A guide for business owners answering commonly asked questions about taxation of S corporations and how to reduce taxes as a pass-through entity.

Setting up your business as an S corporation (S corp) provides several tax advantages that are not available to owners of C corporations (C corp) or Limited Liability Companies (LLCs). You may wonder how the S corporation taxation generally works. Are you really doing everything you can to reduce your tax burden? And are you taking full advantage of all the business exemptions and credits available in your industry?

The following guide offers numerous strategies and tips that owners of S corporations can use to lower their taxes, including deductions and credits.

Jump to ↓

| How are S corporations taxed? |

| How can S corporations reduce their taxes? |

| How a corporate tax software can help filing S corporation taxes |

How are S corporations taxed?

To the IRS, S corporations (S corps) are considered “pass-through entities”, which means any deductions, losses, income, credits, and profits pass through directly to shareholders, who report their share of the business’s performance on their own personal tax returns. The tax rate an owner/shareholder pays on S corp profits is determined by their individual income-tax rate, which can be anywhere from 10% to 37%, depending on the filer’s total taxable income.

As a pass-through entity, one of the biggest tax advantages of the S corp business structure is that it avoids double-taxation, which means S corps don’t have to pay taxes at the federal level the way C corps do. Instead, S corp profits are only taxed once, on the personal tax returns of individual shareholders. However, shareholders who incur out-of-pocket expenses related to the business cannot be deduct them on their tax return. Instead, an expense claim form must be submitted to the S corp, which pays the shareholder back.

When are S corps taxes due?

S corporations are required to file their annual tax return by the 15th day of the 3rd month after the end of the tax year. For 2024, S corp taxes are due on March 15, 2024. Extension requests (using IRS Form 7004) are also due on this date.

What IRS tax forms do S corps file?

To file taxes, S corps use two main forms: IRS Form 1120-S, the U.S. Income Tax Return for an S Corporation, and Schedule K-1 (Form 1065).

IRS Form 1120-S is used to report income, losses, credits, and deductions, as well as employee wages, officer compensation, and any other information related to business income and expenses. Filing Form 1120-S automatically generates a Schedule K-1 form for each individual shareholder/partner. The S corp must then supply a completed Schedule K-1 form to each individual shareholder indicating their portion of any income, losses, credits, or deductions.

In addition, the business owner of an S corp is required to pay themselves a W-2 salary (with taxes withheld), which is reported as income on the S corp owner’s IRS Form 1040. Shareholders (including the S corp owner) report income distributions and business losses via Schedule E of Form 1040.

What are the tax advantages of an S corporation?

S corps enjoy several tax advantages. Among them:

- Pass-through status: In an S corp, business income, deductions, credits, and losses are passed through to shareholders, and are not taxed at the corporate level.

- Employee income advantage: S corp owners must pay themselves a reasonable “salary,” and other shareholders can also be employees. As “employees,” business owners only have to pay taxes on their salary, not on the total income of the business.

- Loss deductions: S corps that incur a loss can pass the loss on to shareholders on a pro rata basis, and those losses can be deducted from other income on a shareholder’s tax returns.

- Self-employment tax relief: S corps that pay out taxable income (as salaries) do not have to pay the 15.3% Federal Insurance Contributions Act (FICA) taxes for Medicare and Social Security, also known as “self-employment taxes”. Rather, FICA is only applied to the salary amount. Contributions to a shareholder/employee’s retirement plan are also tax exempt.

- Healthcare insurance: Healthcare premiums can be expensed as wages and are therefore deductible, which exempts them from FICA taxes. Therefore, business owners can save on taxes by having the S corp pay for their healthcare coverage.

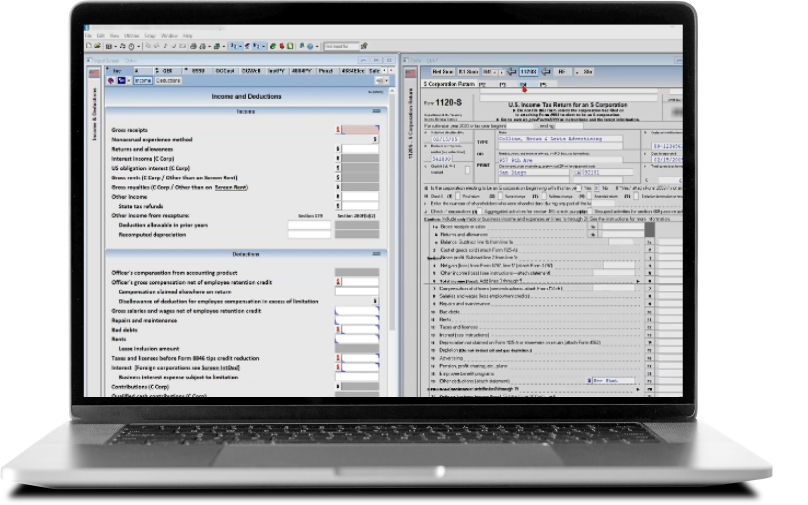

UltraTax CS

Professional tax preparation software to reduce your workflow time and increase your productivity

Learn more ↗How can S corporations reduce their taxes?

S corp can lower their tax burden in a number of different ways, some of which are relatively easy, and some of which may require the help of a qualified tax professional. In most cases the business’s size, nature, and complexity will determine the tax strategies available, but these are the most common ways to save on taxes:

1. Itemize business deductions

Like most businesses, S corps can reduce their tax burden by deducting expenses related to operation of the business. Some examples include—but are not limited to—the following:

- Business vehicle expenses

- Charitable donations

- Real-estate taxes

- Self-employment health insurance

- Marketing and advertising costs

- Salaries and employee benefits

- Business-related travel expenses

- Professional fees/organizational dues

- Training/education

- General business expenses (e.g., rent, office supplies, phone, equipment, utilities, etc.)

Tip: Almost any expense incurred during the day-to-day running of an S corp is tax-deductible, so the best way to reduce the business’s tax liability is to keep track of any and all expenses, even if you don’t think an expense is deductible — because it may very well be. An exhaustive list of possible deductions is hard to come up with, because there are so many. When in doubt, consult a qualified tax professional.

2. Take the home office deduction

Work from home may also deduct the percentage of your home used exclusively for business. And according to the IRS, S corp owners can also deduct a corresponding percentage of expenses such as rent or mortgage interest, utilities, business-related phone expenses, insurance, and costs for (or depreciation of) equipment such as computers and printers.

3. Pay yourself a “reasonable” salary

S corp status requires the business owner to pay themselves a salary, but the amount of that salary is up to the owner, sort of. The IRS expects owners to pay themselves a “reasonable compensation,” which is dictated by industry or marketplace standards. For instance, a graphic designer in a competitive urban market might make $100,000. If she forms an S corp, she cannot elect to pay herself a “salary” of $10,000 and say that the remaining $90,000 is “distribution” to shareholders.

Tip: Many S corp owners use the so-called 60/40 rule, wherein 60% of business income goes to salary and 40% is distributed to the S corp shareholders. The advantage of the 60/40 approach is that rather than being taxed on total business income, the S corp owner only pays personal income taxes on the salary amount, which can save quite a bit on taxes.

4. Hire your children

Business owners can make themselves a true “family” business by providing jobs for their children. Each child can make up to $12,000 without paying federal income taxes, and those salary amounts ($24,000 for two children, say) are subtracted from the business’s total income, saving on taxes. The owner still has to pay payroll taxes, and the children do have to perform some legitimate job functions, but the overall tax savings are worth it.

5. Deduct state taxes (if possible)

S corps can deduct state and local taxes (known as a SALT deduction), but there are a few factors to consider. First, the 2017 Tax Cuts & Jobs Act introduced a $10,000 limit (known as the SALT cap) on the amount of state and local taxes an individual can deduct from their personal tax returns, which includes income from pass-through entities like an S corp. In response, many states (33 at last count) have passed what’s known as a Pass-Through Entity Tax (PTET), which is essentially a workaround that allows S corps and other pass-through entities to avoid the SALT cap by re-defining state and local taxes as an above-the-line business expense rather than an individual expense passed on to shareholders.

S corp business owners in eligible states who elect the PTET option also receive a state tax credit on their individual taxes to offset most or all the tax paid by the business. PTET rules are different in each state, however, and not all states have them, so consultation with a tax professional is advisable.

6. Use tax credits (if eligible)

Depending on the type of business they are in, certain S corps can qualify for research and development tax credits, which can provide additional cash flow and reduce the company’s tax liability. S corps are also eligible for other general business credits, such as:

- The Retirement Plan Startup Costs Tax Credit

- The Plug-In Electric Vehicle Credit

- The Alternative Motor Vehicle Credit

- The Empowerment Zone Employment Credit

- The New Markets credit

Tip: For a complete list of business tax credits, go to IRS Business Tax Credits and start researching. Unfortunately, IRS guidance is notoriously obtuse, so consulting a tax professional familiar with the type of business you have can help immensely. Also, the rules for carrying over credits from year to year can be confusing, so a tax pro can help there too.

7. Take the Qualified Business Income (QBI) deduction

Like LLCs, eligible S corps can take the QBI deduction (Section 199A), which can amount to as much as 20% of a business’s total taxable income and can be taken in addition to standard and itemized deductions. The IRS defines QBI as the net amount of business income, gains, losses, and deductions, and includes income from qualified real estate investment trusts (REIT) dividends and income from some publicly traded partnerships (PTP). Not every business can claim a QBI deduction. To be eligible, a business must be in a “specified service trade or business,” such as a lawyer, doctor, consultant, financial planner, or accountant. However, the list of possible professions also includes performing artists, athletes, farmers, and many other businesses that rely on the skill or reputation of one or more employees.

Tip: While there are several types of exclusions from QBI, potential S corp owners should know that QBI does include deductible portions of the self-employment tax, health insurance for self-employed individuals, and certain types of self-employment retirement plans. Taken together, these deductions may offer significant tax advantages for the S corp business owner.

How a corporate tax software can help filing S corporation taxes

There are many tax advantages to running an S corp, but determining which strategies can be used will depend somewhat on the size and nature of the business. As pass-through entities, S corps are not subject to double-taxation, but S corps typically have employees, which means paying payroll taxes and providing certain employee benefits, such as healthcare and retirement accounts, all of which have tax consequences—some favorable, some not.

As one might expect, filing S corp taxes can get complicated. Navigating the full range of deductions, credits, exemptions, and options is no easy feat, and without professional help, the likelihood that money will be left on table is much higher, as is the risk of being audited. Hiring a full-time accountant for the business is of course an option too—and their salary is tax-deductible.

Depending on the type of business, investing in corporate tax software may be worth considering as well. For example, ONESOURCE corporate tax software has modules for tax planning and preparation that can help streamline the process and make tax preparation more efficient. ONESOURCE can also automate indirect tax calculations, which is especially helpful if the business is selling a high volume of products or is doing business across state lines and is collecting sales tax. In any case, automating the most time-consuming aspects of the tax process can save money and give business owners peace of mind that their corporate tax filings and reports are as accurate as possible.

Related blog

S corp vs C corp vs LLC: What’s the difference, and which one is better for your business?

S corp vs C corp vs LLC ↗

|

BookPPC’s Guide to Tax Planning: S Corporations explains the tax consequences of electing and maintaining S status, operating the S corporation, and terminating the S election. |