How does your firm keep up with the ever-changing tax laws?

Jump to ↓

| The challenges of tax research |

| How Checkpoint Edge with CoCounsel can simplify and automate tax research |

| Benefits of using Checkpoint Edge with CoCounsel alongside UltraTax CS |

| Optimize your tax processes with Checkpoint Edge with CoCounsel and UltraTax CS |

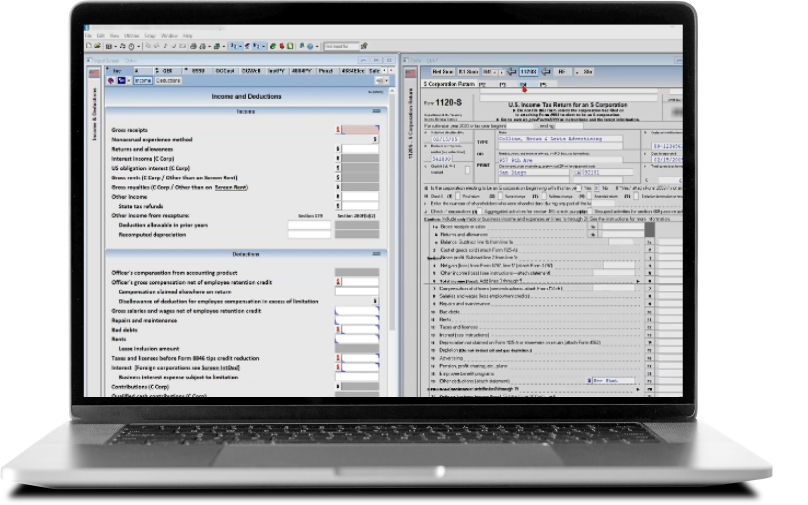

With Checkpoint Edge with CoCounsel, you can navigate the latest trends and emerging issues with ease. Whether you’re onboarding new staff or have more experienced professionals working in a less familiar area, this powerful tool integrates with Ultra Tax CS to provide comprehensive answers to even the most complex of tax questions.

Combined with UltraTax CS, Checkpoint Edge with CoCounsel helps users take full advantage of its features, such as RIA Form/Line Finder, PPC Deskbooks, and Quickfinder on Proview. These features allow users to access the most current tax information, save time in their tax research, and increase accuracy in tax preparation. As a result, CPAs are able to spend less time on administrative tasks and more time on providing quality advice to their clients.

The challenges of tax research

One of the biggest challenges of tax research is the time-consuming manual processes required. To ensure accuracy in filing, firms must manually sift through pages and pages of information to find what they need — a process that takes an immense amount of time and effort. Furthermore, it leaves room for human error, with the risk that mistakes could be made in filing or advice given incorrectly.

Staying up to date with ever-changing tax laws is also a challenge for firms performing their own research. With new regulations being introduced all the time, it can be difficult to keep track of all the changes, meaning firms may miss out on key rules or regulations that could have implications when filing.

In addition to this, professional tax research services can be expensive and provide limited access to resources. This makes it difficult for firms without access to specialist tools and technology to gain accurate information quickly and efficiently. Finally, inadequate access to tax information and resources further complicates the process, as firms don’t have enough current or reliable data at their fingertips for accurate decision-making.

Listen to what Chris Peden, CPA Owner/Managing Partner Peden & Associates, had to say about his journey with UltraTax CS and the impact it’s had on his firm.

How Checkpoint Edge with CoCounsel can simplify and automate tax research

Tax research can be daunting, but luckily, Checkpoint Edge with CoCounsel has been designed to simplify and automate the process. This professional research tool provides users a quick and easy way to search for tax laws, regulations, and rulings by leveraging a powerful natural language search engine. By inputting keywords or phrases into the platform, users can easily find the relevant documents they need in seconds.

The integration with UltraTax CS helps provide accuracy of data during filing by providing real-time updates on changing tax laws and tax rates from various sources. In short, Checkpoint Edge with CoCounsel allows users to reduce the time spent on tax research and ensure accuracy in filing while providing helpful insights into their firms’ performance over time. With its easy-to-use features, automated processes, and up-to-date information on changing laws, firms can save resources while meeting their compliance obligations confidently and accurately every time they file taxes.

Benefits of using Checkpoint Edge with CoCounsel alongside UltraTax CS

By integrating Checkpoint Edge with CoCounsel and UltraTax CS, users are able to quickly access detailed information on tax laws and regulations and easily incorporate this information into their tax forms.

Have you ever encountered a situation where you are preparing a return where the taxpayer qualifies to claim the child tax credit, but you suddenly recall that you have some due diligence you must complete in order for the taxpayer to claim the credit? Enter Checkpoint Edge’s PPC Deskbook feature. Get the answers you need, when you need them. The PPC Deskbook instantly retrieves all relevant key issues, illustrations, and practice aides, allowing you to easily complete the return.

Checkpoint Edge with CoCounsel provides users with detailed explanations and illustrations of applicable tax laws and regulations, and the ability to access tax research materials from multiple sources, making the entire research process much simpler and more efficient. Firms can bridge the experience gap of their employees by tapping into solutions that are easy to use, no matter the experience level, without a dip in quality.

Optimize your tax processes with Checkpoint Edge with CoCounsel and UltraTax CS

The integration of Checkpoint Edge with CoCounsel and UltraTax CS offers a comprehensive solution for navigating the complexities of tax laws.

By providing real-time updates, automating workflows, and simplifying tax research, this powerful tool enables firms to enhance accuracy, save time, and confidently meet compliance obligations. Contact sales to learn more about the integration.

|

|

|

|