On August 16, 2022, the Inflation Reduction Act was signed into law by President Biden. A large portion of this bill includes climate change provisions. For tax practitioners, this is all about energy credits.

Let’s take a look at four key provisions within the Inflation Reduction Act that relate specifically to energy efficient property credits.

Jump to ↓

| Sec. 13301 – Non-Business Energy Property Credit |

| Sec. 13302 – Residential Clean Energy Credit |

| Sec. 13303 – Energy Efficient Commercial Buildings Deduction |

| Sec. 13304 – Energy Efficient Home Credit |

| Learn more about energy efficient property credits |

Sec. 13301 – Extension, increase, and modifications of the Non-Business Energy Property Credit

If you’ve had clients tell you that they’ve spent $5,000 on new energy efficient windows for their home and, year after year, you’ve patiently explained to them that the most they can get is a $500 lifetime credit, you’re now in luck.

Under the Inflation Reduction Act, taxpayers may take the credit for energy-efficient property placed in service before January 1, 2033 [IRC Sec. 25C(g)(2)]. The increased credit for a tax year is an amount equal to 30% of the sum of:

-

- The amount paid or incurred by the taxpayer for qualified energy efficiency improvements installed during that year

- The amount of the residential energy property expenditures paid or incurred by the taxpayer during that year. Note that the term residential energy property expenditures mean expenditures made by the taxpayer for qualified energy property; an

- Amount paid or incurred by the taxpayer for home energy audits

The credit is increased by amounts spent for a home energy audit conducted on a taxpayer’s principal residence. The amount of the increase due to a home energy audit can’t exceed $150 [IRC Sec. 25C(b)(6)(A)]. The audit must be completed by a certified home inspection auditor and is meant to identify the most significant and cost-effective energy efficient improvements.

The Act repeals the lifetime credit limitation and instead limits the allowable credit to $1,200 per taxpayer per year. In addition, there are annual limits of $600 for credits with respect to qualified energy property expenditures, $600 for exterior windows and skylights, and $250 for any exterior door (and $500 total for all exterior doors).

However, a $2,000 annual limit applies with respect to amounts paid or incurred for specified heat pumps, heat pump water heaters, and biomass stoves and boilers [IRC Sec. 25C(b)].

What to include and exclude with the non-business energy efficient property credit

For purposes of figuring the credit on Form 5695, do not include amounts paid for the onsite preparation, assembly, or original installation of the building envelope component (exterior windows and doors, and insulation material or system).

Conversely, taxpayers can include expenditures for labor costs properly allocable to the onsite preparation, assembly, or original installation of qualified energy property (e.g., central air conditioner, natural gas hot water boiler).

And coming soon, no credit shall be allowed for any item of specified property placed in service after December 31, 2024, unless:

-

- The item is produced by a qualified manufacturer and

- The taxpayer includes the qualified product identification number of the item on his tax return for the taxable year.

For this purpose, the term qualified product identification number means the product identification number assigned to the item by the qualified manufacturer (e.g., a unique alphanumeric ID).

So, in summary, the extension of credit applies to property placed in service after 2021 (i.e., the old rules), the amendment of the credit applies to property placed in service after 2022 (i.e., the new rules), and the identification number requirement applies to property placed in service after 2024.

Sec. 13302 – Residential Clean Energy Credit

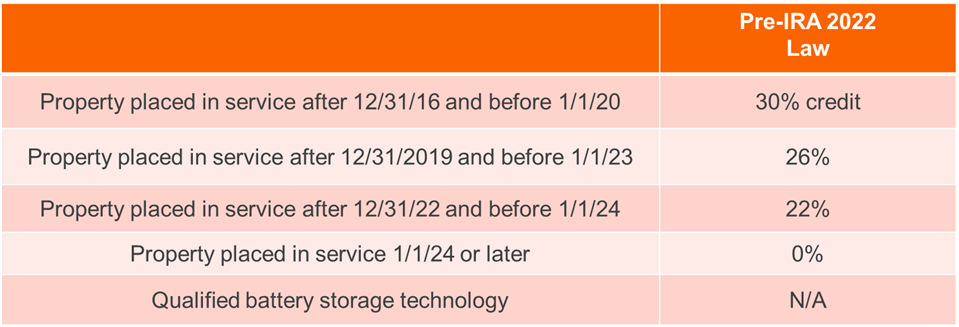

Previously, individuals were allowed a personal tax credit, known as the residential energy efficient property (REEP) credit, for solar electric, solar hot water, fuel cell, small wind energy, geothermal heat pump, and biomass fuel property installed in homes in years before 2023 [IRC Secs. 25D(a) and 25D(h)].

The credit is available for both existing homes and homes being constructed.

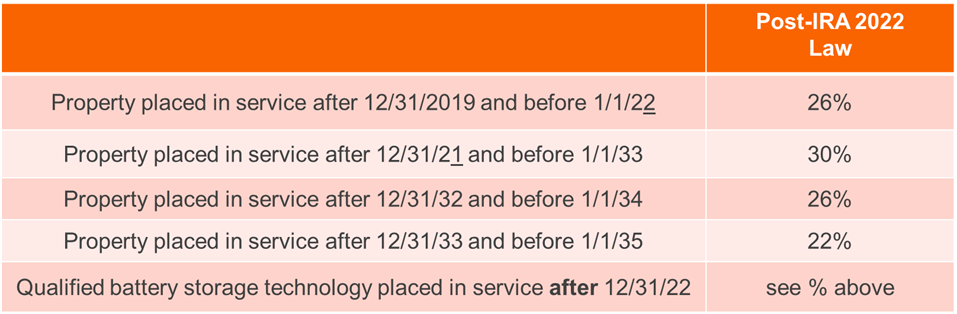

The Inflation Reduction Act makes the credit available for property installed in years before 2035. The Act also makes the credit available for qualified battery storage technology expenditures and provides a definition of those expenditures.

However, the allowance of the credit for qualified battery storage technology, and the definition of that technology, apply only to expenditures made after December 21, 2022.

For comparison, here is a high-level look at the pre-IRA 2022 law.

And here is a look at the post-IRA 2022 law.

Use Form 5695 to figure and take the residential energy efficient property credit.

Sec. 13303 – Energy Efficient Commercial Buildings Deduction

IRC Sec. 179D provides an accelerated cost recovery deduction for energy efficient commercial building (EECB) property for the year placed in service.

Historically, the maximum amount of the deduction allowed for a year was calculated by multiplying a statutory dollar amount ($1.88 in 2022) by the square footage of the building. Then, the product was reduced by the total EECB property deductions taken related to the building in all prior years to arrive at the applicable limitation. In addition, EECB property had to satisfy certain installation requirements, including a certification of annual energy and power savings of 50% or more.

The Inflation Reduction Act lowers the minimum EECB efficiency standard required for deduction benefits from a 50% reduction in total annual energy and power costs to a 25% reduction [IRC Sec. 179D(c)(1)(D)]

ADV multiplication factor explained

The Act also modifies the formula for calculating the maximum deduction by switching to an applicable dollar value (ADV) multiplication factor, which is variable based on the percentage of total annual energy and power cost reductions for the building.

The ADV is $0.50, and it can be increased by $0.02 for each percentage point cost reduction over 25% (capped at $1). The Act also provides an opportunity to exponentially increase the ADV. If, among other things, prevailing wage and apprenticeship requirements are satisfied, then the ADV is $2.50 increased by $0.10 per eligible cost reduction percentage point (capped at $5.00) [IRC Sec. 179D(b)(3)].

Deduction (IRC Sec. 179D) = ADV x square footage of building

In the case of energy efficient commercial building property installed on or in property owned by a specified tax-exempt entity (government, Indian tribal government or exempt organization), the IRS will promulgate regulations or guidance to allow the allocation of the deduction to the person primarily responsible for designing the property in lieu of the owner of the property. Such person (the designer of the project) shall be treated as the taxpayer for purposes of IRC Sec. 179D.

For the past deduction(s) reduction factor, instead of totaling from all prior years, the lookback is the three (four if the deduction is allowable to a person other than the taxpayer) immediately preceding tax years.

Replacement of partial deductions

The Act eliminates the allowance of partial deductions. Essentially, there are two kinds of qualifying property for the deduction:

-

- Energy efficient commercial building property

- Energy efficient building retrofit property (including property installed pursuant to a qualified retrofit plan). This new alternative deduction is taken in the year of qualifying final certification.

-

-

- The alternative deduction requires a qualified retrofit plan, and it looks to percentage reductions in energy use intensity rather than total annual energy and power costs.

- The alternative deduction cannot exceed the aggregate adjusted basis of retrofit property placed in service pursuant to the plan [IRC Sec. 179D(f)(1)(B)].

-

The term energy efficient building retrofit property means property:

-

-

- for which depreciation (or amortization in lieu of depreciation) is allowable,

- which is installed on or in any qualified building,

-

-

-

- which is installed as part of (i) the interior lighting systems, (ii) the heating, cooling, ventilation, and hot water systems, or (iii) the building envelope, and

- which is appropriately certified.

-

For this purpose only, the term qualified building means any building that:

-

-

- is located in the United States, and

- was originally placed in service not less than 5 years before the establishment of the qualified retrofit plan for that building.

-

These provisions apply to tax years beginning after December 31, 2022.

Sec. 13304 – Extension, increase, and modifications of new Energy Efficient Home Credit

The Inflation Reduction Act retroactively revives the IRC Sec. 45L general business credit and makes the credit available for qualified new energy efficient homes acquired before January 1, 2033 [IRC Sec. 45L(g)].

IRC Sec. 45L(c)(1)(A) general energy savings requirements:

-

-

- $2,500 credit

-

-

-

- $500 credit for multi-family dwelling units

-

IRC Sec. 45L(c)(1)(B) zero energy ready home program requirements:

-

-

- $5,000 credit

- $1,000 credit for multi-family dwelling units

-

A dwelling unit qualifies for the increased credit if it’s certified as a zero-energy ready home under the zero-energy ready home program of the Department of Energy as in effect on January 1, 2023 (or any successor program determined by the Secretary).

Multi-family dwellings meeting prescribed prevailing wage requirements receive an increased credit of $2,500 (for eligible properties that don’t meet the zero energy ready home requirements), and $5,000 for zero energy ready homes.

Essentially, the prevailing wage requirements state that the taxpayer shall ensure that any laborers and mechanics employed by the taxpayer or any contractor or subcontractor in the construction of such residence shall be paid wages at rates not less than the prevailing rates for construction, alteration, or repair of a similar character in the locality in which such residence is located as most recently determined by the DOL.

These modifications generally apply to dwelling units acquired after December 31, 2022. However, the extension of the credit applies to dwelling units acquired after December 31, 2021.

Learn more about energy efficient property credits

Accountants, serving as trusted advisors, play a vital role in guiding clients through changes to existing tax credits, new incentives, and evolving guidelines surrounding the energy efficient credit space.

Stay up to date with green tax initiatives by utilizing Thomson Reuters Checkpoint Edge, a cutting-edge tax research tool informed by 680+ highly-qualified editors and outside practitioners.

Additionally, Thomson Reuters ESG solutions, including Checkpoint ESG Toolkit, helps equip tax, corporate, risk, and legal professionals to navigate environmental-related tax credits and incentives while ensuring compliance.

SolutionsSimplify complex ESG tax and finance issues with ESG solutions from Thomson Reuters. |

NewsletterStay up to date with the latest changes in ESG legislation with Checkpoint newsstand. |