Discover how advanced automation solutions like Thomson Reuters' ONESOURCE can streamline tax compliance, reduce costs, and enhance efficiency in the oil and gas industry, ensuring accuracy and strategic focus amid fluctuating prices and complex regulations.

Oil prices are nothing if not consistent in their volatility. Since 2000 they’ve peaked above $200 per barrel and plunged below $25 – and everywhere in between – as fluctuating macro-economic conditions, global conflict, natural disasters, and the Covid-19 pandemic sparked turbulence. When margins were squeezed, the oil and gas industry had to grapple with cost-cutting measures. As prices rebounded from the lows (sitting at around $80 per barrel in mid-2024), many companies have seen the benefits of remaining trim to boost profitability.

Advanced automation is playing a growing role in streamlining the processes related to motor fuel taxation. This area is highly complex, yet critical for business operations, making automation the ideal solution to navigate the intricate web of rules and regulations which differ from jurisdiction to jurisdiction.

Jump to ↓

| Cost centers under scrutiny |

| The growing need for tax automation |

| Motor fuel tax complexity |

| Fuel tax compliance and the digital shift |

| An advanced automated solution |

Cost centers under scrutiny

Unsurprisingly, CapEx (Capital Expenditure) and OpEx (Operational Expenditures), which plays a key role in exploration, production, and infrastructure development, have historically come under the most pressure when oil prices are lower.

In an oil and gas company, the finance department, including the tax team, is often viewed as a cost center. In the face of reduced profitability, it’s one of the first areas of the business to undergo cost/benefit analysis and scrutiny.

As companies have charted a path towards lower costs, they’ve explored offshoring to push work that is not part of their core competencies into low-cost jurisdictions, and outsourced tax work that cannot be offshored to specialist tax firms. Harnessing the power of technology to automate processes and drive efficiency gains is another powerful lever they can pull.

The growing need for tax automation

It is becoming clear to many that automating processes is the only truly effective way to achieve more with fewer resources. When companies decide to bring previously outsourced or offshored work back in-house to regain quality control, they often face challenges in adding enough staff to support these functions. Meanwhile, the push to maintain ‘lean’ operations persists. As a result, companies recognize that the most cost-effective way to meet their needs is to rely more heavily on technology.

In addition to helping companies address cost concerns, technology solutions can also empower companies to manage tax complexity more effectively. Automating motor fuel tax compliance is a case in point. This is an area where high costs and serious risks are involved, so accuracy is essential.

Companies face the risk of overpaying or underpaying taxes, impacting cashflow, and could incur fines for non-compliance that can lead to financial losses of tens of thousands of dollars daily. Additionally, they may encounter other financial penalties, suffer reputational damage, or potentially face business interruptions. Automating processes can significantly improve accuracy and reduce the risk of these catastrophic errors.

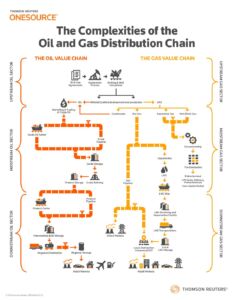

Motor fuel tax complexity

There are hundreds of thousands of possible permutations of tax treatment emanating from just one single fuel transaction, and ultimately, up to 15 different tax rates will typically apply. Put simply, this is because there are:

- Multiple tax layers: In the U.S., the oil and gas sector must navigate through federal excise taxes and a myriad of state and local taxes. Each of the 50 U.S. states, as well as various municipalities within them, has its own set of tax regulations.

- Diverse licensing types: Each state has its own rules regarding buyer and seller licenses, which dictate what activities a company can engage in, from importing and exporting fuel to buying and selling within state lines. All these activities have associated tax implications.

- Wide variety of fuel types: The market differentiates between various fuel types, including different grades/blends of jet fuel, diesel and gasoline.

- Moving regulatory goalposts: Moreover, tax rates and regulations are changing all the time, as fluctuations in oil & gas prices have triggered monthly adjustments.

Combining all these factors creates a complex maze for every fuel transaction. Companies that manage their compliance internally must navigate these difficulties independently, with tax professionals dedicating substantial time to track regulatory updates and manually adjust custom settings in their organization’s Enterprise Resource Planning (ERP) systems in conjunction with IT resources to make such updates.

|

|

Fuel tax compliance and the digital shift

As tax moves higher up the agenda for oil and gas companies, the need for digital tax transformation is becoming more critical, say the KPMG professionals in the oil and gas tax industry.

|

Brad Brown

Chief Innovation Officer and National Transformation & Technology Leader for Tax, KPMG

Responding to regulatory changes and ensuring compliance will require a massive shift in how oil and gas companies currently manage their tax function. According to survey findings, tax leaders say they will improve data management to operate effectively in the new normal.

Organizations need to frequently reassess their tax operating models to stay compliant with new regulations and manage talent needs, budget limits, and other operational challenges. Developing scalable and agile tax capabilities can help organizations meet growing obligations and transform tax functions into valuable assets for the entire enterprise.

While tax departments are expected to be more strategic and efficient, they often lack the necessary technological tools and capacity. Nearly 80 percent say they will require data management, extract, load and transformation (ETL) tools, and 60 percent say they need ERP, source systems and data warehouses to operate more effectively.

According to the KPMG 2024 CTO Outlook Study, these are the steps tax functions are taking to leverage technology and automation:

- 44% of tax functions are implementing tax software solutions

- 43% are integrating or leveraging enterprise financial systems

- 39% are using data analytics and business intelligence tools for tax planning

- 37% are automating tax compliance processes

- 30% of tax departments plan to increase their technology investment in the next 12 months

An advanced automated solution

Instead of this labor-intensive approach, what if a sophisticated automated tax engine could do it all for you? A solution that is automatically updated with all the latest regulatory changes and deploys algorithms to expertly navigate the complex web of jurisdictions, licenses, and fuel types. Such a solution could greatly alleviate the tax compliance challenges oil and gas companies face and ease significant pain points.

The ONESOURCE platform from Thomson Reuters provides advanced automation functionality supported by best-in-class technology capabilities in the cloud, with a robust and expansive content set that ensures the right decisions are taken across multiple tax types and countries.

With no manual system maintenance required, leveraging technology in this way enables a leaner tax team to work more efficiently at a faster pace. This makes the investment in automated solutions extremely compelling from a business standpoint.

Additionally, tax automation provides consistent and reliable operations, unlike temporary employees who may quit, fall ill, or tire. During challenges like the COVID-19 pandemic, uninterrupted automation functionality proved crucial, maintaining accuracy and compliance with tax regulations. This adoption continuously reduces human error and frees up tax teams for strategic tasks.

As oil and gas prices remain volatile due to factors like an upcoming election, ongoing economic uncertainty, changing weather patterns, and geopolitical tensions, companies can find solace in technology solutions. By adopting these technologies, businesses can reduce risk and expenses while maintaining quality and enhance their overall operations.

Learn more about ONESOURCE automation

|

|

|

|