Staffing, time management, changing tax laws, and billing top the list.

Jump to:

| What are the top challenges accountants are facing? |

| Attracting, hiring, and retaining staff |

| Time management and deadlines |

| Keeping up with tax law |

| Billing and cash flow issues |

| Rising challenges for accountants |

The accounting industry continues to experience profound change as tax and accounting professionals navigate the fluid regulatory landscape amid shifts in client and employee expectations and advancements in innovative technologies like artificial intelligence.

As a result, a growing number of firms are re-examining their business models to keep pace. This involves leveraging technology to drive greater efficiencies, broadening service offerings to remain competitive, and working to better attract and retain top talent.

While such moves can unlock new growth opportunities, firms must first have a greater understanding of how to overcome the challenges impacting much of the profession. To help tax and accounting professionals, this article explores some of the top issues firms face and the solutions that can help them achieve greater success.

What are the top challenges accountants are facing?

The top challenges facing tax and accounting professionals will vary depending on the size of the firm and the resources it has in place. That being said, there are several commonly cited issues sweeping across the profession.

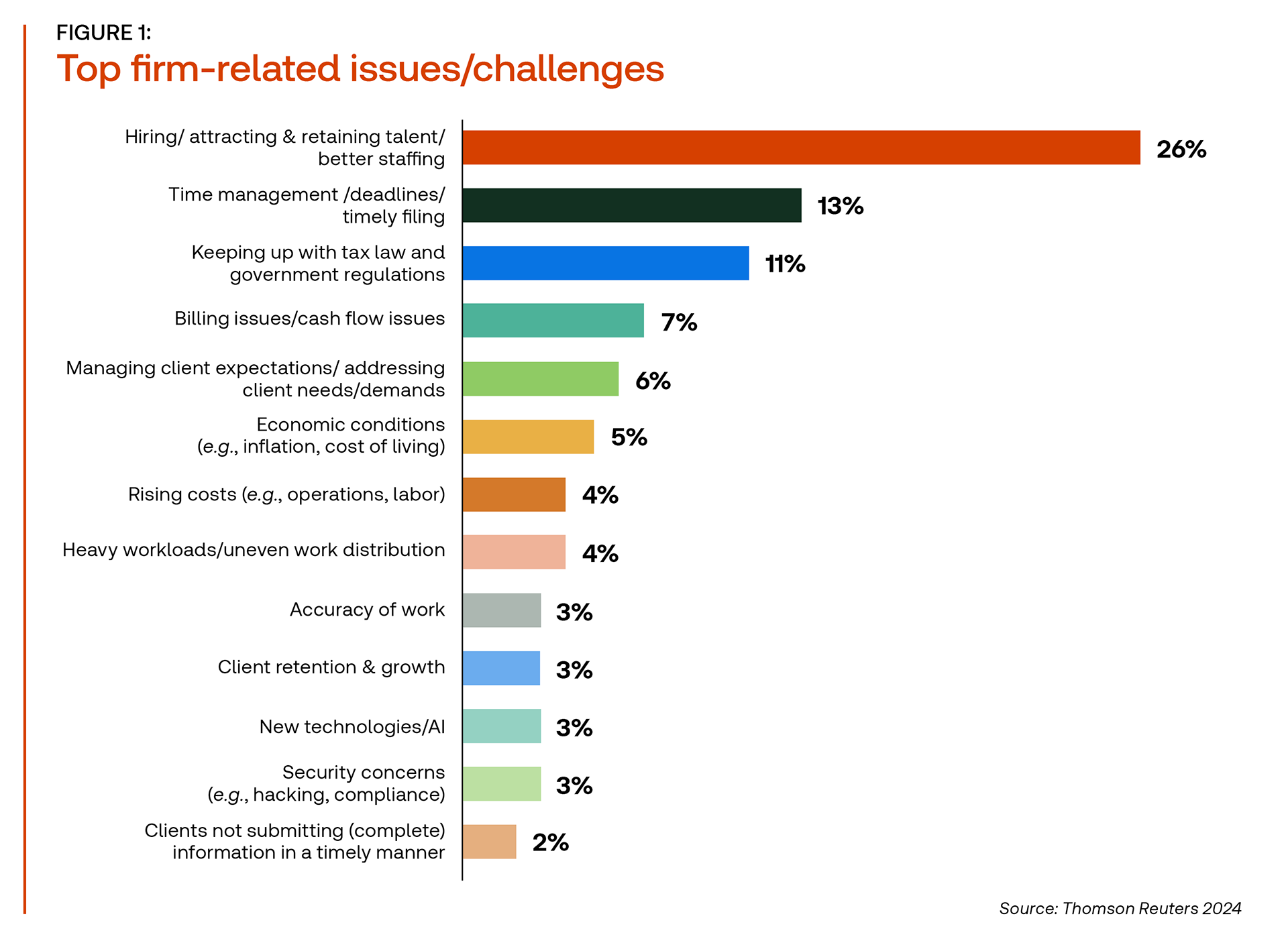

Based on the findings of the Thomson Reuters Institute 2024 State of Tax Professionals Report, these include:

- Attracting and retaining the right talent who possess the tax and technical skillsets needed in today’s environment.

- A lack of time management to effectively meet deadlines and file taxes.

- Keeping up with ever-changing tax regulations and rules.

- Billing and cash flow issues.

The good news is that firms are not powerless. A growing number of tax and accounting firms are taking proactive measures to remain competitive and boost profitability. Let’s take a closer look at the top four challenges and the steps firms can take to solve them.

Attracting, hiring, and retaining staff

Staffing constraints is far from a new concern for the profession. However, there’s no doubt that shifts in employee expectations, an anemic pipeline of new accounting majors and graduates entering the profession, and a growing number of seasoned professionals seeking retirement has exacerbated the issue.

In fact, Thomson Reuters research found 32% of survey respondents rated hiring and development of talent as their highest priority. This is up from 23% in 2023. More specifically, recruitment was listed as the most important priority, especially at midsize accounting firms.

When it comes to talent, perhaps the most daunting challenge facing firms is finding personnel with the requisite tax experience and technical skills necessary in today’s environment. In fact, 64% of respondents said recruitment in 2024 was likely to be highly or somewhat challenging.

Meanwhile, 58% of respondents said they thought training and development of existing employees would be either highly or somewhat challenging, and 41% said the same about retention of existing employees.

In light of such challenges, it comes as little surprise that increasing salaries and incentives (49%), ramping up training and personnel development (16%), and easing workloads to provide a better work/life balance (10%) are among the planned strategies for maximizing retention in 2024.

However, it is critical that firms not overlook the role that greater technology automation can play in easing bandwidth constraints and driving greater efficiencies. This involves weeding out as many time-consuming, manual tasks as possible through greater automation and ensuring that systems are tightly integrated to better streamline workflows.

According to the findings, nearly half (49%) of survey respondents said that increasing the use of automation is an option if they are unable to fill certain roles.

Recruiting freelancers and turning to outsourcing (both onshore and offshore) are also strategies that a growing number of firms are considering.

Time management and deadlines

Given the bandwidth constraints and rise in client demands and expectations that many firms are facing, it is no surprise that a lack of time to meet deadlines and file taxes in a timely manner is a top challenge facing many firms.

According to Thomson Reuters research, efficiency remains the top strategic priority for firms in 2024, with roughly one-third of respondents (32%) citing it now, just as they did in the 2023 report (34%).

Improved time management and meeting deadlines not only eases the strain on staff but also leads to happier clients and a greater ability to provide clients with higher-value, higher-margin advisory services — all important factors that today’s firms must consider.

When asked about barriers to offering requested advisory services, time constraints was cited as a barrier to providing more strategic tax services. As stated by one survey respondent, “I have enough work. I don’t want to spread my time too thin and not be able to be effective.”

One of the most common ways for tax and accounting firms to improve efficiencies, which can lead to better time management, is to introduce some measure of automation. Eliminating as many time-consuming, manual tasks as possible and ensuring that systems are tightly integrated to more effectively streamline workflows can help provide staff with the time they need to better meet deadlines.

The critical role that technology plays in fueling efficiencies is not going unnoticed, judging by the top investment priorities among firms.

When rating investment priorities over the next two years, the priorities firms most often mentioned were improving processes and workflows and investing in tax-technology solutions. In fact, two-thirds (66%) of respondents said their firms were going to be streamlining their processes over the next two years, and 47% said they were eyeing new technology solutions, up from 41% in 2023.

CoCounsel: Your trusted AI partner

One agentic AI assistant for tax, audit, and accounting professionals.

Learn more ↗Keeping up with tax law

Keeping pace with ever-changing tax laws and regulations is no small feat, especially in today’s dynamic and global market. That’s why it is imperative that firms have the right tools and resources in place to help ensure compliance and mitigate risk. Failure to do so can not only tarnish a firm’s reputation and result in a loss of clientele, but it can also lead to hefty fines and penalties.

According to the report, keeping up with tax law and government regulations ranked No. 3 among the top accounting challenges in 2024. This is not surprising as tax rules are frequently revised, and the changes aren’t always easy to interpret.

Fortunately, there are measures that firms can take to help ensure team members are up-to-date on their tax knowledge. Such efforts include:

- Running workshops so team members can share their knowledge and expertise in a particular tax area.

- Attending industry-leading seminars and conferences, such as Synergy, to get team members up to speed on the most recent tax law developments.

- Taking advantage of live webinars and on-demand events hosted by leading tax, audit, and accounting experts.

- Leveraging technology, such as artificial intelligence (AI)-powered tools to stay on top of tax law changes. For instance, with AI-powered tax research software, professionals can get targeted search results in less time.

Billing and cash flow issues

As a growing number of firms look to pivot away from compliance-based services in favor of providing more higher-value, strategic offerings, it is imperative that firms are being properly compensated for the value they deliver and are optimizing cash flow. For many, this means moving away from hourly billing and embracing different pricing models as a strategic tool to help boost revenue.

While hourly billing may still have its place in some instances, the challenges surrounding hourly billing are manifold. Such issues include:

- Clients not considering the overall value a professional is providing.

- Clients don’t know how much they will be paying for a firm’s services until the work is done and the hours are calculated. This lack of transparency can leave clients feeling frustrated.

- It contradicts a firm’s quest to improve efficiencies because, under an hourly billing model, fewer billable hours means less profitability for the firm.

The need to rethink pricing models to keep pace with industry changes is clear. In prior surveys, pricing barely hit the radar screen. However, this year it catapulted to No. 3 on the list of strategic priorities, with 23% of survey respondents referencing their pricing model as a top priority for 2024.

According to Thomson Reuters research, the billing model gaining the most traction in 2024 is value-based pricing, in which charges are based on expertise, guidance, and results, rather than time spent. Nearly half (48%) of respondents said their firms already offer value-based pricing on some of their services, and 18% said their firms plan to start offering it by the end of the year.

Additional pricing models that are attracting more attention include:

- Market-value pricing: 21% of survey respondents said their firm plans to roll this model out in 2024.

- Retainer pricing: 19% of respondents plan to offer this model.

- Competition-based pricing: 13% of respondents have plans to offer this pricing model.

- Cost-plus pricing: 11% of respondents said their firms are considering this pricing structure.

Clearly, there’s no cookie-cutter approach to pricing, and client preferences are another factor to consider. However, firms offering a range of pricing options are keen to optimize cash flow by leveraging the pricing method that will generate the most revenue for the service they provide.

Rising challenges for accountants

There’s no doubt that the accounting profession is in the middle of significant change. While navigating the complexities of staffing, time management, tax law changes, and billing and cash flow issues may be high on the list among current challenges, there are additional issues raising concern.

For instance, economic headwinds, such as inflation and cost of living, rising labor and operational costs, and privacy breaches continue to persist. Additionally, generative AI is top of mind as more and more firms explore how they can leverage the innovative technology within their practice while maintaining data security and ethical usage.

Make sure your firm is in the know — read the full Thomson Reuters Institute 2024 State of Tax Professionals Report to learn more about how accounting firm business priorities have changed since 2023.

CoCounsel: Your trusted AI partner

One agentic AI assistant for tax, audit, and accounting professionals.

Learn more ↗