FAQs on how to treat depreciation for business software.

In today’s tech-driven environment, companies need software to efficiently run their business, whether it is software they purchase from an outside source or develop internally. However, when it comes to software tax depreciation, the complexities can quickly add up.

According to a nationwide survey released by the Chamber of Commerce, 93% of today’s small business owners said they use at least one type of technology platform to help run their business, with the average owner utilizing three different platforms. Of those, 85% said technology platforms helped to get their business up and running, and 94% said technology helps them drive efficiencies.

Looking ahead, the survey found that most small businesses plan to continue making investments in their use of technology. The majority (83% of respondents said they will boost their use of technology platforms in the next two to three years, and more than half (63%) said they plan to use the most advanced tech, from artificial intelligence to virtual reality.

Given the complexities that can come with software tax depreciation, it is important to understand the tax implications and deduction opportunities when it comes to your business clients and the use of software in running their business.

Jump to ↓

What is software depreciation?

How is software depreciated for tax purposes?

Internal use versus external use software

Solutions for managing software depreciation for taxes

What is software depreciation?

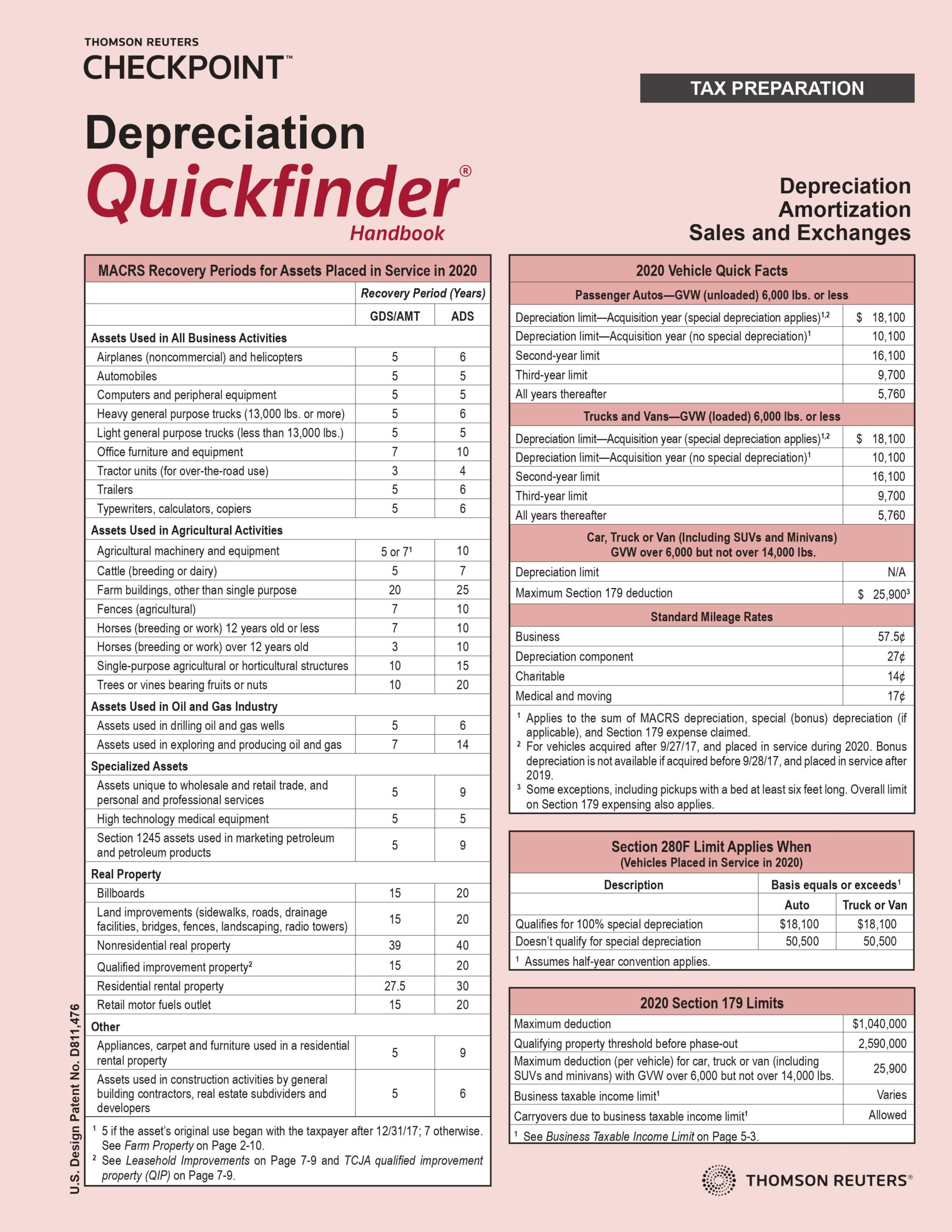

Depreciation in general is an annual income tax deduction that enables taxpayers to recover the cost of business assets over a number of years. However, when it comes to certain property like software, there are specific factors that must be considered.

According to the IRS, if the software meets certain requirements, it may also qualify for the section 179 deduction and special depreciation allowance. Take this example:

Your business client purchased software in December 2022 to process payroll, accounts payable, and accounts receivable, but they didn’t put that software into service until January 2023. The software is eligible for bonus depreciation, so the client would then be required to wait until they filed their 2023 tax return to claim bonus depreciation on the software. Since the bonus depreciation phase out begins January 2023, the business would then be eligible for 80% bonus depreciation (not 100%).

How is software depreciated for tax purposes?

When it comes to depreciating software for tax purposes, there is no one size fits all. Most types of tangible property, such as vehicles, machinery, furniture, and equipment, can be depreciated. And certain intangible property, like computer software, patents, and copyrights, can also be depreciated.

Companies tend to consider software, which has become such a critical part of their business, as a fixed asset.

Property must meet all the following requirements to be depreciable:

- The taxpayer must own the property.

- It must be used in their business or income-producing activity.

- It must have a determinable useful life.

- It must be expected to last more than one year.

As noted earlier, if the software meets certain requirements, it may also qualify for the section 179 deduction and special depreciation allowance. If the taxpayer can depreciate the cost of computer software, the IRS instructed the use of the straight-line method over a useful life of 36 months.

It is important to be aware that there are instances when software is not eligible for depreciation. For example, if the software is purchased solely for research and development (R&D) it cannot be depreciated.

Another instance is if the software was “acquired in connection with the acquisition of assets constituting a business or a substantial part of a business.” In that case, it is generally a section 197 intangible and cannot be depreciated (but there are caveats to this as well).

Can software be amortized?

The short answer is “yes.” It depends on how the asset is categorized, but some companies choose to amortize their internal-use software over a “useful life” period of five to seven years.

Depreciation and amortization are essentially the same concepts in accounting. Amortization differs in that it refers to spreading the cost of an intangible asset over its useful life.

Capitalized internal-use software development costs should be amortized. This is typically done on a straight-line basis. And for each module of a software project, amortization should begin when the software is ready for use, “regardless of whether the software will be placed in service in planned stages that may extend beyond a reporting period,” as explained by Grant Thornton LLP.

Internal use versus external use software

There are several ways that companies can leverage software, and it is important to determine if the software is for internal use or external use.

External-use software is basically software to be marketed, sold, or leased. Capitalized software should generally be classified as an amortizable intangible asset, regardless of whether it is acquired or developed internally.

Common elements of internal-use software include:

- Software that will be used by the company’s employees to provide services to customers.

- Software that will be used by the company internally, such as in the accounting, finance, or payroll departments, for storage of information, or internal communications.

- Software that will be used as part of a company’s manufacturing process, such as running machinery to produce goods or to control other operations within a manufacturing plant or distribution center.

Solutions for managing software depreciation for taxes

Without the right tools and resources in place, software depreciation can be confusing and time-consuming to navigate, given the gray areas that exist.

Leveraging comprehensive depreciation software, such as Thomson Reuters Fixed Assets CS®, enables practitioners to work smarter and faster with unlimited depreciation treatments, automatic federal and state depreciation calculations, customized reporting, and more.

Turn to Thomson Reuters to get expert guidance on tax depreciation and other cost recovery issues to help your firm work more efficiently.

Depreciation accounting software

Fixed Assets CS calculates an unlimited number of treatments — with access to any depreciation rules a professional might need for accurate depreciation.

Learn more ↗