As an accounting professional, tax research is one of the most time-consuming parts of your day. Responding to clients’ questions and providing strategic advice requires you to sift through loads of search results and cite facts that validate and support your position — in a timely manner, no less.

Jump to:

| A better starting point for tax research |

| An opportunity to quickly upskill staff |

| AI-assisted research unlocks a competitive advantage |

| Are you ready to embrace the future of tax research? |

As an accounting professional, tax research is one of the most time-consuming parts of your day. Responding to clients’ questions and providing strategic advice requires you to sift through loads of search results and cite facts that validate and support your position — in a timely manner, no less.

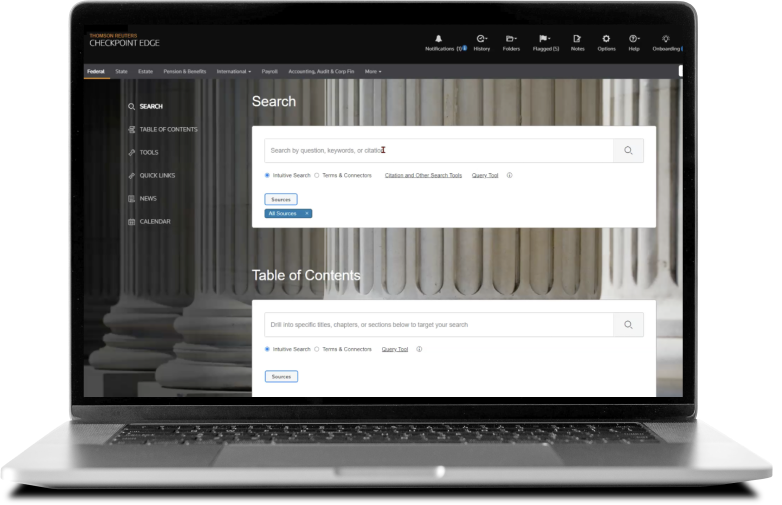

But with AI-assisted research from Checkpoint Edge with CoCounsel, tax research becomes your competitive advantage. Just ask a question in everyday language and receive a professionally summarized answer with references to trusted content so you can easily validate and forward to a colleague or client. A simple process, but with powerful benefits.

Let’s take a deeper look at how this transformative tool can redefine your workflow, empower staff, and unlock profitability.

Peter Mayolo of Mayolo & Associates gives his first impressions of the new AI-Assisted Research on Checkpoint Edge

A better starting point for tax research

For many accounting professionals, the go-to resource for tax research is Google or a publicly available generative AI platform like ChatGPT — both of which are quick, easy to use, and free.

However, answers from these platforms are based on data pulled from across the internet which may be inaccurate, out-of-date, or quite simply unverified. This can lead to accuracy, privacy, and security concerns, not to mention the possible financial impacts and reputational damage that can come with unvetted tax research.

Checkpoint Edge with CoCounsel is like hiring a speedy tax research assistant who only searches relevant editorial content and vetted source materials. With an intuitive interface, it delivers straightforward answers to even challenging questions – just as if you were speaking directly to a subject matter expert or trusted advisor.

Simply pose a question and you’ll quickly receive a relevant and understandable answer, complete with citations from expert-written and trusted sources on Checkpoint. Once verified, you can seamlessly copy and paste the summarized response into your client or staff communications, thus enhancing your clarity, professionalism, and responsiveness.

An opportunity to quickly upskill staff

Because tax research is a discipline most often learned on the job, junior staff are often not trained on how to properly conduct tax research and struggle with well-formed searches, especially when working in unfamiliar areas. They often default to using Google because that’s where they’re comfortable.

Google is user-friendly, but it often gives too many unreliable results. Sorting through these results can take a lot of time, especially when junior staff need to check their findings with senior colleagues. Moreover, because tax policies change frequently, a simple Google search is often not sufficient to get up-to-date and accurate information.

Checkpoint Edge with CoCounsel is built on Checkpoint’s legacy of authoritative guidance and award-winning editorial expertise, so it’s always up to date with the latest in tax policy and regulation. Alongside expert commentary and unique insight, junior staff will have no problem finding insightful and accurate answers on their own.

In addition to empowering entry-level staff members, AI-assisted research also fosters a culture of learning for all professionals, instilling confidence and freeing up time for senior colleagues to focus on higher-value, higher-margin tasks.

|

|

AI-assisted research unlocks a competitive advantage

By leveraging AI-assisted research, you can stay ahead of competitors who rely on traditional research methods. The ability to provide faster, more accurate, and comprehensive advice is a key differentiator in a crowded market.

Checkpoint Edge with CoCounsel delivers straightforward and direct responses that can help vet tax positions, tackle complex tax questions, and bolster your existing tax and accounting knowledge without having to pour over multiple references and layers of content. You’ll also unlock the ability to answer client questions in “real-time” rather than having to get back to them later. All, with the referenced citations at your fingertips.

And with the ability to make quicker decisions based on powerful summaries from thousands of documents, Checkpoint Edge with CoCounsel gives you a leg up in a competitive market where timely advice can significantly impact client satisfaction and retention.

With so much information at your fingertips, you may even consider expanding your practice and adding additional areas of expertise. That’s how AI-assisted research opens the door to new revenue streams, including the ability to offer more lucrative advisory services that address a broader range of client needs.

Are you ready to embrace the future of tax research?

There is no doubt that AI-assisted tax research tools like Checkpoint Edge with CoCounsel will transform the way accounting professionals operate, offering numerous benefits that translate into a significant competitive edge.

By embracing these tools now, you can enhance efficiency, accuracy, and client satisfaction, all while building deeper knowledge and expertise.

To experience the transformative impact of Checkpoint Edge with CoCounsel, schedule a demo or consultation today and see firsthand how this advanced tool can revolutionize your practice and keep you one step ahead.

|

Tax research toolTurn your tax research over to Checkpoint Edge with CoCounsel! |

BlogCheckpoint Edge with CoCounsel: What a GenAI tax assistant can do for you |