Highlighting the similarities and differences between accounting depreciation and tax depreciation.

Jump to:

| What is book depreciation? |

| What is tax depreciation? |

| What are the differences between book and tax depreciation? |

| What is accelerated depreciation? |

| What is book-to-tax reconciliation? |

| Managing book and tax depreciation with software |

Depreciation. Unlike how other expenses are recorded, this method deducts a portion of the cost of a fixed asset over a number of years due to declines in the fair value of that asset. For professionals in the tax and accounting industry, there are multiple types of depreciation — namely, tax and book.

This article will explore some of the differences and how accountants can better manage both book and tax depreciation.

What is book depreciation?

Book depreciation, which is also known as accounting depreciation, is the amount recorded in a business’s financial statement for a fixed asset (i.e., machinery, equipment, and tools for business use) that is allocated over the useful life of that asset. Depreciation recognizes the normal wear and tear that occurs from the usage of the asset.

This non-cash business expense is guided by accounting principles and standards such as US GAAP or International Financial Reporting Standards (IFRSA) and is recorded as a depreciation expense on the income statement. This ultimately reduces the net income reported by a company.

For example, a business owner buys a new piece of machinery for business use. Over time, the machinery will decrease in value, and despite care and maintenance, will suffer from normal wear and tear. To account for this decrease, the accountant depreciates the cost of the machinery over a period of time for the client using such depreciation methods as straight-line, double-declining balance, units of production, and sum-of-years digits.

The straight-line method is the most common and simplest method. Using this method as an example, the calculation would work as follows:

Let’s say the business owner purchased the machinery for $5,000. You would then need to determine its salvage value (this is the estimated resale price for an asset after its useful life) and its useful life. In this example, you determine that the salvage value is $2,000, and its useful life is five years.

Straight-line method formula: ($5,000 – $2,000) / 5 = $600 annual depreciation expense

$600 / 12 = $50 monthly depreciation expense

What is tax depreciation?

Tax depreciation is a depreciation expense listed by a business client on their tax return for a given tax period. This accounts for the loss in the value of a tangible asset used by a company in income-generating activities.

Tax depreciation is beneficial as it enables business clients to reduce their taxable income and the tax amount owed.

As outlined by the IRS, in order for an asset to be eligible for depreciation it must meet the following requirements:

- It must be property the business client owns.

- It must be used in a business or income-producing activity.

- The asset must have a determinable useful life.

- The asset must be expected to last more than one year.

For example, your business client buys a new company truck that is used only for business purposes. Each year, the truck will continue to lose its value as it is used and miles accrue. Tax depreciation enables the client to reduce their tax liability and save money by deducting from the taxes a portion of the truck’s declining value.

|

|

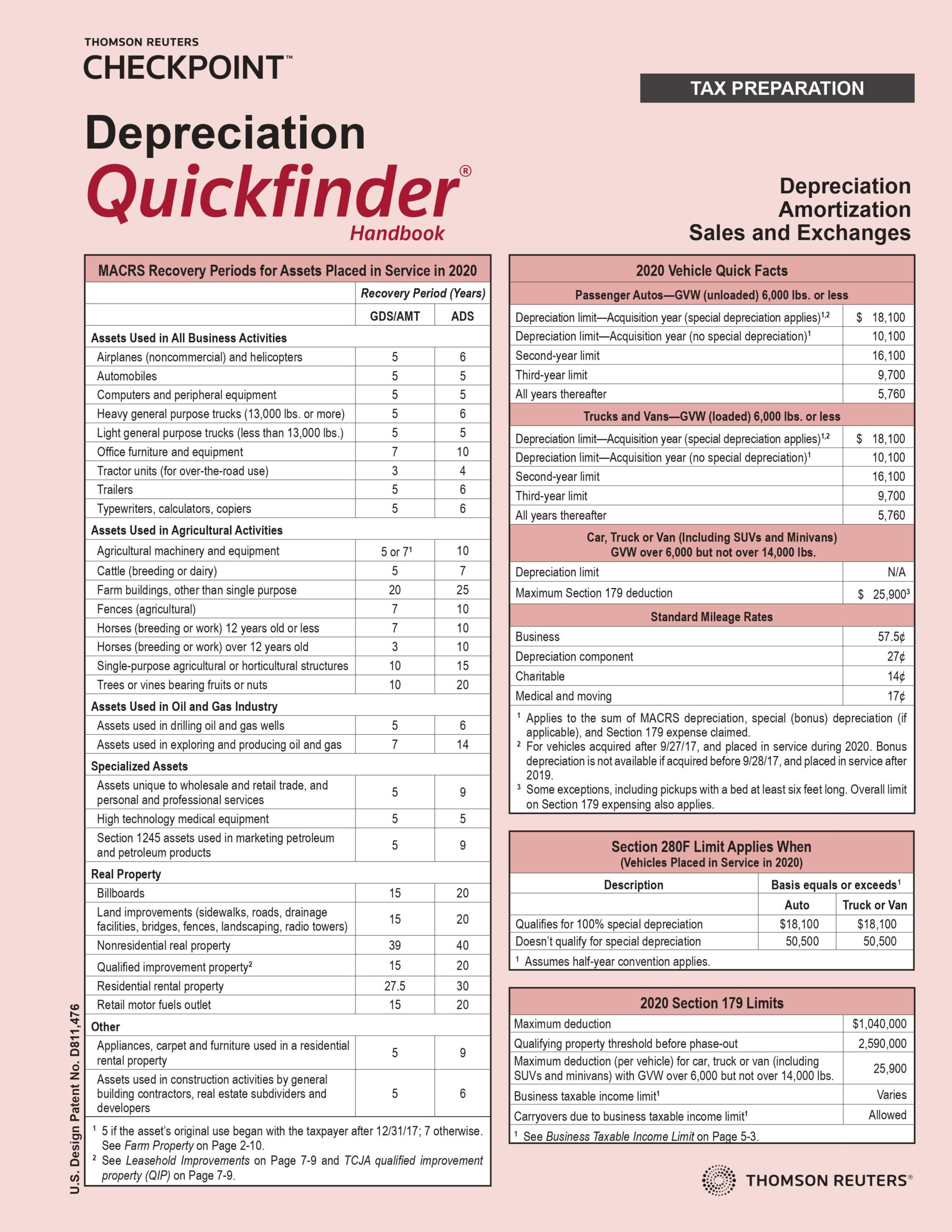

BookThe trusted tax depreciation guide book from Thomson Reuters Checkpoint® |

What are the differences between book and tax depreciation?

While depreciation can apply to both accounting and tax, there are several notable differences between book and tax depreciation to keep in mind. These differences include:

- Book depreciation is treated as a company’s expense and is recorded as a depreciation expense on the income statement. This results in savings as it reduces the net income reported by a company. Tax depreciation, however, is a tax deduction listed on the tax return that reduces the business client’s taxable income.

- With regard to tax depreciation, there are rules that allow for a certain amount of depreciation depending on the asset classification. The asset’s useful life and actual usage are not taken into consideration. On the hand, book depreciation is more in line with the actual usage of the asset.

- There are calculation differences between tax depreciation and book depreciation. As noted earlier, the straight-line method is commonly used to calculate book depreciation.

- Tax depreciation uses an accelerated form of depreciation, known as Modified Accelerated Cost Recovery System (MACRS). It results in a more rapid recognition of depreciation expense compared with book depreciation.

What is accelerated depreciation?

Accelerated depreciation is a method that decreases an asset’s book value at a faster pace compared with other depreciation methods. In other words, an asset will have greater deductions in value in the initial years after it is placed into service compared with the later years.

It is logical to assume that a company’s assets will be more productive in the initial years compared with the later years when the assets have aged and experienced more wear and tear. Given this, accelerated deprecation may be an attractive tax-reduction strategy.

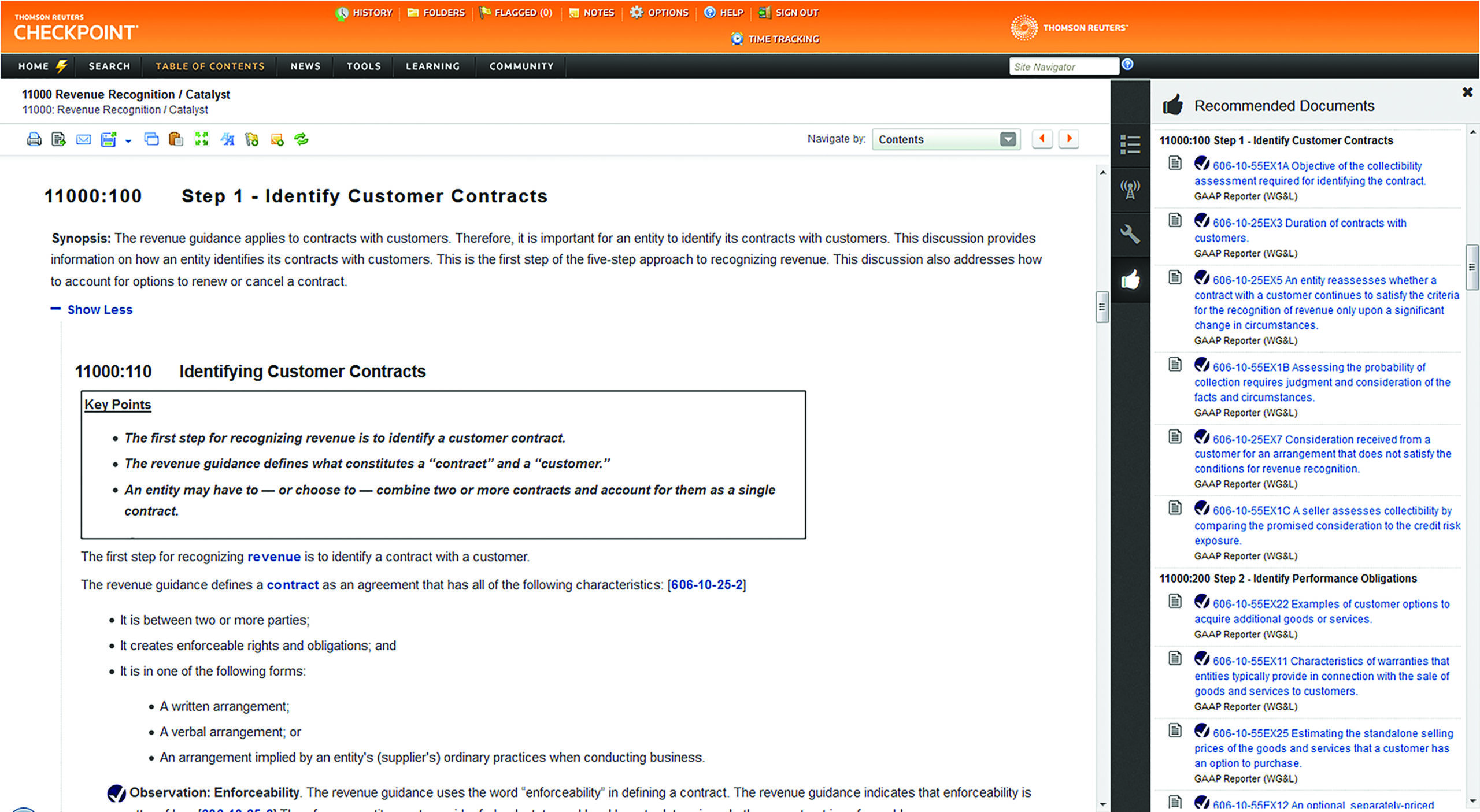

Adapt to a changing business landscape with Checkpoint Catalyst: US GAAP®, the next generation of online tax research.

What is book-to-tax reconciliation?

Book-to-tax reconciliation is the act of reconciling the net income on the books to the income reported on the tax return by adding and subtracting the non-tax items.

Schedules M-1 and M-2 can be used to reconcile a company’s accounting income to the taxable income. However, companies with more than $10 million in assets need to use Schedule M-3, which is more detailed.

Managing book and tax depreciation with software

Managing book and tax depreciation can be complex and time consuming without the right tools and resources in place. That’s why it is important to implement robust fixed assets management software.

Thomson Reuters Fixed Assets CS® can provide your firm with expert guidance on tax depreciation and other cost recovery issues for clients. Among the features available in this depreciation software is the ability to calculate an unlimited number of treatments. This gives accountants access to virtually any depreciation rules needed for accurate depreciation.

Free trialSign up now for a free, cloud-based trial of Fixed Assets CS and begin transforming your practice today. |

|

Blog postExplore the tax implications and deductions of software depreciation |

|