Tax considerations for monetary donations.

As the season for giving approaches, many individuals and businesses consider making monetary donations to charitable organizations. In addition to helping our communities, these donations can also lead to significant tax benefits.

For accountants, understanding the ins and outs of tax deductions for charitable contributions, including how to properly report monetary donations using Schedule A, is an essential part of tax planning for clients. In this article, we will explore the rules, limits, and strategies for maximizing the tax benefits of your client’s charitable donations.

Jump to ↓

| Which donations are tax deductible? |

| Charitable contributions from IRAs |

| How much of a donation is tax deductible? |

| Rules for cash donation tax deductions |

| Filling out Schedule A for Form 1040 |

| Helping clients with tax deductible donations on their tax return |

Which donations are tax deductible?

Charitable donations that are tax-deductible include:

- Cash donations. Donations made in the form of cash, checks, or electronic funds transfers are usually tax-deductible. However, it’s important to keep proper documentation, such as bank records or written communication from the charity, to support your claim.

- Property donations. Donations of property, such as clothing, household items, or vehicles, to eligible charitable organizations can also be tax-deductible. The value of the deduction is typically based on the fair market value of the donated property.

- Stock or securities donations. Donating appreciated stocks or securities to a qualifying charitable organization can offer tax benefits. The donor can generally claim a deduction for the fair market value of the donated securities, and they may also avoid paying capital gains tax on the appreciation.

- Donations to qualified organizations. Donations to organizations that are recognized as qualified by the IRS, such as 501(c)(3) organizations, are usually tax-deductible. It’s essential to confirm the organization’s tax-exempt status before claiming the deduction.

It’s crucial to note that donations made to individuals, political organizations, and certain private foundations do not qualify for tax deductions. Tax-deductible charitable donations can be made to qualified nonprofit organizations, such as religious institutions, educational institutions, humanitarian groups, and more.

The IRS maintains a list of eligible organizations, so it’s crucial to ensure your chosen recipient is eligible to receive tax-deductible donations. Use Schedule A Form 1040 to figure your itemized deductions. In most cases, your federal income tax will be less if you take the larger of your itemized deductions or your standard deduction.

What is the tax deduction limit for charitable donations?

Taxpayers can generally deduct up to 60% of their Adjusted Gross Income (AGI) for cash contributions and up to 30% of their AGI for donations of appreciated property. However, certain types of contributions, such as those made to private foundations, have lower limits.

It’s important to stay updated on the latest charitable contribution deduction requirements as they can be subject to adjustments based on regulatory changes.

Charitable contributions from IRAs

For those aged 70½ or older, donating directly from your Individual Retirement Account (IRA) to a qualified charity can be an advantageous tax strategy.

These transfers, known as Qualified Charitable Distributions (QCDs), allow you to contribute funds directly from your IRA to a charity – up to $100,000 each year – without including the distribution as taxable income. QCDs can reduce your AGI, which may positively affect other aspects of your tax return.

How much of a donation is tax deductible?

The amount of a donation that is tax deductible depends on several factors, including the type of donation, the organization receiving the donation, and the donor’s Adjusted Gross Income (AGI). Here are some key points to consider regarding the tax deductibility of donations:

- Cash donations. For cash donations made to qualified charitable organizations, the general rule is that you can deduct up to 60% of your AGI. This means that if your AGI is $50,000, you can generally deduct up to $30,000 in cash donations to eligible charities.

- Non-cash donations. For donations of non-cash items such as clothing, household goods, or other property, the deductible amount is typically the fair market value of the donated items. However, special rules apply to non-cash donations, and it’s essential to follow the IRS guidelines to determine the deductible amount accurately.

- Itemizing vs. standard deduction. It’s crucial to understand whether it’s more beneficial for you to itemize deductions or take the standard deduction. If your total itemized deductions, including charitable donations, exceed the standard deduction amount, itemizing can lead to greater tax savings.

- Limits and specific rules. Different types of donations might have specific limits or rules governing their tax deductibility. For example, the IRS has particular rules for donations of appreciated property, and there are additional restrictions on certain types of charitable organizations, such as private foundations.

- Documentation requirements. To claim a tax deduction for any donation, you need proper documentation. This includes receipts, written acknowledgments from the charity, and other relevant records to substantiate the value and validity of your donation. For cash donations of $250 or more, you must obtain a written acknowledgment from the charity to claim the deduction.

It’s important to stay informed about the latest IRS guidelines and regulations, as they may change over time.

Rules for cash donation tax deductions

When it comes to claiming tax deductions for cash donations, there are specific rules and requirements set by the IRS. Adhering to these rules is crucial to ensure that your charitable contributions are eligible for tax benefits.

Here are the key rules for cash donation tax deductions:

- Cash donations limit. Generally, the IRS allows you to deduct cash contributions up to 60% of your adjusted gross income (AGI). Contributions that exceed this limit can typically be carried forward for up to five years, allowing you to take advantage of the deduction in future tax years.

- Donation to eligible organizations. To claim a tax deduction, your cash donation must be made to a qualified charitable organization recognized by the IRS. Be sure to verify the organization’s tax-exempt status before making any contributions.

- Recordkeeping. Maintain proper records of your cash donations. This includes bank records, such as canceled checks, bank statements, or credit card statements, that clearly show the donation amount, the date of the contribution, and the name of the charitable organization.

- Receipts or written acknowledgments. For cash contributions of $250 or more, you must obtain a written acknowledgment from the charity that includes the amount of the donation and a statement that no goods or services were provided in exchange for the donation. This acknowledgment is crucial when claiming the deduction on your tax return. Even for donations under $250, it’s advisable to keep a record of the donation.

- Proper timing. Donations must be made within the tax year for which you are claiming the deduction. Ensure that the donation is postmarked by December 31 or made electronically by the end of the year to qualify for a tax deduction in that year’s tax return.

By adhering to these rules, you can ensure that your cash donations to eligible charitable organizations are properly documented and meet the requirements for tax deductible contributions.

Can you carryover charitable contributions?

Yes, in certain situations, you can carry over charitable contributions that exceed the annual deduction limit. If your charitable contributions for a tax year surpass the applicable percentage limit of your Adjusted Gross Income (AGI), you can carry forward the excess contributions to future tax years.

The general rule is that excess charitable contributions can be carried over for up to five years. This means you can deduct the excess contributions in the following tax years, subject to the percentage limits for those years.

For instance, if you make charitable contributions in a given year that amount to 70% of your AGI, exceeding the 60% limit, you can carry over the 10% excess to the next tax year. In that subsequent year, you would be subject to the applicable deduction limit based on your AGI for that year.

However, it’s crucial to keep accurate records of these excess contributions and any carryover amounts. Documentation, such as receipts, acknowledgments from the charities, and records of the carried-over amounts, should be maintained for each tax year. These records will be necessary to substantiate your deductions and carryover amounts when you claim the deductions in subsequent years.

Taking the standard deduction vs. itemizing

Taxpayers can choose between taking the standard deduction or itemizing their deductions. If your total itemized deductions, which include charitable contributions, mortgage interest, and medical expenses, exceed the standard deduction amount, itemizing can be more financially beneficial.

Carefully evaluate your financial situation to determine which option is more advantageous.

Filling out Schedule A for Form 1040

Filling out Schedule A for Form 1040 involves the itemization of various deductions, including those related to charitable contributions, medical expenses, state and local taxes, mortgage interest, and other qualifying expenses. To complete Schedule A, follow these general steps:

- Gather necessary documentation. Collect all relevant receipts, statements, and documentation for the various deductions you plan to itemize. This includes receipts for charitable donations, medical expenses, property taxes, and mortgage interest, among others.

- Fill out the information section. Provide the required personal information, such as your name, Social Security number, and filing status, at the top of Schedule A.

- Itemize deductions. Go through each category of deductions, including medical and dental expenses, state and local taxes, mortgage interest, and charitable contributions. Enter the relevant amounts in the appropriate sections of Schedule A.

- Calculate the total. Add up the total amounts for each category to determine your total itemized deductions.

- Compare with standard deduction. Compare your total itemized deductions with the standard deduction for your filing status. If your total itemized deductions are higher than the standard deduction, itemizing may be more beneficial for your tax situation.

- Transfer total to Form 1040. After calculating your total itemized deductions, transfer the final amount to the appropriate line on Form 1040.

- Keep records. Maintain accurate records of all documentation used to support your itemized deductions. Retain these records for at least three years in case of an IRS audit.

Helping clients with tax deductible donations on their tax return

In the spirit of charitable giving, understanding the tax implications of your client’s charitable donations can make a significant impact on their financial well-being.

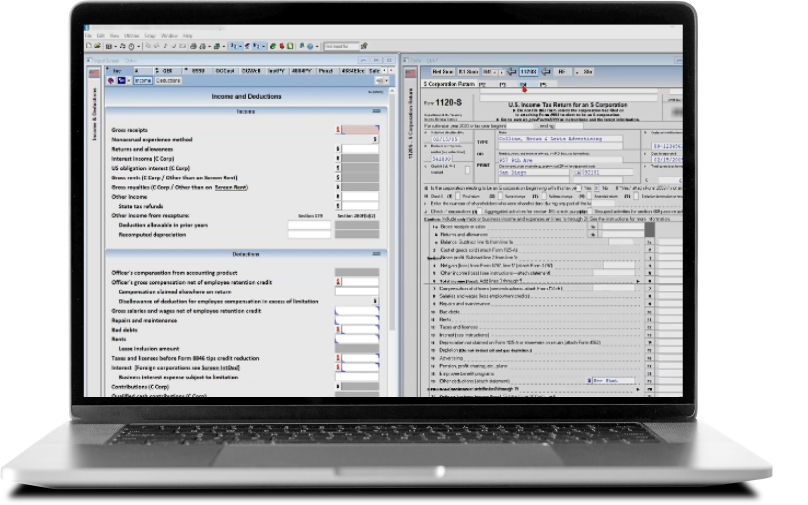

Accountants can leverage integrated tax software to streamline the process of identifying and accurately recording tax deductible charitable contributions using Schedule A. Tax software can assist in accurately calculating deductions, minimizing errors, and ensuring compliance with the latest IRS guidelines, while saving both time and money.

From staying up to date on new IRS regulations to advising your clients on the best ways to support the causes that are important to them, tax software is essential in providing sound financial advice and ensuring strategic philanthropy for individuals and businesses alike.

By leveraging the capabilities of Thomson Reuters UltraTax CS, you can be confident in your ability to guide clients on the best charitable giving tax strategies, while optimizing your firm’s tax planning and preparation workflow.

UltraTax CS

Professional tax preparation software to reduce your workflow time and increase your productivity

Learn more ↗