge with CoCounsel

Built on Checkpoint’s legacy of authoritative guidance and award-winning editorial expertise, Checkpoint Edge with CoCounsel is an industry-specific, professional-grade, generative AI tax research assistant built specifically for tax and accounting professionals. Its conversational interface delivers straightforward answers to even your most challenging questions — just as if you were speaking directly to a subject-matter expert or trusted advisor. Learn more about how integrating Checkpoint Edge with CoCounsel can give your firm a strategic advantage in an increasingly competitive landscape.

UltraTax CS

UltraTax CS professional tax software automates your entire tax workflow and delivers powerful, time-saving tools. UltraTax CS seamlessly integrates with other Thomson Reuters solutions, including CS Professional Suite, SurePrep 1040SCAN, and SPBinder, so you never lose any billable hours to manual processing. Meet all your tax workflow needs with a customized, end-to-end solution built on cloud computing, advanced data sharing, and paperless processing.