Tax provisions, corporate alternative minimum tax, and more.

Jump to:

| How does depreciation affect corporation taxes? |

| Accelerated depreciation for corporations |

| How does depreciation work in an S corporation? |

| What is the purpose of making a provision for depreciation? |

| What is the depreciation guidance for corporate alternative minimum tax? |

| Managing corporate tax depreciation |

Each tax season, business clients turn to their accountant for assistance in navigating corporation tax depreciation and leveraging every tax deduction they can take to minimize their tax liability. With tax obligations on the rise, your role as a trusted advisor is bound to grow in importance.

Consider this: the 2022 BDO Tax Outlook Survey found that 65% of tax executives surveyed said their total tax liability had increased in the past 12 months. More than a quarter (26%) saw significant increases, while just 18% saw their total tax liability decrease. Furthermore, 73% said they expected their total tax liability to increase over the next 12 months.

Having a clear understanding of corporation tax depreciation can help accounting professionals better serve their clients. In this article, we’ll explore how depreciation affects corporate taxes, how depreciation works in an S corporation, the guidance for corporate alternative minimum tax, and more

How does depreciation affect corporation taxes?

In short, depreciation can result in a reduction in corporate taxes.

Tax depreciation is the depreciation expense that can be reported by a business for a given reporting period. It is the recovery of an asset cost over a number years or, in other words, the asset’s useful life. When businesses deduct the declining value of assets used in their income-generating activities, it reduces the amount of taxable income they must report to tax authorities.

Consider the following simplified example:

You have a business client who owns a bike shop that earned $100,000 in net income this year. They can take $20,000 in total depreciation deductions on the building they own. Due to the deduction, the IRS would tax the client on $80,000 of income versus $100,000. At a corporate tax rate of 21%, the client would save $4,200 on taxes.

Accelerated depreciation for corporations

There is also accelerated depreciation, which was expanded under the Tax Cuts and Jobs Act (TCJA) in 2017. This temporary expansion is better known as bonus depreciation.

Bonus depreciation is an important tax savings tools for businesses as it allows them to take an immediate deduction in the first year on the cost of eligible business property. This lowers a company’s tax liability because it reduces their taxable income.

When enacted, bonus depreciation enabled businesses to immediately write off 100% of the cost of eligible property acquired and placed in service after Sept. 27, 2017, and before Jan. 1, 2023. Prior to TCJA, it was 50%.

The bonus percentage is now decreasing 20 points each year and will fully expire on Jan. 1, 2027.

According to a recent report by the Institute on Taxation and Economic Policy, the TCJA expanded tax breaks for “accelerated depreciation” have reduced taxes by nearly $67 billion for “the 25 profitable corporations that benefited the most, based on information disclosed by the companies themselves.” This was during the five years (2018 through 2022) that 100% bonus depreciation was in effect under TCJA.

|

|

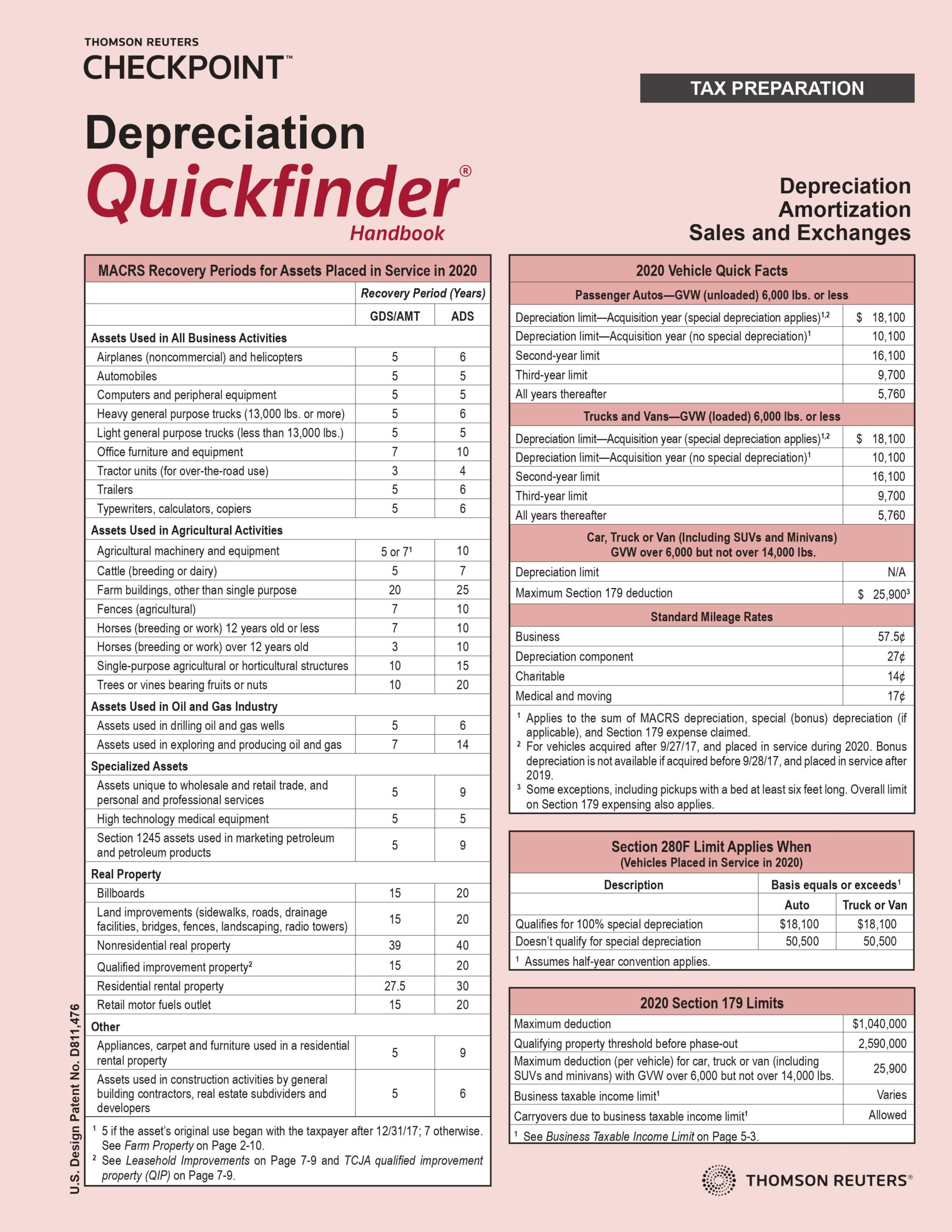

BookThe trusted tax depreciation guide book from Thomson Reuters Checkpoint® |

How does depreciation work in an S corporation?

S corporations are handled differently given that they do not pay income tax. The owner pays tax individually on their own income tax return as though it were a sole proprietorship or partnership. They are allowed to deduct and depreciate their share of assets such as company equipment and corporate vehicles.

If the client is not eligible for bonus depreciation or Section 179, they can deduct a percentage of the value each year until they have written off the entire cost of an asset.

What is the purpose of making a provision for depreciation?

The purpose of making a provision for depreciation is to enable a business client to account for the gradual decline in value of their fixed assets over time. A depreciation provision, which represents the depreciation during the current accounting period, results in more accurate financial statements.

Other types of provisions a business typically accounts for include, but are not limited to, income tax, product warranties, pensions, bad debts, and sales allowances.

What is the depreciation guidance for corporate alternative minimum tax?

The depreciation guidance for corporate alternative minimum tax (CAMT) is currently “limited.” In late December 2022, the IRS and Treasury Department issued Notice 2023-07, which provides interim guidance regarding the application of the new CAMT, until the issuance of proposed regulations. In particular, Notice 2023-07 clarifies which corporations the CAMT applies to and how the alternative minimum tax is calculated.

However, as noted by Tim Shaw, Tax News Editor for Thomson Reuters, “Preliminary guidance on the corporate alternative minimum tax (CAMT) released by the IRS late December does not go far enough to properly address the treatment of depreciation for adjusted financial statement income calculation purposes.”

Tax depreciation deductions are considered when calculating adjusted financial statement income (AFSI) for CAMT liability.

Shaw goes on to state, “Ellen McElroy, an Eversheds Sutherland partner, explained that the IRS’ position currently is that this is limited to depreciation deductions under Code Sec. 167, to which Code Sec. 168 applies. McElroy told Checkpoint in an interview that while limited to Section 168 property, the guidance in part reiterates what is in the statute, but then clarifies that depreciation that’s attributable to inventory can be used to offset AFSI.”

Managing corporate tax depreciation

Without the right tools and resources in place, navigating corporate tax depreciation can be time-consuming and complex.

Leveraging comprehensive depreciation software like Thomson Reuters Fixed Assets CS® enables practitioners to work smarter and faster with unlimited depreciation treatments, automatic federal and state depreciation calculations, customized reporting, and more.

Turn to Thomson Reuters to get expert guidance on tax depreciation and other cost recovery issues to help your firm work more efficiently.

Free trialSign up now for a free, cloud-based trial of Fixed Assets CS and begin transforming your practice today. |

|

Blog postExplore the tax implications and deductions of software depreciation |

|