A guide to calculating depreciation for accountants for different types of property.

Tax depreciation, which enables business clients to reduce the amount of their reported taxable income, may seem straightforward at first glance. But depreciation can quickly become complex and cumbersome as tax professionals navigate which assets can be depreciated for tax purposes, how to calculate tax depreciation, and any state-level nuances that may arise.

Unfortunately, the complexities and the time it can take to manually input business clients’ asset information, especially when onboarding new clients, means added work and stress in an already busy tax season. Without the proper tools in place, it is a major drain on staff resources and can lead to a greater risk of errors.

We will explore how to weed out the time-consuming labor that can come with tax depreciation and how tax professionals can better assist clients in making more tax-efficient business decisions. Let’s first take a step back and begin with the basics.

Jump to ↓

| What is tax depreciation? |

| What is bonus depreciation? |

| How to calculate tax depreciation |

| What are the tax depreciation methods? |

| What is MACRS? |

| Tax depreciation and state-level complexities |

| Managing depreciation of fixed assets |

What is tax depreciation?

In short, tax depreciation is the depreciation expense that can be reported by a business for a given reporting period. It is the recovery of an asset cost over a number of years or, in other words, the asset’s useful life. When businesses deduct the declining value of assets used in their income-generating activities, it reduces the amount of taxable income they must report to tax authorities.

As mentioned, depreciation is the recovery of an asset cost over a number of years. In general, businesses are not able to deduct in one year the full cost of property they produced, purchased, or improved upon and placed into use either in their trade, or business, or income-producing activity if the property is a capital expenditure. Instead, businesses must deduct a part of the cost each year until they fully recover the cost.

Consider the following example: A business owner purchases new computer equipment for $10,000. Each year, the computer equipment will lose some of its value. Let’s say it loses 10% of its value each year. The business owner can then deduct a portion of the equipment’s declining value from their taxes. In this scenario, the owner could deduct $1,000 each year on tax return for depreciation. This results in tax savings for that business owner.

The complexities start to emerge given that there are rules as to which assets, and how much money, can be depreciated each year on a client’s taxes.

Equipment, buildings, machinery, office furniture, and vehicles are the types of property that can be depreciated. Personal property does not apply. However, if property, like a car, is used for both business or investment and personal purposes, then the business or investment use portion of that property can be depreciated.

To depreciate an asset, it must meet all of the following requirements, according to the IRS:

- It must be an asset that the business owns.

- It must be used in a business or income-producing activity.

- The asset must have a determinable useful life.

- The asset must be expected to last more than one year.

- It cannot be excepted property. Excepted property (as described in Publication 946, How to Depreciate Property) includes certain intangible property, certain term interests, equipment used to build capital improvements, and property placed in service and disposed of in the same year.

While certain land improvements and buildings may be depreciated (such as rental property), land is not depreciable.

What is bonus depreciation?

Bonus depreciation is a temporary business tax deduction, to be fully phased out in 2027. It accelerates depreciation by allowing businesses to write off a large percentage of the eligible asset’s cost in the first year it was purchased. The remaining cost is deducted over multiple years using regular depreciation.

With the passage of the Tax Cuts and Jobs Act (TCJA) in 2017, bonus depreciation underwent significant change.

Prior to the passage of TCJA, bonus depreciation was 50%. TCJA, however, enacted 100% bonus depreciation. This enabled businesses to immediately write off 100% of the cost of eligible property acquired and placed in service after Sept. 27, 2017, and before Jan. 1, 2023.

On Dec, 31, 2022, 100% bonus depreciation expired. The bonus percentage now decreases by 20 points each year for property placed in service after Dec. 31, 2022, and before Jan. 1, 2027, unless the law changes. After Jan. 1, 2027, bonus depreciation is eliminated.

For instance, bonus depreciation is 80% in 2023. It then decreases by 20 points to 60% for 2024.

Even though bonus depreciation is no longer at 100%, it remains an important tax savings tool for business clients as it allows them to take an immediate deduction in the first year on the cost of eligible business property.

What is Section 179?

Section 179 is also an immediate expense deduction, similar to bonus depreciation. In the coming years, as bonus depreciation phases out, some taxpayers may be able to maintain some initial-year expensing through section 179 rules.

There are some differences between bonus depreciation and section 179. Among the more notable differences is that section 179 allows taxpayers to deduct a set dollar amount versus a percentage as with bonus depreciation.

How to calculate tax depreciation

In general, the IRS requires that certain guidelines be followed when calculating tax depreciation.

“[The IRS] dictates exactly what depreciation method is required to be used depending on the assets’ categorization. So, if I bought office equipment, or if I bought a building, from a tax perspective that is dictated very rigidly by the IRS,” said Corey Greene, Senior Product Marketing Manager at Thomson Reuters.

For tax purposes, depreciation is calculated each year. When calculating depreciation, an asset’s useful life, the salvage value, and tax depreciation method are factors that are considered.

What are the tax depreciation methods?

When it comes to the depreciation methods, there are several common methods. These methods include: straight-line, double-declining balance, units of production, and sum-of-the-years’ digits.

Straight-line depreciation

Given its simplicity, this method is commonly used when a more complex depreciation method is not required. Using this method, the expense amount is the same each year over the useful life of the asset.

The formula for straight-line depreciation is as follows:

(Cost of the asset – estimated salvage value of asset) / useful life of asset = straight-line depreciation

Double-declining balance (DDB)

This method differs from straight-line depreciation in that the asset is expensed higher in the first few years of its useful life, while the depreciation expense is lower in later years.

There are several required steps (i.e., calculate the depreciation rate, calculate the depreciation expense, and calculate the ending period value, etc.) when determining the double-declining balance.

This method should be used in the following circumstances:

- The desire is to recognize more expense now and shift profit recognition further into the future.

- During the early part of an asset’s useful life its usefulness is being consumed at a higher rate.

Units of production method

This method determines the value of a company’s income-producing assets before the assets deteriorate. If an asset operates extensively over a period of time (i.e., equipment, vehicles, and machines), this method may be the best fit.

The formula for the units of production method is as follows:

[(Original value – salvage value) / estimated production capability] x units per accounting period = units of production depreciation

Sum-of-the-years’ digits (SYD) method

If an asset has greater production capacity in its early years or it depreciates faster, it may make more sense to use the SYD method.

This is an accelerated method for calculating an asset’s depreciation (i.e., higher depreciation expense in the early years and lower depreciation expense in later years).

When using this method, there are several steps that must be followed:

- Calculate the depreciable amount

- Calculate the sum of useful life

- Calculate depreciation factors

- Calculate depreciation for each year

What is MACRS?

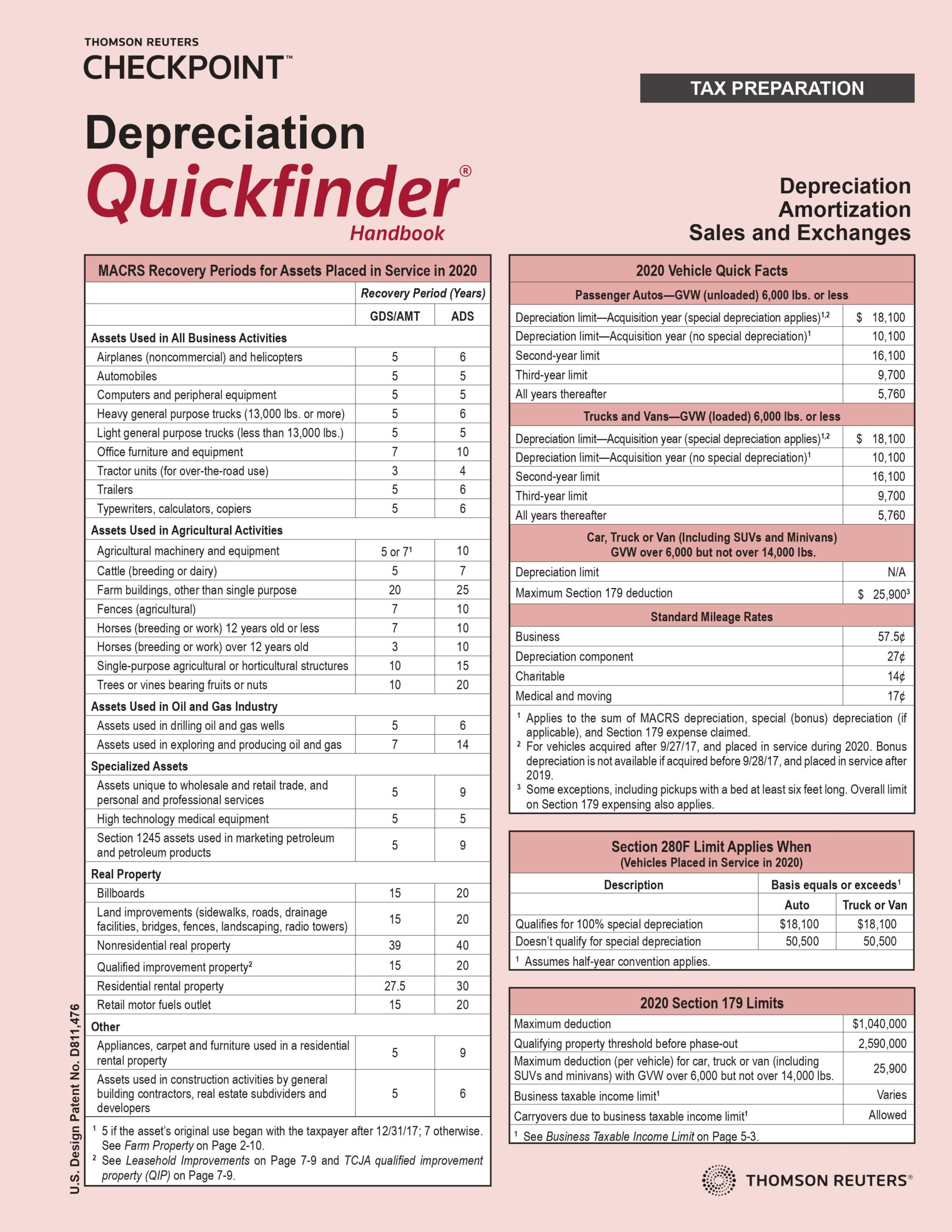

The Modified Accelerated Cost Recovery System (MACRS), which is the required tax depreciation system in the United States, is used for property placed in service after 1986.

MACRS helps business clients recover tax depreciation costs on assets through deductions taken over a period of time. MACRS consists of two depreciation systems: the General Depreciation System (GDS), which is the more commonly used system, and the Alternative Depreciation System (ADS). As noted by the IRS, these systems provide different methods and recovery periods to use in figuring depreciation deductions.

MACRS cannot be used to depreciate the following property:

- Property placed in service before 1987.

- Certain property owned or used in 1986.

- Intangible property.

- Films, videotapes, and recordings.

- Certain corporate or partnership property acquired in a nontaxable transfer.

- Property elected to exclude from MACRS.

When depreciating property placed in service before 1987, use the Accelerated Cost Recovery System (ACRS) or the same method used in the past.

Tax depreciation and state-level complexities

As mentioned earlier, tax depreciation can quickly become complex and cumbersome. This is due, in large part, to many states not following the federal guidelines.

Some states conform to the current Internal Revenue Code (IRC), other states have decoupled from the IRC provisions, and others have enacted legislation that allows partial conformity or conformity in some but not all tax years covered by the federal rule. This has resulted in inconsistencies and greater challenges when calculating depreciation.

“Regulations and requirements can change from state to state, and many states do not follow what has been laid out at the federal level. So, as these states have decoupled from the federal guidelines there is a need then for the tax professional to calculate those federal and state depreciation differences where they are applicable,” said Greene.

Given the complexities, it is important to leverage a solution that provides comprehensive and inclusive state calculations. This saves preparers significant time and also reduces the risk of errors.

Managing depreciation of fixed assets

Managing fixed assets effectively means having the right depreciation software in place. In today’s environment, arming tax professionals with the right tools to simplify both state and federal-level nuances, drive automation, and streamline processes is critical.

When considering a solution, look for one that delivers such features and benefits as:

- A timesaving data-entry feature that automatically fills in the methods and lives for an asset.

- Support for a broad range of depreciation methods.

- Comprehensive and inclusive state calculations, such as all 50 state treatments for each asset, Section 179 limits for all states, and bonus depreciation deduction for all states, to name a few.

- Virtually limitless reporting capabilities so tax professionals can create custom reports tailored to the needs of each client.

- The ability to add, change, and dispose of assets using an easy-to-navigate file folder format and customizable tracking and sorting options.

Thomson Reuters Fixed Assets CS delivers these capabilities and more.

“Really minimizing work at the state level, and greatly simplifying the federal and state depreciation nuances is certainly a value that Fixed Assets CS brings to the market,” said Greene.

“Another pain point that I commonly hear is with regards to the time it takes to enter the data for assets. Many times, a firm might be working with a new client. As they onboard a new client, that client might have hundreds of assets they need entered, if not more. And some clients, depending on the business that they’re in, might purchase dozens, if not more, assets a year just based on the line of business that they’re in. So, the ability for Fixed Assets CS to ingest spreadsheet imports for those clients, and streamline that data entry process, and bypass the need to enter those [assets] one at a time, is a significant time saver for tax professionals.”

Furthermore, tax professionals using Fixed Assets CS have the ability to extend the use of the software to their clients, so clients can enter in their own data. This ability to co-manage data can also save firms significant time.

Learn more about fixed assets software

In today’s environment, tax depreciation can quickly become complex and time-consuming for tax professionals, but it doesn’t have to be.

Turn to a solutions provider that can deliver expert guidance on tax depreciation and other cost recovery issues, so your firm can better serve business clients.

Depreciation accounting software

Fixed Assets CS calculates an unlimited number of treatments — with access to any depreciation rules a professional might need for accurate depreciation.

Learn more ↗