Key insights from the Thomson Reuters Institute 2024 State of the Corporate Tax Department Report

The 2024 State of the Corporate Tax Department report by the Thomson Reuters Institute, in collaboration with tax executives, highlights the challenges and opportunities facing tax departments today. With talent shortages looming and technological advancements accelerating, tax departments are at a pivotal juncture.

This post delves into the key findings of the report, providing valuable insights and strategies to address these challenges. Among these resolutions are workforce retention programs, automation and technology integrations, while also considering resource and budget allocations. We will emphasize the crucial role of advanced technology in addressing talent gaps and improving operational efficiency.

Highlights:

|

Jump to ↓

| The tax department talent conundrum |

| Strategies to address workforce retention and technology advancements |

| Automation and technology integration |

| Resource management and budget allocation |

| Strategic priorities and compliance challenges |

| Future outlook for tax department talent |

The tax department talent conundrum

One of the most pressing issues facing tax departments today is the acquisition and retention of skilled professionals. Nearly 40% of respondents in the report view hiring challenges as highly significant. This issue is partly due to under-resourced tax teams, increasing global compliance requirements, and continuous technological advancements impacting tax processes. Additionally, the impending retirement wave of Baby Boomers is exacerbating the shortage, with many planning to retire within the next few years.

This talent squeeze is not just about numbers; it’s about retaining and nurturing the right skill sets to navigate the complex tax landscape. These insights underscore the urgent need for a strategic approach to talent acquisition and retention.

Strategies to address workforce retention and technology advancements

These recent shifts have created a growing demand for tax experts proficient in international tax laws and advanced technologies, including AI and software integrations. To address these changes, tax departments can implement several key strategies to help with workforce retention and development concerns:

- Develop new roles: Focus on creating roles that bridge the gap between tax and technology. Hiring tax department talent with both tax and IT skills, also known as a taxologist, is essential for expanded thinking, embracing technology, and fostering collaboration. Overhauling existing teams to integrate advanced technology into daily operations can help departments leverage AI-driven tools, improve efficiency, and allow tax professionals to focus on strategic tasks.

- Provide meaningful career paths: Implement structured career development programs that outline clear paths for advancement. This includes mentorship programs, leadership training, and opportunities to work on strategic projects. Cross-functional work opportunities also allow tax professionals to gain broader business insights and develop diverse skills.

- Offer internal continued education programs: Provide crucial continued education in technology skills and AI innovations for all staff. This helps improve efficiency and automate processes, enabling departments to shift from reactive to more strategic tasks and proactive work. Ensuring teams are well-equipped to handle the evolving demands of the tax industry is crucial.

These strategies will foster a more dynamic, resource-efficient, and effective team, helping to lessen the effects of Baby Boomer retirements.

|

|

Automation and technology integration

Tax departments are increasingly turning to automation and technology integration to address the dual challenges of personnel shortages and increasing workloads. These technologies not only streamline existing processes, but also open new avenues for efficiency and accuracy in tax operations.

Currently, 79% of departments have automated less than half of their work processes, indicating significant room for growth in automation. The report reveals that many corporate tax departments view automation and process improvement as vital to addressing the talent crunch. Over one-third of respondents cited automation and process improvement as a top priority, even higher than staffing and resource management.

The potential of technology to revolutionize tax departments is immense. Two-thirds of respondents described their tax departments as reactive or chaotic in their approach to embracing new technology. This reactive stance is particularly pronounced among under-resourced departments, with over half (54%) considering their approach reactive.

|

|

Resource management and budget allocation

Efficiency is also being driven by strategic resource management and budget allocation. Many tax departments are planning to expand their teams by hiring more tax professionals with technology training, while also maximizing the potential of their current team members through continued education programs. Concurrently, there is an expectation of increased budgets for technology, which is seen as a critical investment to enhance the capabilities and value of in-house tax functions.

Despite recognizing the potential of technology, less than one-quarter of the average tax department’s budget is currently spent on technology. However, almost half of the respondents expect their departments’ technology budgets to increase beyond the usual annual rate. This anticipated increase reflects a broader understanding of the importance of advanced technology in enhancing the efficiency and effectiveness of tax functions.

Strategic priorities and compliance challenges

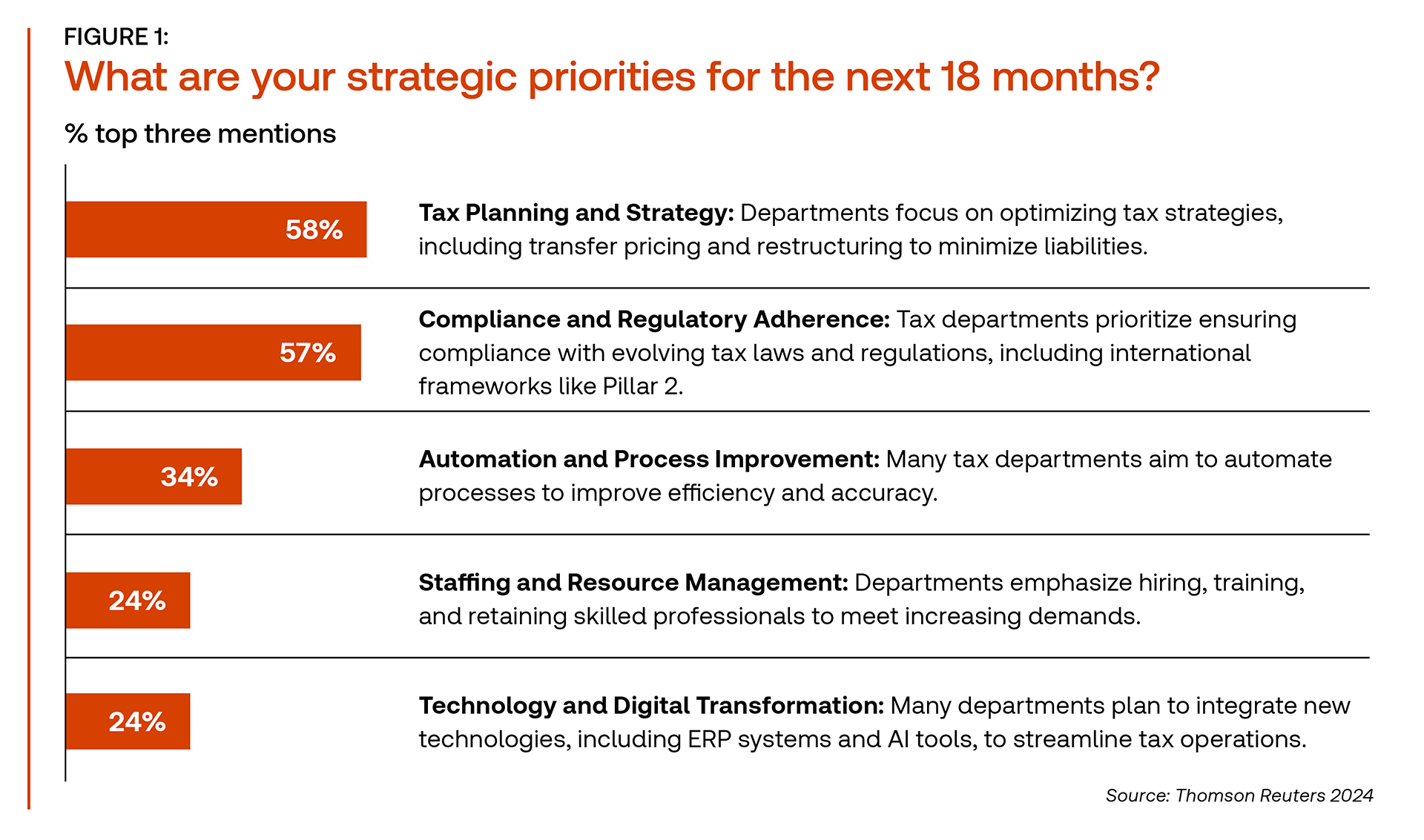

The report highlights several strategic priorities for tax departments over the next 18 months. Tax planning and strategy, along with compliance and regulatory adherence, top the list, with 58% and 57% of respondents respectively citing these as their focus areas. The emphasis on compliance is particularly pertinent given the evolving international tax frameworks like Pillar 2 and Global Minimum Tax (GMT). Compliance issues surrounding Pillar 2, GMT, and BEPS 2.0 were listed as the second, third, and fourth most significant challenges, respectively.

Future outlook for tax department talent

The 2024 State of the Corporate Tax Department report paints a picture of a sector in radical transition. The dual challenges of talent shortages and under-resourcing are significant, but the optimism around technology-driven solutions offers a path forward.

This period of transformation presents both challenges and opportunities. Using advanced technology, creating a culture of continuous learning and adapting, will be essential in navigating these new developments. The renaissance of the tax department hinges on using technology to not only fill the talent gaps, but also to elevate the strategic role of tax professionals within their organizations.

The future outlook for tax departments is optimistic, with anticipated growth in technology budgets enabling the adoption of new AI-driven tools. The focus is on automating processes to improve efficiency and accuracy. This shift allows for a transition from tactical tasks to more strategic and proactive work, which could provide long-term benefits to companies.

By doing so, tax departments can transform from being reactive entities to proactive, strategic partners that drive value for their organizations.

Read the full Thomson Reuters Institue 2024 Corporate Tax report.

|

|